Multi-Portfolio Optimization for UMAs

A case study

Going beyond a Separately Managed Account (SMA) sleeve

Author

Walid Bandar

Wealth Management Specialist

SimCorp

Unified Managed Accounts (UMAs) have emerged as a powerful answer to the demands for customization in wealth accounts, particularly where tax efficiency is concerned. According to Cerulli Associates, AUM in a UMA structure is set to increase to $3.7tr by the end of 2026. These vehicles for managing complex investment strategies within a single account structure may be a no brainer but how to optimize them effectively across multiple goals, restrictions, objectives and constraints takes some careful thought.

The optimization challenge

When a leading wealth management firm recently needed to rebalance a complex UMA spanning four investment sleeves while harvesting tax losses and maintaining precise risk targets, they faced what many would consider an impossible optimization problem. The reality is, without multi-portfolio optimization capabilities, our client would have needed to manage each sleeve independently, potentially triggering wash sales across accounts, missing tax-loss harvesting opportunities and ultimately, failing to maintain optimal tax alpha and risk-adjusted returns at both the sleeve and aggregate levels.

This scenario, which we'll explore in detail, illustrates why traditional approaches to UMA management often fall short. While many firms attempt to handle these challenges they can only solve half the problem. Most approaches use one of the following two options: Trade each sleeve in order and restrict the purchase of any securities that were sold (for a loss) from the previous sleeve traded. Or, manage each sleeve separately and then check across the sleeves if there are any wash sales. Both of these approaches lead to suboptimal outcomes, operational inefficiencies, and missed opportunities for tax-alpha generation. In addition, neither option addresses risk or guardrail constraints at the UMA level.

Understanding the UMA advantage

At its core, a UMA consolidates multiple investment strategies, asset classes, and products into a cohesive structure. This integration allows wealth managers to offer their clients a sophisticated investment approach that combines various investment vehicles – from mutual funds and ETFs to individual securities and separately managed accounts – all within a single, manageable framework.

The benefits extend beyond mere consolidation. UMAs enable precise customization, enhanced tax efficiency, and comprehensive oversight of investment strategies. For portfolio managers, this means the ability to implement complex strategies while meeting client-specific objectives.

While the concept of UMAs is compelling, the execution presents a tall order. Portfolio managers must simultaneously:

- Balance multiple investment objectives across different sleeves

- Maintain optimal asset allocation while managing risk

- Maximize tax-loss harvesting opportunities

- Ensure wash-sale compliance across sleeves

- Facilitate efficient tax lot transfers

- Align with both sleeve-specific and overall portfolio benchmarks

Real-world implementation

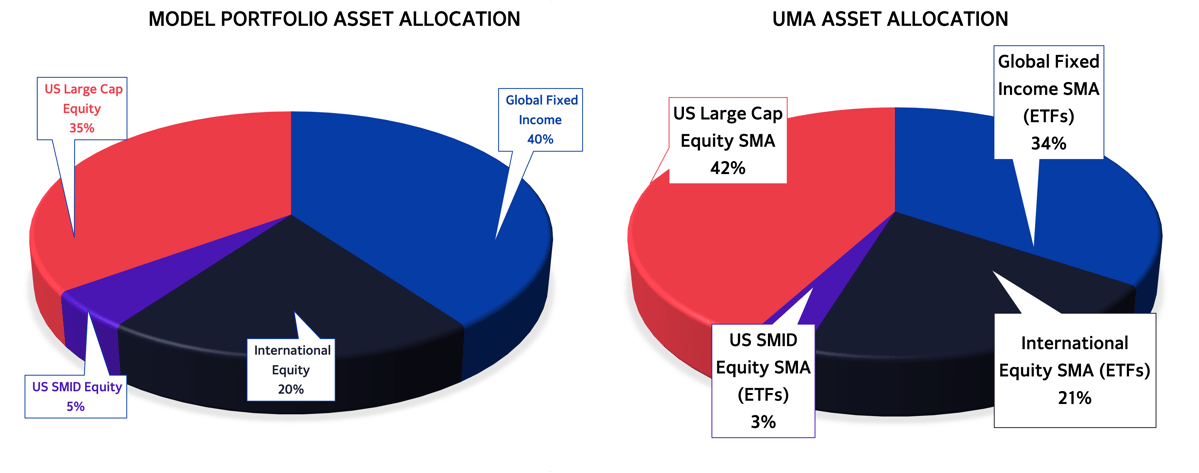

Let's return to our opening scenario and the solution we provided for our wealth management client. Their UMA consists of four sleeves:

- A US Large Cap Equity SMA holding large-cap US stocks

- A US Small-Mid Cap Equity SMA invested in three ETFs and two individual stocks (Workday and Apollo Global Management), with a Buy universe of six ETFs

- An International Equity SMA holding two ETFs out of a six-ETF Buy universe

- A Global Fixed Income SMA containing ten ETFs from a 14-ETF Buy universe

Figure 1: Example UMA Asset Allocation vs Model Portfolio

The client wanted to better align the UMA with the Model Portfolio’s asset allocation by addressing the following goals:

- Harvest tax-losses for the UMA

- Precisely match the Model Portfolio’s asset allocation weights

- Reduce overall UMA tracking error to approximately 40 basis points

- Significantly lower the tracking error for the Global Fixed Income Account to 25 basis points

- Reduce the tracking error for the SMID sleeve to around 50 basis points

- Decrease the Large Cap Equity sleeve's tracking error to about 1%, while maintaining loss harvesting opportunities

- Transfer tax lots where appropriate, specifically for Workday and Apollo Global Management, which were recently added to the US Large Cap Model but currently reside in the Small-Mid Cap Account

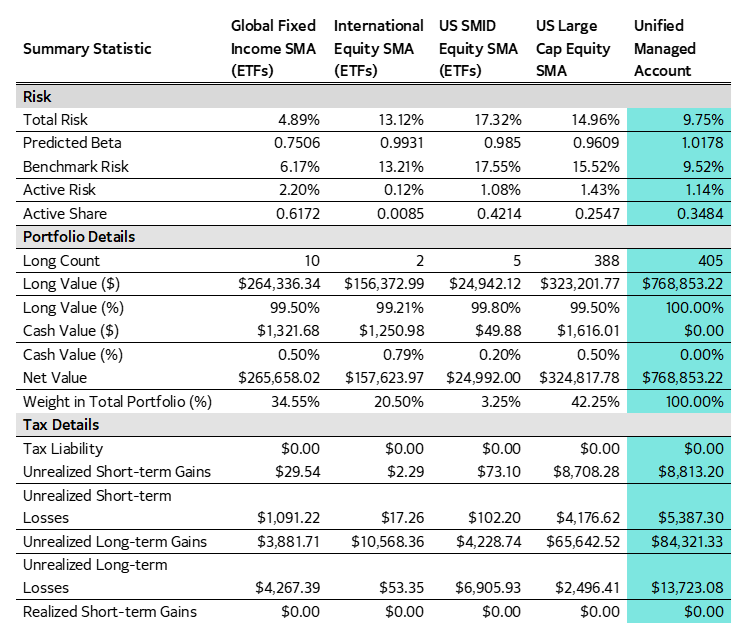

Figure 2: UMA Risk, Portfolio and Tax Details (Pre-Optimization)

"Portfolio managers who leverage advanced quantitative tools can deliver superior outcomes while managing the inherent complexities of Unified Managed Accounts. "

Using quantitative tools

With the Multi-Portfolio Optimization feature within the Axioma Portfolio Optimizer, this type of problem can be solved in one optimization instantly. Because of its ability to manage multiple constraints across sleeves, users can manage the wash-sale rule, transfer tax lots efficiently and adjust sleeve sizes for optimal performance.

Without this feature in play, the firm would have needed to:

- Optimize each sleeve independently and use one of the two methods mentioned earlier to avoid conflicts between sleeves and deprioritize portfolio-level objectives

- Manually track wash sales across sleeves, increasing operational risk and reducing tax alpha

- Make difficult tradeoffs between tax-loss harvesting and risk management

- Sacrifice precision in model alignment to accommodate other constraints

This fragmented approach prevents optimal UMA management but ultimately, reduces scalability and limits firm growth. Because each sleeve is not rebalanced simultaneously, managers cannot coordinate trades or understand the risk from individual sleeves. The portfolio drifts from model allocations, tax-loss harvesting opportunities are missed and importantly, tax lots are moved manually, introducing operational risks.

Figure 3: Dynamically Adjusted Sleeves

.png)

The values in the chart are the value change in each sleeve. For example, the US sleeve was reduced by $55,808.54 to hit the 35% targeted allocation in the Model Portfolio.

By using multi-portfolio optimization, they were able to satisfy all of the goals:

- Harvested a net total of $8,127.02 in tax losses

- Matched the Model Portfolio’s asset allocation with a maximum deviation of 2 basis points

- Reduced the overall UMA tracking error to 38 basis points

- Lowered the Global Fixed Income Account’s tracking error to 25 basis points

- Decreased the SMID sleeve’s tracking error to 51 basis points

- Brought the Large Cap Equity sleeve’s tracking error to approximately 1.03%, preserving its tax overlay ability

- Transferred three shares of Apollo Global and one share of Workday Inc. from the US SMID Equity SMA to the US Large Cap Equity SMA

The future of UMA management

As UMA adoption continues to accelerate, the ability to efficiently manage and optimize these complex structures becomes increasingly crucial. Portfolio managers who leverage advanced quantitative tools can deliver superior outcomes while managing the inherent complexities of Unified Managed Accounts. It also allows for advancements as clients become more sophisticated and want to add individual bonds and private securities.

The key lies in selecting tools that can handle the multi-dimensional nature of UMA optimization – balancing risk, tax efficiency, and investment objectives across multiple sleeves while maintaining operational efficiency and creating a long runway for growth.

The case study presented here demonstrates how quantitative multi-portfolio optimizations can transform what seems like an impossible optimization challenge into a precise, automated process that delivers measurable results:

- Enhanced tax efficiency through strategic loss harvesting

- Precise alignment with model portfolios

- Reduced tracking error across all sleeves

- Streamlined operational efficiency

For wealth managers looking to scale their UMA offerings, the message is clear: The future belongs to those who can harness sophisticated quantitative approaches to deliver superior client outcomes while maintaining operational efficiency.

Learn more about the Axioma Fund Allocation Models for wealth managers and the Axioma Portfolio Optimizer.

Related Content