EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JULY 26, 2024

Axioma Risk Monitor: US Large Caps keep losing ground to Small Caps; New sources of risk creeping into the US Small Cap market; China suffers largest losses

US Large Caps keep losing ground to Small Caps

US large-capitalization stocks lost more ground resulting in small losses for the US market overall, after a tumultuous week when tech giants took another tumble midweek. The STOXX US index fell nearly 1% in a week when the Magnificent Seven experienced the largest one-day loss on Wednesday.

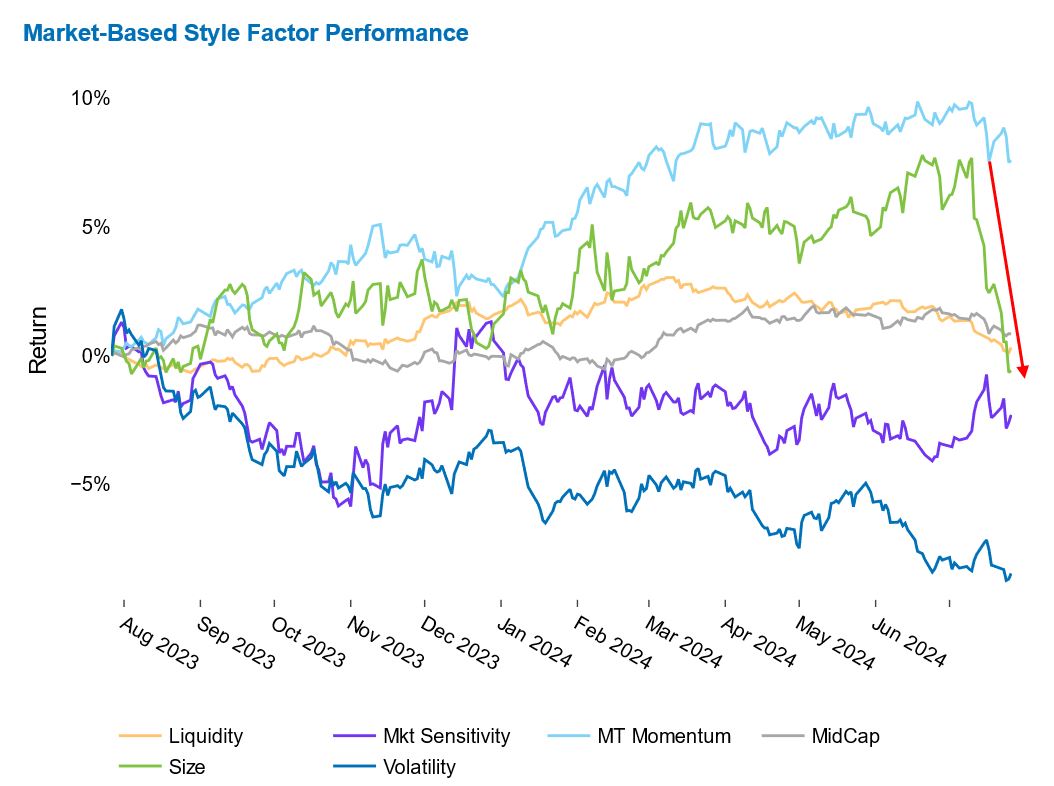

The Size style factor in the Axioma US4 fundamental medium-horizon model recorded large outsized negative returns over the past week and month. The factor’s five-day return of -3% was more than three standard deviations below the expectations at the beginning of the week, while the monthly -7% return was nearly four standard deviations below the expectations at the beginning of the period.

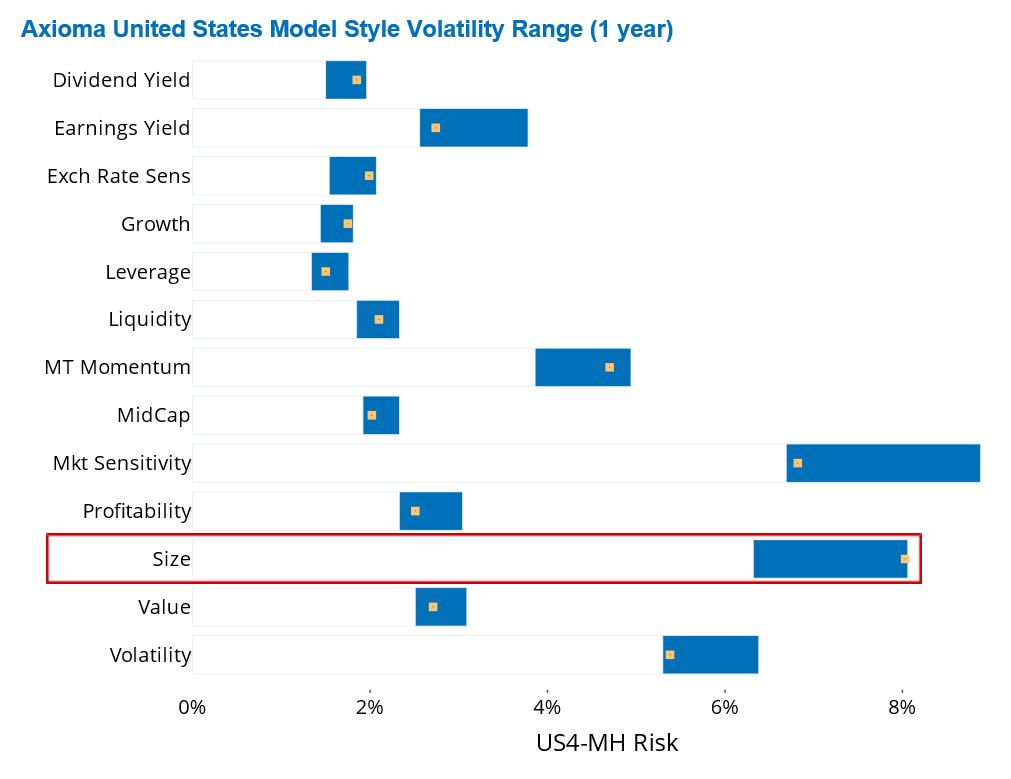

After having had one of largest positive returns among all style factors in the US model for most of the year, Size’s 12-month return turned negative last week. US Size not only became the most volatile factor in the US model, outpacing Market Sensitivity, but it was also positioned at the high end of its one-year volatility range.

See graphs from the STOXX US Equity Risk Monitor as of July 26, 2024:

New sources of risk creeping into the US Small Cap market

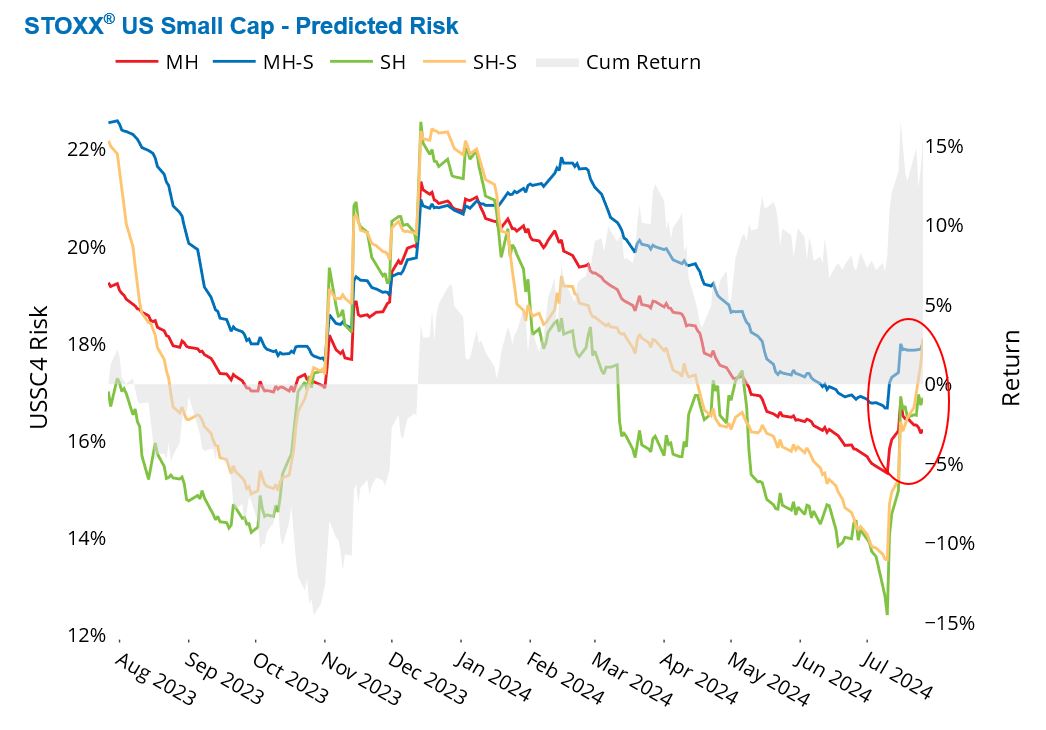

While risk has climbed abruptly in the US Small Cap market, statistical-fundamental risk spreads have also widened, suggesting that extra risk is being picked up by the statistical models. This may point to potential changes in the risk regime and/or the emergence of non-traditional factor risk sources in this market.

After dipping to a four-year low earlier this month, fundamental short-horizon risk for the STOXX US Small Cap index rose 36% in 12 business days, as measured by Axioma US Small Cap model. The medium-horizon fundamental variant only went up 6% during the same period.

The short-horizon statistical variant saw a similar increase and is now exceeding its fundamental counterpart. The spread between the statistical and fundamental forecasts at the medium-horizon has been positive for most of 2024, has increased since June, and is now around 2%—well above the six-year median of -0.02%.

See graph from the STOXX US Small Cap Equity Risk Monitor as of July 26, 2024:

China suffers largest losses

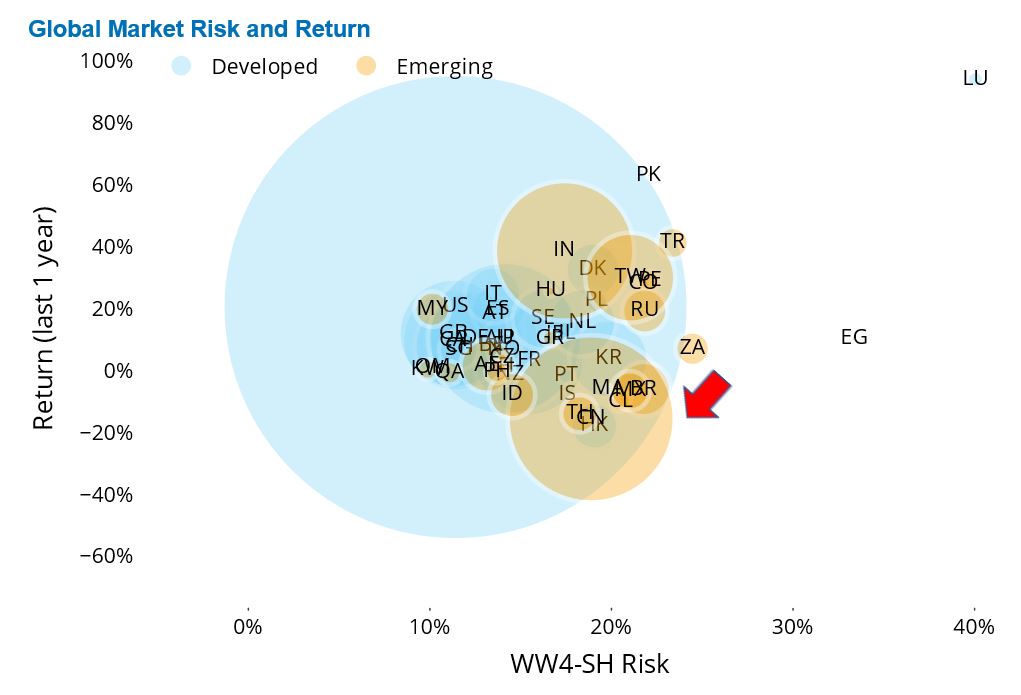

The Chinese market became the worst performer among developed and emerging markets over the past year. The Chinese economy grew slower than expected in the second quarter as it witnessed a decline in consumer consumption, despite the efforts of the Chinese government to prop up its economy. The Chinese market, as represented by the Axioma China Market Portfolio, has fallen nearly 20% over the past 12 months denominated in US dollars.

In terms of risk, China remained somewhere in the middle of the pack among emerging markets, as measured by Axioma’s short-horizon Worldwide fundamental model.

See graph from the Equity Risk Monitors as of July 26, 2024: