MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED FEBRUARY 14, 2025

Treasury yields seesaw over opposing inflation and economic data…

Treasury yields seesaw over opposing inflation and economic data…

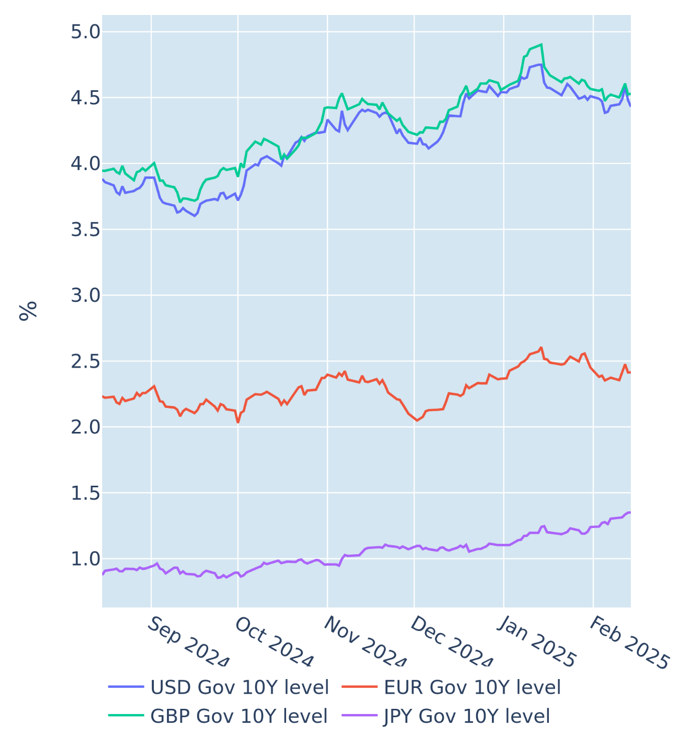

US Treasury yields seesawed in the week ending February 14, 2025, torn by the opposing forces of stronger-than-expected inflation and weaker-than-expected retail sales.

Long-term borrowing rates climbed to a 3-week high on Wednesday, after the Bureau of Labor Statistics reported that headline consumer prices grew by 3% in the twelve months to January, up from 2.9% in December and exceeding analyst projections of no change. Annual core inflation was expected to continue its downward trend from 3.2% to 3.1% but instead accelerated to 3.3% due to higher car insurance premia and recreation costs.

The data seemed to further corroborate Jerome Powell’s testimony to the Senate’s banking committee on Tuesday, in which he noted that the Federal Reserve did “not need to be in a hurry” to further ease monetary conditions. In response, short-term interest-rate (STIR) futures markets upped the implied probability of no rate cut this year to 30%, from 17% at the start of the week. This also propelled the monetary policy-sensitive 2-year yield to its highest level in four weeks.

However, the these market movements started to reverse on Thursday, when an ongoing slowdown in core producer prices somewhat alleviated the inflation concerns. Yields then ended the week slightly below the previous Friday’s levels, after US retail sales were reported to have fallen by 0.9% over the month of January, which was a much bigger drop than the -0.1% predicted by economists.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated February 14, 2025) for further details.

…while currency markets focus on the downside only

The US dollar fell to its weakest level in over two months against a basket of major trading partners, as currency traders appeared to focus mostly on the downside risks in last week's news. The value of the greenback has been very strongly positively correlated with monetary policy expectations over the past three years, so it is quite unusual that it did not appreciate when STIR markets completely priced out any likelihood of a second rate cut on Wednesday. But it still followed rates on the way down when the move was reversed on Thursday and Friday.

On the flip side, the pound strengthened by 1.6% to its highest value since mid-December, after the British economy unexpectedly grew by 0.1% in the fourth quarter, beating analyst predictions of a contraction of the same magnitude.

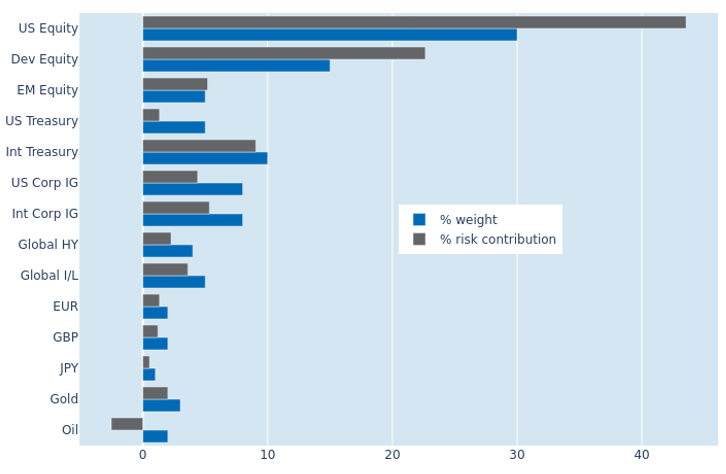

Stock-market recovery further reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased by another 0.4% to 7.5% as of Friday, February 14, 2025, amid an ongoing decline in stock-market volatility. The benefit was once again mostly notable for US equities, which saw their share of total portfolio risk shrink further by 2.8% to 43.6%. But the strong co-movement of share prices and exchange rates against the dollar made their counterparts in other developed markets appear a lot more volatile and raised the percentage risk contribution of the latter from 22.1% to 22.7%. The ongoing decline in oil prices, on the other hand, meant that the commodity remained inversely correlated with all other asset classes in the portfolio, reducing overall volatility by 0.2% in absolute terms.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated February 14, 2025) for further details.

You may also like