MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED FEBRUARY 21, 2025

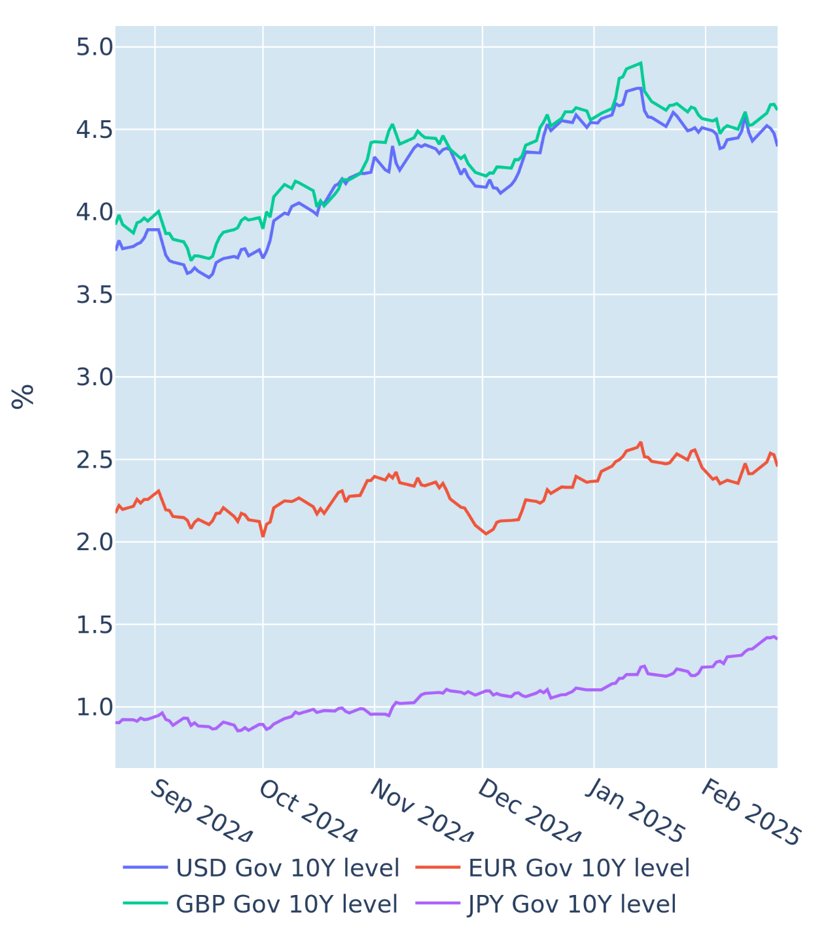

Surprise surge in UK inflation boosts pound and Gilt yields

The pound climbed to a two-month high against the dollar in the week ending February 21, 2025, as UK consumer prices fell less in January than they usually do at that time of the year. Post-holiday discounts, seasonal sales, and reduced travel demand tend to put downward pressure on prices at the start of the year, but last month they fell only 0.1%, compared with a 0.6% decline in January 2024. This meant that the annual headline inflation rate accelerated from 2.5% to 3%, well above the consensus forecast of 2.8%. Core CPI growth experienced a similar surge from 3.2% to 3.7%, with a smaller-than-usual decrease in air fares and the introduction of VAT on private school fees among the biggest upward drivers.

In its latest monetary policy report from earlier this month, the Bank of England predicted that inflation is likely to rise even further to 3.7% by the middle of this year, before eventually descending back to the 2% target in 2027. The expectation therefore remained that the Bank will cut rates two more times to 4% over the remainder of 2025, leaving short long Gilt yields largely unchanged, while long rates climbed around 9 basis points.

Please refer to Figures 3&6 of the current Multi-Asset Class Risk Monitor (dated February 21, 2025) for further details.

US services contraction depresses Treasury yields

Flight-to-safety flows depressed long Treasury yields to a nine-week low on Friday, February 21, 2025, amid concerns that the US economy may have cooled off more than previously expected. The S&P Global US services purchasing managers’ index (PMI) plummeted into contractionary territory below 50 for the first time since 2023, thwarting analyst predictions of a modest increase.

The news also triggered the worst daily and weekly sell-off in the American stock market since the Federal Reserve signaled a slower pace of monetary easing in mid-December. This notion was further underpinned by Thursday’s release of the January FOMC meeting minutes, which noted that participants wanted “to see further progress on inflation before making additional adjustments to the target range for the federal funds rate.”

The market reaction may seem severe, given that the corresponding manufacturing PMI surprised on the upside and at 51.6 still points toward expansion in the sector. But it reflects a growing concern of what toll the long and ongoing environment of high inflation and tight monetary conditions may have taken on the US economy.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated February 21, 2025) for further details.

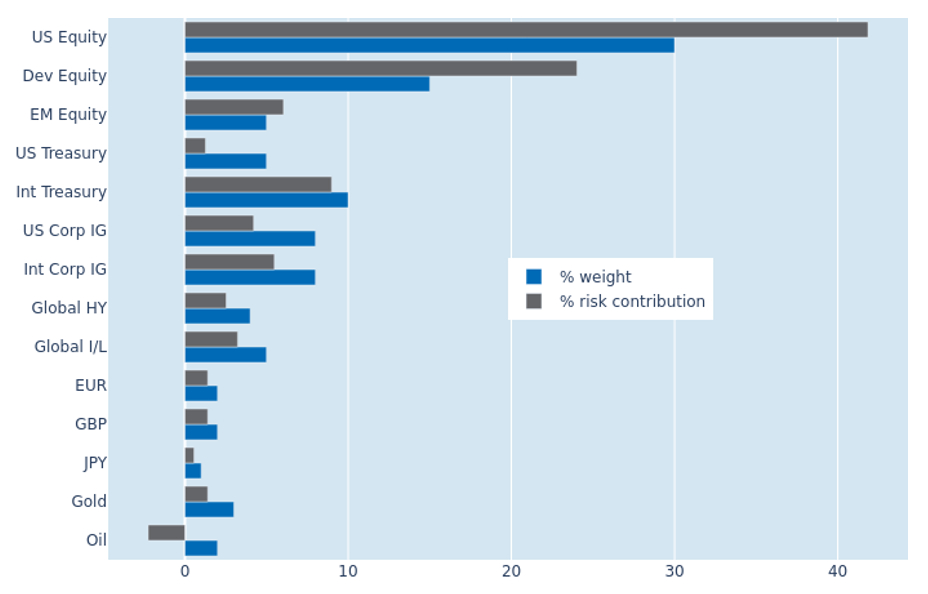

Portfolio risk keeps contracting despite stock market selloff

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased for a fourth consecutive week to 7.1% as of Friday, February 21, 2025, as equity volatility decreased despite last week’s severe selloff. The benefit was mostly limited to US stocks, which saw their share of overall risk squeezed further from 43.6% to 41.8%. This was in contrast to the percentage risk contributions of non-US developed and emerging market equities, which rose by 1.3% and 0.8% to 24% and 6%, respectively. Stronger exchange rate fluctuations and an ongoing co-movement of FX and share price returns made them appear more volatile than their American counterparts. But volatilities and correlations remained largely unchanged for most other asset classes, keeping their contributions to total portfolio risk stable.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated February 21, 2025) for further details.

You may also like