MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 15, 2024

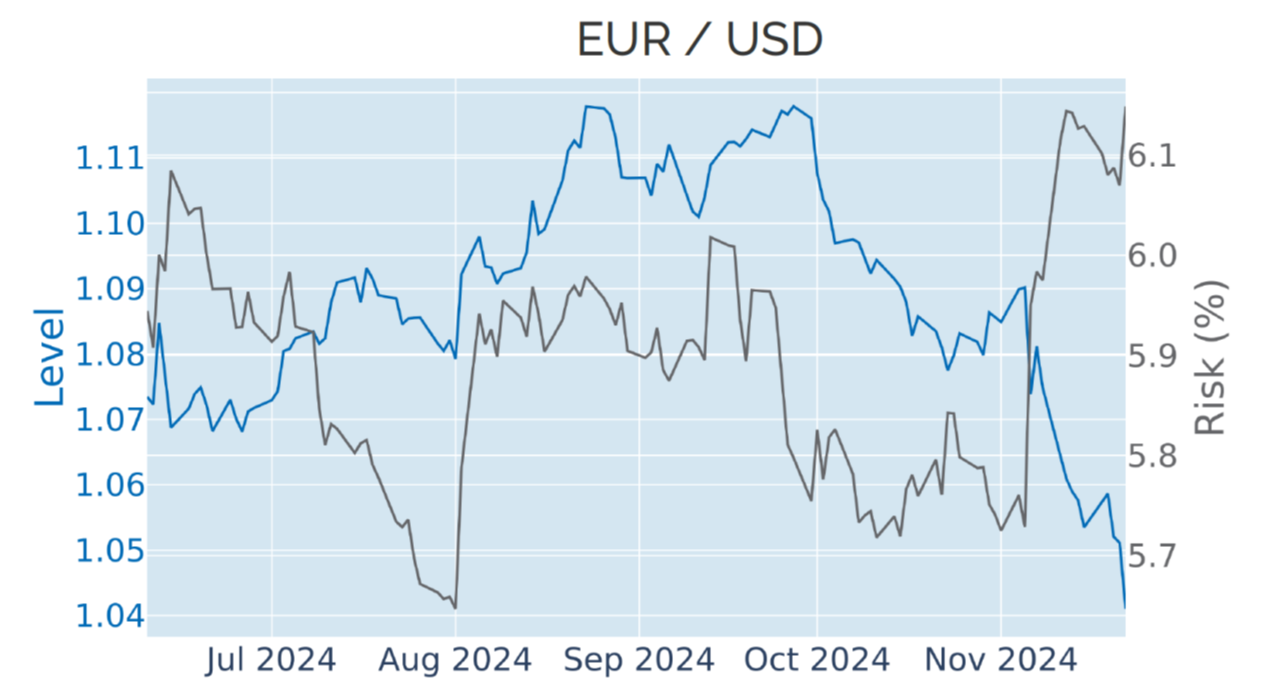

Recession and trade war fears depress euro to 2-year low

The euro fell to its lowest level against the US dollar in almost two years in the week ending November 22, 2024, following an unexpected decline in business activity in the Eurozone. S&P Global reported on Friday that its composite purchasing manager index (PMI) for the currency bloc dropped from a neutral reading of 50 in October to 48.1 in November, pointing toward renewed economic weakness in the area. The services sub-PMI also defied analyst projections of a sustained expansion at 51.6 by falling to a contractionary level of 49.2, while the manufacturing sector plunged even deeper into recessionary territory (from 46 to 45.2). In response, short term interest rate traders upped their rate cut expectations for the upcoming European Central Bank meeting on December 12 from 25 basis points to half a percentage point.

The latest depreciation of the euro was part of a wider strengthening of the greenback against most major European currencies since the US presidential election earlier this month, reflecting growing concerns over a new trade war. The single currency was hit particularly hard—having lost more than 4% against its American rival over the past three weeks—as president-elect Donald Trump threatened to raise tariffs on imports from the European Union by 10 to 20 percent. This would be a particular blow for Germany—the bloc’s largest economy—due to its heavy dependence on global automobile sales.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated November 22, 2024) for further details.

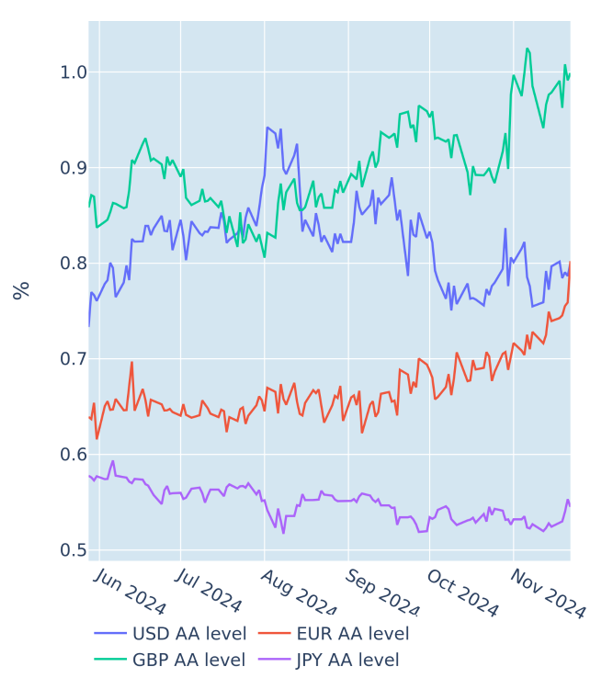

European credit risk premia soar to 10-month high

The risk premia on high-quality euro-denominated corporate debt soared to their widest levels since late January in the week ending November 22, 2024, mirroring declines in the corresponding regional stock market. Since mid-October, the EURO STOXX 50 benchmark has lost over 4%, while the wider STOXX Europe 600—which includes the UK—has descended more than 3%. This is in stark contrast to an almost 3% gain in the STOXX USA 900 index, which meant that USD credit spreads remained relatively stable. Yet, European bonds still outperformed their American counterparts, as the yield differential between 10-year US Treasury securities and same-maturity German Bunds expanded by more than 30 basis points over the past six weeks.

Please refer to Figures 4 and 5 of the current Multi-Asset Class Risk Monitor (dated November 22, 2024) for further details.

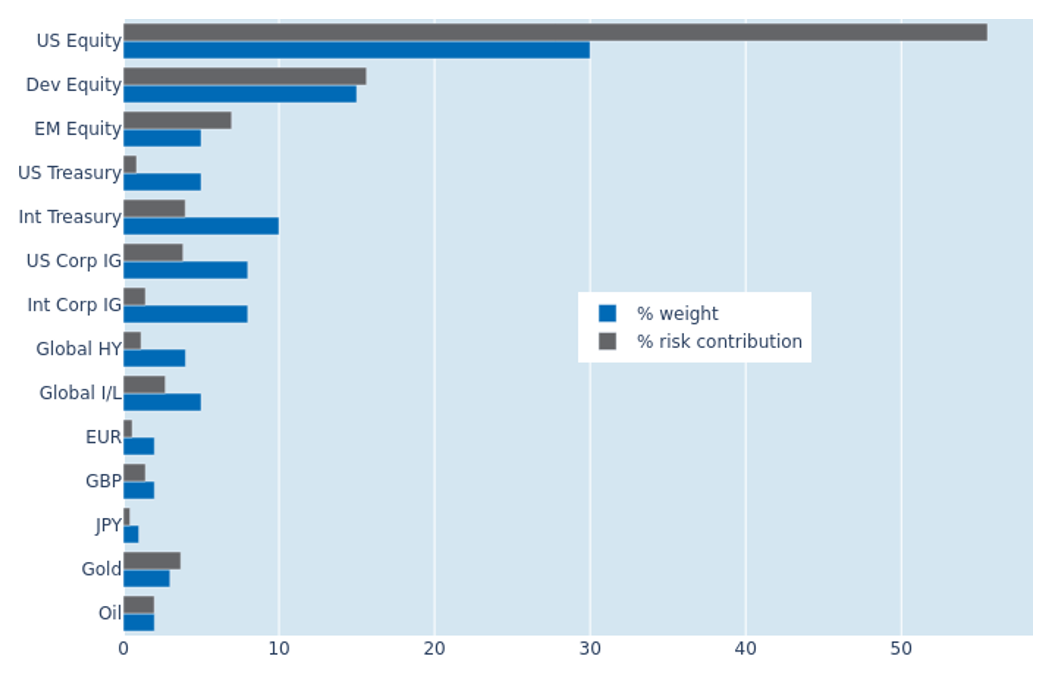

Lower FX and equity volatility reduce portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio shrunk by half a percentage point to 7.1% as of Friday, November 22, 2024, driven by a combination of lower FX and equity volatilities. Non-US developed and emerging markets stocks were the biggest beneficiaries, as their respective percentage risk contributions dropped by 2.3% and 0.8%. Non-USD sovereign bonds also saw their share of total portfolio volatility drop from 4.6% to 4%, supported by weaker fluctuations in risk-free interest rates. The latter also benefitted US Treasury securities, which offered the biggest diversification benefits relative to their monetary weight, as their returns remained uncoupled from those of the American stock market.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated November 22, 2024) for further details.

You may also like