EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED FEBURARY 7, 2025

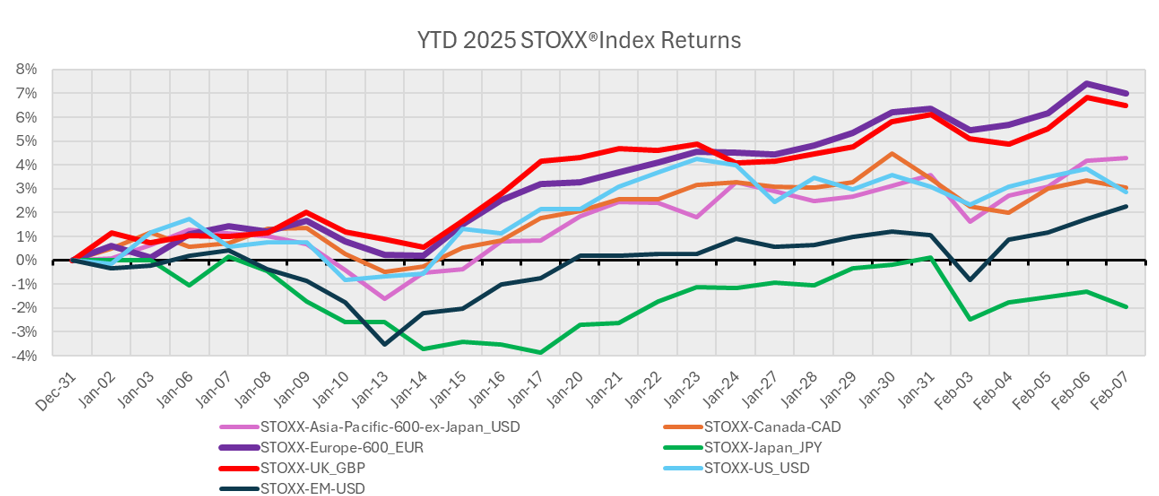

Europe and UK lead Global Equity Markets

The STOXX Europe 600 and STOXX UK indices have been the leading markets YTD over the regions we track. This is most likely healthy for global markets, as the US has led by so much for so long:

While the US has eked out a positive return YTD, the same cannot be said for Japan which was also very strong in 2024.

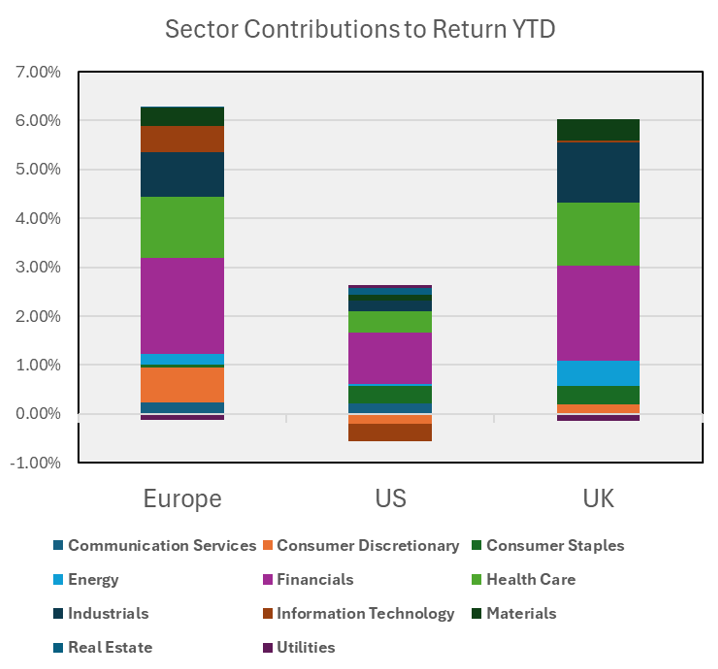

Europe and the UK were both led by strong positive contributions from Financials and Health Care, and Information Technology also contributed positively in those regions. However, in the US, IT and Discretionary have both detracted YTD:

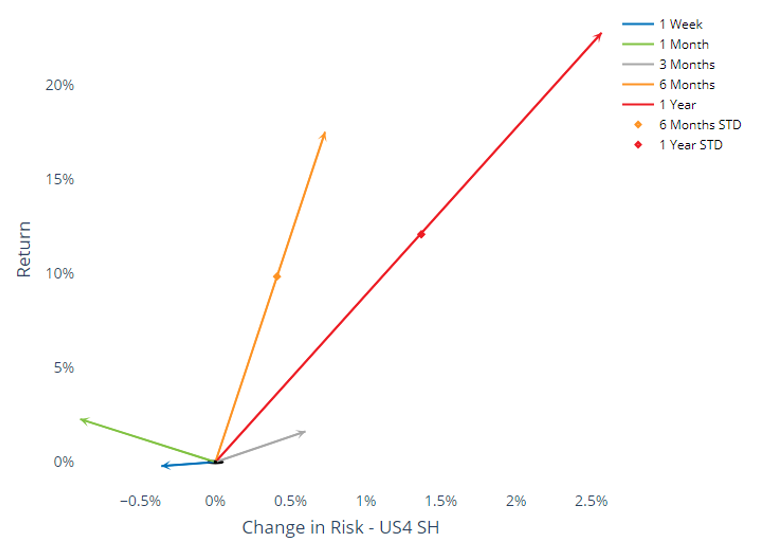

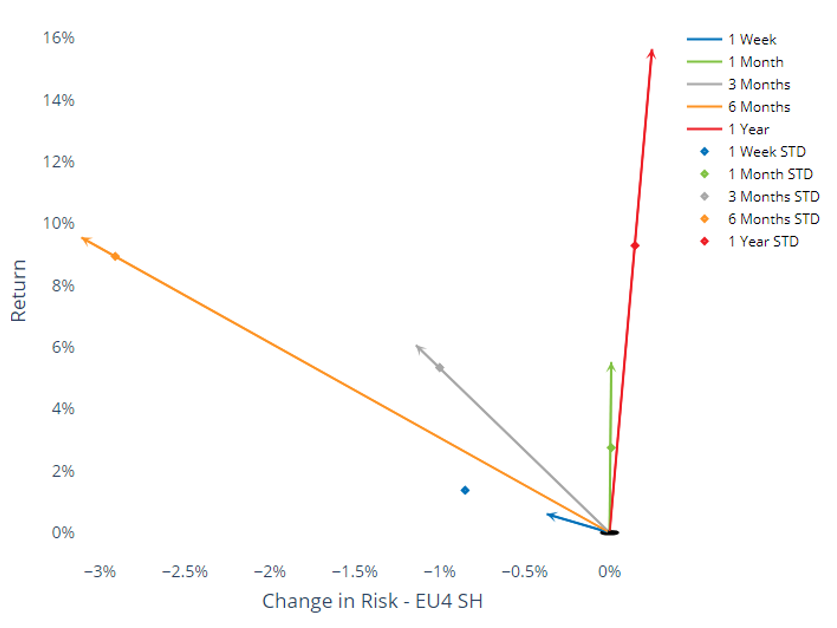

Meanwhile, Forecast Risk is down in the US despite the “DeepSeek Shock” of January 27th and all the volatility added by policy uncertainty, particularly as it relates to tariffs and trade. Risk is also down in Europe, while the UK has actually experienced an uptick in forecast risk:

See Chart 11, STOXX Europe 600 “Risk Watch”, February 7, 2025:

See Chart 11, STOXX US “Risk Watch”, February 7, 2025:

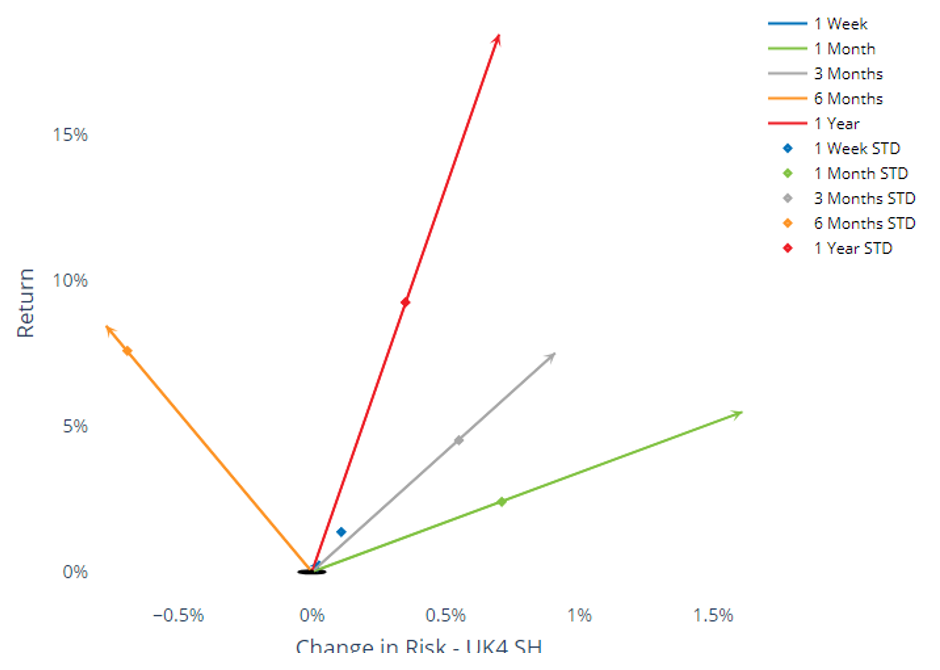

See Chart 11, STOXX UK “Risk Watch”, February 7, 2025:

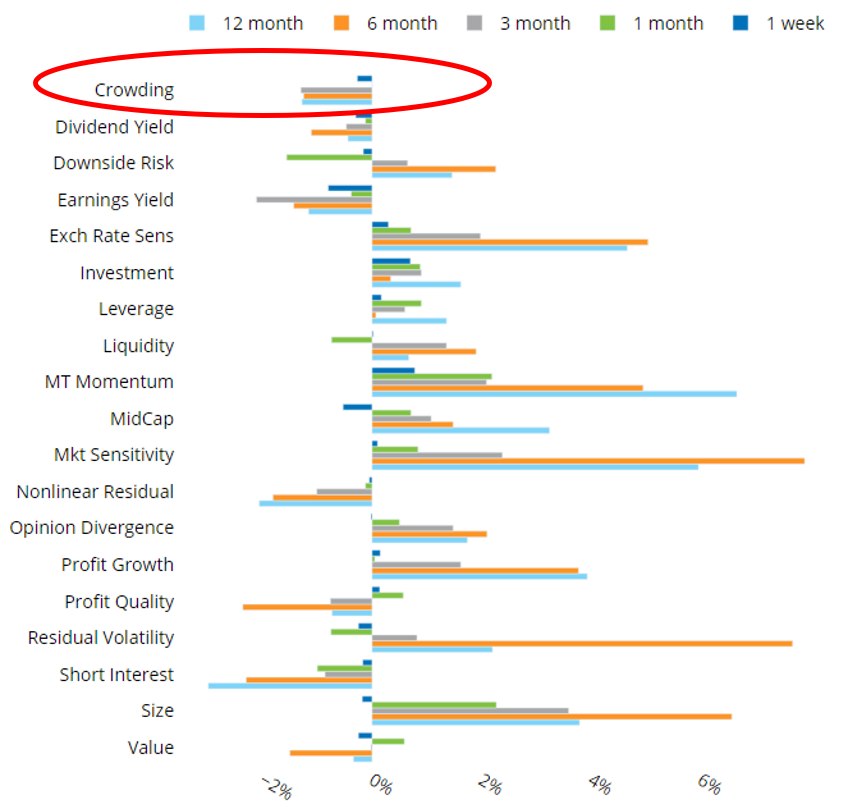

Crowding Factor Continues Poor Performance

Historically, the Crowding Factor in the US 5.1 models has a strong positive return premium. However, we now have a trailing 12 month negative return in the factor and the bulk of that is over the last 3 months:

See Chart 17, US5.1 Risk Monitor, February 7, 2025:

While it is tempting to think that this is reflective of the “Magnificent 7” and their retracement of recent weeks, these stocks are not “Crowded” by our metrics because they have enormous floatation and daily volume. It is typically smaller stocks, particularly in Biotechnology, Pharma, Life Sciences, some Retail and Gaming stocks with high turnover and smaller market capitalizations that are widely held by private funds that get ranked as “crowded”.

You may also like