Front Office

Release 26.01

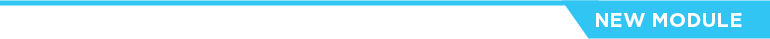

Portfolio Analysis – AI-Powered Portfolio Viewing Capabilities

This is a cloud-native evolution of Asset Manager, designed to enhance decision-making, streamline workflows, and unlock new analytics capabilities. You can view the positions and analytics supported by the visualizations as of today and as for a historical date.

Benefits

- Fast web access to view your data anytime, anywhere.

- Intuitive design for smooth navigation and visualisation.

- Leverage Generative AI for smarter, faster data analysis.

- Dive into time-series data with easy historical browsing.

Caption: Next Gen AI-Powered Portfolio Viewing Capabilities in Dark Theme

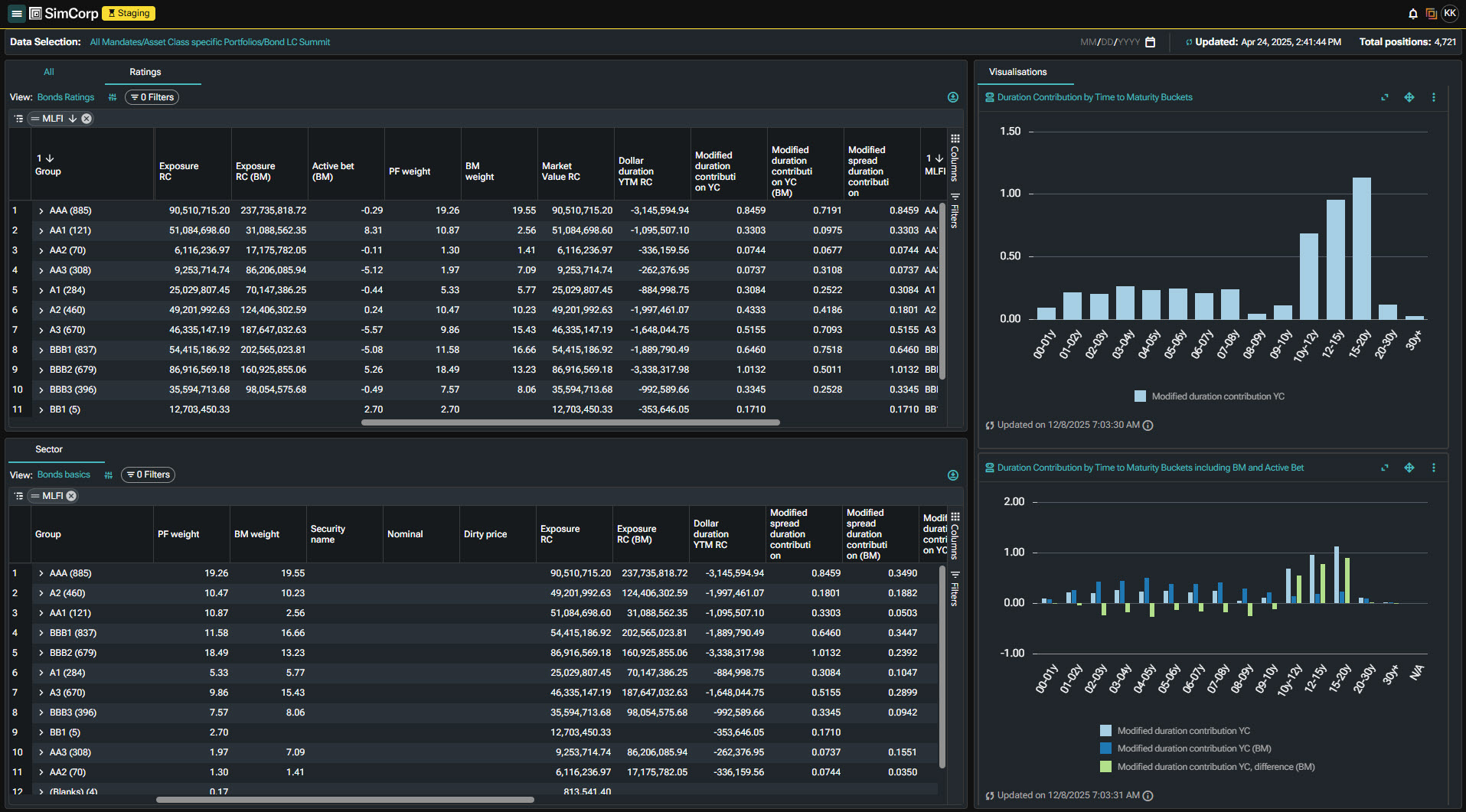

Caption: Next Gen AI-Powered Portfolio Viewing Capabilities in Light Theme

Subscription based licensing

Next Gen Asset Manager, Copilot, Front Office API

Sales module dependency

Asset Manager - Base, Asset Manager API

Browse the Release Portal

Simple End-of-Period Reporting of Investment Restrictions

Version 25.10 of Compliance Manager brings a dedicated web API for easy end-of-period reporting of investment restrictions.

The API highly simplifies the retrieval of post-trade compliance results. This reduces implementation time and removes the need to understand the structure of the underlying database.

With just a few parameters, you can query portfolio or mandate level results, or dive into the individual results for detailed reporting of breached investment restrictions.

To improve the operational workflow, the API further enables you to detect upstream issues early and query for updated results in case some post-trade validations have been rerun.

Benefits

- Reduced implementation time of reporting solutions

- No need for SQL competences

- Simplified operational workflow

- Improved security as directly database access is not required

Subscription based licensing

Compliance Manager

Sales module dependency

N/A

Release 20.10

Release 25.07 - Front Office

Input Fields in the Asset Manager

Enablement of stronger portfolio construction workflows

With the 25.07 release, we have introduced new input fields in the Asset Manager, enabling the creation of even more flexible and powerful construction workflows.

Together with all the attributes and analytics fields in the Asset Manager, we are now introducing user- configurable input fields. In these fields, you can easily type in and edit values, which will be persisted and loaded the next time you open the Asset Manager.

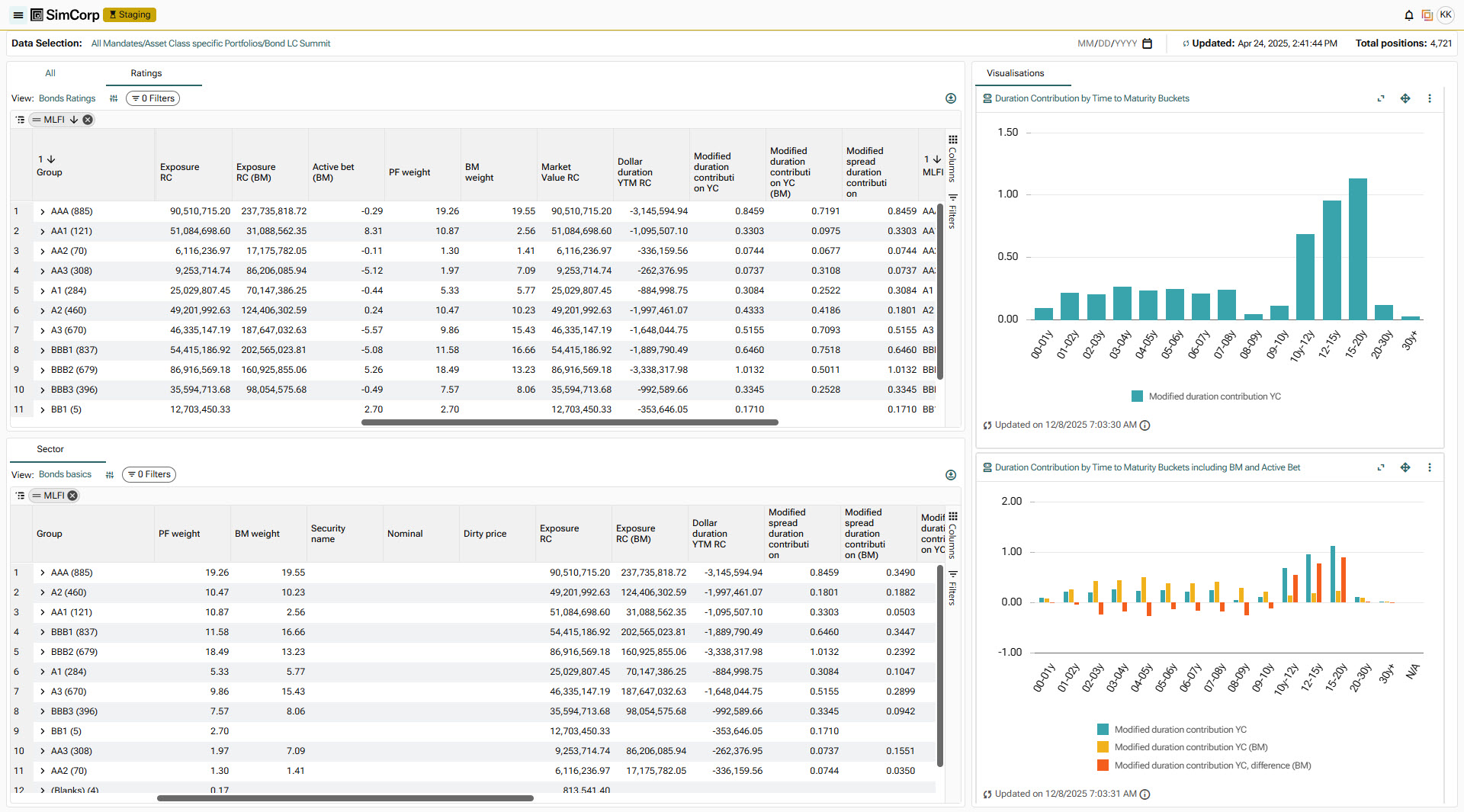

The input fields can be anchored on different levels–security, issuer, sector, portfolio, etc.– and can, for example, represent long-term investment targets, trading signals, or risk appetite.

This may appear like a small thing, but on the back of these input fields, you can build powerful automated portfolio construction workflows. You can create Simulation Macros that take these input field values and run customized, client-specific calculations to create suggested trades. Hereby, you can create some very rich allocation and alignment workflows.

Benefits

- Easy input of values on different levels.

- Persisted for later use.

- Enables creation of much more advanced Simulation Macros using input values from multiple levels for simulation generation.

Example of an Input Field in the Asset Manager.

Subscription based licensing

Asset Manager

Sales module dependency

Asset Manager

Release 25.04 - Front Office

Electronic trading (via FIX) of inflation swaps

Inflation swap volumes have increased significantly in recent years, leading to greater uptake of electronic trading in the market. Order Manager now supports electronic trading via FIX of Zero Coupon Inflation Swaps (ZC ILS) on Tradeweb, using the same fast and efficient order flow already available for other instrument types.

Both bilateral and centrally cleared swaps can be traded, and position-closing orders for cleaned positions can also be traded (on NPV).

Benefits

- Enables straight-through-processing of ZC ILS orders, increasing speed of execution and reducing operational risk.

- Regulatory identifiers (allocation and beta USIs) and clearing status are automatically consumed and stored from Tradeweb for reporting and recordkeeping.

- Competing quotes are automatically saved to document best execution.

Subscription based licensing

Order Manager and add-ons

Sales module dependency

Order Manager

Streamlined workflows and enhanced insights

Over the past year, we have partnered with several of our daily users of Compliance Manager to eliminate time-consuming, tedious manual tasks and boost productivity. With version 25.04, we are excited to bring another round of workflow enhancements.

We have brought the pre-trade side into the process of working with post-trade breaches. When working with a post-trade failure in the Alerts Inbox, we now show relevant pre-trade failures and override comments. Often, these comments help explain why a compliance rule fails post-trade.

The presentation of compliance result details has been enriched and made more compact, giving better insights into the evaluation of complex rules.

More visual cues have been added to the action and event history of alerts. For longer-running breaches, this helps maintain oversight and make informed decisions. One possible action is to temporarily approve a breach, which can now be done in more flexible ways.

The daily users of Compliance Manager are the experts on what works well and what can be improved. To make it easier for everyone to contribute their insights, we have added a new feedback feature directly inside Compliance Manager. We invite you to use it and share your feedback with us.

Benefits

- Direct access to pre-trade override comments when working with post-trade breaches

- Enriched result details that enable easier understanding of complex compliance rules

- Additional visual cues on post-trade alerts to, for instance, easily distinguish agreement date-based rules from settlement date-based rules.

Subscription based licensing

Compliance Manager

Sales module dependency

Compliance Manager - Base

Release 25.01 - Front Office

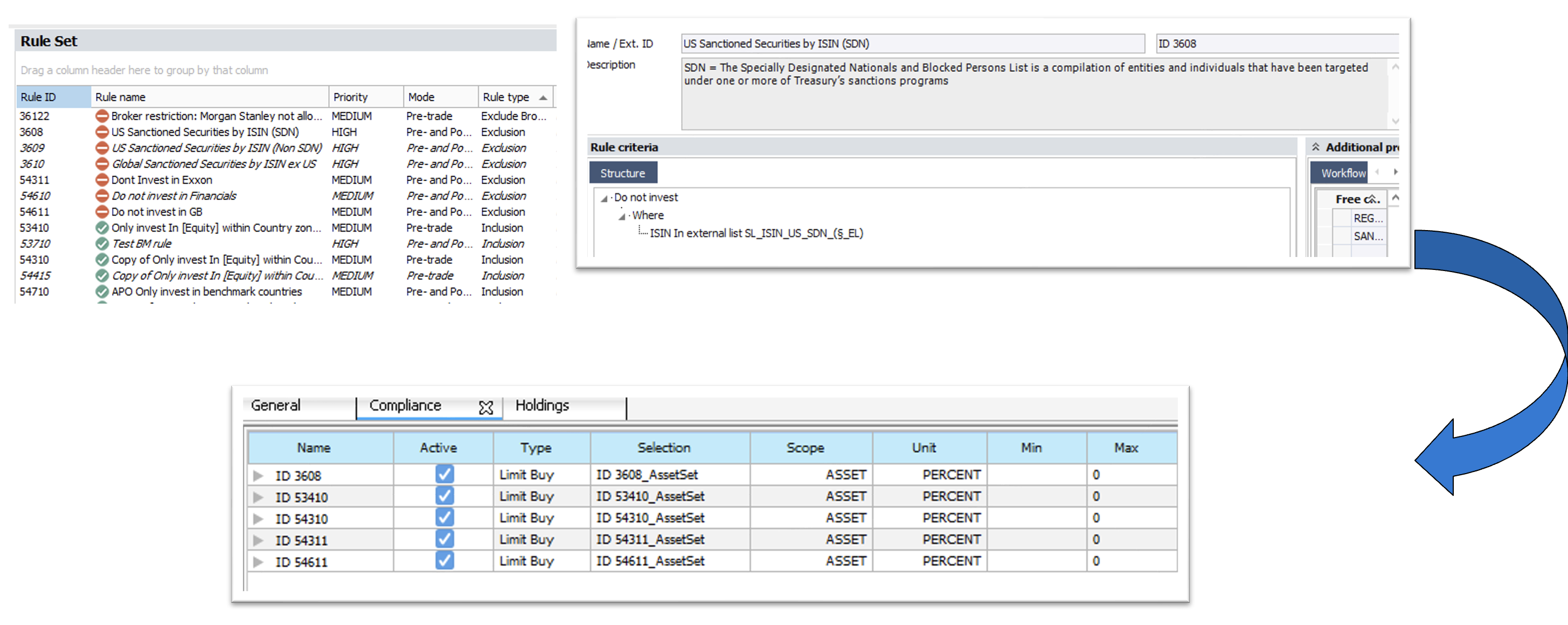

Using Compliance Rules to define Optimization Constraints

The Axioma Portfolio Optimizer is widely used by SimCorp clients to efficiently create quantitative or systematic investment strategies. The quality of the solution and the resulting trade list can be greatly enhanced by improving the accuracy of the data sets.

To date, integration between these products has ensured consistency and precision in portfolio and benchmark positions, prices, and analytics, supported by a shared set of reference data.

The next step has been to add Compliance rules to that list. This ensures that the resulting optimal trades will pass pre-trade compliance checks.

The first phase has focused on “Do Not Invest” lists. E.g., Global sanctions lists, blacklisted ESG securities, specific sectors, or country lists.

Benefits

This resolves the challenge of creating an optimal trade list, only to find that it subsequently fails pre-trade compliance, requiring the process to be re-run. In effect:

- This improves the quality of the solution and trade list.

- Reduces the number of iteration to get to a solution

- Allows a single system to manage constraints and compliance rule sets with the requisite auding and controls.

The top row of the image represents the compliance rules being managed in SimCorp Dimension, and the bottom row represents the corresponding investment constraints represented in Axioma Portfolio Optimizer. Notice the common ID that provides the link between the 2 systems.

Subscription based licensing

Axioma Portfolio Optimizer Integration

Sales module dependency

Asset Manager

Flexible Aggregations of Portfolios in Compliance Manager

Compliance Manager now offers much greater flexibility and an improved system for applying investment restrictions to sets of portfolios.

With the newly introduced concept of business entities, you can define named sets of portfolios dynamically. These sets can represent investment mandates, clients, strategies, etc., and are independent of the portfolio/portfolio group structure.

The included portfolios can change over time, with the sets able to overlap or intersect each other as needed.

In Compliance Manager, business entities are structured in a new hierarchy parallel to the existing portfolio hierarchy. This follows the well-known principles and workflow of the module, including lifecycle management, assignment of global rules and legal sets, and more.

This is an often requested addition to Compliance Manager, which has sometimes been referred to as a portfolio hierarchy without portfolio groups. We are very excited to release it with version 25.01.

Benefits

- Model portfolio structures freely in a dynamic way, independent of portfolio groups

- Improved system performance for compliance rules across large numbers of portfolio groups

- More transparent configuration of investment guideline monitoring

- Better model your investment process and structures in Compliance Manager

- Shared concept with support being rolled out to other functional areas of SimCorp Dimension in upcoming releases

Subscription based licensing

Mandates and Investment onboarding (Add-on, new)

Sales module dependency

Mandates and Investment onboarding

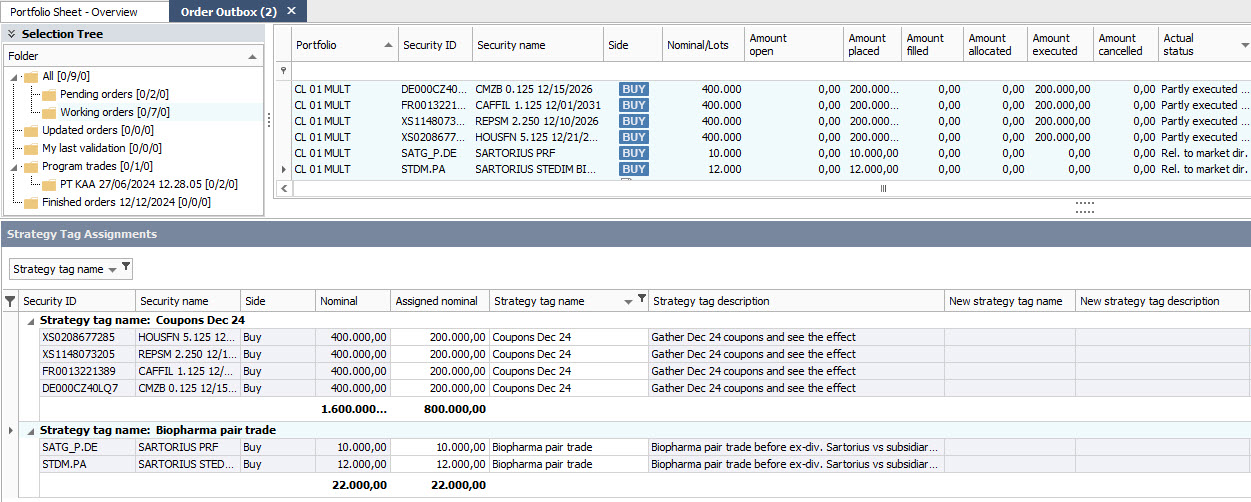

Strategy Tagging

Strategy tagging provides a flexible a way to group simulations, orders, and transactions, enabling portfolio managers to analyze investment decisions over time.

Traditional grouping methods in portfolio management often rely on accounting-focused split fields, which, while effective, may not fully capture the dynamic nature of opportunistic decisions. This highlights the potential for more innovative approaches that better represent pair trades, long-short strategies, bets on the macroeconomic events, credit spread strategies, etc. With the new module, you can analyze strategy tags in isolation, compare strategy tags to evaluate the different decisions, and learn from the strategy tag results.

Strategy tagging was developed with an API-first approach. A full maintenance workflow can be undertaken by using the Strategy Tagging API. Additionally, you can perform some strategy tagging tasks by using the Strategy Tags window and Strategy Tag Assignments applet in Asset Manager.

You can leverage a set of pre-defined strategy tags or create new ones on-the-fly to group simulations, orders, or transactions effectively. The flexibility of the strategy tagging approach allows you to allocate the full or partial nominal to a strategy tag, facilitating the division of an order across multiple strategies while still releasing it as a single order to the dealing desk. Strategy tagging operates independently of workflow status, allowing for swift execution and retrospective modifications.

For all transactions that are assigned to a specific strategy tag, you can request the calculation of market value, exposure, and other PKR-driven key ratios, balance book value, unrealized P/L, year-to-date P/L, and other standard accounting values, as well as associated cash flows. The cash effects of coupons and dividends are projected by using the assigned nominals of transaction assignments that can differ from the IBOR records.

Benefits

- Enables playground for portfolio managers to track their decisions and learn

- Supports active portfolio management strategies

- Optimizes impact on accounting view

A new Strategy Tag Assignments applet in Asset Manager

Subscription based licensing

Add-On Package (for SBL): Strategy Tagging API

Sales Module (for MBL): Strategy Tagging API

Sales module dependency

Asset Manager module increases the value

CS01 calculation supported natively

In version 25.01, DV01 – the dollar value of a 1 basis point key ratio, measuring the interest rate sensitivity of a bond or portfolio of bonds, or fixed income instruments in general, became natively available in Asset Manager and elsewhere in Simcorp Dimension.

The native support for fixed income analytics has now been expanded to include CS01. CS01 captures the change in dirty price due to a 1 basis point shift in the discounting curve, whereas DV01 measures the 1 basis point shift in both the fixing and discounting curves.

CS01 serves the same purpose as the spread duration key ratio and is, in fact, defined as a simple scaling of Spread Duration – except for callable bonds, where CS01 is based on yield to worst date calculation logic.

Previously, CS01 was modeled using User Defined Key Ratios (UDKRs). Native support for CS01 removes some limitations associated with UDKRs. For example, it is now possible to use CS01 as a target key ratio in the automated position weight adjustment in Asset Manager.

Benefits

- Reduces configuration maintenance by using CS01 as a native key ratio.

- Allows CS01 to be targeted as a key ratio in Asset Manager

- Follows best practices by using SimCorp’s standard CS01 key ratios, which are applicable for bonds, swaps, index bonds, and more.

Subscription based licensing

Asset Manager

Sales module dependency

Asset Manager

Release 24.10 - Front Office

Use DV01 key ratio for targeting in Asset Manager

The DV01 key ratio, or the dollar value of 1 basis point key ratio, measures the interest rate sensitivity of a bond or a portfolio of bonds, or fixed income instruments in general. It serves the same purpose as the dollar duration key ratios and is, in fact, defined as a simple scaling of dollar duration.

Previously, DV01 was not available natively in the Asset Manager or elsewhere in SimCorp Dimension. While it could be easily created via a user-defined key ratio (UDKR), it is now available as a native built-in key ratio. This change removes some limitations that are associated with UDKRs. For example, it is now possible to use DV01 as target key ratio in the automated position weight adjustment in the Asset Manager.

The DV01 key ratios are available in multiple variants for all fixed income, including inflation-related instruments, where the so-called real DV01 key ratios are relevant.

Benefits

- Reduce configuration maintenance by use of DV01 as native key ratio

- Include DV01 as a key ratio that can be targeted in Asset Manager

- Follow best practices by using SimCorp’s standard DV01 key ratios applicable for bonds, swaps, index bonds, and more

Subscription based licensing

Asset Manager

Sales module dependency

Asset Manager

![]()

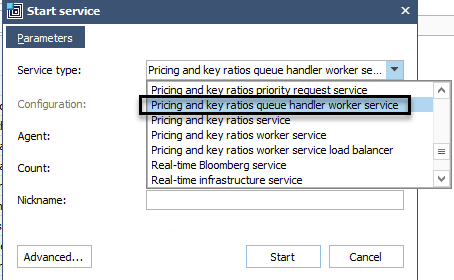

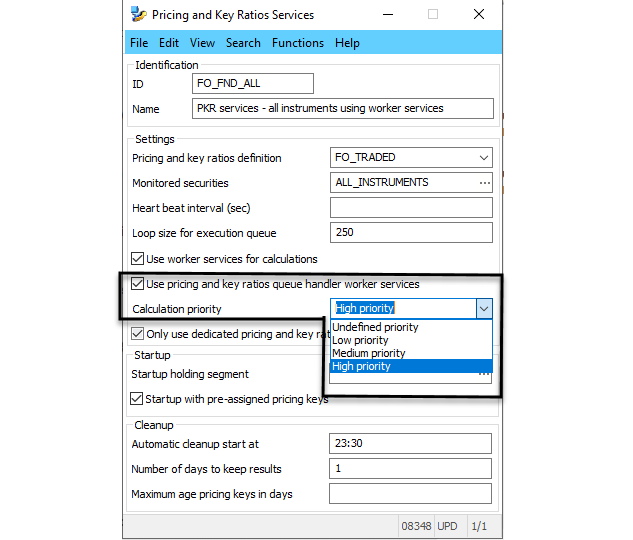

Enable more than one PKR service using workers at the same time

You can now run more than one Pricing and Key Ratios (PKR) Service with Worker Services at any given time with the Pricing and Key Ratios Queue Handler Worker Service. This service is available in your installation’s System Manager. Previously, only one PKR Service at a time could use workers.

The PKR Queue Handler Worker Service has no calculation timeout, unlike the PKR Worker Service. No timeout means you can have a bigger loop size. Additionally, the calculation of a single batch should never take more than 15 minutes.

Benefits

The bigger loop size and no timeout can:

- Reduce the overhead associated with the calculations (there is an overhead for each loop)

- Ensure that pricing for complex securities is completed and not timed out (giving no result)

- Creating queues allows for more than one PKR Service to read requests/responses/details

Pricing and key ratios queue handler worker service

The calculation requests from a PKR Service with a higher priority than other PKR Services are taken first.

PKR Service’s queue handler calculation priority options

Subscription based licensing

Asset Manager, Compliance Manager

Sales module dependency

Asset Manager Base, Compliance Manager Base

Release 24.07 - Front Office

Streamlined Workflows to Boost Productivity

Compliance Manager brings a number of improvements to the investment controller’s daily workflow in version 24.07. These improvements unify the way you work with post-trade compliance warnings and failures, and pre-trade compliance override requests. Your daily work related to the pre- and post-trade compliance workflows are now all anchored in Alerts Inbox. An additional number of smaller, powerful, improvements to the usability further boost your efficiency.

Alerts on warnings brings the rich workflow, that you know from post-trade failures, to the warning level of your investment guideline monitoring. This reduces the risk of potential issues being overlooked and escalating to become failures.

For failures that do happen, the automatic classification into active or passive breaches has been refined so that you can designate certain types of transactions as being passive. Typically back office transactions.

Portfolio managers’ requests for compliance overrides now arrive in Alerts Inbox from where you can accept or reject them. This allows different people to receive automatic email notifications dependent on which compliance rule, portfolio, etc. an override request is for. All standard alerts actions, such as assigning, writing comments are available for compliance override request alerts.

All Compliance Manager alerts now show related alerts as a part of their details. As an example, when working with a compliance failure, you will see recent similar warnings and data exceptions to give you a fuller picture of what lead to it.

Benefits

- Unified and consistent workflow for compliance warnings and failures.

- Rich workflow for compliance override request, including advanced email notifications and configuration of who is permitted to accept overrides of which compliance rules.

- Full transparency and auditability of actions and events, for both pre- and post-trade workflows

- Granular automatic classification of active and passive breaches.

- General productivity boost though a number of general usability improvements to compliance alerts, such as new standard alerts filters and additional information displayed in the alert headers.

Subscription based licensing

Compliance Manager

Sales module dependency

Compliance Manager

Improvements to Front office holding service load balancing.

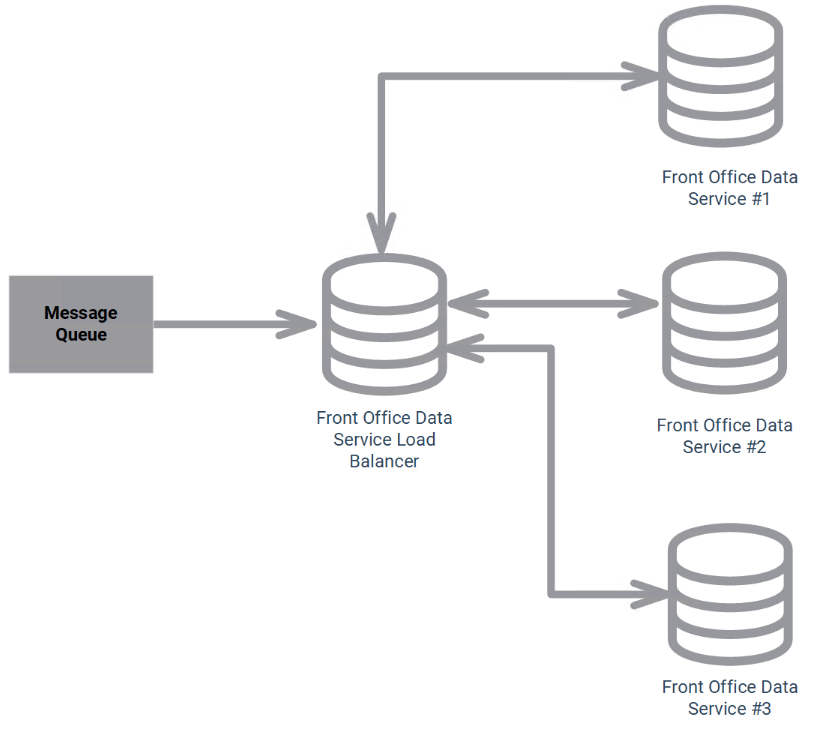

The Front office holding service type is now deprecated. It is replaced by the Front office data service by default, which is the recommended service from version 24.07. This means that on upgrading to version 24.07, a conversion program runs to replace automatically the Front office holding service with the Front office data service in your Service Model. There is no manual intervention or configuration required after the upgrade.

This solution is designed to handle a message queue of position updates by weighting all messages and distributing them across multiple data services.

To implement such a solution, a new Front office data service type and a Front office data service load balancer service type are available to run on the Service Platform. When you run one or more Front office data services, a Front office data service load balancer service type is started automatically.

Benefits

- Improved system performance due to faster processing of queue.

- All operations with queue are done on the Front office data service load balancer without locking any resources. Loading of the Front office data services is done in a better way involving them all in parallel when needed.

- No processing delays as the Front office data service load balancer guarantees that Front office data services do not try to update the same positions.

- The Front office data service load balancer keeps History of updated positions. The service which did update of similar position before has preference during distribution.

- New opportunities to implement scaling strategies for the Front office data services in future.

Improvements to Front office holding service load balancing.

Subscription based licensing

Asset Manager

Compliance Manager

Sales module dependency

Asset Manager

Compliance Manager

![]()

Support Index certificates in Order Manager

The Index Certificate instrument type is now supported on the New Order Manager Architecture for Equities asset class.

Index Certificate orders can be released from Asset Manager and executed in Order Manager using all capabilities of New Order Manager Architecture including FIX and manual trading.

Benefits

- Increase Order Manager instrument coverage.

- Enable front to back workflow for Index Certificate instrument in SimCorp Dimension.

Subscription based licensing

Order Manager

Sales module dependency

Order Manager

Release 24.04 - Front Office

Alert API

The Alerts API for Compliance Manager alerts enables you to integrate post-trade compliance information seamlessly into external applications.

For portfolio managers that use their own specialized applications (whether based on Excel, in-house built or third-party solutions), the Alerts API complements the existing Front Office API to bring both the pre-trade and post-trade compliance directly to them.

Investment controllers screen and qualify compliance breaches using Compliance Manager’s Alerts Inbox and pass them onto portfolio managers, no matter if they use Asset Manager or another portfolio management tool. Through the API the portfolio manager can see all events and actions related to a post-trade compliance breach, access the result details and comment on an alert before possibly passing it back to the investment controller for further clarification. Used in this way, the API provides full transparency and auditability of the process – also for actions performed on alerts by non-SimCorp Dimension users.

Other possible use cases for the Alerts API include:

- Connect Alerts Inbox with a company-wide incident management system to centralize exception handling.

- Further automate the alerts workflow on top of the possibilities provided by Business Rules Manager.

- Create a dedicated application specifically for compliance failures to make it easier for infrequent SimCorp Dimension users to work with them.

For software engineers implementing API solutions, the API is simple and intuitive to work with and follows modern web API design principles.

Benefits

- Deeper integration of the compliance workflows into external tools and applications

- Enable non-SimCorp Dimension users to work directly with post-trade compliance failures from Compliance Manager

- Full transparency and auditability of alert actions no matter if they are performed natively in SimCorp Dimension or via the API

- Automate alert actions above what is possible with Business Rules Manager

Subscription based licensing

Compliance Manager

Sales module dependency

Compliance Manager Base

Streaming Delta Overview

SimCorp introduces a new real-time streaming API for Order Manager data to help support clients have the capability to enrich and utilise more effectively their own proprietary trading support and decision-making tools.

The streaming API provides consistent data structures so the data that is streamed isn’t subject to breaking changes as newer trading opportunities arise i.e. adding trading Repos in a later release.

This makes it possible for trading / Order Manager data to be streamed based on events as they occur in Order Manager

Scope

- When an event happens in NOMA, several delta messages will be published on the same message session to ensure message ordering.

- Covers important Order Manager domain concepts like orders, programs and comments.

- Support protobuf binary payloads for efficient serialization/deserialization.

Benefits

- Azure Service Bus is the communication medium to ensure a robust connection between the cloud-native environment and on-premise/SaaS SCD installations.

- Possible client APIs: native Azure Service Bus clients, REST clients, etc.

Subscription based licensing

Order Manager

Sales module dependency

Release 24.01 - Front Office

Pre-placement compliance validation for Equity & Futures when configured

As of version 24.01, if you are using the new Order Manager architecture, you can configure equity and future placements to be subject to compliance validation before placing.

If pre-placement compliance validation is enabled, then the equity and future placement is affected in the following way:

- The placement distribution is pre-allocated and any fills received/executed are distributed on that basis.

- The placement is created in a draft state when the compliance validation for the portfolios/placements is pending.

After the validation, if enabled, a ‘Can Proceed’ indicator is displayed at the placement level, reflecting the response from the compliance validation.

- If the ‘Can Proceed’ indicator displays a green arrow, any trading communication is released immediately, and the placement state changes to ‘Working’.

- If the ‘Can Proceed’ indicator displays a general prohibition sign, you must amend or cancel the placement.

- If the ‘Can Proceed’ indicator displays a yellow arrow, it means that there are compliance validation errors. You can override them with or without providing a reason.

- If the ‘Can Proceed’ indicator displays a blue arrow, you must request compliance approval.

- If the ‘Can Proceed’ indicator displays a yellow or blue arrow, any actions, such as setting an override, are monitored by SimCorp Dimension. This means that the placements are updated automatically when an override is set.

You can still amend your ‘Working’ placements. The following rules apply:

- Changes are subject to compliance validation (if enabled).

- The amendment to the placement is created in a draft state when the compliance validation for the portfolios/placements is pending.

- During the amendment process, you can preview the compliance validation in the placements blotter/grid.

- Changes are committed in the ‘Compliance Results’ applet, available when you right-click a placement in the placements blotter/grid and select ‘View Compliance Results’.

- If required, the amended placements can be reverted to their previous state.

Benefits

- Placements (for Equities and Futures) can be configured for validation

- Standard Compliance “user interfaces” are used for rule definition and then approval, where applicable.

- Placements that are Auto placed; Placed to favourite; Manual placed can all utilize this flow.

Subscription based licensing

N/A

Sales module dependency

Order Manager & Compliance