Alternative Investments

Release 25.07

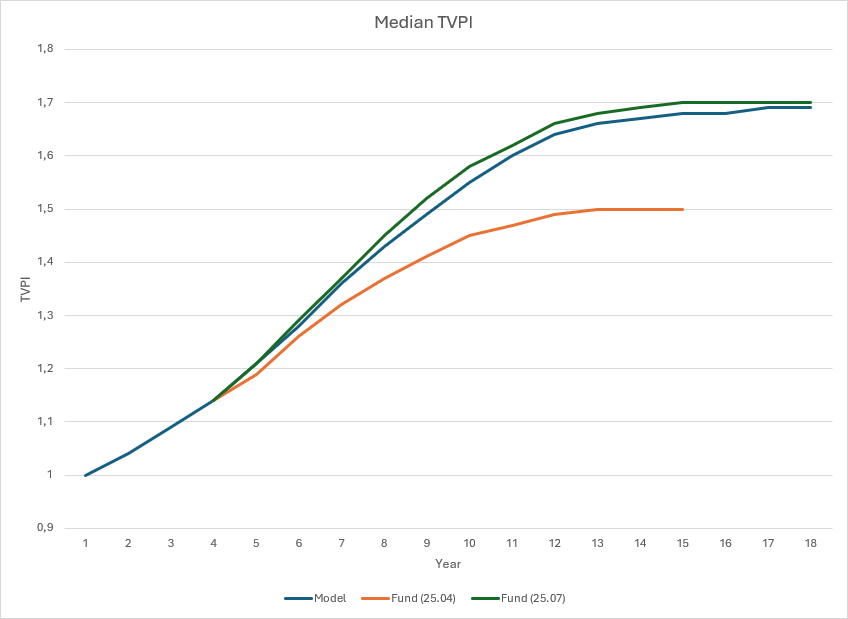

Improved TVPI/lifetime adjustment

Improved TVPI/lifetime adjustment

The convergence of a fund’s forecasted TVPIs and lifetimes towards its TVPI and lifetime on maturity is controlled by an internal age mechanism. The feature assures that, on inception date, the forecast for the fund is consistent with the forecast model’s projections.

Benefits

- No confusion over forecast model’s projection and what is forecasted for a fund at inception date

- Increased confidence that forecasts are consistent over time and converge towards the fund’s outcome at maturity

The chart shows median TVPI development for a draft forecast model. ‘Fund (25.04)’ shows the development in version 25.04 of a fund from the end of year 4. At the end of year 4, the fund has the same total contributed, total distributed, and NAV as the forecast model projected on average over the same time horizon. ‘Fund (25.07)’ shows that the new release produces better results for this case.

Subscription based licensing

Alternatives Strategy Analysis

Sales module dependency

Alternative Investments Manager

Alternatives Strategy Analysis

Browse the Release Portal