MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED FEBRUARY 7, 2025

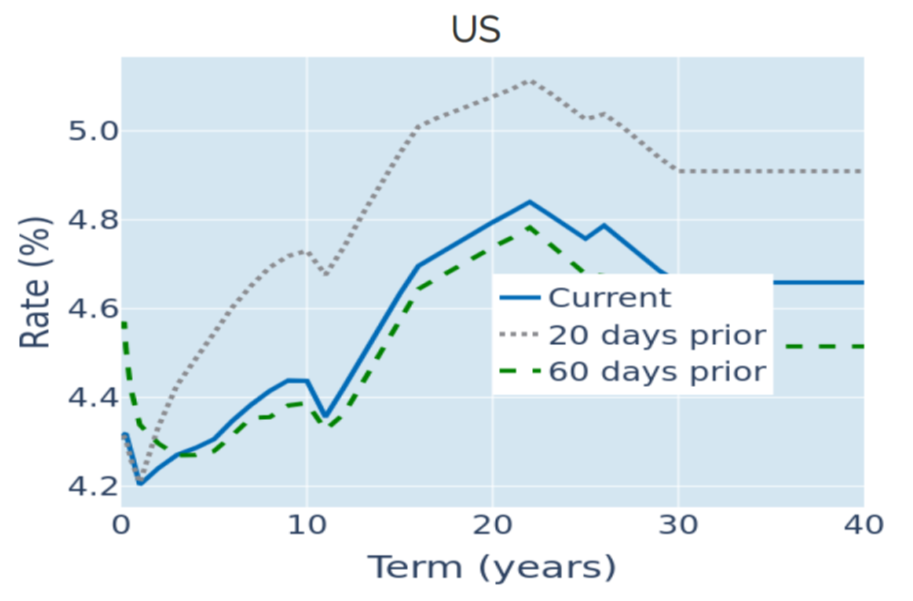

Treasury curve flattens over inflation and monetary policy concerns

The term spread between long and short-term US Treasury yields fell to its lowest level since mid-December in the week ending February 7, 2025, as bond markets assessed the potential impact of persistent inflation and tight monetary policy on economic growth. The Bureau of Labor Statistics reported on Friday that the American economy created 143,000 jobs in January. The release missed analyst expectations of 170,000, but the shortfall was more than made up for by a combined upward revision of 100,000 in the November and December figures. The notion of a resilient labor market was further underpinned by a drop in the unemployment rate from 4.1% to 4% and stronger-than-expected growth in average hourly earnings of 4.1% year-on-year, compared with a consensus estimate of 3.8%.

The combination of renewed inflationary pressures from rising wages and the tariffs threatened by the Trump administration on one side and low unemployment on the other seemed to support the Federal Reserve’s decision to pause its easing of monetary conditions a week earlier. Short-term interest-rate futures market reacted by lowering the implied probability of more than one rate cut this year from 57% to 46%, and the monetary policy-sensitive 2-year yield rose by 8 basis points in response. This contrasted with a 0.9% decline in the 10-year benchmark, which reflected the dampening impact of restrictive monetary policy on both long-term inflation and economic growth expectations.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated February 7, 2025) for further details.

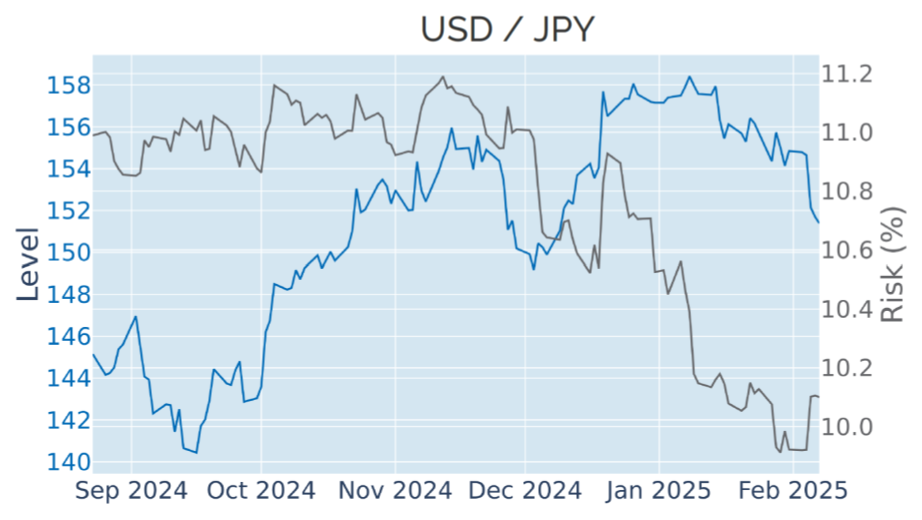

Currencies diverge amid decoupling central bank rates

Exchange rates against the US dollar diverged in the week ending February 7, 2025, reflecting the different paths of central bank rates projected for the respective countries and regions. The euro and the pound depreciated against their American rival, after the European Central Bank and the Bank of England both lowered their policy benchmarks by 25 basis points over the past two weeks, each citing ongoing disinflation and weak economic growth.

This was in contrast to the Japanese yen, which recorded its biggest weekly gain in more than two months, as the 10-year JGB yield soared to a 14-year high amid speculation that accelerating inflation may prompt the Bank of Japan to raise its short-term interest rate sooner than anticipated. The move also makes the yen the only currency that is up against the dollar since the US presidential election in early November.

The latest FX rate movements mark a break from the familiar pattern observed over most of the past 3.5 years, in which the value of the greenback was predominantly driven by the anticipation of Federal Reserve policy, while most other currencies simply mirrored the move, almost irrespective of local rate expectations.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated February 7, 2025) for further details.

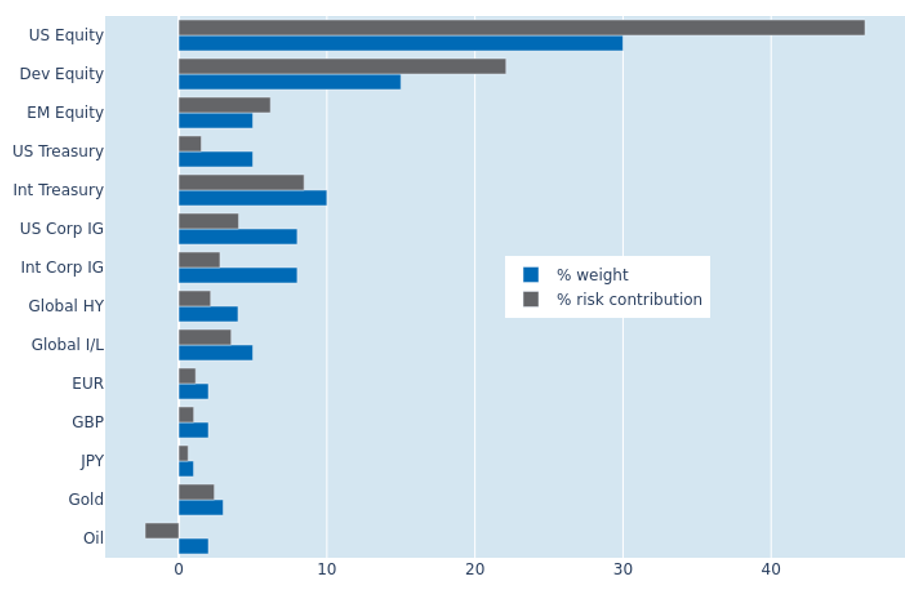

Lower equity volatility depresses portfolio risk

A decline in stock-market volatility depressed the predicted short-term risk of the Axioma global multi-asset class model portfolio to 7.9% as of Friday, February 7, 2025. The benefit was largely limited to US equities, which saw their share of total portfolio volatility shrink from 48.7% to 46.3%. This was in contrast to their counterparts from other developed markets, where a positive interaction of share prices and exchange rates against the dollar meant that their percentage risk contribution expanded by 1.8% to 22.1%. Most other asset classes were mostly unaffected, as both volatilities and correlations remained broadly stable.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated February 7, 2025) for further details.

You may also like