The impact of Nvidia on market returns

The style factors Nvidia has a hold on

Authors

Leon Serfaty, CFA

Axioma Solutions Specialist

Melissa R. Brown, CFA

Head of Investment Decision Research (formerly Applied Research)

Nvidia has been a big positive contributor to the market, but a decline could mean a larger than expected impact on the market.

The investment world has laser-focused its attention on Nvidia this year, even before it joined the ranks of the largest stocks in the US market (among the top three, depending on the day and the index). Although the stock is quite volatile – its mean daily return on up days was more than 2.7% while it averaged about -2% when the stock dropped – the price has risen more than 150% since the beginning of the year. Through June 25, 2024, the S&P 500 has risen about 15.5%. Nvidia alone accounted for about 30% of that return.

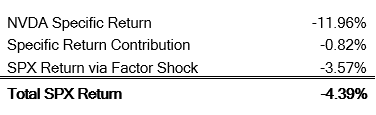

Many investors are concerned about what will happen if Nvidia experiences a correction, as it came close to doing around the Juneteenth holiday, falling 13% from the close on the 18th to the end of trading on the 24th. A simple test of the impact of that eventuality would be to look at its weight in an index and multiply that by a projected decline. For example, given its weight in the S&P 500 of about 6.6% and its expected decline of 25%, the index would fall by 1.65%. However, that simple calculation might be a bit too simple, as Nvidia is correlated with other stocks and factors. Using the Axioma US Equity Factor Risk Model (US4) factor covariance matrix, we estimate that a 25% drop in Nvidia stock would result in a 4.4% drop in the S&P 500, much more than a simple weight-based calculation would predict (Table 1).

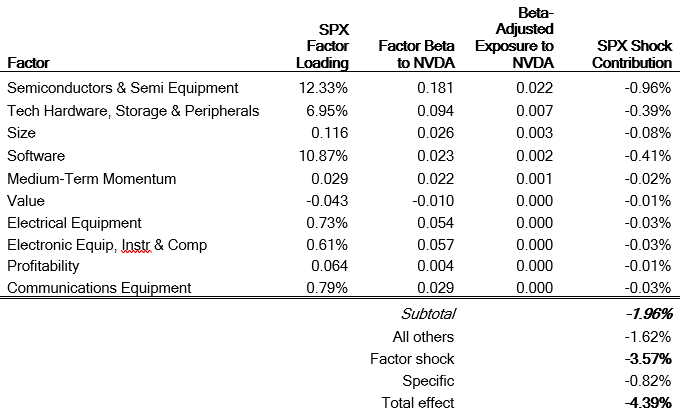

How does this happen? As we show in Table 2, several factors have high betas (sensitivities) to Nvidia. For example, the whole semiconductor industry, about 12% of the S&P, has a beta of 0.18 to Nvidia, meaning a decline in the stock would drag others in the sector down with it. Other industries such as Technology Hardware, Electronic Equipment and other tech-related industries also have positive betas. Some style factors such as Market Sensitivity and Volatility have positive betas to Nvidia but the index overall has negative exposure, so the contributions from these factors in such a shock scenario would actually offset some of the drawdown. The Size and Momentum factors, meanwhile, sport positive betas and positive S&P 500 exposures, and would contribute to the index decline1. In turn, Nvidia’s drop would contribute to factor downturns as we illustrate in the next section.

Table 1: Impact of Nvidia Shock of -25%2

Source: Axioma US Equity Factor Risk Model (US4)

Table 2: SPX Scenario Factor Attribution - Largest Beta-Adjusted Exposures to Nvidia

Source: Axioma US Equity Factor Risk Model (US4)

Nvidia’s impact on style factors

Nvidia has also loomed large in the returns of certain style factors in the US. When we refer to factor returns, we mean the return to a factor-mimicking portfolio (FMP), one that is long-short, fully invested with generally small weights across a broad universe of stocks, unit exposure to the factor in question and no exposure to any other risk factors and rebalanced daily with no regard to transaction costs. Most stocks’ weights, whether long or short, are small in magnitude. The average absolute value of weight for all the stocks in the Size FMP, for example was 0.09% on June 25.

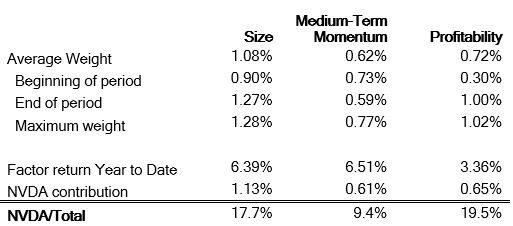

Nvidia’s weight – along with a few other select names – in the Size, Profitability and Medium-Term Momentum FMPs is orders of magnitude larger than that average weight. Combined with its strong performance, it has had substantial impact on the performance of these factors. It has averaged more than 1% weight in the Size FMP this year, and contributed 1.13% to the factor’s 6.39% year-to-date return, almost 18% of the total. Its weight in the Medium-Term Momentum FMP has been smaller than in Size, and interestingly, is lower now than it was at the beginning of the year. Still, it contributed 61 basis points of return, or about 9.4% of the total return, the biggest contribution of any stock in the FMP. Remarkably, just one stock out of more than 3,000 contributed almost 10% of the overall return.

Among the FMPs, Nvidia had the biggest impact on Profitability. Its weight averaged 72 basis points this year, and was 1%, very near the year’s high, most recently. This high weight meant that Nvidia contributed 65 basis points, or 19.5%, of the factor’s return this year.

Table 3: Nvidia Impact on Factor Returns Year-to-Date 2024

Source: Axioma US Equity Factor Risk Model (US4)

Any portfolio that was underweight Nvidia this year has clearly suffered in terms of total return. Portfolio factor exposures would have also been hurt by an underweight position. The contribution of the stock to the total return of each factor means that it may have been more difficult to achieve the factor return without a positive exposure. Nvidia is clearly having an impact beyond just its effect on the market.

"Among the FMPs, Nvidia had the biggest impact on Profitability. Its weight averaged 72 basis points this year, and was 1%, very near the year’s high, most recently."

Footnotes

1 Email AxiomaInfo@simcorp.com for more details on the underlying calculations.

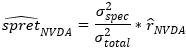

2 Normally, in a factor shock scenario, we ignore specific returns or assume that they would be negligible over the market portfolio. In this case, we are shocking the Nvidia asset itself and because it has such a significant weight in the index, and the model’s estimate of Nvidia’s specific risk is nearly half the total risk for the stock, we must include the estimate of Nvidia’s specific return in the shock by: