MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 30, 2024

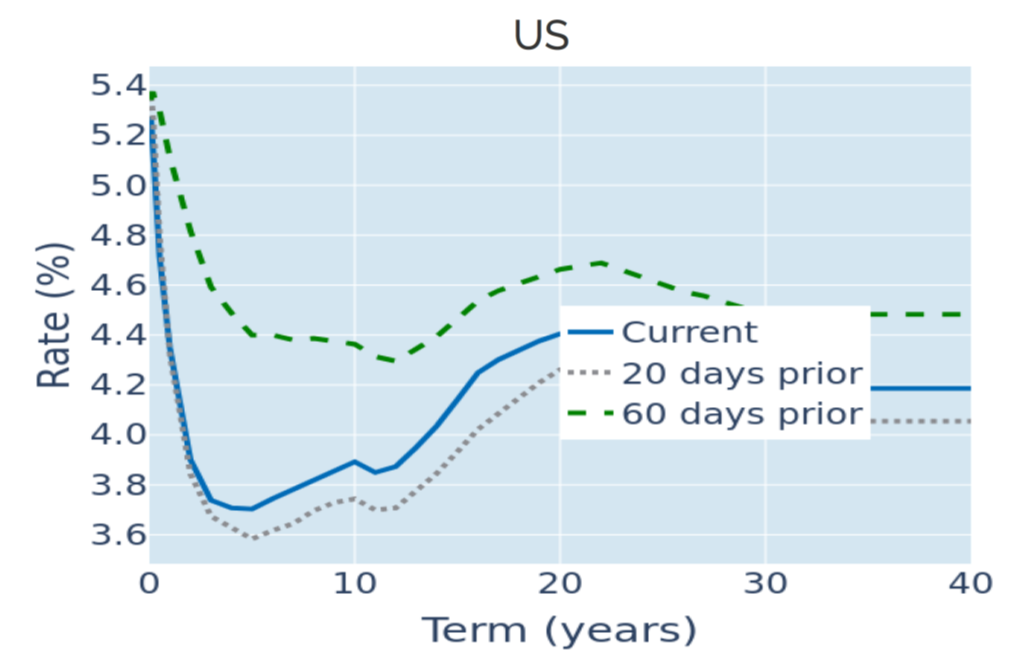

Treasury term spread turns positive for first time in 2 years

Long-term US Treasury yields rose more than short-term rates in the week ending August 30, 2024, lifting the term spread between the 10-year and 2-year tenor points out of negative territory for the first time in over two years, thereby ending the longest and deepest inversion since 1981. Past “normalizations” of yield curves have consistently been followed by recessions, which usually started within 3-7 months of the term premium turning positive. The Federal Reserve would also start easing monetary conditions either shortly before or after these inflection points. Historical evidence suggests that share prices can continue to rise for a few more months, especially with support from lower central bank rates. However, market participants will pay close attention to any clues from other economic indicators, the non-farm payroll report this Friday being one of the most important ones.

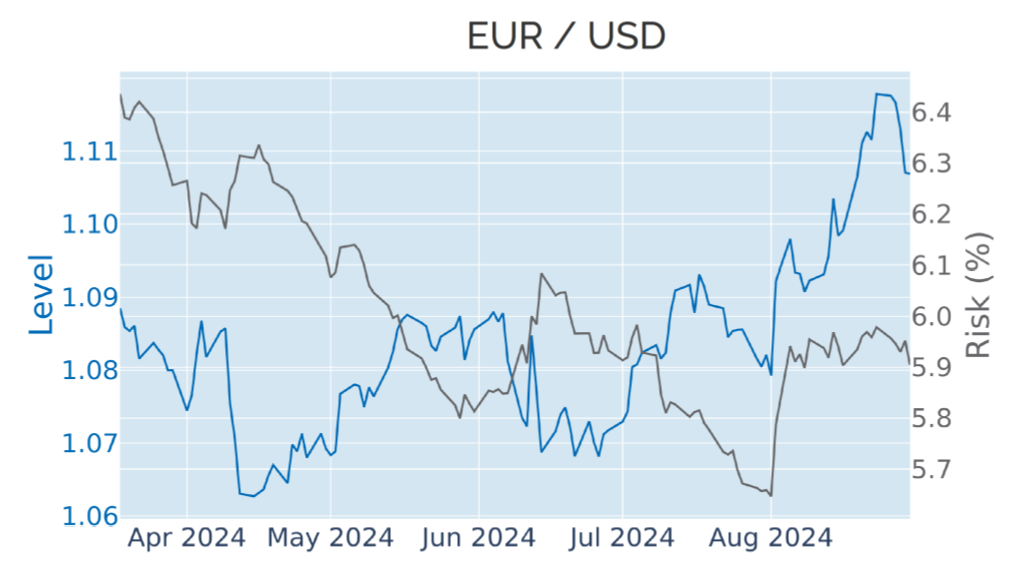

Weaker-than-expected inflation weighs on the euro

The euro plummeted 1% against the US dollar in the week ending August 30, 2024, following weaker-than-expected inflation in Germany and Spain. Eurostat estimated on Thursday that consumer prices in Europe’s largest economy grew by 2% over the past twelve months, down from 2.6% in July and significantly undershooting analyst predictions of 2.3%. This reinforced investor expectations that the European Central Bank will lower its policy rates by another 25 basis points at its upcoming meeting on September 12. Spain’s annual headline inflation rate of 2.4% also came in below the consensus forecast of 2.5%. For the entire currency bloc, CPI growth was estimated to have fallen from 2.6% in July to 2.2% in August, mostly driven by lower energy costs. But services inflation remained stubborn at 4.2%, keeping the annual change in core prices at 2.8%.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated August 30, 2024) for further details.

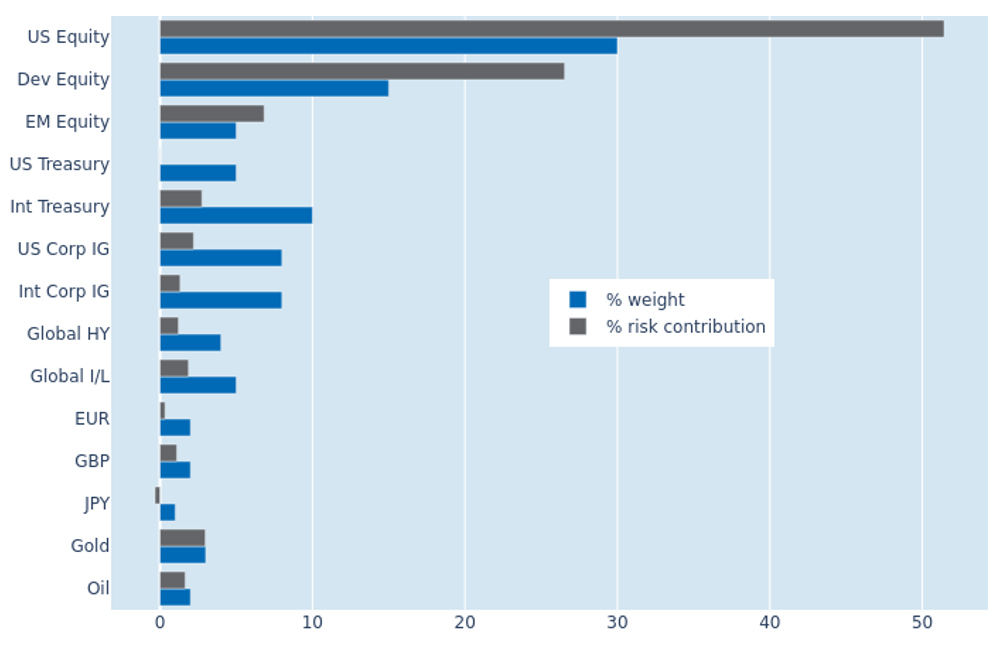

Portfolio risk eases further as stock-market recovery continues

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased by another percentage point to 9.1% as of Friday, August 30, 2024. The change was predominantly due to the ongoing recovery in global stock markets, which advanced for a fourth consecutive week. US equities in particular saw their share of total portfolio risk shrink by 1.9% to 51.4%. However, the effect was much smaller for their counterparts in other areas of the world—both developed and emerging—as positive local returns were partly offset by weaker exchange rates against the US dollar. The latter even amplified the losses suffered by non-USD-denominated government bonds, resulting in a bigger risk contribution from that asset class.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 30, 2024) for further details.