MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 17, 2025

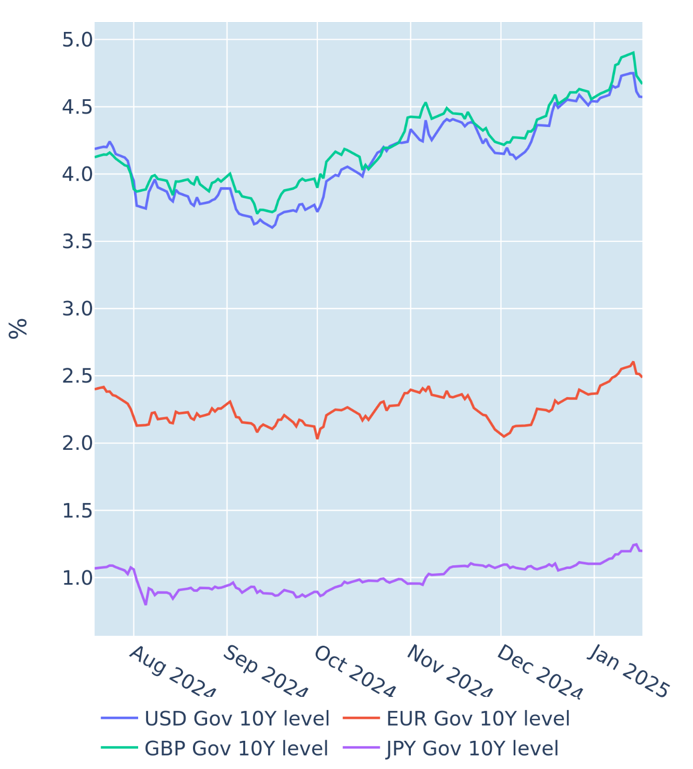

Yields ease off recent highs as inflation slows unexpectedly

Long-term sovereign yields in the United Kingdom and the United States eased off their recent highs in the week ending January 17, 2025, following a surprise decline in inflation in both countries.

The UK Office for National Statistics reported on Wednesday that British overall consumer prices grew by 2.5% in the 12 months ending December, down from 2.6% the month before and undershooting the consensus forecast of no change. Gilt yields dropped by an average of 20 basis points across all maturities in response, accompanied by a similar change in monetary policy expectations. The Bank of England is now projected to lower its base rate by a total of 0.75% to a ‘terminal’ rate of 4% over the course of this year, instead of the two rate cuts anticipated at the start of the week.

Also on Wednesday, the Bureau of Labor Statistics reported that US headline inflation continued to rise from 2.7% in November to 2.9% in December in line with market expectations. But underlying core prices grew less than predicted, reducing the annual rate from 3.3% to 3.2%. Investors chose to focus on the latter, and the 10-year Treasury benchmark fell by 16 basis points compared with the previous week’s close.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated January 17, 2025) for further details.

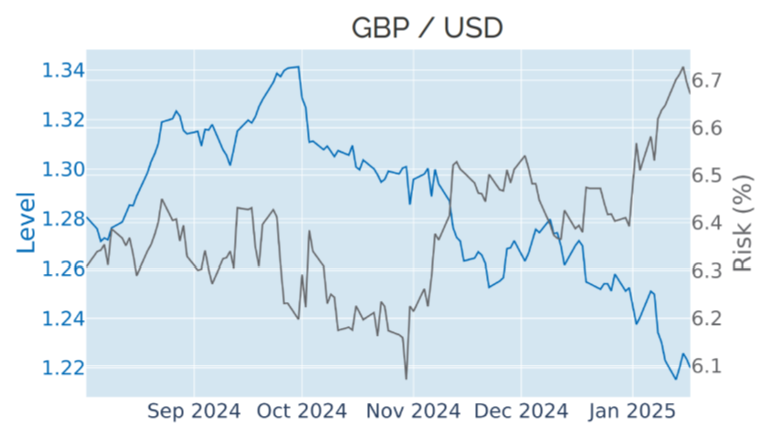

Poor economic data weigh down the pound

The pound sterling ended last week in the red despite an initial boost from the unexpected deceleration in consumer price growth. Following the inflation release on Wednesday, the GBP/USD exchange rate closed almost 1% up from Monday’s 14-month low. However, the latest GDP figures released on Thursday showed that the UK economy grew by 0.1% in November, which was less than the 0.2% predicted by analysts. Friday’s release of British retail sales numbers for December, which fell by 0.3% month over month instead of growing by 0.4% as anticipated, added further downward pressure and pushed cable below the previous week’s close, making the pound the only G10 currency to underperform the weakening greenback.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated January 17, 2025) for further details.

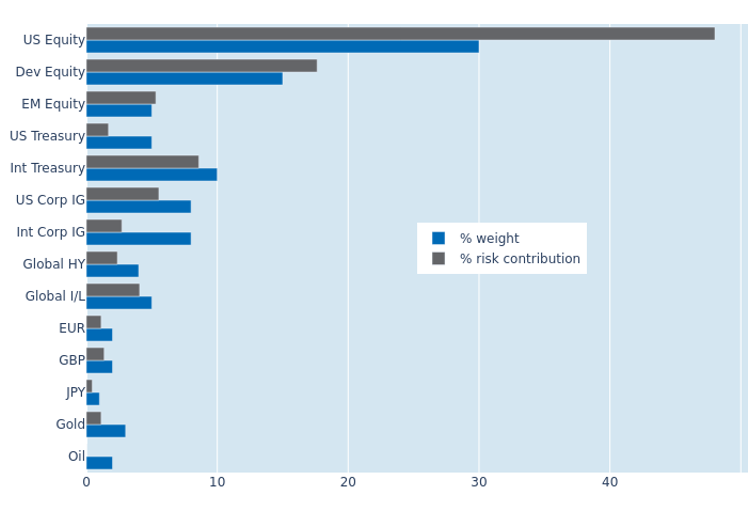

Cross-market rebound boosts portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio soared two percentage points to 9.3% as of Friday, January 17, 2025, as stocks, bonds, and exchange rates against the US dollar all rebounded together on the back of weaker-than-expected inflation. Non-USD-denominated sovereigns saw their share of overall volatility expand from 7.2% to 8.2% on the back of this, while their American counterparts also became riskier due to their increased co-movement with share prices. US investment grade corporate securities got an extra boost from tightening credit spreads on top of the lower risk-free rates, raising their percentage risk contribution by 1.8% to 5.4%. Oil, in contrast, continued to provide the best diversification benefit relative to its monetary weight, due to its ongoing near-zero correlation with stocks and its inverse relationship with the euro and the pound.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated January 17, 2025) for further details.

You may also like