MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 24, 2025

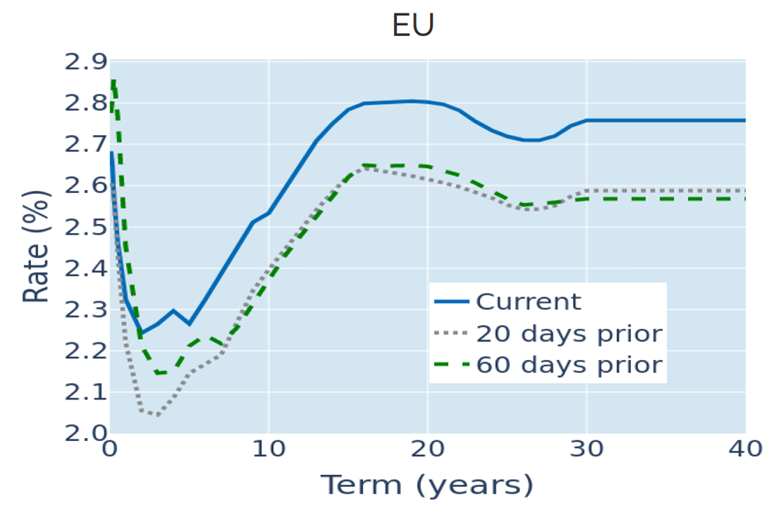

Improved German manufacturing outlook lifts Bund yields…

German Bund yields rose across all maturities in the week ending January 24, 2025, as stronger-than-expected economic data prompted traders to reduce the number of projected rate cuts from the European Central Bank. The purchasing manger index for the German manufacturing sector climbed from 42.5 in December to 44.1 in January, and although a reading below 50 still signals further contraction, it was less severe than the consensus forecast of 42.7. Short-term interest-rate futures markets now consider it more likely that the ECB will only ease monetary conditions by 75 basis points over the remainder of this cycle, compared with almost a full percentage point priced in earlier this month. The monetary policy-sensitive 2-year yield climbed 0.07% in response, while longer rates gained on average 4 basis points.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated January 24, 2025) for further details.

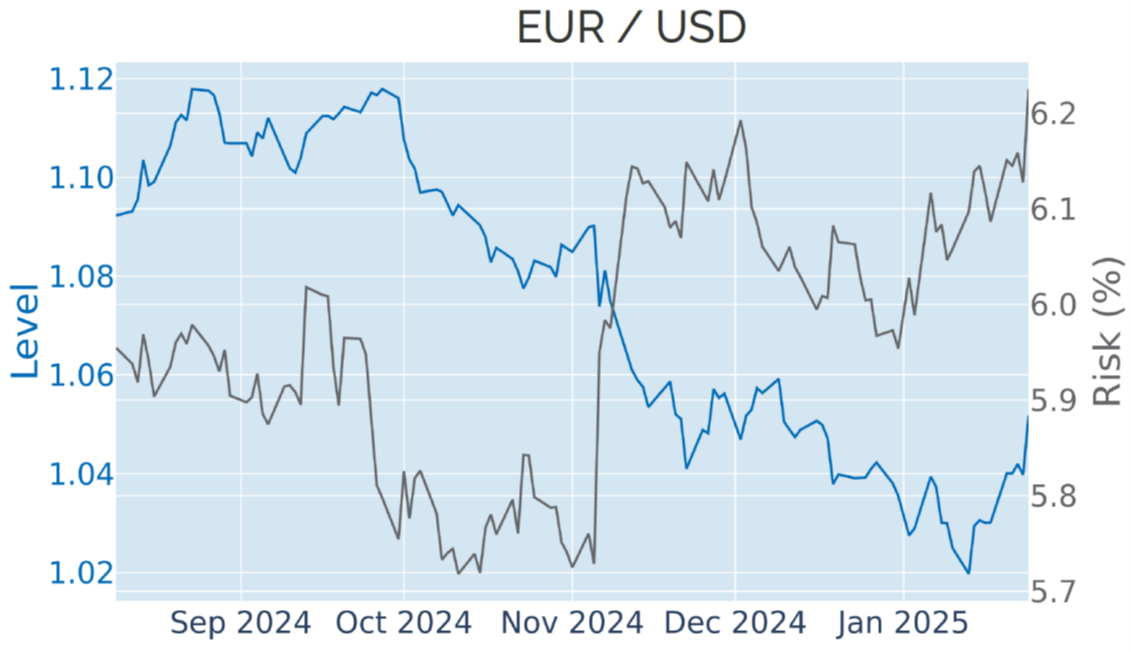

…and boosts the euro – or does it?

The euro also strengthened by more than 2% against the US dollar last week in its biggest weekly gain in 1.5 years. It might be tempting to link this to the higher interest rates and less gloomy economic outlook in the common currency area. But it is more likely once again driven by a general weakening of the greenback, which depreciated by an average 1.6% against all other G10 currencies. In fact, exchange rates against the US dollar over the past three years have been driven predominantly by the stateside legs of their relationships, which closely followed anticipated monetary policy decisions by the Federal Reserve Bank. This often generated the erroneous impression that the values of the euro or the pound were inversely related to interest rates in their respective regions, which closely tracked their American counterparts.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated January 24, 2025) for further details.

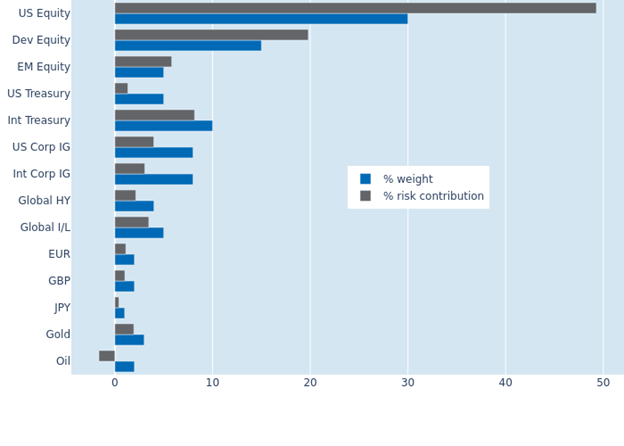

Ongoing US stock-market recovery further raises portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio climbed a further 0.5% to 9.8% as of Friday, January 24, 2025, following another strong week for US equities, which saw their share of overall volatility expand from 47.7% to 49.3%. The effect was even more pronounced for their counterparts from other developed countries, where returns got a further boost from strengthening exchange rates against the US dollar. This was partly offset by the adverse effect of higher interest rates on bond prices, making government and high-quality corporate securities appear less correlated with share prices than in previous weeks. Oil also intensified its inverse relationship with stock markets, as crude prices dropped following calls for increased OPEC production from President Trump. This meant that the commodity once again actively reduced total portfolio volatility.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated January 24, 2025) for further details.

You may also like