IBOR

Release 26.01

Spread option enhancements

As of version 26.01, the Spread option, OTC instrument supports forward premium payments and barrier conditions on the underlying assets in the Trade Manager.

With the forward premium payment enablement, the user can define when the premium is paid (spot or forward). With this enhancement, you can select whether the premium is paid upfront (spot) or at maturity (forward).

Optionally, you can also define the barrier levels for each underlying asset to control when the option becomes active. To support rate contingency, two optional fields—Upper barrier and Lower barrier—have been added for each underlying asset. These fields define thresholds that determine whether the option becomes active and generates a payoff.

The pricing correlation setup is now optional and only required if you specify a contract-specific pricing model. If you price the spread option without this model, you do not need to specify pricing correlation.

Benefits

- Enables users to book a Spread Option transaction according to market standards

- Enables users to handle more exotic Spread Option variants with conditional payoffs

Subscription-based licensing

TM Spread Option

Sales module dependency

TM Spread Option

![]()

Handling caps/floors on daily fixings

As of version 26.01, you can apply caps and floors to daily reference rate fixings on overnight index swaps (OIS) for Flexi Formula Swap XpressInstruments.

Benefits

- Enables the user to apply a cap or a floor on the individual daily fixing rate, like SOFR/SONIA, when calculating the daily compounded rate

Subscription-based licensing

XpressInstruments custom

Sales module dependency

N/A

![]()

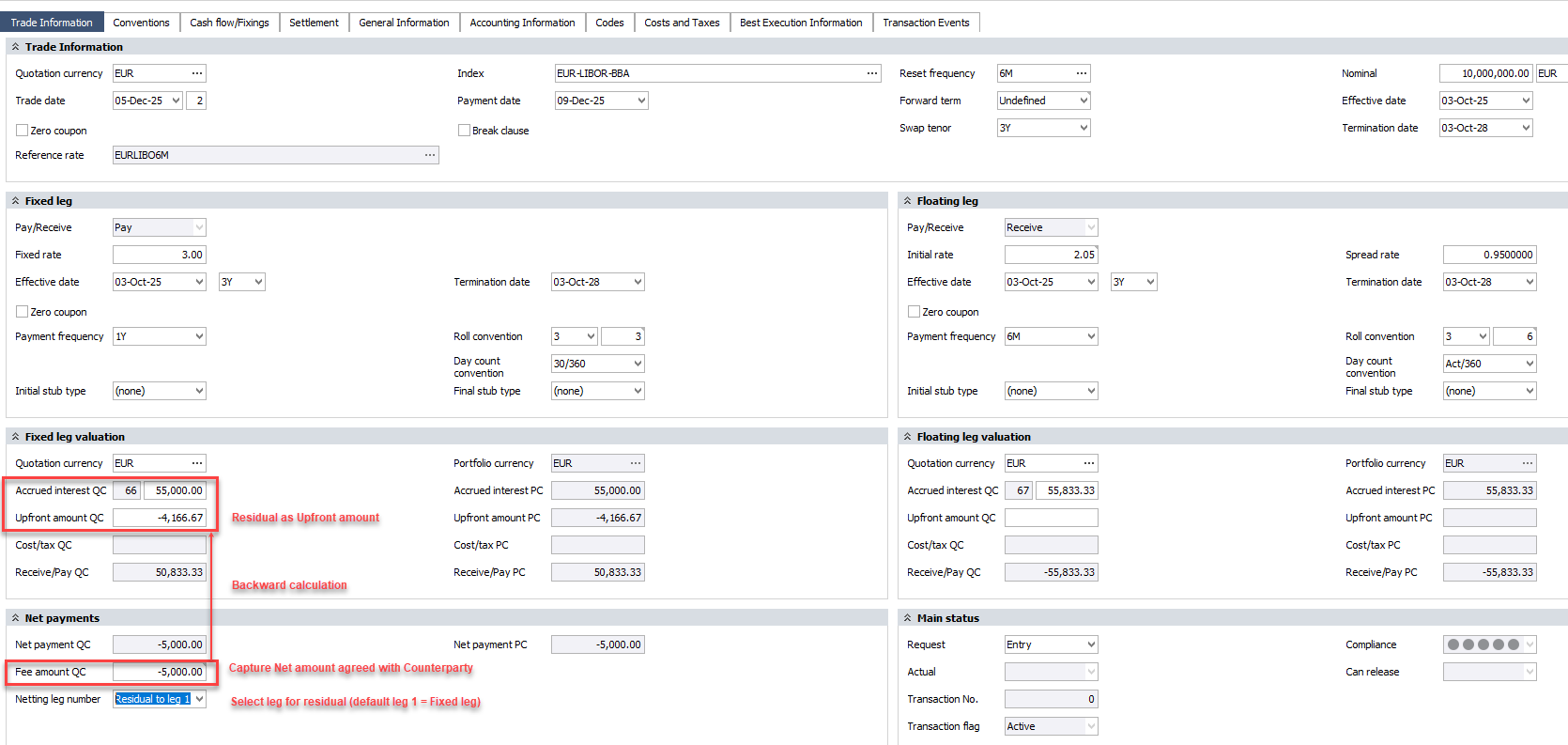

Interest rate swaps – Support trading on NPV

As of version 26.01 it is possible to trade Interest Rate Swaps (deliverable and non deliverable currencies) based on agreed net present value. SimCorp Dimension will then do the backward calculation of accrued interest on the two legs and place the residual as an upfront amount on the chosen leg (Default is to place the Residual on leg 1, which is the fixed leg for the supported types).

This new feature is especially relevant when doing offset trades and post trade events for bilateral swaps and it is the Standard used by most Trading platforms. The new feature is available for

Swap types:

- IR swap, fixed/float

- IR swap, OIS

- Non-deliverable IR swap fixed/float

Event types: - Close (existing)

- open new

- Increase existing

- Offset close

- Increase new

- Novate

Benefits

- Align with market standards when executing offset trades and performing post trade events

Subscription-based licensing

Interest Rate – Swaps and Swaptions

Sales module dependency

Fixed/Float Interest Rate Swaps,

Asset swaps and Non-deliverable swaps

![]()

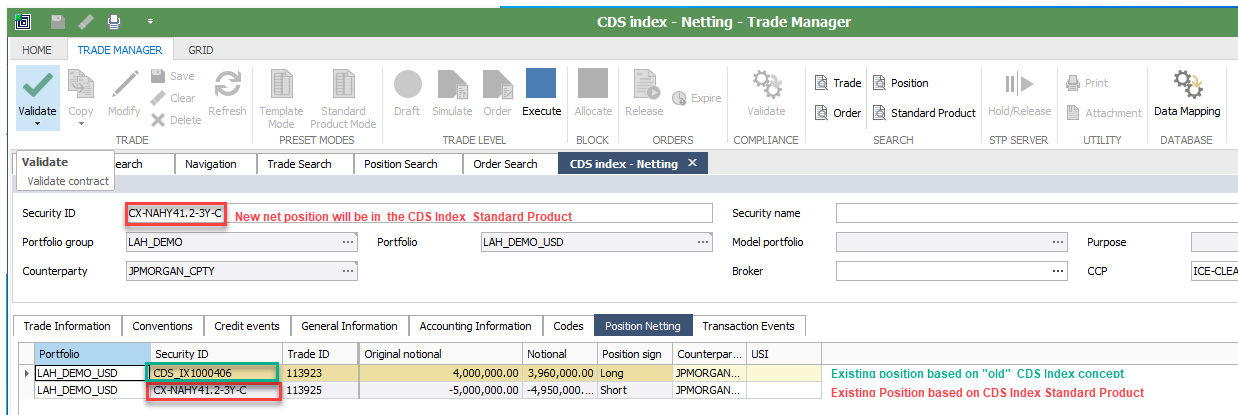

CDS Index – New features for CDS Index Standard products

A group of new features Related to CDS Index has been introduced with 26.01.

The first new feature is the possibility to define standard settlement days for transactions based on standard products (typically 1 day for Cleared CDS Index Trades and 3 days for bilateral). The standard settlement days can be maintained in the convention tab for CDS Index Standard products.

The second feature introduced with 26.01 is the possibility to do netting across existing positions using the “old” CDS Index concept and positions using the “new” CDS Index Standard product concept. The result will be a position in the Standard Product. This feature makes it possible to make a smooth and easy transition of existing CDS Index positions (based on the “old” concept”) to the new CDS Index Standard Product concept without need for a “big bang” or conversion of existing data.

Benefits

- Smooth transition from the “old” CDS Index concept to the “new” concept based on Standard Products

Subscription-based licensing

Credit – Credit default Swaps and Swaptions

Sales module dependency

CDS Index as a standard product

![]()

Valuation of Mid Curve Swaptions and CMS Spread Options

You can now perform advanced valuation and risk analysis for complex interest rate derivatives using two new pricing models:

- Gaussian-Copula Model with Normal SABR for CMS Spread Options

Enables accurate pricing and sensitivity analysis for CMS spread options, incorporating swap rate correlations and volatility surfaces.

- Bachelier Model for Mid-Curve Swaptions

Supports valuation of mid-curve swaptions and is captured in Trade Manager, providing robust analytics under normal volatility assumptions.

Instrument Scope

- TM Spread Option, OTC, with underlying CMS rate

- TM Swaptions, Fixed/Float and OIS, with Forward term

Benefits

Comprehensive Risk Metrics

Calculate prices, sensitivities, and Greeks including:

- Delta, Gamma, Vega, Theta

- DV01, OAS

- Dirty price, Clean price

- Correlation sensitivity (Rho)

Improved Accuracy for Complex Structures

Advanced models (Gaussian-Copula + SABR, Bachelier) allow calibration to market prices and precise valuation of instruments sensitive to correlation and volatility shifts.

Scenario Analysis and Portfolio Impact

Incorporate market data scenarios for portfolio-level calculations, improving decision-making under different market conditions.

Streamlined Workflow

Direct integration with Trade Manager and Volatility Curve Definitions ensures smooth setup:

- CMS Spread Options: Configure underlying reference rate, par yield convention, and single-look payment structure.

- Mid-Curve Swaptions: Capture trades with correct reset frequency and ATM moneyness.

Transparency and Troubleshooting

Use Calculation Trace and Explain Calculation for detailed diagnostics during valuation.

Why This Is Valuable

These enhancements empower users to:

- Confidently price and manage risk for CMS spread options and mid-curve swaptions.

- Meet regulatory and internal risk management requirements with accurate Greeks and correlation sensitivities.

- Reduce operational complexity by leveraging integrated workflows and standardized data sources.

Subscription-based licensing

Interest Rate - OTC Derivatives,

Interest Rate – Swaps and Swaptions

Sales module dependency

No dependency

![]()

Valuation of Convertible Bonds with Ayache-Forsyth-Vetzal model

You can now use Ayache-Forsyth-Vetzal (AFV) model for pricing convertible bonds. This enhancement enables accurate valuation and risk analysis for convertible bonds using advanced numerical methods, supporting both theoretical pricing and calibration to market price.

- Convertible bonds with underlying instruments:

- Equity

- Fund certificate

- GDR/ADR

Benefits

- Comprehensive Analytics for Convertible Bonds

- Calculate a wide range of key ratios and risk measures.

- Credit Spread Handling

- The AFV model uses the spread yield curve for credit spread specification, ensuring more accurate discounting and calibration.

- Dividend Projection Support

- For convertible bonds with equity underlyings, valuations incorporate time-series dividend projections.

- Calibration to Market Prices

- The Quoted price + yield curve method supports calibration by calculating OAS, enabling alignment with observed market prices.

- Integrated Workflow and Transparency

- Updated Explain Calculation report reflects AFV model enhancements, and Calculation Trace supports troubleshooting.

Why This Is Valuable

These enhancements empower users to:

- Accurately price and manage risk for convertible bonds in portfolios.

- Incorporate realistic dividend projections and credit spreads for better valuation precision.

- Meet compliance and reporting requirements with full transparency and detailed analytics.

- Streamline workflows by leveraging integrated pricing definitions and volatility curve settings.

Subscription-based licensing

Foundations

Sales module dependency

No dependency

Browse the Release Portal

Release 25.10

Index fixing for swaps in Trade Manager

As of version 25.10, users of TRS in the trade manager can add their own “customer” business centers in addition to the standard business centers maintained by Simcorp. Users can add the new business centers via the new business center form and will be able to link them business center calendars in the same way as the previous standard centers.

These new “customer” business centers will be shown with the business center owner as “customer” and will only be selectable on the following instruments:

- Index Swaps

- Bond Swaps

- Equity Swap

- Bond swap, baskets

- Equity Swap, baskets

This enhancement will allow users to define business centers that are not in the current FpML list such as exchange business centers. This will enhance the flexibility of those instruments where they are permitted.

Subscription based licensing

TM Total Return Swap

Sales module dependency

TM Total Return Swap

![]()

Enhancements for exotic FX options in Trade Manager

As of version 25.10, the Trade Manager introduces enhancements for exotic FX options, with a focus on improving lifecycle handling, transparency, and alignment with market standards. These enhancements support correct modelling of barrier options, rebate handling, and valuation logic across the following exotic FX options:

- FX Option, Double Barrier

- FX Option, Single Barrier

- FX Option, Touch

Benefits

- Barrier window configuration—For FX Option, Single Barrier, FX Option, Double Barrier, and FX Option, Touch instruments, you can define a custom barrier observation period. You can do so by using the new Barrier window start and Barrier window end fields. This barrier observation period is independent of the effective dates and expiry dates applicable for the option but must remain within the effective expiry range.You can start the barrier observation period on the same day as the option's effective date, in line with market standards.

- Barrier window type—For FX Option, Single Barrier and FX Option, Double Barrier instruments, you can specify the barrier window type as either American or European in the new Barrier window type field.

- Rebate handling—For FX Option, Single Barrier and FX Option, Double Barrier instruments, the new Rebate field is available. SimCorp Dimension supports rebate amounts and automatically processes them for knock-in and knock-out scenarios where the option remains, or becomes inactive. Rebate payments are generated on expiry and are handled as separate payments, with no link to forward premium.

- Barrier description—For FX Option, Single Barrier and FX Option, Double Barrier instruments, a second option is available next to the Barrier type field. This second option reflects combinations of option types and barrier types applicable to the FX option.

- Support for knock-in/knock-out barrier combinations—For FX Option, Double Barrier, you can configure barrier type combinations such as knock-in-knock-out scenarios.

- Monitored values—For FX Option, Single Barrier, FX Option, Double Barrier, and FX Option, Touch instruments, the new BARRIER_HIT and OPTION_ACTIVE monitored values are available. These values help you track whether a barrier has been breached and whether the option is currently active. These values can be retrieved by using relevant formula functions. You can also use the new getximmonitored() formula function that retrieves monitored values from XpressInstruments—specifically for use in transaction-level and position-level contexts.

Subscription based licensing

TM Total Return Swap

Sales module dependency

TM Total Return Swap

![]()

Enhancements to TRS business centres in Trade Manager

As of version 25.10, users of TRS in the trade manager can add their own “customer” business centers in addition to the standard business centers maintained by Simcorp. Users can add the new business centers via the new business center form and will be able to link them business center calendars in the same way as the previous standard centers.

These new “customer” business centers will be shown with the business center owner as “customer” and will only be selectable on the following instruments:

- Index Swaps

- Bond Swaps

- Equity Swap

- Bond swap, baskets

- Equity Swap, baskets

This enhancement will allow users to define business centers that are not in the current FpML list such as exchange business centers. This will enhance the flexibility of those instruments where they are permitted.

Subscription based licensing

TM Total Return Swap

Sales module dependency

TM Total Return Swap

Release 25.07 IBOR

![]()

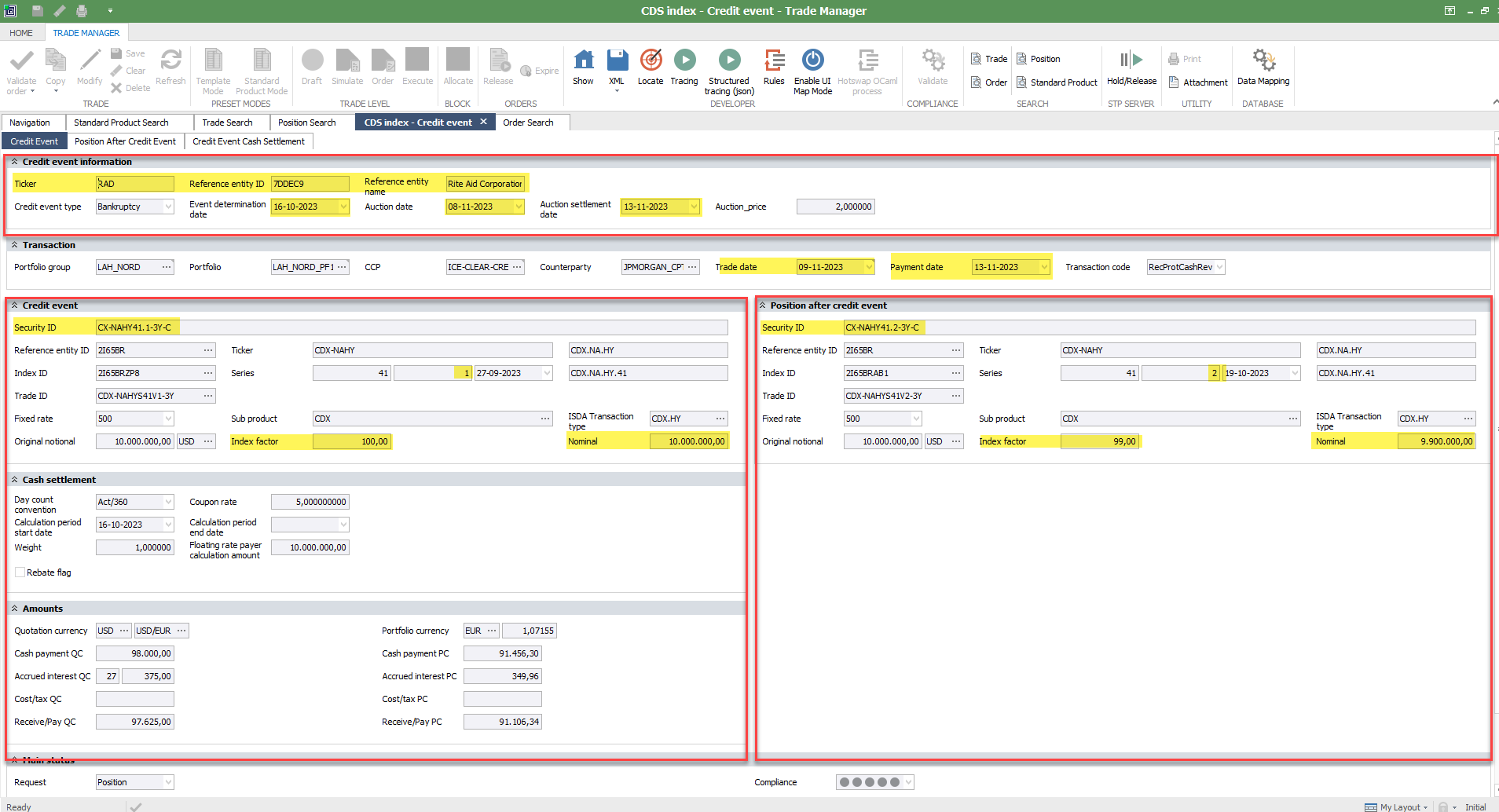

CDS Index - Support of hard credit events

A new Event type, Credit Event, has been introduced for CDS Index to improve the handling of hard credit events (e.g., bankruptcy, failure to pay). The new event type combines the settlement of the credit event with the re-versioning of the continuing CDS Index position to the new index version.

The new Event type is available for CDS Index:

- In the Trade Manager Position search for manual processing of credit events.

- As a new option in Create Credit Derivatives Transactions supporting an automated flow.

The new event type is a two-legged transaction where:

- The first leg contains information about the old version of the Index and the settlement of the Credit Event.

- The second leg contains information about the continuing position in the new index version.

A feature of the new event type is, that it supports different views on the re-versioning in front office and back office.

- In front office, the re-versioning will take place the day after the auction date, when trading in the new index version will start.

- The back office view will align with the Trade Information warehouse and the clearing house, keeping positions in the old version open until the auction settlement date, when the re-versioning takes place.

New Credit Event transaction type in the Trade Manager.

The new Credit Event transaction contains 3 tabs:

- Credit event tab showing an overview of the credit event, the position before and after the credit event, including settlement information.

- Position After Credit Event tab containing detailed information about the position continuing after the credit event.

- Credit Event Settlement tab containing detailed information about the position before the credit event and its settlement.

The overview tab (see above) is divided into 4 sections:

- First section contains information about the credit event, including defaulting entity, auction date, price, and auction settlement date. This information is generated based on Credit Event data and can’t be changed.

- Second section contains affected portfolio, other position identifiers, and main transaction data such as transaction type and trade and payment date.

- Third section contains information about the position before the Credit Event (based on standard product) and the settlement information of the Credit Event.

- The fourth section contains information about the continuing position in the new standard product representing the new index version and adjusted nominal.

On a credit event transaction, SimCorp Dimension calculates P/L values based on the notional portion of the CDS position corresponding to reference entities in the index version that have experienced a hard credit event.

Thus, in the P/L sub-window, on the out leg, you can view:

- P/L values calculated for the defaulted parts only.

- Cost value, book value, and up front-related balances relevant to the entire position.

Balances proportional to nominal outstanding are reallocated and booked to the new CDS index version position.

As a result of a credit event, positions in the old CDS index version are fully closed, and a position in the new CDS index version is opened.

Please note:

- A prerequisite for using the new Credit Event type is the use of CDS Index Standard Products. Standard product for the new version must be created in advance.

- The use of the new event type requires the use of the upfront approach for CDS Index Trades.

- You are recommended to use the Up-front in book value - advanced multiple trades swap payments setting option in the FAM window, even though SimCorp Dimension supports all applicable CDS Index Swap payment options in relation to CDS indices standard product accounting.

- UTI/USI will remain the same for the position in the new index version

Benefits

- Optimized credit event handling by combining settlement of the credit event and re-versioning of the continuing position into one new event type.

- Improved handling of positions seen in front office. Positions will be shown in the new version the day after the auction date.

- Improved handling of positions seen in back office. Positions will be shown in the old version until the auction settlement date (where the re-versioning also takes place in the DTTC trade Information warehouse and at the Clearing House).

- Improved accounting handling with transfer of values from the old to the new version.

Subscription based licensing

Credit-Credit Default Swaps and Swaptions

Sales module dependency

CDS Index as a standard product

CDS Index

Trade Manager

Enhanced notional reset handling and cash flow calculations for total return swaps in the Trade Manager

Nominal changes, notional resets, and cash flow calculations of total return swaps will be reflected more accurately in the Trade Manager

As of version 25.07, nominal changes, notional resets, and cash flow calculations of total return swaps will be reflected more accurately in the Trade Manager TRS instruments:

Instrument scope:

- Bond swap

- Bond swap, basket

- Equity swap

- Equity swap, basket

- Index swap

Note: This feature is not applicable to TRS basket contracts with adjustment transactions.

Key benefits

- Accurate cash flow information—Factoring in the new notional on existing reset transactions resolves previous discrepancies in the cash flow information of the funding leg for open and lifecycle transactions. Notional changes between resets, occurring due to any lifecycle transaction, are considered to ensure correct nominals on both performance and funding legs.

- Enhanced view of reset transactions—The Resets tab displays detailed information for both performance and funding legs, including notional changes and performance amounts. This offers a more integrated and transparent overview. A mouse-over tooltip on the Notional field in the grid highlights the impact of reset transactions affected by lifecycle transactions.

- Enhanced view of lifecycle transactions—You can also view the details of all lifecycle transactions associated with a TRS trade in the added Lifecycle Transactions tab under the Cash flow/Fixings tab in the Trade Manager. You can monitor the notional changes and performance amounts for lifecycle transactions created in the Trade Manager. This enhancement streamlines the TRS workflow by offering comprehensive insights into the trade.

Subscription based licensing

TM Total Return Swap

Sales module dependency

TM Total Return Swap

Removed limitation on number of business centers for total return swaps

The Trade Manager previously had a limitation of the number of business centres on a TRS instrument and this has now been removed

As of version 25.07, you can select any number of business centres for the following TRS instruments in the Trade Manager:

- Bond swap

- Bond swap, basket

- Equity swap

- Equity swap, basket

- Index swap

This feature is only applicable to payment dates, valuation dates, reset dates, and FX conventions for TRS instruments.

Benefits

- Users can enter any number of business centres in TRS instruments now.

Subscription based licensing

TM Total Return Swap

Sales module dependency

TM Total Return Swap

Added Expiry Time and Expiry Time zone to FX Options in Trade Manager

As of version 25.07, you can add settlement information for a new FX option trade in the Trade Manager. Two fields, Expiry time and Expiry time zone, have been added for the following FX option instruments in the Trade Manager:

- FX Option

- FX Option, Digital

- FX Option, Double Barrier

- FX Option, Single Barrier

- FX Option, Touch

- The Expiry time field contains the latest time (in hh:mm format) and the Expiry time zone field contains the applicable time zone when the option can be exercised.

- Both fields are optional and available for data import.

- Neither field can be modified during the lifecycle of the trade.

- To enter these details for an FX option trade in the Trade Manager:

- Go to the Trade Information section on the Trade Information tab of the contract.

Set the latest possible time to exercise the option as Expiry time and select the Expiry time zone to the applicable time zone.

Subscription based licensing

N/A

Sales module dependency

Trade Manager

Include US Pools as underlying for TM Straight repos

Nominal changes, notional resets and cash flow calculations of total return swaps will be reflected more accurately in the Trade Manager

As of version 25.07, nominal changes, notional resets, and cash flow calculations of total return swaps will be reflected more accurately in the Trade Manager TRS instruments:

Instrument scope:

- TM Repo (straight repo)

Key benefits

- Ability to select US Pool instrument as underlying instrument type.

- When selecting underlying Security ID only US Pool securities are selectable.

- Pool factors from the underlying US pool are taken into account, when calculating the settlement amount.

Subscription based licensing

TM Straight repo

Sales module dependency

TM Straight repo

Corporate Action Instruction Widget

Automatic linkage and display of MT565/MT567 status and reason

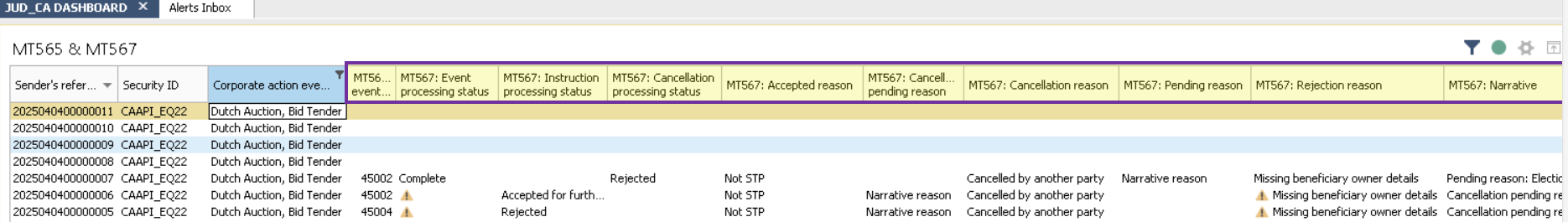

The new Instructions Widget offers a significant enhancement to Corporate Actions processing capability. It is designed to provide greater transparency and efficiency by offering a consolidated, real-time view of MT567 status messages linked to each MT565 corporate action instruction.

This widget automatically links incoming MT567 messages to the corresponding MT565 event and displays the latest MT567 status code (e.g., PACK, PEND, CANC) along with the associated reason code. This enables users to immediately understand the current position of their instruction. Where multiple active MT567 messages exist for a single MT565, the widget shows the total count and displays the latest.

In addition, users can:

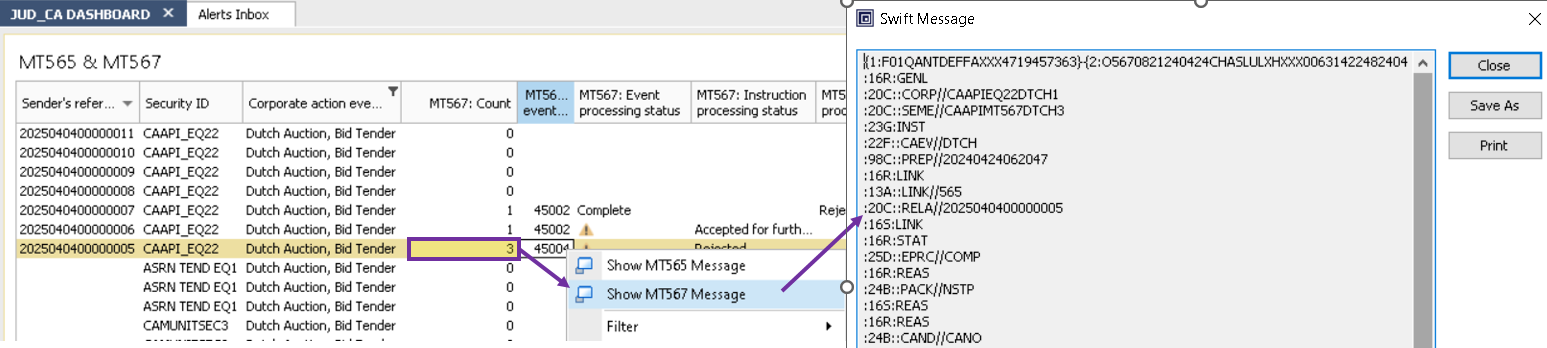

- View the full MT565 and MT567 message content directly from widget by right clicking on the widget item.

- See the full narrative text associated with the reason code, offering additional context for rejected or pending instructions.

- View the distinct status types (e.g., Instruction status, Processing status, Cancellation status) all in one place.

This enhancement allows users to work more efficiently, reducing the need to search across multiple windows.

Benefits

- Instantly view the latest status of MT565/MT567 messages without switching screens.

- Helps operations teams identify and resolve issues early, reducing downstream risk and ensuring timely, accurate processing.

- Minimizes the risk of settlement failures, missed entitlements, and instruction rejections or cancellations.

- Eliminates the need for manual reconciliation, freeing up valuable operational resources.

This image shows the MT567 Instruction Widget within the Corporate Action Dashboard, highlighting the status, reason, and narrative fields.

This image demonstrates the right-click functionality, revealing options to Show MT565 Message and Show MT567 Message for full message visibility.

Subscription based licensing

Equity - Securities

Sales module dependency

Equities

Ability to dynamically calculate tolerances during reconciliation based on rules

Tolerances in general reconciliation can now be specified in a more flexible way. Use predefined rules to dynamically determine and apply the appropriate tolerances based on the values of the internal reconciliation results. You can now, in a single reconciliation rule, specify different tolerances for various currencies, for example, 1 EUR for payments that settle in EUR and 10 YEN for payments in YEN. You can apply tolerances to all numeric reconciliation fields.

This setup also allows for entering a universal base tolerance in a base currency. Set a threshold for the reconciliation tolerances in a base currency, for example 1 USD, and get the threshold calculated automatically in different currencies, using the prespecified FX rates, and have those applied during reconciliation. The FX rates can be automatically updated via a batch job or manually as often as needed.

You can define the tolerance conditions in the Dynamic Tolerance Conditions window and use them in the Reconciliation rules.

Benefits

- More precision and consistency when reconciling.

- Define distinct tolerances per currency within a single rule .

- Manage tolerance logic with flexibility in one place (Dynamic Tolerance Conditions window).

Subscription based licensing

Reconciliation Manager

Sales module dependency

IBOR Manager

Release 25.04 IBOR

New batch job for updating OTC contract calendars

During the lifetime of an OTC contract, there may be changes to the definition of which days are non-banking days in the relevant business centers. A date that may have been a banking day when the contract was entered into, and so expected to have e.g. a swap payment, can turn out to be a non-banking day due to a new holiday.

With the new batch job ‘OTC Instruments– Validate All,’ such changes can be automatically detected and reflected on IRS and TRS contracts, correcting any days that are now non-banking days.

Benefits

- Automates the maintenance of banking days on IRS and TRS contracts.

Subscription based licensing

N/A

Sales module dependency

Trade Manager

Support for MXN OISs and MXN OIS swaptions with lunar calendars

As part of the industry-wide move away from LIBOR based benchmarks to alternative risk-free rates (“RFRs”) and following the announcements made by the Banco de México, as of 1 January 2025, new MXN swap contracts will be based on TIIE de Fondeo (an overnight rate), thereby replacing the existing 28-day Interbank Equilibrium Interest Rate in local currency (Tasa de Interés Interbancaria de Equilibrio, “28D-TIIE”).

This change will affect all MXN swaps with OIS legs. Therefore, Dimension now supports lunar calendars for the following Trade Manager swap instruments: IR swap, OIS, IR swap, OIS, basis, Cross currency, basis, Cross currency, fix/float, Non-deliverable IR swap, fix/float, Non-deliverable cross currency, fix/float.

These swap enhancements are available from 25.04 but have also been patched down to 24.10 and 25.01.

Secondly, from 25.04, Dimension now also supports handling lunar calendars for the Trade Manager instrument Swaption, IR swap, OI.S

Benefits

- The ability to handle MXN-based OTC contracts with lunar calendars

Subscription based licensing

N/A

Sales module dependency

Trade Manager

Support for NDS swaptions with physical delivery

Until 25.04, the existing Trade Manager instrument Swaption, Non-deliverable IR swap, fixed/float could only handle the settlement method Collateralized Cash Price”. The number of settlement methods has now increased, so Dimension now supports the following settlement methods: Physical, Cleared Physical, Cash Price and Collateralized Cash Price.

Secondly, we have also applied the Forward term to Swaption, Non-deliverable IR swap, fixed/float, allowing clients to handle forward-staring/mid-curve NDS swaptions.

Benefits

- Widen the scope and usability of the Trade Manager instrument Swaption, Non-deliverable IR swap, fixed/float.

Subscription based licensing

N/A

Sales module dependency

Trade Manager

Support for rounding on the Price QC field for Cross Currency TRS

We have added support to allow the ability to round the Price QC field on the Trade Manager to a defined decimal precision and rounding method.Additionally, this rounding on the Price QC field will continue throughout the lifecycle of the Total Return Swap.

Benefits

- Correctly support Cross Currency Total Return Swap rounding on the Price QC field for Index Swap, Bond Swap, and Equity Swap instruments.

Subscription based licensing

N/A

Sales module dependency

TM Total Return Swap

Support Forward Starting TRS with known Initial Price and Initial FX Rate

We have added support to allow users to define an Initial Price and an Initial FX Rate on a Forward Starting TRS. Previously, this was restricted and had to be created via valuation fixings/FX Fixings. Now, users can enter the initial price and/or initial FX Rate for a forward-starting TRS, and these will be picked up from Trade Manager in the initial exchange transaction.

Benefits

- Users can enter Price/FX Rate on a Forward Starting TRS from Trade Manager, and it will be used in the initial exchange without further action from the user.

Subscription based licensing

N/A

Sales module dependency

TM Total Return Swap

TRS – Portfolio Swap Agreement Tool

We have added support for a Portfolio Swap Agreement tool for Total Return Swaps. This allows users to define a Portfolio Swap Agreement in the newly created form in SCD. This reference can then be applied to multiple TRS trades using the portfolio swap agreement field in Trade Manager.

Benefits

- Users can link multiple Total Return Swaps in a synthetic wrapper within SCD.

Subscription based licensing

N/A

Sales module dependency

TM Total Return Swap

TRS – Increase lifecycle event available in Asset Manager Modify Position

We have added support for the Increase lifecycle event in the Modify Position functionality within Asset Manager. Previously, this was only available via Trade Manager.

Benefits

- Users can perform an Increase on a Total Return Swap using Asset Manager.

Subscription based licensing

N/A

Sales module dependency

TM Total Return Swap

TRS – Contract Simulation

Contract Simulations were not supported for Total Return Swap Baskets in Trade Manager and Asset Manager. This has now been added to enhance the overall functionality of the Equity Swap, Basket, and Bond Swap, Basket. We have also enhanced the single-name TRS contract simulation by adding the conventions tab, so that users can change defaults without accessing Trade Manager.

Benefits

- Users can perform a contract simulation for a Total Return Swap Basket in both Trade Manager and Asset Manager.

- Asset Manager users can now change default settings on TRS Single name without accessing Trade Manager.

Subscription based licensing

N/A

Sales module dependency

TM Total Return Swap

Release 25.01 IBOR

Price method “Quoted price and yield curve” can now use quoted price as input for FRAs

The price method quoted price + yield curve has been enhanced for FRAs to support changes in market quotations. Previously, FRAs were predominately quoted in yields, but more market vendors and clearing houses are now providing price information for FRAs in the form of of quoted prices.

With the quoted price + yield curves, it is now possible to use either a quoted yield or quoted price as input. As before, yield curve sensitivities are calculated regardless of the type of market quote used.

Benefits

- Supports the new type of market quoting for FRAs when using price method quoted price + yield curve to accommodate market standards.

- The same sensitivities are calculated, no matter which type of quote (yield or price) is used.

Subscription based licensing

Foundation

Sales module dependency

N/A

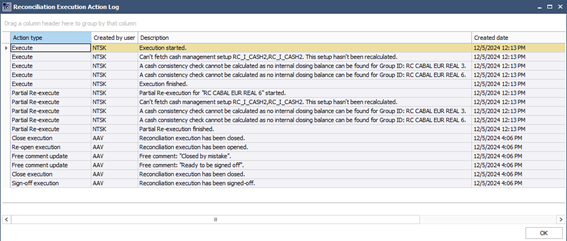

Audit trail for reconciliation execution actions and reconciliation results

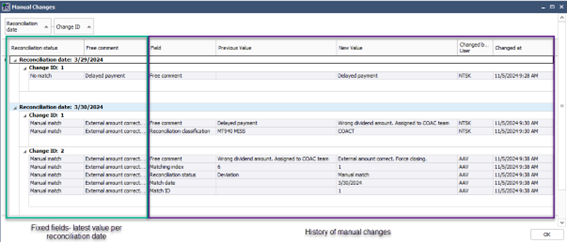

Enhanced history log of manual changes

You can now access the full history of manual changes, even for results rolled over multiple days. In addition to displaying the manually changed fields, the new native fields Reconciliation Status and Free Comments provide an easy overview by displaying the latest value for each reconciliation day. All this is presented in a brand-new GUI, offering a more intuitive and user-friendly experience with customizable views, including filtering, grouping, or sorting.

Benefits

- Improved transparency to track and understand the evolution of the reconciliation results over time

- Better analysis and decision-making

New GUI showing details about the changes from this record inception date

New audit trail for reconciliation execution actions

This version introduces an audit trail for actions performed at the reconciliation execution level. The log is accessible directly from the Reconciliation Manager.

For the following reconciliation actions, the log provides detailed information on when the action was started, any warnings or errors, when the action was completed, and by whom:

- Execute

- Partial re-execute

- Re-execute

- Internal import

- External import

- Apply auto-fill rules (only when applied manually or through a batch job)

- Re-open execution

- Close execution

- Sign-off execution

- Changes to the execution free comment (with the new comment visible in the Description)

Benefits

Improved transparency and accountability over the reconciliation process

Easier access to see errors or warnings that happen during execution or re-execution

Actions log for a reconciliation execution

Subscription based licensing

IBOR Manager

Sales module dependency

Reconciliation Manager

Ability to use a holiday calendar for calculating date deviations

Date deviation can now be calculated using business days instead of calendar days. The holiday calendar used for calculating break age can now also be used to calculate date deviations.

Benefits

- Date calculations are more accurate and aligned with your business operations

- Increased matching rates and reduced manual effort for resolving false deviations

Subscription based licensing

IBOR Manager

Sales module dependency

Reconciliation Manager

Ability to apply auto-fill rules manually

Rules created in the auto-fill rules application can now be triggered manually, directly from the Reconciliation Manager, for both active and inactive rules. This complements the existing options of applying rules during execution (for active rules) or via a batch job (both active and inactive rules).

Moreover, the engine has been enhanced to also allow deactivation/reactivation of the reconciliation records, based on predetermined rules.

To applied rules, these actions are logged in the new reconciliation execution log.

Benefits

- Users can apply rules on an ad-hoc basis with just a few clicks

- Reduce tedious manual work and the risk of errors by setting up rules for automatic filling

Deactivated checkmark can be turned on or off based on rules

Pressing Apply auto-fill rules and choosing one or multiple auto-fill rules to apply

Subscription based licensing

IBOR Manager

Sales module dependency

Reconciliation Manager

Automatically process CFDs on position adjustment MAND Corporate Actions.

With the increasing complexity of financial markets and the growing demand for derivatives processing, automation has become a necessity. This enhancement empowers our clients to seamlessly manage Contract for Differences (CFDs) processing for the following mandatory position adjustment corporate actions events:

- Bonus issue

- Stock splits

- Reverse stock splits / Consolidations

Benefits

- Enables users to assess how a portfolio of funds will respond to future changes in market conditions and identify factors that could jeopardize the investment strategy’s success.

- Enables users to produce more robust forecasts, as stress scenarios can reflect a wider variation of possible futures and situations that may not have occurred in the past.

- Allows users to flexibly combine several types of cashflow-related stresses, such as accelerating capital calls, delaying repayments, and extending fund lifetimes, define the groups of funds to which these combined stresses can be applied.

Subscription based licensing

Corporate Actions Manager

Sales module dependency

Corporate Actions Manager, Equities

OTC Web API

We have launched the OTC web API, which allows for programmatic access to the OTC functionality in SimCorp Dimension. Orders and transactions on OTC contracts can now be created, changed, deleted, and updated. The API is integrated with the Front Office API, so that it is now possible to combine OTC and non-OTC orders in automated flows.

Benefits

- Enables automation of OTC workflows that were traditionally handled manually within the Trade Manager

- Enables easier integration with Front Office processing

- Enables export of OTC contracts to external systems

Subscription based licensing

OTC Web API

Sales module dependency

N/A

Create inflation curves from index bonds

In many developed markets, forward-looking inflation curves are best created from inflation derivatives, primarily from zero coupon inflation swaps (ZCIS). In other markets, such as Mexico and Brazil, where there is no liquid ZCIS market, the best alternative is to use index bonds. The former has long been possible in SimCorp Dimension’s Yield Curve Manager, and the latter is now also supported.

The inflation curve creation is enabled for all built-in index variants but is most relevant in practice for Mexican and Brazilian variants.

With the new functionality, you can create accurate inflation curves also in economies without a liquid ZCIS market. The accurate inflation curves lead to more consistent pricing and improved risk management of inflation-linked instruments.

Benefits

- Generate accurate valuation and risk analytics for inflation-linked instruments in Mexico and Brazil

- Full auditable transparency in curve generation via the ubiquitous Explain calculation functionality

- Automate inflation curve generation with scheduled jobs shared across all curve types

Subscription based licensing

N/A

Sales module dependency

N/A

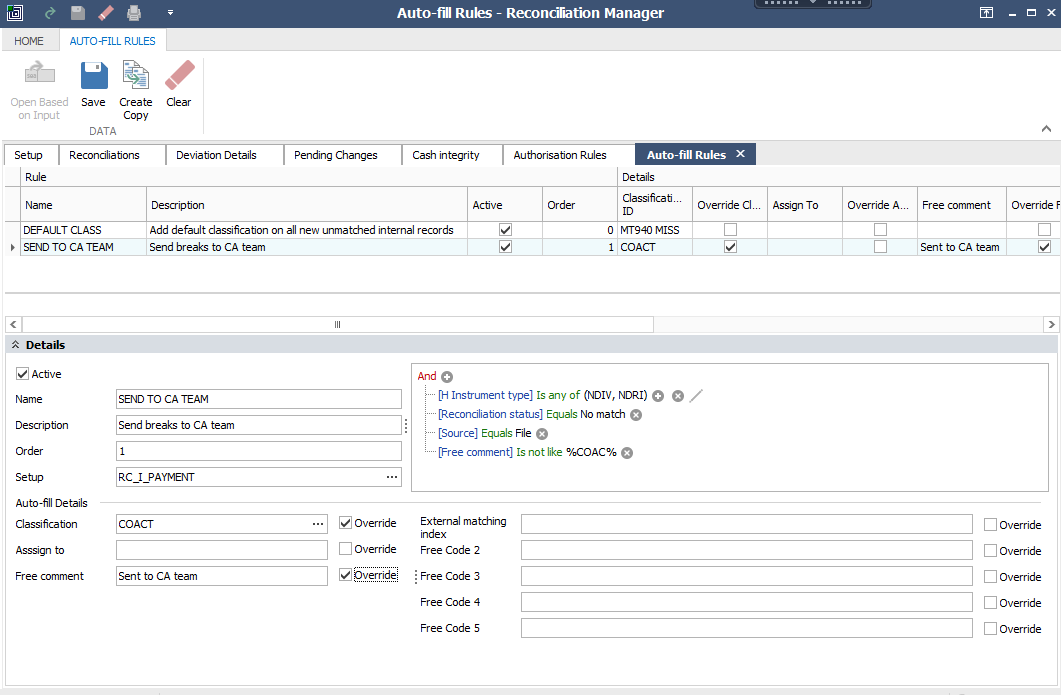

Auto-fill reconciliation fields based on predefined rules

Define rules based on the existing reconciliation results to automatically populate other reconciliation fields such as Classification, Free Comment, Reconciliation Free Codes, or Assign to fields. You can configure these rules in the new Auto-fill rules applet within the Reconciliation Manager. The rules will apply automatically during the reconciliation execution or can be executed ad hoc using a batch job.

Benefits

- Reduce tedious manual work and the risk of errors

- Streamline your reconciliation processes so you can focus on critical tasks

Multiple rules can be configured and executed in the specified order. In the image above, two rules will be applied during the execution: one rule adds a default classification to all new internal breaks, while the second rule sends external breaks on dividends to the COAC team by filling in the predefined classification value, COACT. This classification could also trigger an alert.

Subscription based licensing

IBOR Manager

Sales module dependency

Reconciliation Manager

More flexibility and a better control framework for one-side matching

You can now configure the one-side matching algorithm to apply exclusively to records from the external side, the internal side, or both sides. Previously, it would always apply to both sides.

Additionally, you can now set up authorization rules with the maximum possible granularity to control manual actions in the Reconciliation Manager and prevent human errors. Action types such as match, pay, force close, partial pay, etc., can now be combined with the type of record (internal or external) and the number of records (one-record or multiple).

These rules can now be highly customized depending on the specific action to be performed in the Reconciliation Manager.

Benefits

- Increased flexibility allows for better control over the matching process in the reconciliation application

- Enhanced security and risk of human errors by defining who can perform specific manual actions in the Reconciliation Manager and under which conditions

Define rules in the Authorization rules applet in Reconciliation Manager. The Total deviation field type has been enhanced to calculate the net amount for one-sided matching actions, while for both sides matching actions, it will check the difference between the amounts. Tolerances can also be set.

Subscription based licensing

IBOR Manager

Sales module dependency

Reconciliation Manager

Release 24.07 IBOR

![]()

Valuation of Mexican Inflation Linked Bonds

You can now use the full flow for Mexican inflation-linked bonds, known as MXN Udibonos. That includes the calculation of fair theoretical value and key ratios such as breakeven inflation rate, implied spread, money yield, real yield. This enhancement brings offers more precise and reliable valuations that align with the unique characteristics of the Mexican financial market.

In addition, you have the capability to build an Inflation Curve that predicts future MXN/UDI rates, leveraging market quotes from Mexican UDI/TIIE Swaps while considering peculiarities of the Mexican market.

Benefits

This enhancement offers support to investors in the Mexican capital market by enabling them to:

- Develop effective strategies to hedge against inflation.

- Evaluate risk exposures associated with Mexican Inflation bonds, utilizing metrics such as duration, convexity, and spread duration to assess interest rate risk, credit risk, and overall portfolio risk.

- Access the impact of various market scenarios on portfolio returns and risk measures.

- Analyse movements in the yield curve and their implications on portfolio positioning and strategy, including the Inflation Curve.

- Allocate and monitor performance of inflation-related attributions in FIPA flow.

Subscription based licensing

Inflation – Index Linked Bonds

Sales module dependency

N/A

Enrich/match reconciliation results using external sources

The new ‘Reconciliation results free codes 1’ to 5 fields enable you to enrich the reconciliation results with more information from the external file (using Data Forma Setup and only for external records), from other external sources (using dedicated APIs), or manually. Once the information is brought back into Reconciliation Manager, it can also be used to match records.

Note that in this version also Classifications can be inserted or updated from outside SimCorp Dimension via dedicated API endpoints.

Benefits

- Enrich reconciliation results and help solving breaks by leveraging external data sources

- Match records based on information enriched from outside SimCorp Dimension

- Manually insert and keep track of various information on breaks in text or date format

Subscription based licensing

IBOR Manager and Investment Operations API

Sales module dependency

Reconciliation Manager

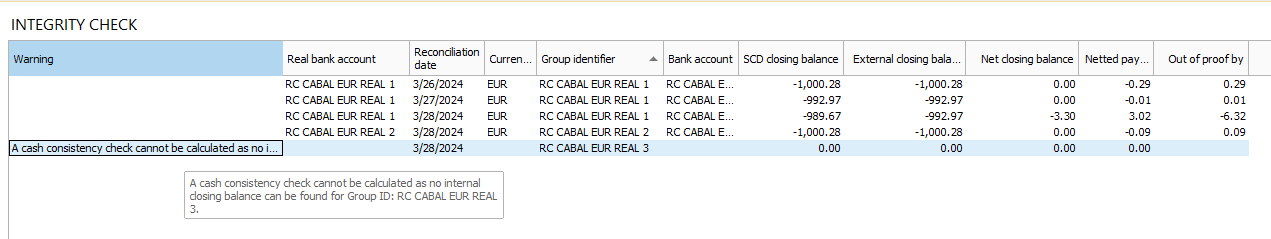

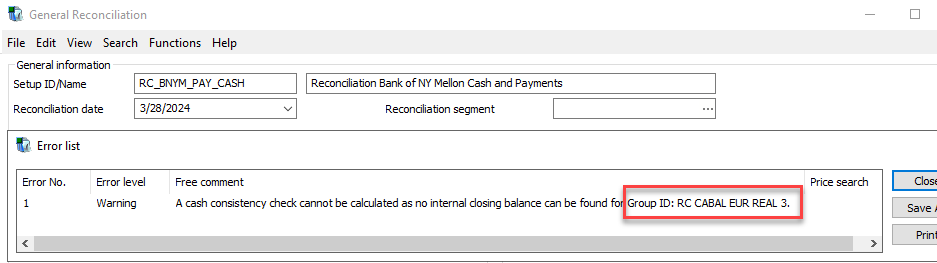

Enhancements to Cash Integrity check

The existing widget and form displaying the integrity check calculations will now include records for accounts where the calculation could not be executed due to various reasons, such as missing internal closing balance.

Benefits

- Gain a complete view of all accounts with their integrity checks, also when they fail

- Receive more informative warning messages when the integrity check cannot be calculated

Integrity check widget show records with warnings. Note the “Out of proof by” field which is empty in this case.

Existing warning message text shows information about the failed Group ID

Subscription based licensing

IBOR Managers

Sales module dependency

Reconciliation Manager

Trade Manager swaps with payment lags

The LIBOR reform was implemented by the end of 2021 for CHF, JPY, EUR and GBP LIBOR rates and by the end of June 2023 for USD LIBOR rates. The replacement rate was based on daily compounded O/N rates like SONIA, SOFR, ESTR etc.

For many OTC derivatives, like OIS swaps, a payment lag is applied to handle the calculation and confirmation of the compounded rate. For basis swaps the user may have to apply different payment lags of the two legs. This was only possible from 22.04 for the Trade Manager instrument “IR swap, OIS”. From 24.07, the user may also apply different payment lags for the following Trade Manager instruments:

- IR swap, OIS basis

- Cross currency swap, fixed/float

- Cross currency swap, basis

- Non-deliverable Cross currency swap, fixed/float

- Non-deliverable IR swap, fixed/float

- Asset swap

Benefits

- Enables users to correctly handle swaps in Trade Manager where the payment lag is different between the legs

- As an example, a EURIBOR vs ESTR basis swap may have a 0 day payment lag on the EURIBOR leg and a 2 day payment lag on the ESTR leg

Subscription based licensing

Trade Manager

Sales module dependency

Trade Manager

Trade Manager OIS manual payment date

The LIBOR reform was implemented by the end of 2021 for CHF, JPY, EUR and GBP LIBOR rates and by the end of June 2023 for USD LIBOR rates. The replacement rate was based on daily compounded O/N rates like SONIA, SOFR, ESTR etc.

In order to support the full flexibility required for the payment date structure the ability to enter manual payment dates is required. This functionality was previously introduced for Fixed and Floating interest rate types. This enhancement also the manual payment dates to be entered for all Trade Manager swap legs with a “Daily Fixings” Interest Rate Type. The instrument scope for this enhancement is:

- Asset swap

- Asset swap inflation

- Equity Swap

- Index Swap

- Bond Swap

- Bond swap, basket

- Equity swap, basket

- Cross-currency basis swap

- Cross-currency fixed/float

- IR swap, OIS

- IR swap, OIS basis

- Non-deliverable cross-currency fixed/float

- Non-deliverable IR swap fixed/float

Benefits

- Enables users to enter manual payment dates for OIS/Daily Fixings legs

Subscription based licensing

Trade Manager

Sales module dependency

Trade Manager

Trade Manager TRS Open the cash flow grid for manual Valuation dates (roll dates=Payment dates)

In a continuation of work to support irregular date structures for the TRS instrument in Trade Manager, from 24.07, users may now enter manual valuation dates on the following Trade Manager instruments when Roll Dates = ‘Payment Dates’

- Equity Swap

- Index Swap

- Bond Swap

- Bond swap, basket

- Equity swap, basket

Benefits

Enables users to enter manual valuation dates for Payment Dates rolls and enables more flexibility in the date structure.

Subscription based licensing

Trade Manager

Sales module dependency

Trade Manager

![]()

Enabled Collateral Optimization via Cassini Systems

This new module enables collateral optimization via third party Cassini Systems.

It enables users to send securities available for collateralization to Cassini Systems and receive optimized selection of assets to allocate thus ensuring the highest quality assets are available for the front office/treasure department for investment or financial purposes and increasing the profitability at a fund level.

Benefits

- Collateral Optimization via Cassini Systems is removing manual process that have been adopted from the front and middle office teams is choosing the lowest quality eligible asset to meet a collateral call.

Subscription based licensing

Collateral Manager

Sales module dependency

Margin Manager and Collateral Manager MarginSphere Adaptor

Release 24.04 IBOR

Ability to leverage the Counterparty SSIs from CTM ALERT database

New dedicated settlement fields on transactions make it possible now to capture the Counterparty’s settlement instructions from the ALERT database, on a trade-by-trade basis. The retrieval and updating of transactions can be done seamlessly during the trade confirmation process in Simcorp Dimension, or imported from external files. The new SSIs can then be used to generate Settlement instructions.

Moreover, it is possible to decide on Counterparty level whether they can be trusted with the SSIs from ALERT per instrument group, and use this decision actively when generating instructions.

Benefits

- Reduced risk of settlement failure due to wrong/outdated internal SSIs

- Reduced pressure on internal Counterparty SSIs maintenance

- Increased operational efficiency

Subscription based licensing

Settlement Manager

Sales module dependency

OMGEO Central Trade Manager - Adaptor

Overview of accounts and their Cash integrity

Cash and Payment reconciliation across multiple accounts pose a lot of complexities. One of them could be ensuring data accuracy and consistency. A new Integrity Check dashboard gives an aggregated view of all your accounts and their cash integrity, allowing for a more focused approach to solving breaks.

Benefits

- Unified view – all accounts and their integrity checks in one place

- Ability to prioritize solving breaks for accounts with integrity anomalies

- Ability to view the cash integrity calculations over several executions

- Ability to drill down to the reconciliation records associated with the account directly from the dashboard.

Subscription based licensing

Reconciliations Manager

Sales module dependency

Reconciliations Manager

Integration with YieldBook

YieldBook is a best of breed financial analytics platform that specialises on valuation of complex instruments including mortgage-backed securities (MBS) and asset-backed securities (ABS).

With the new interface, you can now seamlessly integrate SimCorp Dimension with YieldBook.

This enhancement utilizes the security-protected External Calculation framework and a new External Calculation Result Mapping window, enabling the retrieval of any MBS-specific key ratios. The streamlined process can connect to the YieldBook web API or XML API, unlocking enhanced capabilities for valuing a wider range of structured financial instruments within SimCorp Dimension, namely:

- ABS

- US MBS Pool

- TBA

- CMO

Benefits

This integration significantly improves efficiency and accuracy in valuing complex instruments such as ABSs, US MBS Pools, TBAs, and CMOs. Access to both end-of-day and intra-day analytics on demand eliminates delays and enhances decision-making agility in Front Office applications in an audit proof operation with mitigated operational efforts and risk.

Future Enhancements

The initial release focuses on retrieval of key ratios for MBSs across the SimCorp Dimension, with the potential future iterations concentrating on deeper integration:

- Introduction of Flexible Pricing Configuration.

- Activation of Key Rate Durations.

- Provision of User Defined Market Data.

- Integration of Scenario Analysis within the Risks Module.

- Support for YieldBook Dials.

- Retrieval of Cash Flow Information for ABS/CMOs.

Subscription based licensing

Yield Book/Basic

Sales module dependency

Various; Foundation plus "External Calculations" - Basic

Enable theoretical valuation of Australian Capital Indexed Bonds

You can now use the full flow for Australian Capital Indexed Bonds, including the calculation of fair theoretical value and key ratios such as breakeven inflation rate, implied spread, money yield, real yield.

In addition, you have the capability to build an Inflation Curve that predicts future Australian Consumer Price Indices, leveraging market quotes from Australian Zero-Coupon Inflation Swaps while considering peculiarities of the Australian market.

Benefits

This enhancement offers support to investors in the Australian capital market by enabling them to:

- Develop effective strategies to hedge against inflation.

- Evaluate risk exposures associated with Australian Capital Indexed Bonds utilizing metrics such as duration, convexity, and spread duration to assess interest rate risk, credit risk, and overall portfolio risk.

- Access the impact of various market scenarios on portfolio returns and risk measures.

- Analyse movements in the yield curve and their implications on portfolio positioning and strategy, including the Inflation Curve.

- Allocate and monitor performance of inflation-related attributions in FIPA flow.

Subscription based licensing

Various; Foundation

Sales module dependency

Various; Foundation

TM TRS Basket/Basic

You can now manage total return swap (TRS) baskets in the Trade Manager, including setting up Equity swap, basket and Bond swap basket, creating basket adjustments, handling payments and resets, and creating novation step-out or close transactions. This enhancement simplifies the process of exchanging the total returns of a basket of assets for periodic cash flows in the Trade Manager.

Key features:

- Capture TRS Baskets: You can now capture TRS baskets with either equities or bonds as the underlying assets in the Trade Manager. TRS basket in the Trade Manager includes the following instruments:

Benefits

- Enables clients to use Trade Manager to manage and create Bond Swap baskets and Equity Swap baskets

- Enables clients to create and save baskets in a one step process.

Subscription based licensing

TM TRS

Sales module dependency

TM TRS Basket/Basic

LIBOR Reform: support rounding rules on Trade Manager swaps

SimCorp Dimension now supports rounding rules that can be applied to the compounded rate used in Accrued Interest calculation on all Trade Manager swaps where one or both legs are linked to Overnight reference free rates, in this way the system will comply with the market standard dictated by the LIBOR reform.

Benefits

- Allows users to apply rounding rules on Trade Manager OIS legs and comply with the market standard;

- Enables calculation of rounded Accrued interest amounts upon entering a swap contract, or upon closing a swap contract or in the analytics applications in SimCorp Dimension.

Subscription based licensing

LIBOR Reform package

Sales module dependency

TM Overnight Index Swaps

TM TRS: support IBoxx

SimCorp Dimension now supports front-to-back solution for Standardized Total Return Swaps (TRS) on iBOXX bond indices. The IBOXX TRS trading conventions are embedded in the existing instrument type Index Swap in the Trade Manager so that the standard contract conventions are triggered under a particular configuration. As for any total return swap, a user can capture the IBOXX TRS trade in the Trade Manager, book total return swap resets payments, increase/unwind the position and mature the contract. Accrued Amount at the time of entering into a new trade or closing out a trade, as well as Performance amounts on TRS resets are calculated based on the IBOXX Standardized TRS Trading Convention Guide from the IHS Markit website.

Benefits

- Enables users to trade and manage a highly liquid standardized total return swap contract based on iBoxx bond indices;

- Allows users to simplify the trade capture and apply Iboxx standard conventions as defaults on the existing Index swap instrument upon a particular configuration.

Subscription based licensing

TM TRS

Sales module dependency

TM Index Swaps

LIBOR Reform: support rounding rules on TM swaps

SimCorp Dimension now supports rounding rules that can be applied to the compounded rate used in Accrued Interest calculation on all Trade Manager swaps where one or both legs are linked to Overnight reference free rates, in this way the system will comply with the market standard dictated by the LIBOR reform.

Benefits

- Allows users to apply rounding rules on TM OIS legs and comply with the market standard;

- Enables calculation of rounded Accrued interest amounts upon entering a swap contract, or upon closing a swap contract or in the analytics applications in SimCorp Dimension.

Subscription based licensing

LIBOR Reform package

Sales module dependency

TM Overnight Index Swaps

Consolidation of instrument modules

The following instruments will be removed, with adoption of the long standing Global Standard Solutions required for these models from release 24.10.

Benefits

- Adherence with SimCorp Global Standards, alignment with core FtB workflows and benefit from modelling upgrades where appropriate.

- Simplification of processes.

- Existing, historic transactions will be retained within your database.

Subscription based licensing

Various

Sales module dependency

Various

Release 24.01 IBOR

Reconciliation API

Access and enhance reconciliation results from outside Simcorp Dimension in real-time.

Benefits

Monitor the reconciliation process:

Access reconciliation runs with detailed statistics on auto-matched, unmatched items. Obtain a quick overview of the reconciliation status for efficient monitoring.

Analysis of results:

Retrieve a full list of reconciliation results for in-depth analysis and reporting.

Analyze deviations:

Calculate and analyze deviations between two or more reconciliation records to understand the breaks.

Insert comments:

Enhance collaboration by inserting comments directly on reconciliation results and help with breaks resolution.

Future versions will bring more end points and capabilities. Among others: classifying breaks, signing off the reconciliation results.

Subscription based licensing

Investment operation APIs

Sales module dependency

Reconciliation Manager

Communication Server DTCC CTM Connectivity Solution

A new Communication Server based connectivity solution for DTCC CTM has been developed. The new solution is a preconfigured connection package to make https calls to the CTM backend and integrates internally with the Communication Server that handles the business logic. All requests including polling status requests are generated by the business logic and forwarded to the connection solution, which then exchange it to CTM. Please note that the business logic is not part of this solution.

Benefits

This solution replaces the DCIGATE Communication Server and the 3rd party application DCI Gateway. The communication server connects directly to the CTM backend webservice and allows easier deployment.

Subscription based licensing

N/A

Sales module dependency

Communication Server is available for all customers.

Dependency “Omgeo Central Trade Manager (CTM) – Adaptor”

Improved pricing flow for structured bonds with embedded caps and floors

We have made a significant enhancement to our pricing flow for structured bonds with embedded caps and floors. This improvement introduces valuable changes that directly impact your daily workflow, offering enhanced capabilities and making your pricing tasks more efficient and accurate.

What you can achieve

With this update, you now have the ability to calculate implied spreads or option-adjusted spreads along with their related sensitivities for a diverse range of structured bond instruments. This includes floating interest type bonds with caps and floors, super floaters, reverse floaters, floaters with variable components, floaters linked to risk-free rates, and multiple interest type bonds.

The enhancement supports features such as market data scenarios, delta vectors, convexity adjustments, and risk scenarios, empowering you with deeper insights into the risk associated with your investments.

Benefits

This enhancement is designed to streamline your pricing processes, providing you with a more accurate and comprehensive valuation of structured bonds. The improved pricing flow allows for a seamless calculation of implied spreads and option-adjusted spreads, ensuring that you can make well-informed decisions in managing your investments.

Other benefits

Enhanced Accuracy: The Quoted price + yield curve, structured products price method has been improved to eliminate residuals, ensuring more accurate results.

Efficient Performance: We have improved run-time performance, making the pricing process faster and more efficient, tailored to the specific characteristics of the bond instrument and pricing method.

Improved Transparency: The Explain Calculation spreadsheet has been updated to hold all calculations for the components, including Implied Spread Calculation tab for easy reference.

Error Reduction: Numerous corrections leading to more reliable pricing results.

Subscription based licensing

Various; Foundation

Sales module dependency

Various; Foundation

Do not calculate UDKRs" in applications, where needed

Now it is possible to exclude user-defined key ratios (UDKRs) from applications and services if you do not want them calculated. You can exclude UDKRs at the formula level and at the child-mapping level.

Excluding UDKRs streamlines the calculation process. When you have a single pricing setup, all UDKRs are calculated in all applications even if they are not needed. For example, they are not needed when UDKRs contain ESG key ratios that have scaling properties not available in e.g., Portfolio Calculation. Creating multiple pricing setups to remove unnecessary UDKR calculations can be very cumbersome. The new process of excluding certain UDKRs avoids unnecessary calculations where the results are not required and improves the calculation time.

To use this functionality, you can specify in which applications or services UDKRs can be excluded from the calculations by using the Exclude from field in the Key Ratio Mapping window. Right-click in the two where you have a UDKR to exclude and select Exclude from. In the Select Applications/Services sub-window, you can specify where the UDKRs must be excluded. Currently, the list of applications or services includes:

- Middle-Office Position Calculation

- Performance Calculation

- Portfolio Calculation

- Pricing and Key Ratio Calculation

- Pricing and Key Ratio Service

- Risk Measurement

Benefits

Improve usage of UDKRs by allowing for specification of where to have the UDKRs calculated. This will reduce calculation time and improve performance for applications or services listed previously.

Subscription based licensing

Various; Foundation

Sales module dependency

Various; Foundation

Roll over interest for Straight Repos in Trade Manager

From 24.01, it is now possible to roll-over repo interest for repo roll-over transactions and notifications for cancellable repos and Evergreen repos. When a Straight Repo in Trade Manager is rolled-over (effectively closing the original repo trade and opening a new), Dimension did previously not support the possibility to roll-over interest from the closed part to the opened part. From 24.01 this is now possible for Straight Repos to check a check-box labelled “Roll over interest” under the conventions tab. The repo interest is then calculated across the closed and the opened repo and settled at maturity for the opened repo.

This functionality is only applied for:

- Straight Repos (i.e. not for Sell Buy Back agreements)

- Fixed rate repos (i.e. not for floating rate repos)

Benefits

- Enables users to follow market practice for repo roll-overs

- Enables users to follow market practice for cancellable and Evergreen repos

Subscription based licensing

Trade Manager

Sales module dependency

Money Market – Security Finance

Release 23.10 IBOR

Include known CPI values in ZCIS curve construction

You can now include known Consumer Price Index (CPI) values when estimating Zero Coupon Inflation Swaps (ZCIS) curve used for valuation of Inflation-linked instruments.

Benefits

Get consistent and correct Prices for Inflation-linked instruments by following Market Standards and including known CPI values in estimation of Zero-Coupon Inflation Swap Curves

Subscription based licensing

Various; Foundation

Sales module dependency

Various; Foundation

Release 23.07 IBOR

Monthly tenors in inflation curves

With this release we introduce monthly tenors in inflation curve estimation to apply with market standards.

Furthermore, Explain calculation is now available as part of inflation curve estimation to ensure transparency of the calculations.

Benefits:

With the introduction of monthly tenors in inflation curve, the enhanced inflation curves are now more in line with market standards as well as supporting data from data vendors.

Monthly tenors are typically used in the short end of the inflation curve, so the new enhancement will enable better valuation of inflation linked derivatives within this range.

Furthermore, Explain calculation has been enabled for inflation curve estimation to support transparency of the underlying calculations.

Subscription based licensing

Various; Foundation

Sales module dependency

Various; Foundation

Risk Factor Sensitivities in Pricing and Key Ratios Calculation

You can now calculate 1st order and 2nd order risk factor sensitivities with a Pricing and Key Ratios Calculation (PKR Calculation) instead of a Key Ratio Calculation. The results obtained can be extracted and utilized in Middle Office applications, such as Performance Calculation for Factor Based FIPA.

Benefits:

The introduction of Pricing and Key Ratios Calculation as a central hub for calculating, storing, and managing key ratios offers several advantages over Key Ratios Calculation. These benefits include:

- Support for a range of dates in calculations

- Support for User Define Key Ratios

- Enables position-based pricing

- Support for holding segments

- Capability to recalculate erroneous positions, ensuring accuracy

By incorporating risk factor sensitivity calculations into PKR Calculation, the need for running Key Ratios Calculation is eliminated. This streamlines the client's workflow and enhances the consistency, uniformity, and centralization of risk factor sensitivities and other key ratios.

Subscription based licensing

Various: Foundation + Middle office packages

Sales module dependency

Various: Foundation + Middle office packages

OTC Rates Swaption contract modelling – various enhancements

In this release, we have made the following improvements to swaptions contract:

Swaptions: Support for mid-curve / forward-starting contracts

From 23.07 it now possible to handle so-called mid-curve or forward staring swaptions in the Trade Manager.

For the instrument types “Swaption, fixed/float” and “Swaption, OIS” you can now define a forward starting period for the underlying swap after the exercise date. Previously, that forward starting period was limited to 99 days but can now be set to e.g. 5 years.

Subscription based licensing

Trader Manager, OTC Advanced

Sales module dependency

N/A

LIBOR discontinuation / ARR

In this release, we have made the following improvements to support the LIBOR discontinuation, this time in the Cash Management area:

LIBOR discontinuation: Cash flow forecast of (Alternative Reference Rates) ARR products in the Cash Management Module

As of version 23.07, you can forecast cash flows for the alternative reference rates (ARR) products in Cash Management based on the latest known fixing rates.

You can calculate forecast for instrument types such as bonds, IRSs, and TRSs based on compounded daily rates. If there are no new rates for these types of instruments available for the forecast period, SimCorp Dimension takes the last known values to calculate forecasts in Cash Management.

Previously, it was impossible to perform such forecasts in the absence of values for the requested period. But now SimCorp Dimension uses the rates from the static data windows. The Fixing rate values for bonds and IRSs are taken from the Bonds window and the Transaction IR swaps OIS basis - Trade - Trade Manager window, respectively. While the Fixing rate values for TRSs are in the Total Return Swaps window.

Subscription based licensing

Cash Management

Sales module dependency

N/A

Total Return Swap contract modelling – various enhancements

In this release, we have made the following improvements to TRS contract modelling:

TM TRS - Open the cash flow grid for manual Payment date and Fixing date changes

As of version 23.07, you can manually edit payment dates and fixing dates in the cash flow grids for the following TRS instruments in the Trade Manager:

- Bond swap

- Equity swap

- Index swap

Manual edits for payment dates in the cash flow grid

The enhancements to modify the payment dates apply to the funding leg with a Floating or Fixed interest type, as well as the performance leg.

You can edit these dates in the grid on the Cash flow tab on the Cash flow/Fixings > ... leg Cash flow sub-tab.

When you make any manual edits, SimCorp Dimension automatically selects the Has manual payment date check box in the grid, and the Irregular cash flow check box above the grid. You can clear the Has manual payment date check box to reset the date back to the parametric values. In addition, manual payment dates are always automatically aligned across the legs if the term date is the same.

TM TRS - TRS payment delay, see Release Notes about this feature

TRS – TRS Payment Delay

As of version 23.07, you can capture bond, equity, and index swap trades in the Trade Manager that link to alternative reference rates with a payment delay.

A payment delay is a key feature of the "in arrears" framework that is used by the alternative reference rates that are replacing LIBOR. A payment delay or "payment days lag" is all about the delayed (swap) payments. The observation period is the same, the interest is calculated in the same way, but the payment is paid n business days following the period end date. The advantage of this structure is that it gives more time for the payment.

With this enhancement, TRS instruments in the Trade Manager with an OIS leg are aligned with the other swaps with an OIS leg that are already supported in the Trade Manager.

TRS - prevent proceeds pay out upon close, partial close, maturity

TRS – enhanced handling of proceeds at close, partial close and maturity

As of version 23.07, the proceeds functionality has been extended for TRS instruments to control proceed amount payments when closing or reducing a position.

With this enhancement, you can withhold proceed amount payments at close, partial close, or maturity of transactions until the scheduled payment date for any holding or holding segment.

To support this enhancement, the Do not trigger payments on TRS close transaction check box has been added for TRS contracts.

Subscription based licensing

Trader Manager, OTC Advanced

Sales module dependency

N/A