US election aftermath: Fever dream fades as sentiment shifts

After the US election markets soared then sunk

Author:

Melissa R. Brown, CFA

Head of Investment Decision Research

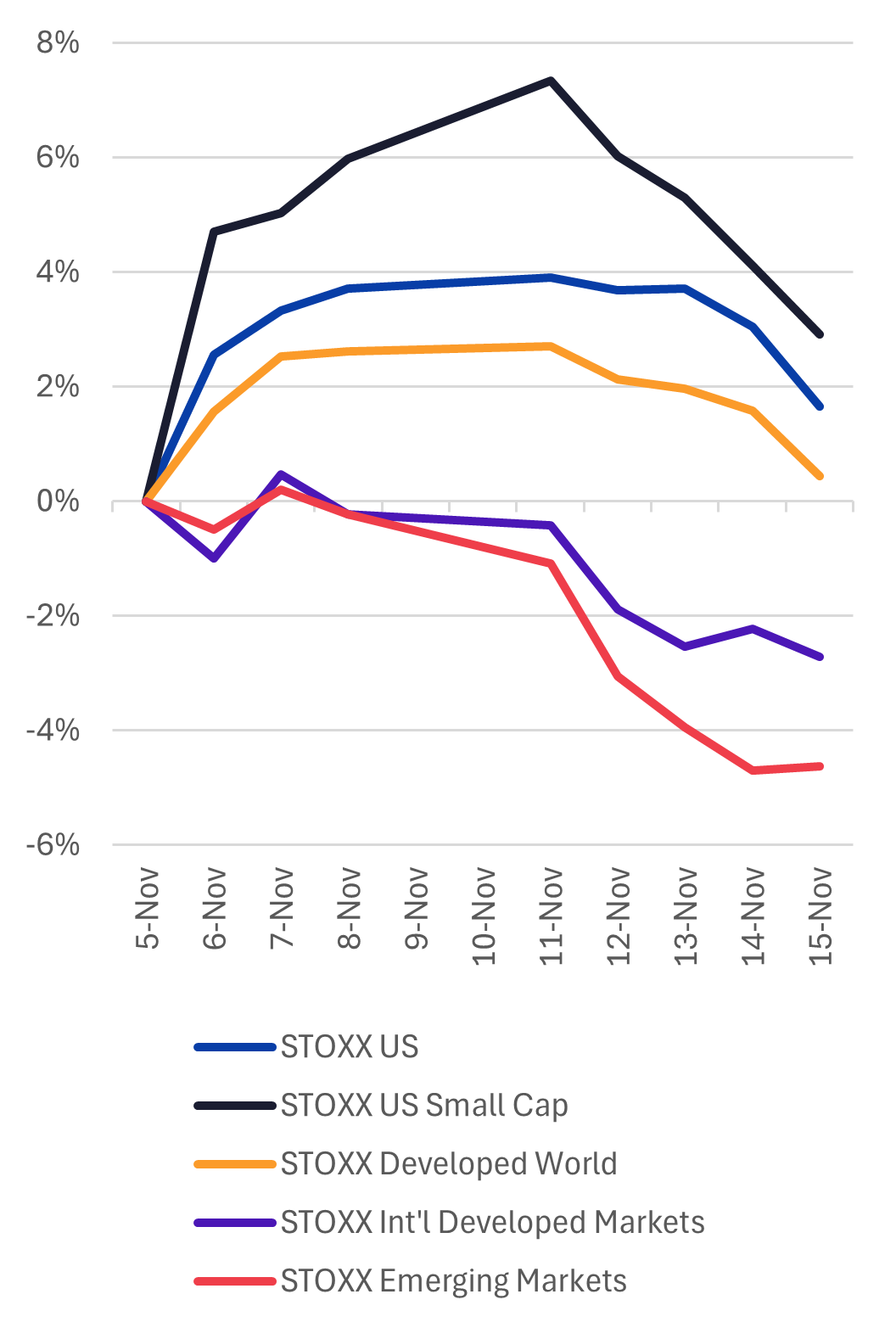

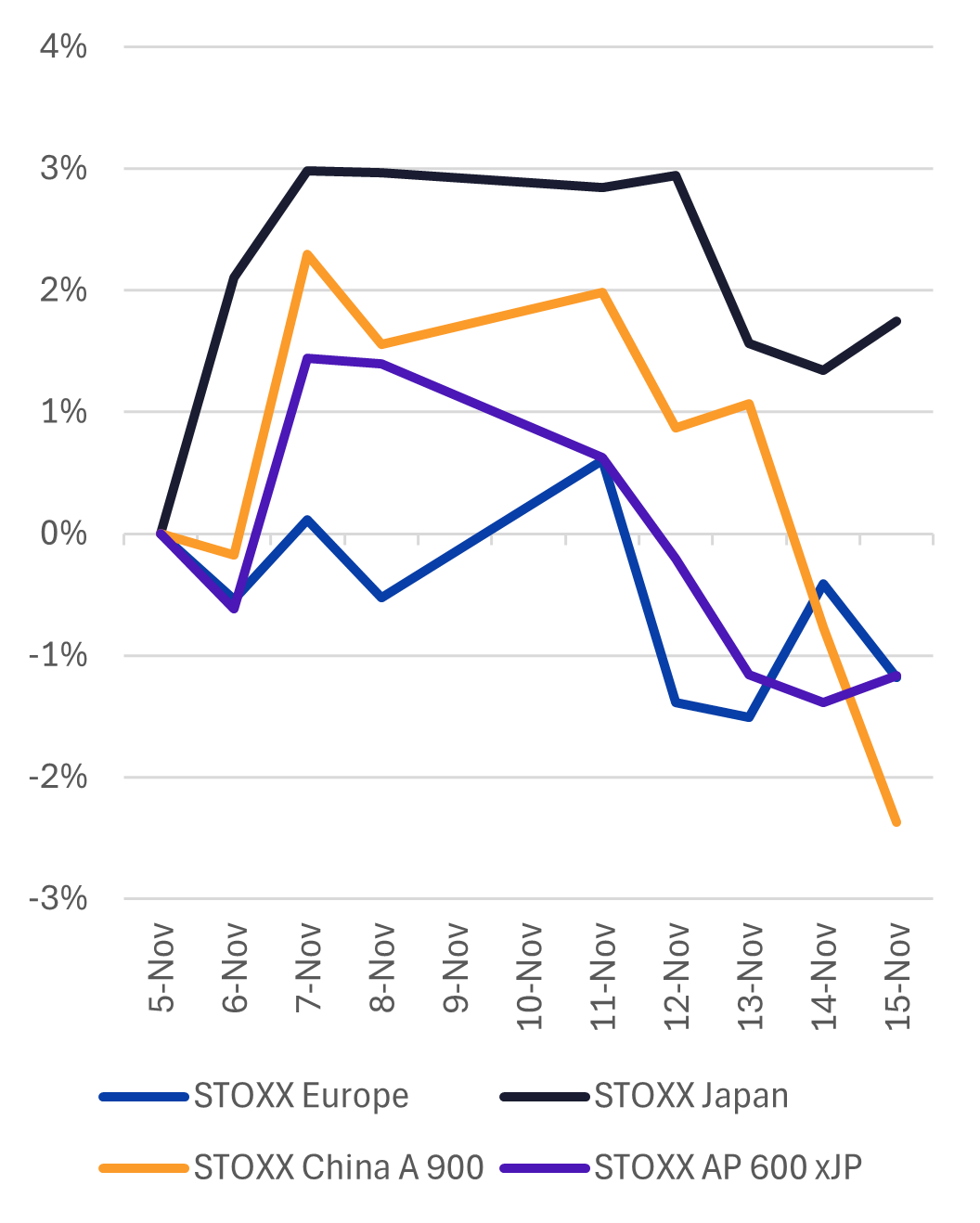

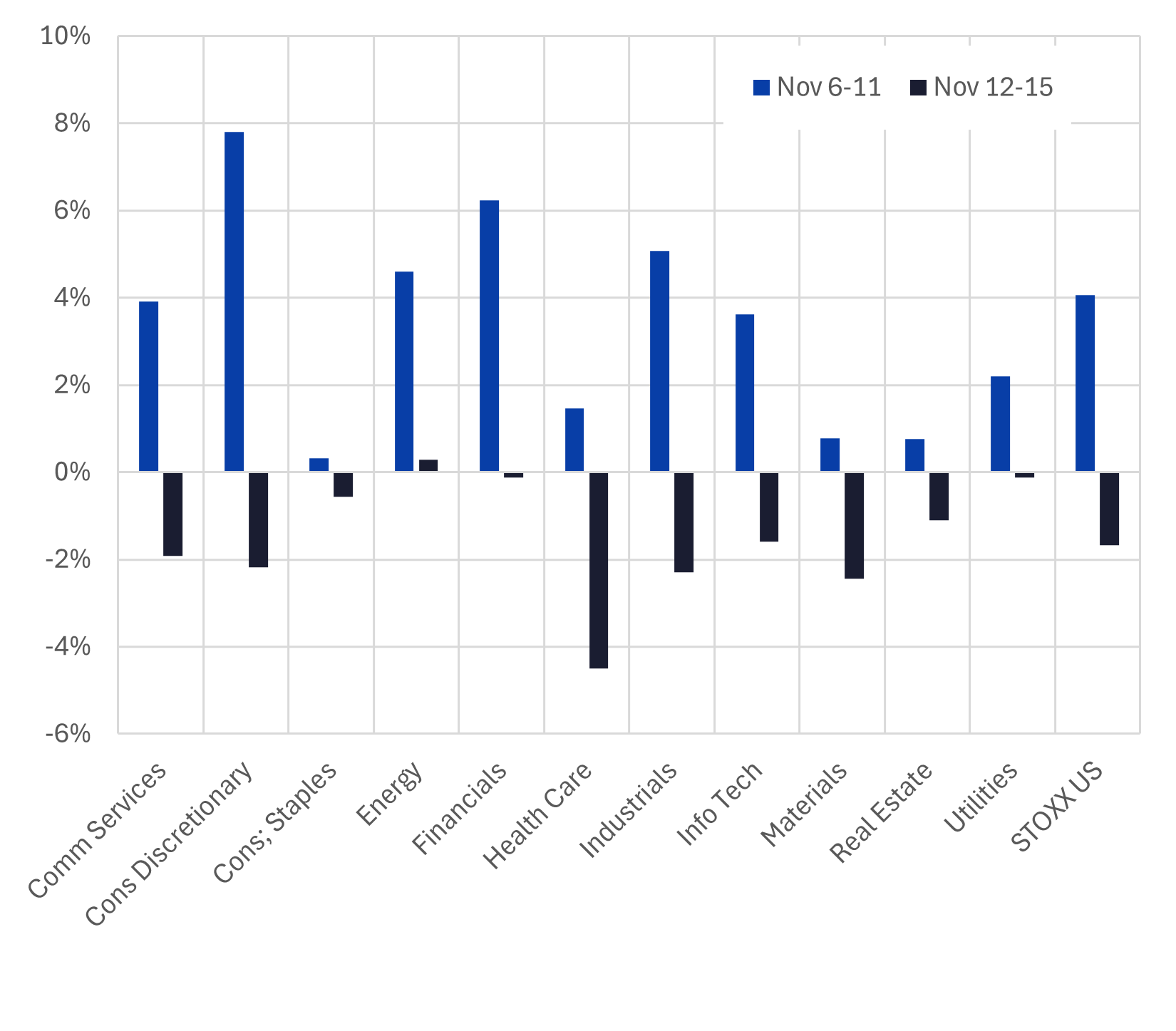

The US market initially had a very positive reaction to the recent election, as concerns about a protracted fight about the winner disappeared, and the possibility of divided government dissipated. Investors especially drove up the prices of small cap names, which they viewed as benefiting from reduced regulation and a strong economy (Figure 1). With its high weight, the US market also drove up global developed markets. Japan, Asia ex-Japan and China initially saw gains, but performance fizzled quickly, with Japan losing less than the others as investors hoped Japan would benefit from tougher China policies. As some markets gained, others lost: the World ex-US and Emerging Markets indices suffered.

In the initial election aftermath, the gains of the US relative to the rest of the developed world were extremely high. Even though all markets declined a week later, US relative strength fell as euphoria turned to more sober assessment of market prospects and investors focused more on the potential inflation impacts of Trump’s policies and the recognition that the US economy has been strong despite Fed rate increases over the past few years. Inflation data hinted that the Fed may not continue on its path of lowering rates, which also deflated some rosy expectations.

The 3 key market takeaways after the US election

1. A Trump victory led to strong US market performance, followed by a decline once inflationary concerns and future Fed actions came front and center.

2. All US sectors recognized a benefit in performance quickly followed by downward performance with more difference between projected winners and losers in the new regime.

3. Factor returns showed initial enthusiasm for the market in general, but a week after the election investors turned more cautious

Figure 1. Cumulative market returns

Source: STOXX, Axioma

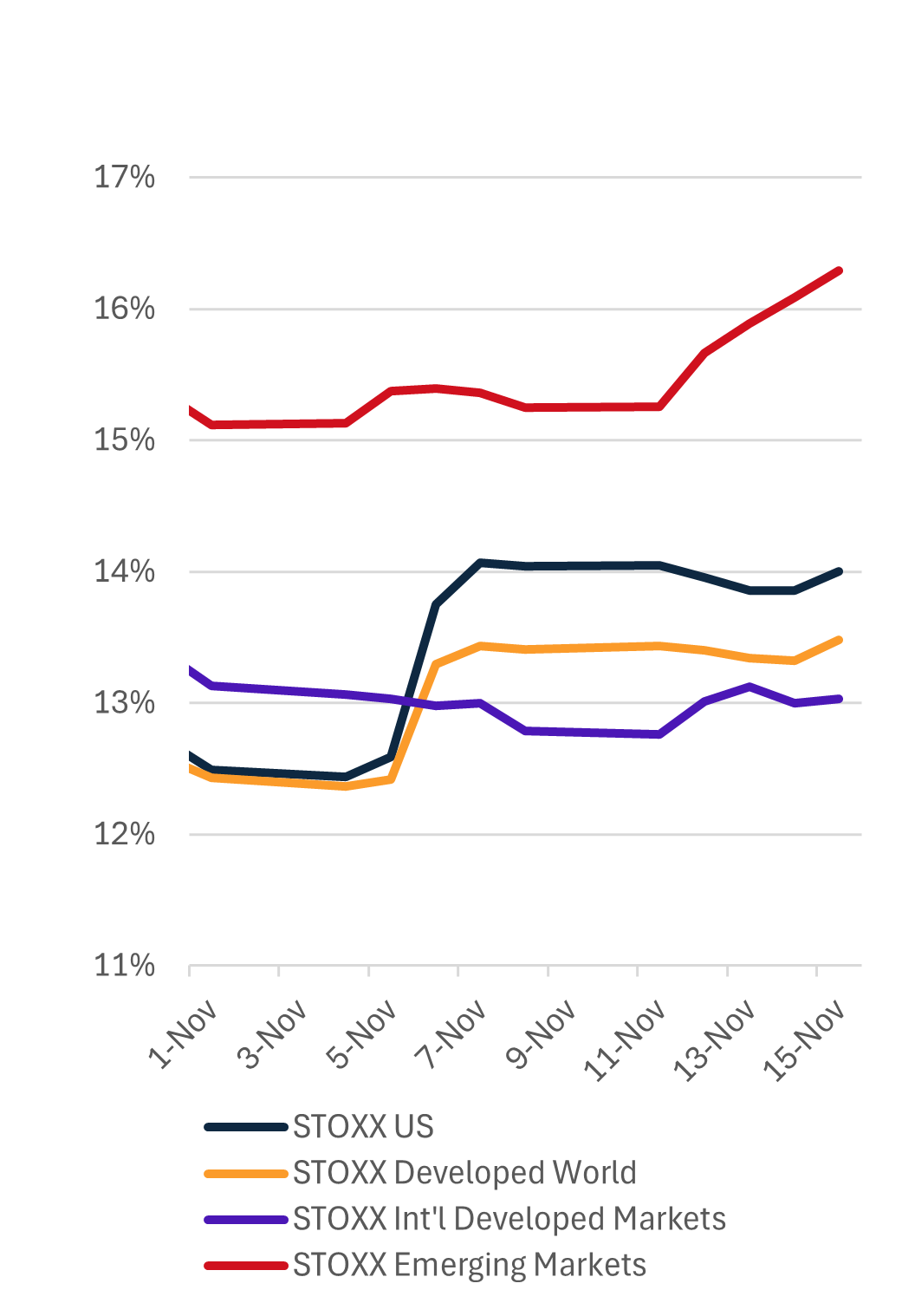

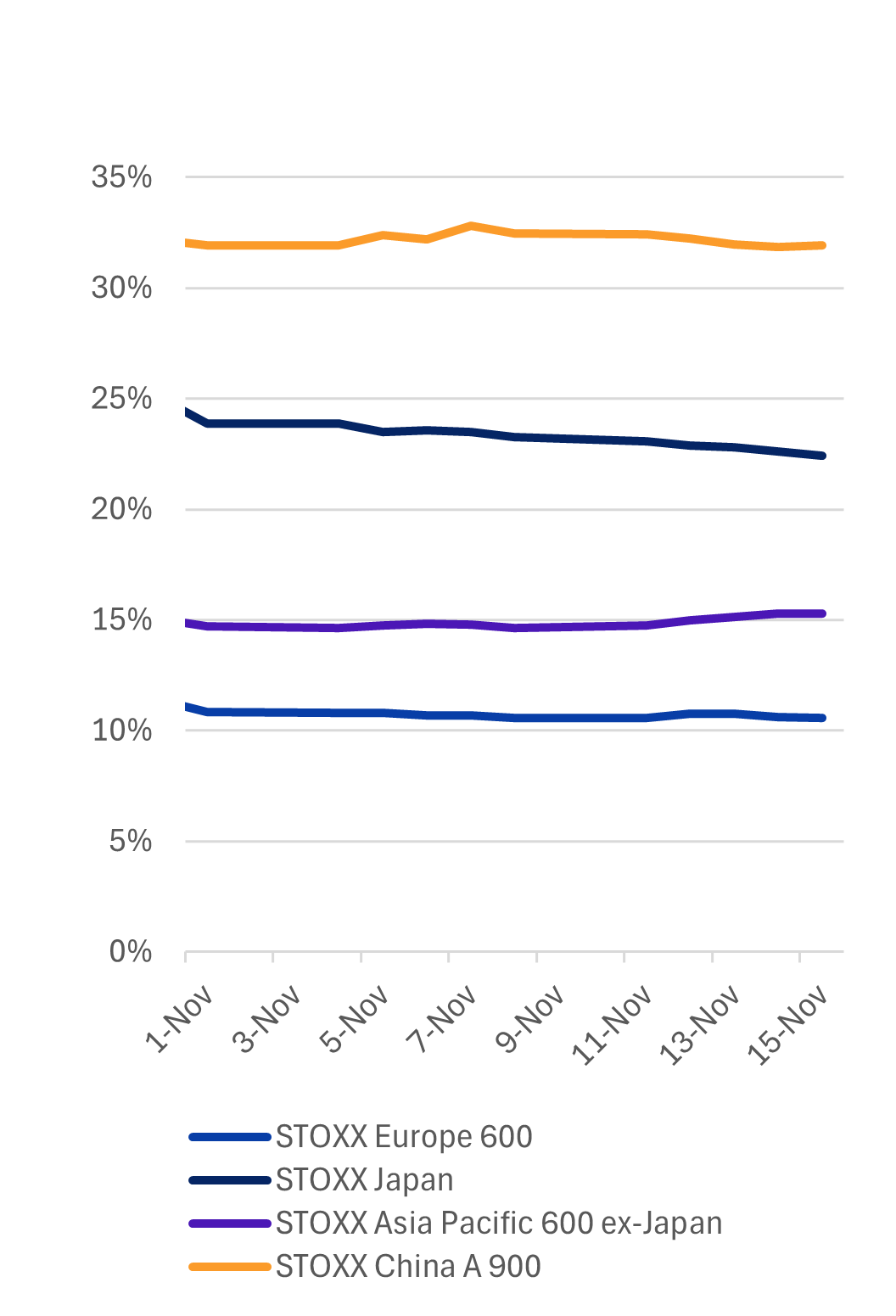

US and Developed Market risk rose, other markets’ risk remained steady

Predicted volatility for the US market jumped (Figure 2), as investors sorted through the names that would benefit under a unified Republican US government, and individual stock, factor and industry volatility rose as well . Correlations (industry-industry and asset-asset) fell, however, keeping a check on the level of volatility increase. Still, the increase in US market risk for the three days post-election was one of the biggest gains in the history of the US model, which goes back more than 40 years. Other markets did not see volatility increases, although emerging markets risk, which has been on a steady upward trend since last summer, also jumped to at least a 12-month high. See our Weekly Equity Highlights for more detail on the risk impact on the US market according to the Axioma US5 model.

"The US market initially had a very positive reaction to the recent election, as concerns about a protracted fight about the winner disappeared, and the possibility of divided government dissipated... A week later, US relative strength fell as euphoria turned to a more sober assessment of market prospects. "

Figure 2. Predicted risk

Source: STOXX, Axioma short-horizon fundamental risk models

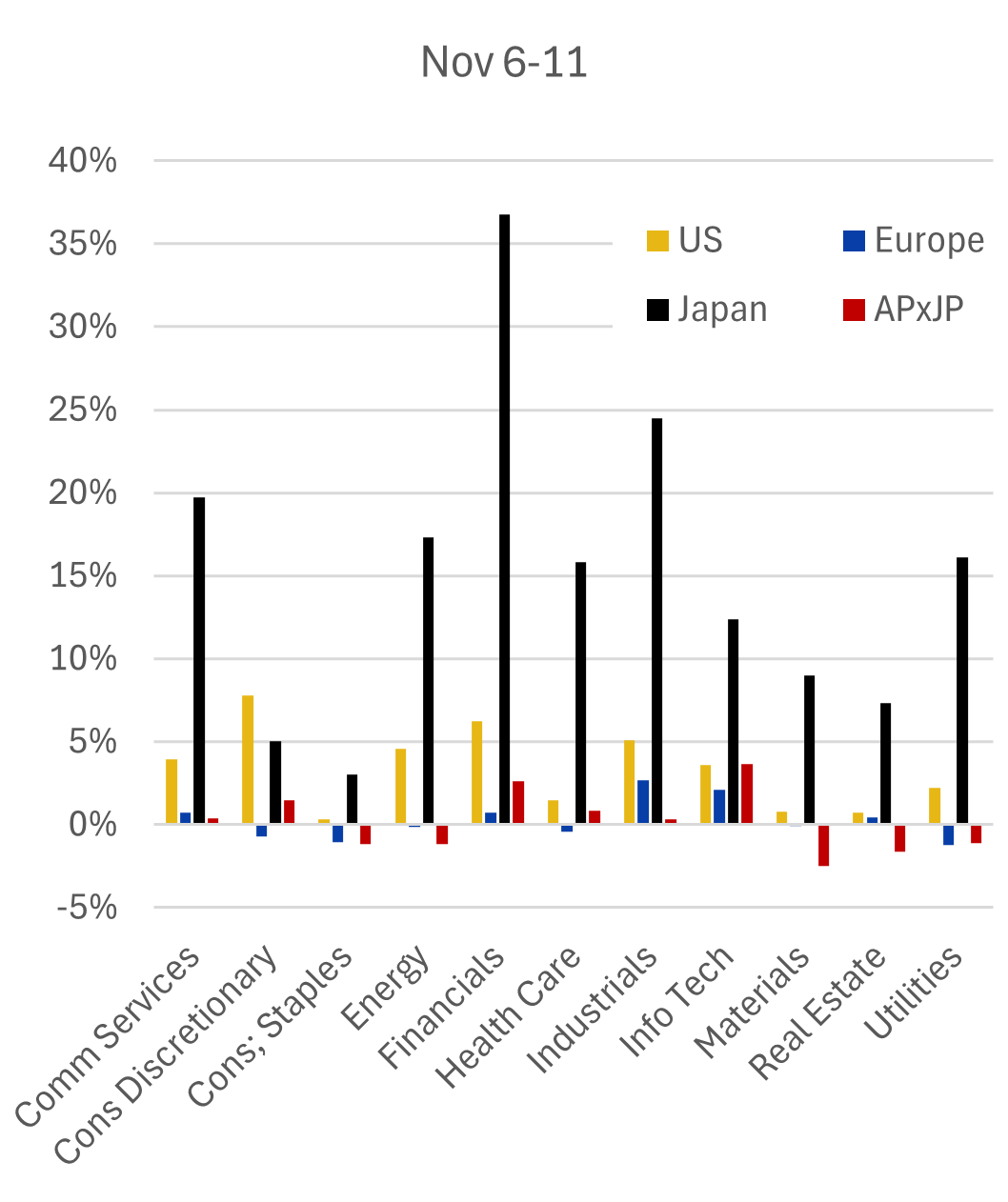

Perceived sector beneficiary shifts

All sectors initially benefitted from the election bounce, with Consumer Discretionary, Financials and Industrials leading the way (Figure 3). When the enthusiasm wore off a week later almost all sectors fell. Health Care led the way down, reflecting concerns about a complete overhaul of the health care system. Energy, Financials and Utilities, all expected to benefit from further deregulation stalled out, but far outperformed the other sectors. For the full period since the election, Financials has turned in the best performance, followed by Consumer Discretionary.

Figure 3. US Sector performance

Note: Sector holdings are based on the STOXX US Index

Source: STOXX, Axioma

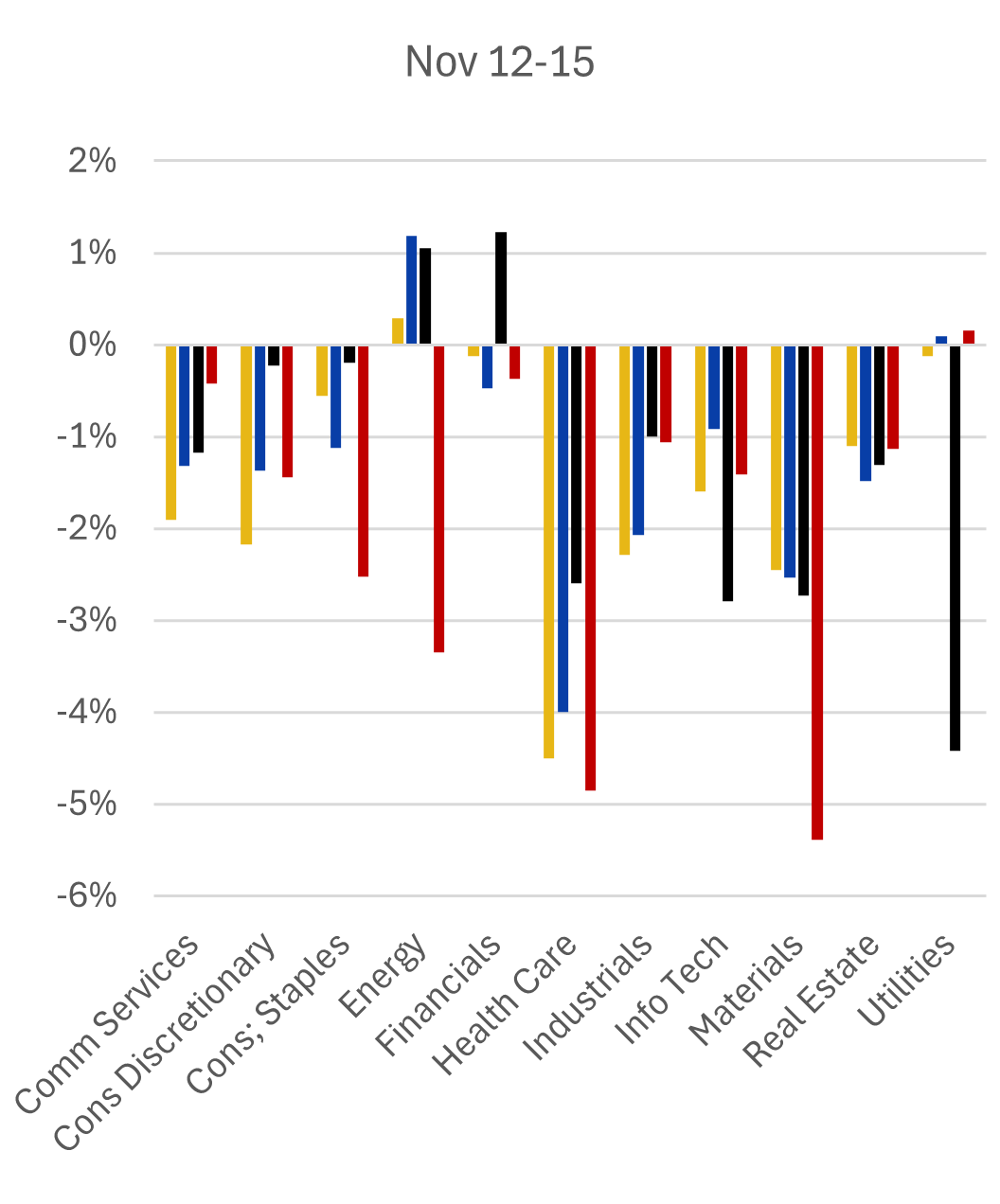

Comparing sector performance in the US with that of other major regions shows that 1) the magnitude of returns in the US was much higher in most cases and 2) the US gains in the earlier period were other regions’ losses in several sectors, most notably Consumer Discretionary, Energy and Utilities (Figure 4). A week later we still see weakness, especially in Asia ex-Japan, but with much less differentiation across regions.

Figure 4. Sector performance comparison

Sector holdings are based on STOXX indices

Source: STOXX, Axioma

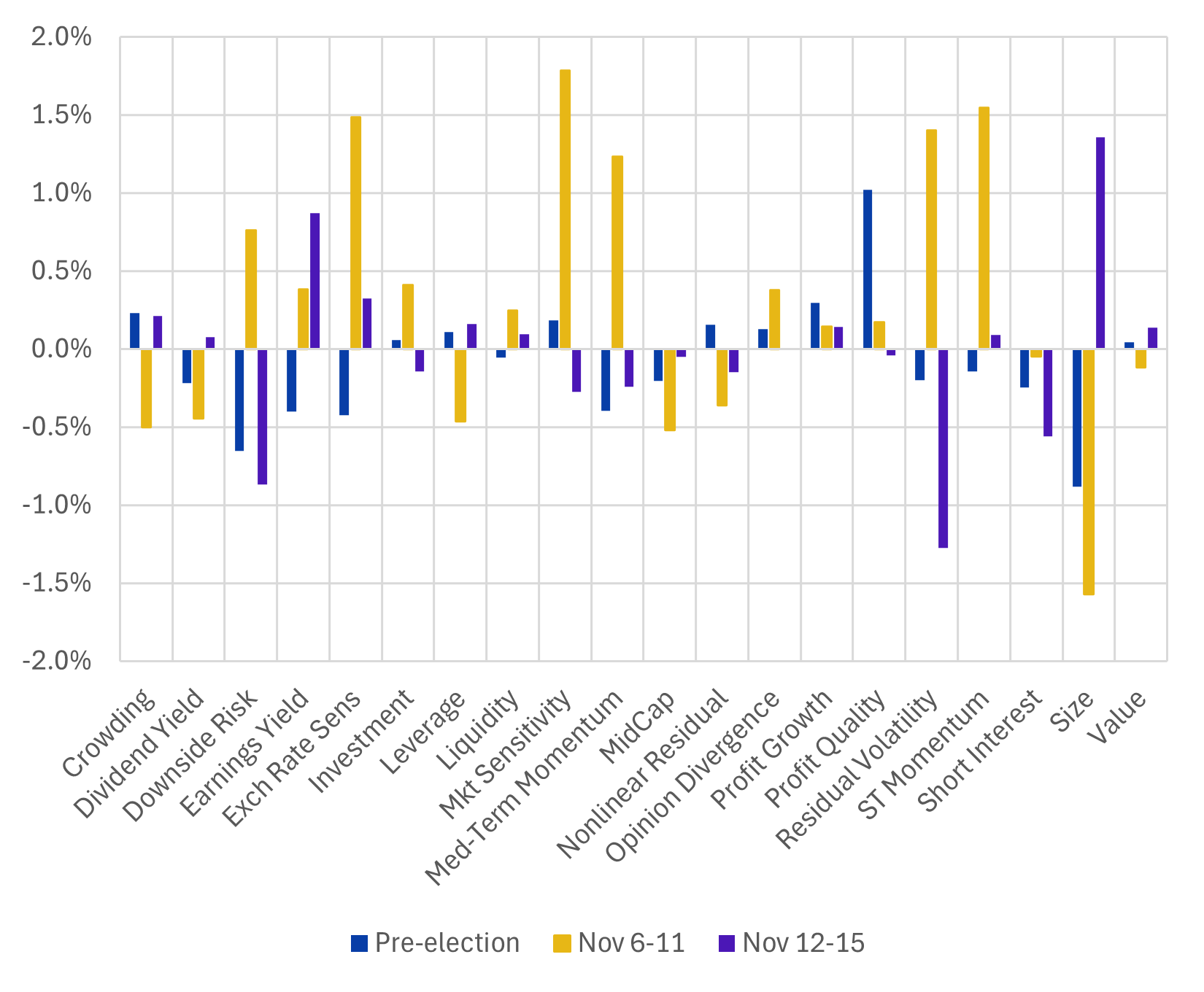

Factor returns highlight abrupt changes in sentiment

The US election also prompted about-faces in factor returns. Most factors reversed course from the week leading up to the election to the week following it (Figure 5). Names with higher Downside Risk, Market Sensitivity and Residual Volatility suddenly became more attractive in the risk-on immediately post-election period. In the US, expectations of a strong dollar showed up in the performance of the Exchange Rate Sensitivity factor, and both Short- and Medium-Term Momentum posted significant gains. After the week of risk-seeking, however, the fortunes of many factors revered. Larger stocks once again prevailed, Momentum reverted and higher risk – Downside, Market Sensitivity and Residual Volatility – was shunned. This reversal in factor returns likely had an impact on portfolios’ active returns, unless the manager held tight and did not trade. It also drove factor volatility higher, so even the manager who did not trade probably saw an increase in active risk, depending on the direction of active bets.

Figure 5: US5 model factor returns pre- and post-election

Source: Axioma US5 fundamental risk model

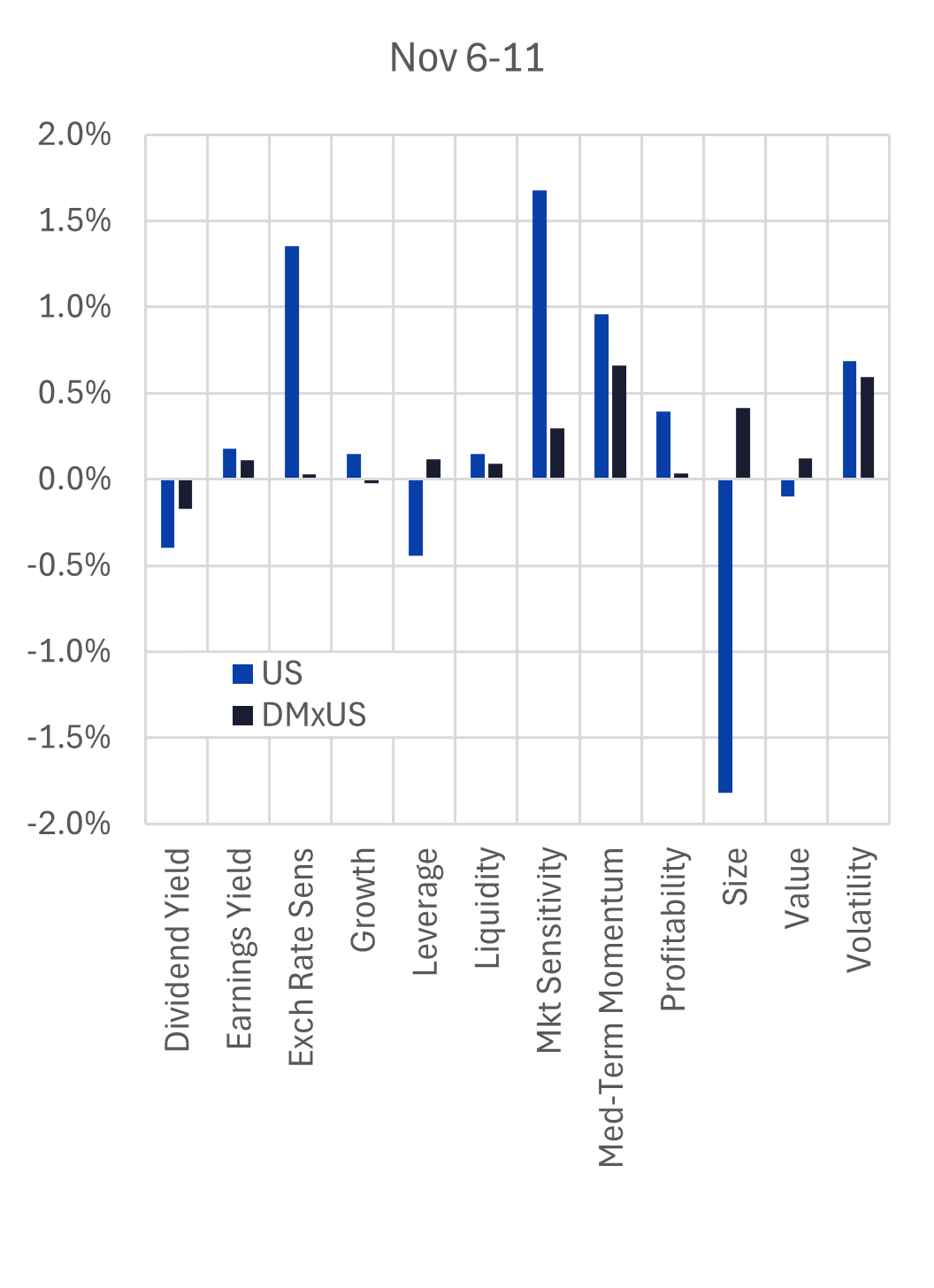

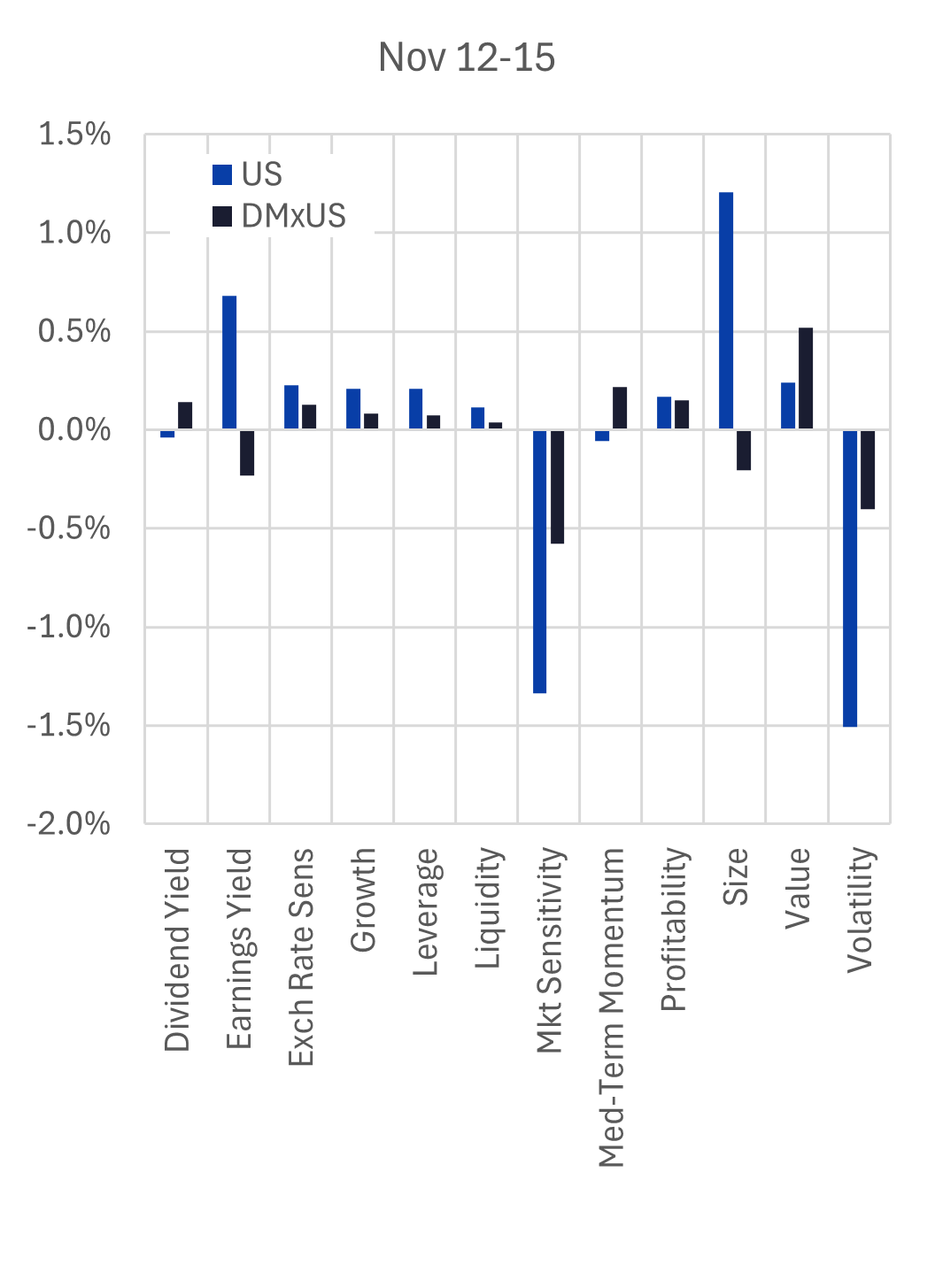

Finally, as we saw with sectors, immediately post-election the magnitude of factor returns was much higher in the US as compared with outside the US, although the direction was generally the same (Figure 6). Size was a major exception, as the dramatic small-cap bounce (i.e. negative Size factor return) was unique to the US. A week later, although markets reverted to a more-cautious stance preferring low Market Sensitivity and Low Volatility, the magnitude of those preferences remained much higher in the US.

For more detail on the impact of US elections on US and Developed Markets ex-US performance and risk, see our Equity Risk Monitor highlights here.

Figure 6. Factor return comparison, US and Developed Markets ex-US

Source: Axioma fundamental models (version 4 for both US and DMxUS for ease of comparison)

Conclusion:

Markets greeted the election news with enthusiasm for equities and renewed interest in risk. The US outperformed the rest of the world, sectors expected to benefit the most from deregulation soared, and investors sought riskier asset characteristics. A week later, that euphoria settled down, investors reassessed and narrowed their focus. They also shifted back to more risk-averse behavior, as evidenced by the factors they chose. We will likely have to wait until the new administration takes office and see which potential policies are put forward, and then wait even longer to see their impact on the critical economic variables the Fed relies on. Until then, we may see continued whipsawing in favored industries and factors, so active investors should brace for the ride. We will do our best to keep our readers updated.

For more detail on the impact on investor sentiment, see our weekly ROOF highlights here.

Related content