How inflation affects high yield bonds

Analyzing the impact of inflation and monetary policy on the risk of high yield bonds

Author:

Christoph Schon

EMEA Investment Decision Research

SimCorp

In times of low and stable inflation and interest rates, high yield investors tend to be less concerned about fluctuations in risk-free rates and focus more on the ability of issuers to repay their debt and interest owed. The picture changes, however, when consumer-price growth accelerates and central banks react by tightening monetary conditions. Share prices fall and credit spreads widen in response, amplifying the losses of corporate bonds caused by higher risk-free rates.

In this article, we examine how the predicted volatility of USD-denominated high yield bonds has evolved since monetary policy expectations began to rise in September 2021. We analyze the impact of the first Federal Reserve rate hikes and the Russian invasion of Ukraine in the spring of 2022 as well as the default of Silicon Valley Bank in March 2023. The risk profile changed once again around the peak in Treasury yields in late October 2023, and the spotlight is now firmly back on inflation and the anticipated central-bank response.

The interplay of interest rates and credit spreads

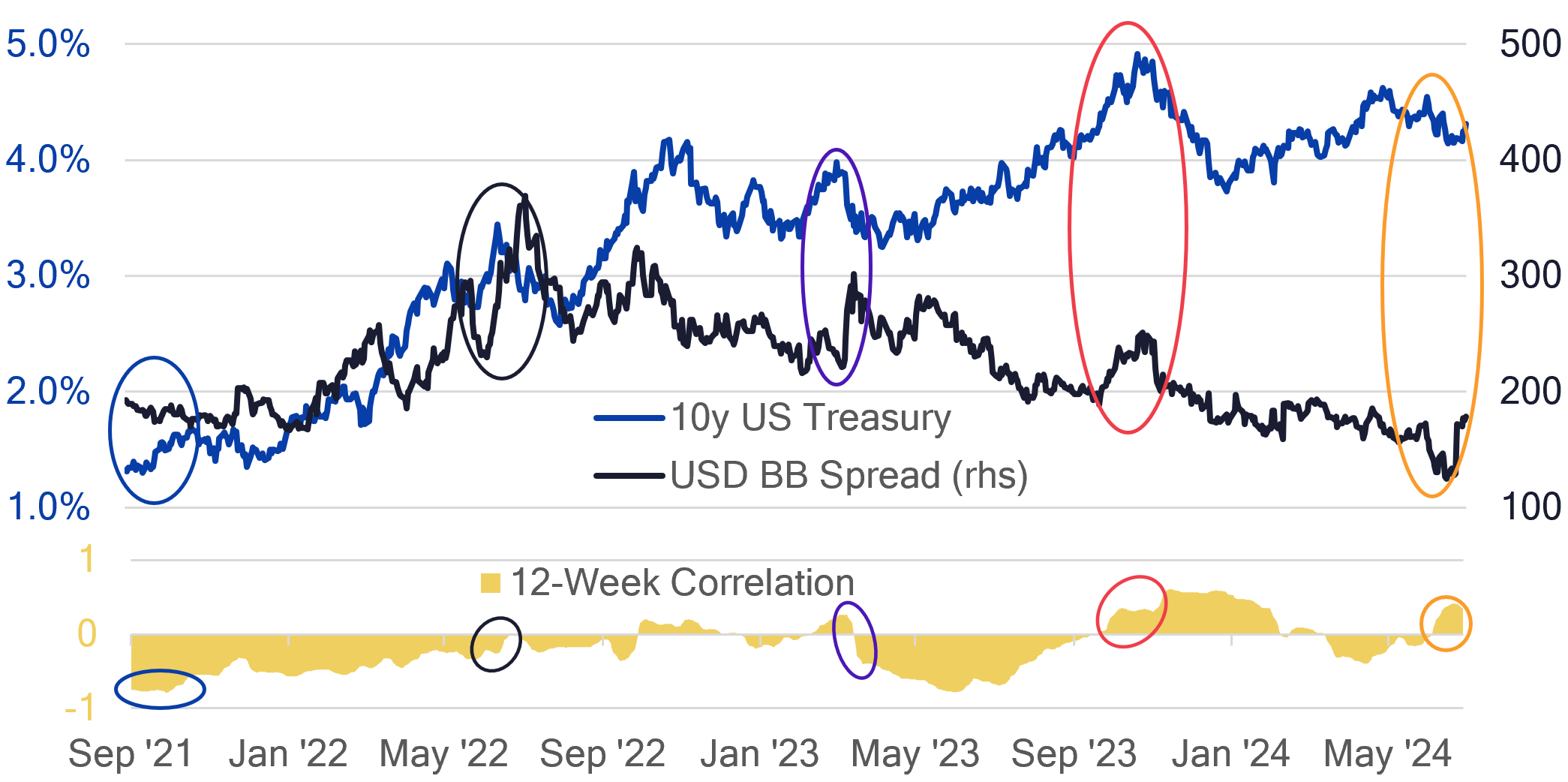

Figure 1 shows the risk premium of BB-rated USD corporate bonds over swaps, compared with the 10-year US Treasury yield since September 2021. The area in the lower part of the chart represents the 12-week correlation between the two time series.

Figure 1: US Treasury Yields vs BB Credit Spreads

Source: Axioma Credit Spread Curves

The first highlighted period in September 2021 represents the time before central bankers acknowledged that the high inflation rates observed back then were no longer ‘transitory’. Credit spreads and interest rates were inversely correlated, with tightening risk premia initially offsetting any rises in rates.

The Federal Reserve started raising interest rates in March 2022, but it did little to bring consumer prices under control, and the central bank embarked on a series of four ‘jumbo’ hikes of 75 basis points each from June. At the same time, the growing uncertainty after the Russian invasion of Ukraine resulted in the widening spreads and increased volatility.

The collapse of Silicon Valley Bank in March 2023 once again led to surging credit risk premia, but this time Treasury yields plummeted, as worries about the stability of the banking system and the economy as a whole (temporarily) superseded inflation concerns.

However, the inverse relationship between the two time series did not last long, and after a brief recovery, strong jobs growth and rising inflation propelled Treasury yields to 16-year highs in October 2023. Credit spreads also widened, leading to a firmly positive correlation.

The impact on corporate bond risk

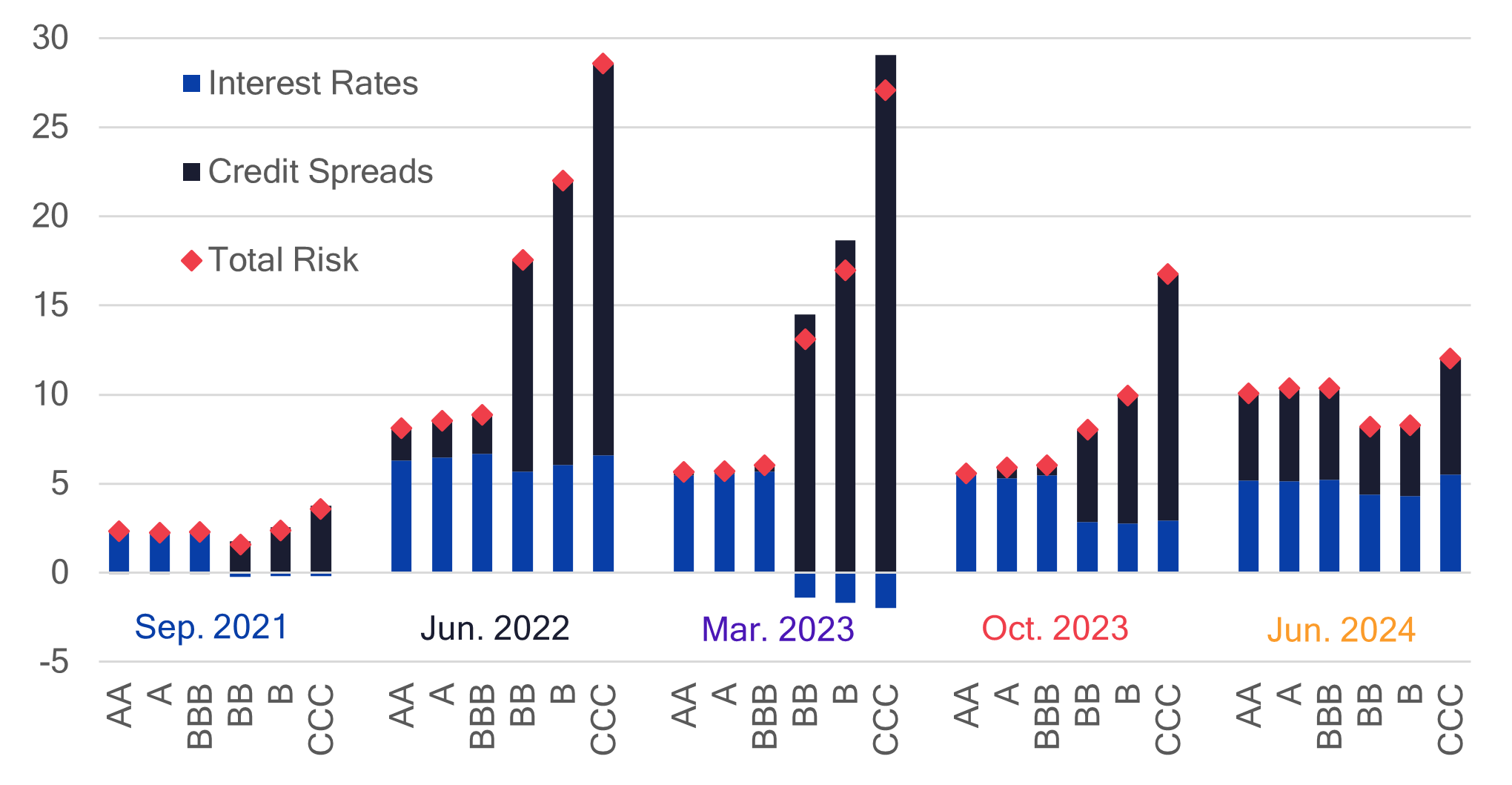

Figure 2 demonstrates what the risk profiles of USD-denominated corporate bonds looked like in each of these environments, broken down by broad rating and split into an interest-rate and a credit-spread contribution. The analysis was performed using Axioma Risk, our portfolio risk software tool and a risk model, which was calibrated on weekly returns over five years with a half-life of one year. The model calculates log returns for the credit component, which means that the exposure is duration times spread. This makes the model very reactive to changes in overall spread levels. The predicted volatilities for each rating band were normalized to a duration of five years.

Figure 2. Contributions to Predicted Volatility of USD-Denominated Corporate Bonds by Rating and Risk Type

Source: Axioma Risk

Before September 2021, the predicted volatility of corporate bonds looked homogeneous, with little distinction between ratings regarding overall risk. The only difference between investment grade and high yield issues appeared to be that the returns of the former were mostly driven by changes in risk-free rates, with no emphasis on creditworthiness, while the risk of the latter was almost entirely attributed to fluctuations in spreads.

The higher rate and spread volatilities in the first half of 2022 saw risk more than double for the investment grade bonds, although most of it was still due to the surge in rates, with again, little differentiation between the highest and lowest rated issuers. This contrasted with high yield debt, which was dealt a double blow by the simultaneous explosion of risk premia that disproportionately affected the lowest-quality securities.

High spread volatility remained the primary driver of high yield risk in March 2023, but this time some of it was alleviated by offsetting movements in interest rates. However, the latter fluctuated much more strongly compared with 18 months earlier, providing the predominant source of risk for investment grade issues.

With Treasury yields resuming their ascent in early April to their eventual peak at the end of October 2023, rate risk remained elevated for the highest-rated securities, but also gained prominence for their lower-quality peers, adding to the pain from wider risk premia.

As of mid-2024, overall volatility was once again almost constant across all rating bands, albeit 4-5 times higher than in September 2021. The relative breakdown of interest-rate and credit-spread risk was also very different, with both contributing equally to the total, irrespective of the quality of the issuer.

Keep a watchful eye on inflation, interest rates and credit spreads

The market focus is likely to remain on inflation releases and labor-market reports for the remainder of the year, with traders adapting their monetary-policy expectations with every additional piece of the puzzle. Barring major geopolitical or economic disruptions that might trigger the type of flight-to-safety flows observed in the second quarter of 2023, the correlation between interest rates and credit spreads can be presumed to stay positive. High yield investors should continue to monitor both drivers of their portfolio risk and performance carefully, using advanced portfolio risk tools.

Learn more about Axioma Risk.

Request a demo