EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JULY 5, 2024

- Nvidia’s increasing weight offset decline in risk from lower factor volatility

- The recent Russell rebalance did not add to Russell 2000 risk

- France’s country risk remains elevated, UK’s steady, while UK sectors have done a 180

Nvidia’s increasing weight offset decline in risk from lower factor volatility

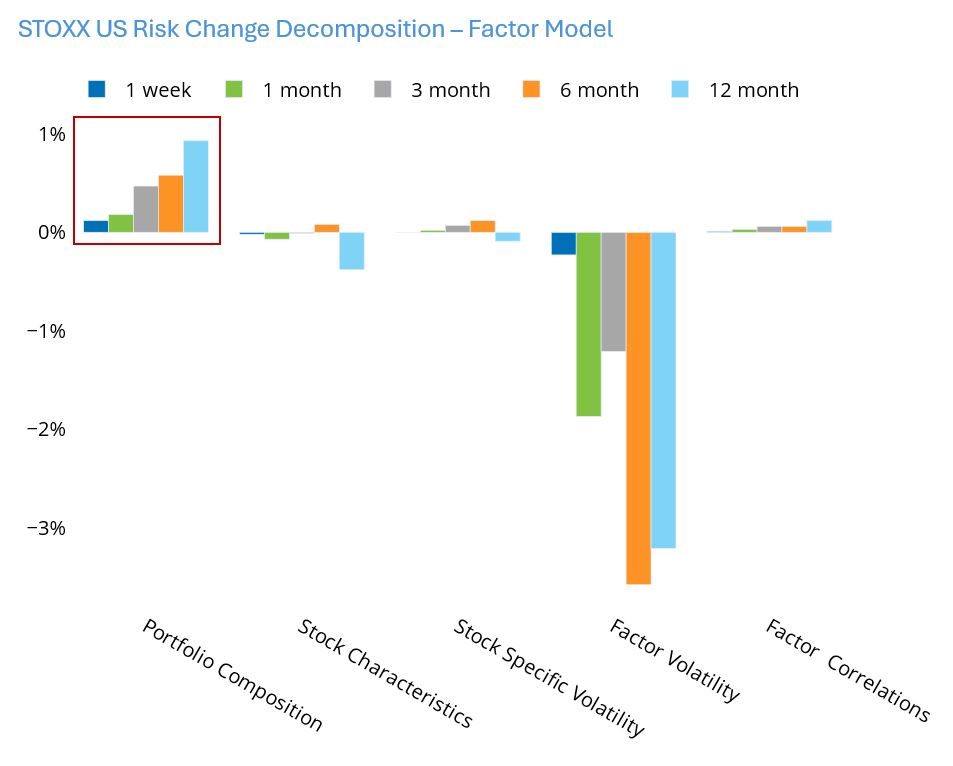

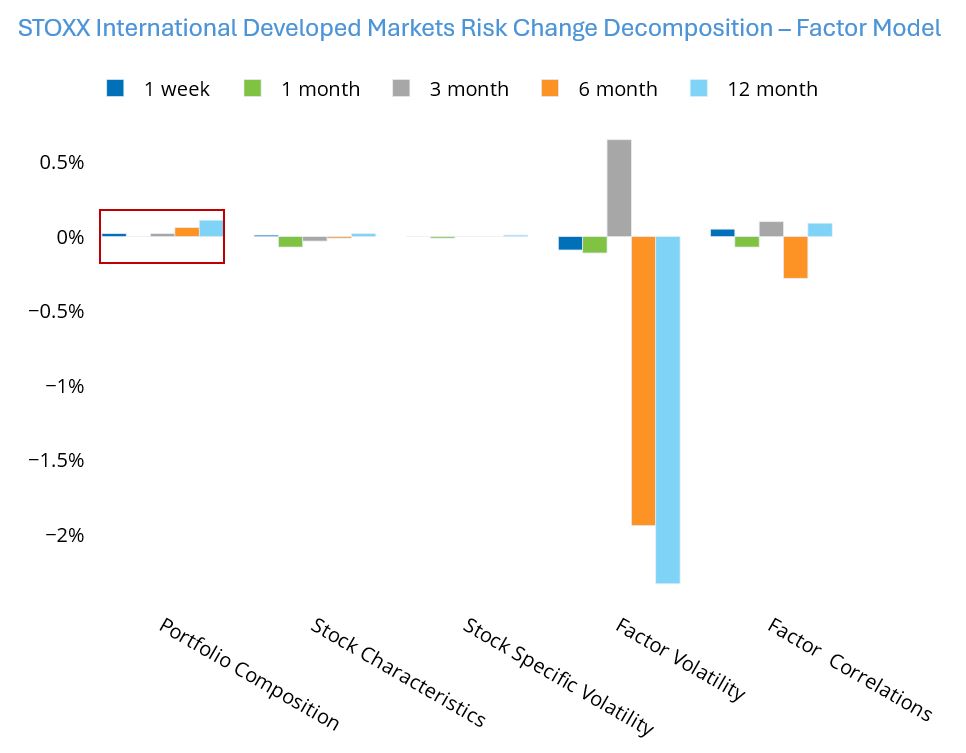

Our factor-model decomposition of the change in risk charts shows the impact of each of the major blocks of the factor model on the change in risk for benchmarks over various periods. We successively change one component to see how that change in isolation would have changed risk, then add on the next.

In practice, we first look at the impact of the change in holdings, so we use last period’s risk model (factor exposures, factor variance-covariance matrix, and stock specific risks) with the current portfolio holdings to calculate a risk forecast.

The difference between this new risk forecast and the initial risk forecast is attributable solely to the change in holdings (change in portfolio composition). We then move on to do the same by updating stock characteristics (factor exposures), then use current stock specific volatility. We then add current factor variances. Finally, the difference between the final actual risk forecast and what we see from prior steps is attributed to factor correlations.

As we are analyzing broad indices, we do not expect to see much change in risk from changes in holdings, factor exposures or stock specific volatility. However, when analyzing the change in risk for the STOXX® US Index, we note that portfolio composition has had an unusually large impact, at least over the past 3, 6 and 12 months. We know the index has not substantially changed holdings but can see that the weight in Nvidia has increased so much that it has largely been the driver of this change in risk. Of course, the increase in risk caused by Nvidia has been more than offset by decreases in factor volatilities, so overall predicted volatility has fallen, but it is noteworthy (and unusual) how much impact one stock can have on the risk of a large, well-diversified index. Finally, we do not see anything similar in the decomposition of the change in risk outside the US.

See graphs from the STOXX US and STOXX International Developed Markets Equity Risk Monitors as of July 5, 2024:

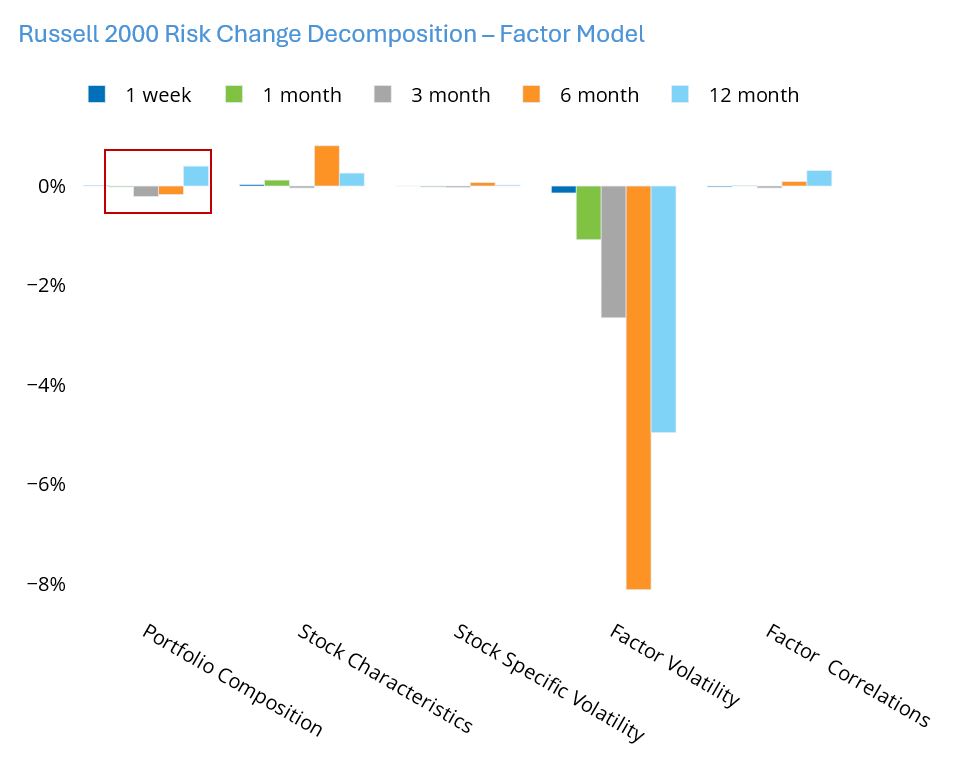

At the same time, the recent Russell rebalance did not add to Russell 2000 risk

While on the topic of the decomposition of the change in risk, we also note that the recent Russell rebalance did not result in a big change in risk for the Russell 2000 index. Over the past month, the “portfolio composition” component is just about zero. While investors certainly had to rebalance to reflect the index changes, they did not have to explicitly reduce risk as they did last year, for example, when the portfolio composition alone added about 63 basis points of risk in the month ended July 3, 2023.

See graph from the Russell 2000 Equity Risk Monitor as of July 5, 2024:

France’s country risk remains elevated, UK’s steady, while UK sectors have done a 180

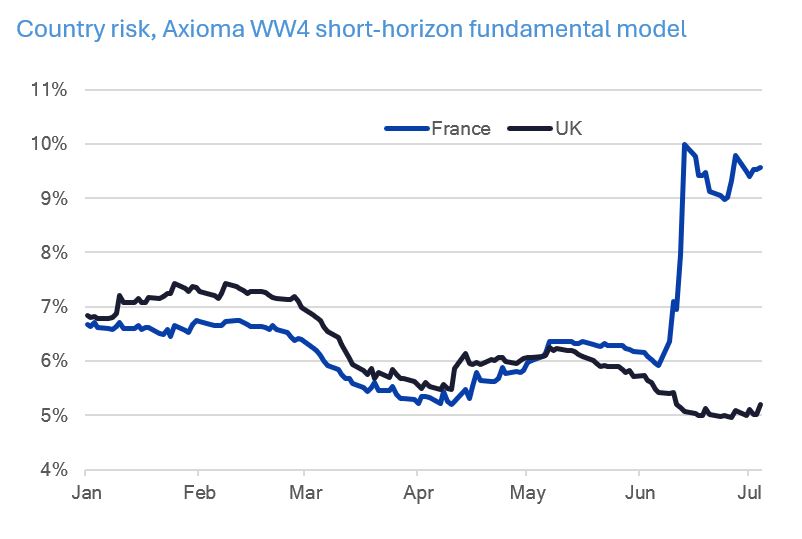

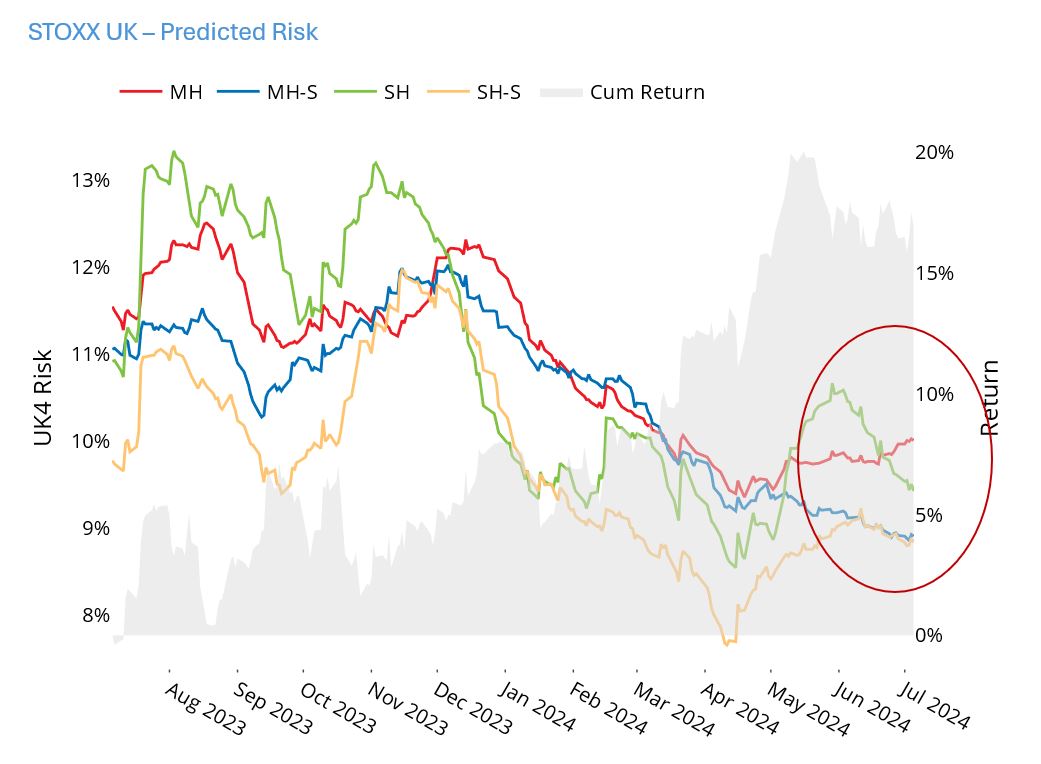

As we noted in our Weekly Highlights for the week ended June 14, 2024 the announcements of snap elections in the UK and France led to a sharp increase in short-horizon country risk in France, while having little impact on overall country risk in the UK (both according to the WW4 fundamental model). The risk in France has remained elevated compared with where it was prior to the election, while risk for the UK has drifted down slightly from where it was before the election announcement.

For the overall UK market, short-horizon total risk from Axioma’s UK fundamental models (in contrast to country risk in the Global model) had been climbing prior to the election announcement, but reversed mid-month and headed back down.

The following chart is not in the equity risk monitors, but is available on request:

See graph from the STOXX UK Equity Risk Monitor as of July 5, 2024:

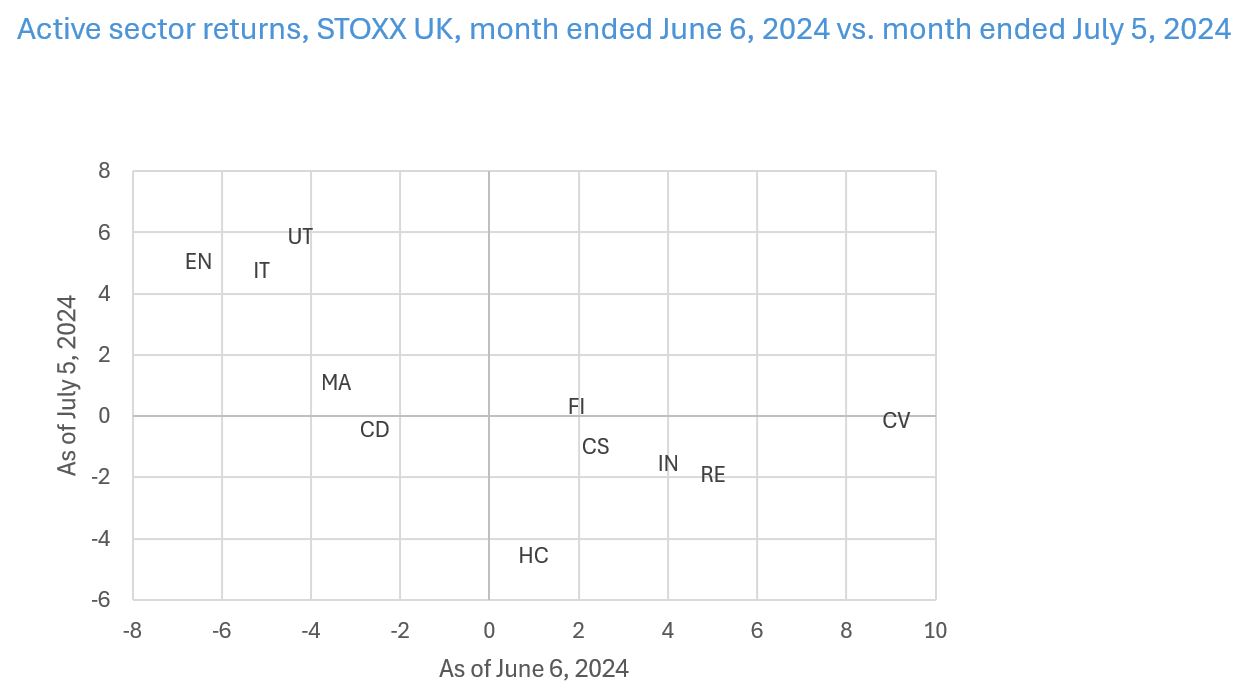

Declining benchmark and country risk in the UK, however, masks the severe sector rotation we see in the STOXX® UK Index from the one month ended June 6 to the subsequent month. Most notably, active returns for the sectors that had been underperforming in the earlier period: Energy, Information Technology, Utilities and Materials turned sharply positive, whereas those with positive returns in the earlier period were largely flat with the benchmark over the last month. Health Care, which had hugged the benchmark for the month ended June 6 retreated sharply over the next month. It is likely no surprise to investors that Labour’s focus will be substantially different from their Conservative forebears and that the proposed reforms were more than just empty promises, and they wasted no time in reflecting those views in their portfolios.

The following chart is not in the equity risk monitors, but is available on request: