EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED FEBURARY 21, 2025

Axioma Risk Monitor: European market continued to lead ahead of German elections; Economic concerns hit US small caps harder than large caps; Stellar gains in Asia Pacific ex-Japan tech sector amid global tech retreat

European market continued to lead ahead of German elections

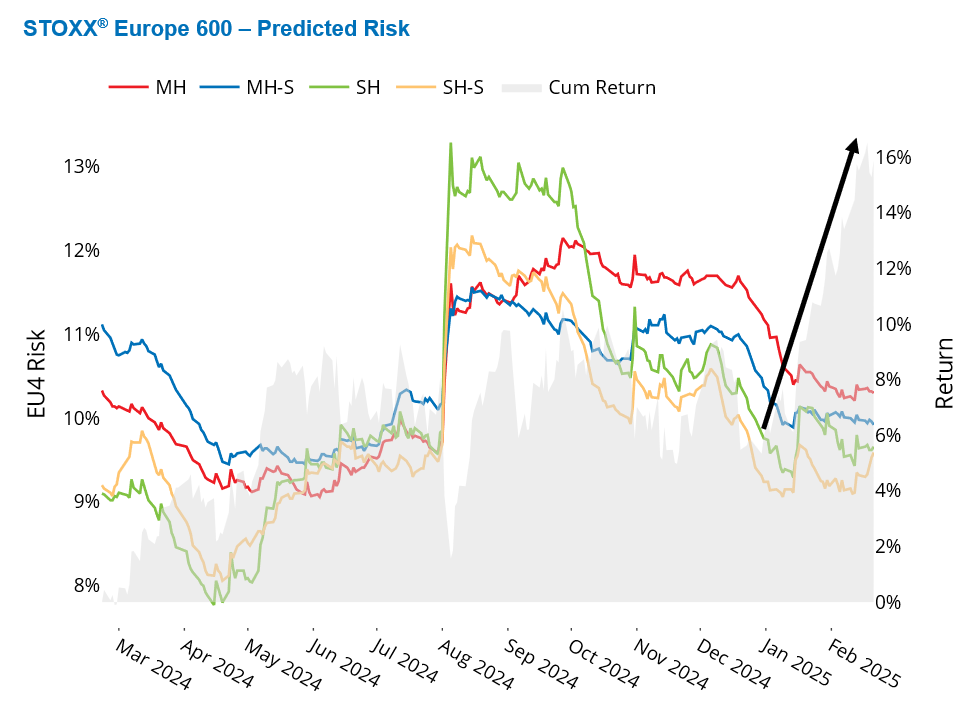

The European stock market eked out a small gain in the week prior to the German elections, maintaining its lead among the geographies covered by the Equity Risk Monitors. Germany was a major detractor last week, contributing -11 basis points to the STOXX Europe 600's weekly return of 0.33%. However, Denmark and Switzerland more than compensated, driving the modest positive return of the European benchmark. At the same time, European risk remained relatively flat over the past five business days, making Europe one of the least risky regions, as measured by Axioma fundamental short-horizon regional risk models.

After reaching their second-highest level in 25 years in January, fund inflows into European stocks continued their strong momentum in February. The STOXX Europe 600 is now outperforming the STOXX US and STOXX Asia Pacific 600 indices by 7 and 5 percentage points, respectively, for the year-to-date period. So far in 2025, all European countries have contributed positively to the STOXX Europe 600's return of 9.33%, with France, Germany, and Switzerland being the largest positive contributors.

There is hope that tensions in Ukraine could subside, US tariffs might be less severe than feared, and most importantly, the European Central Bank stimulated the European economy by further lowering its key interest rate on January 30th, following four rate cuts in 2024.

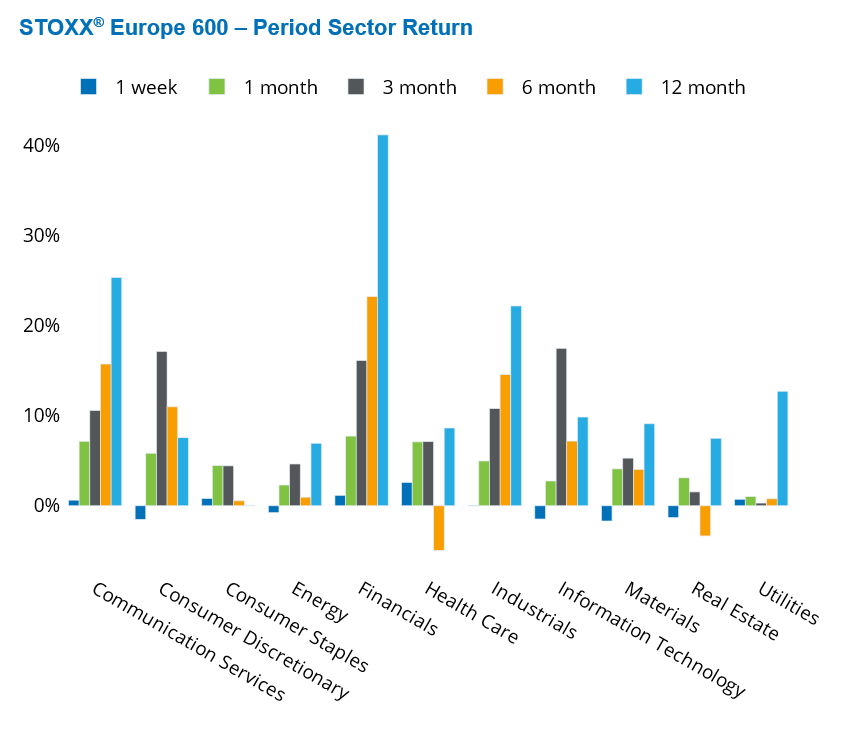

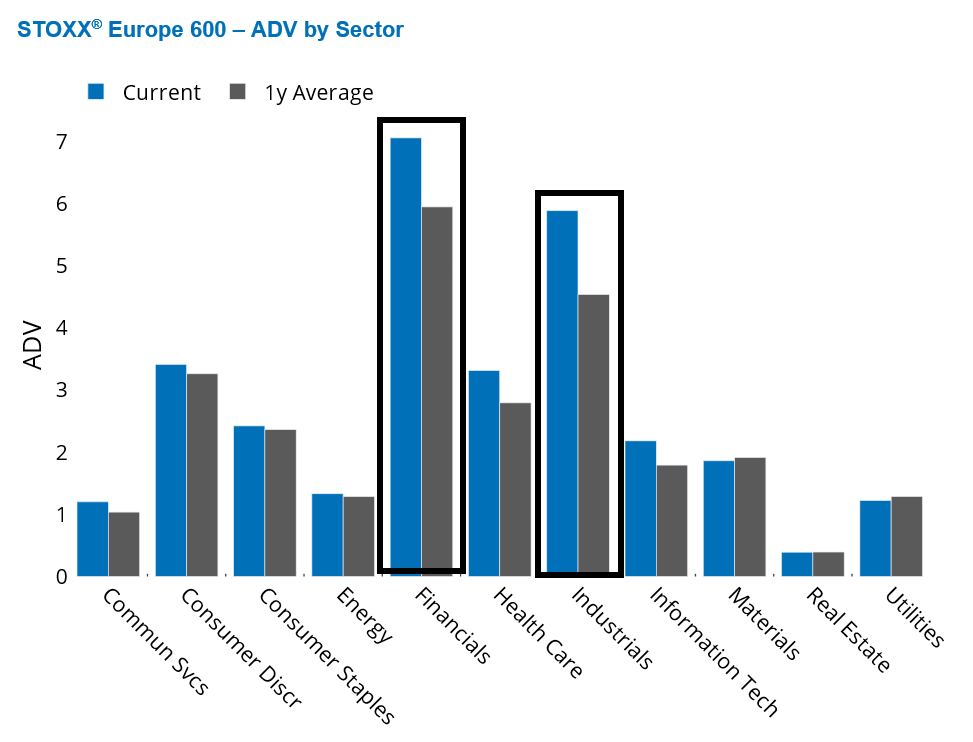

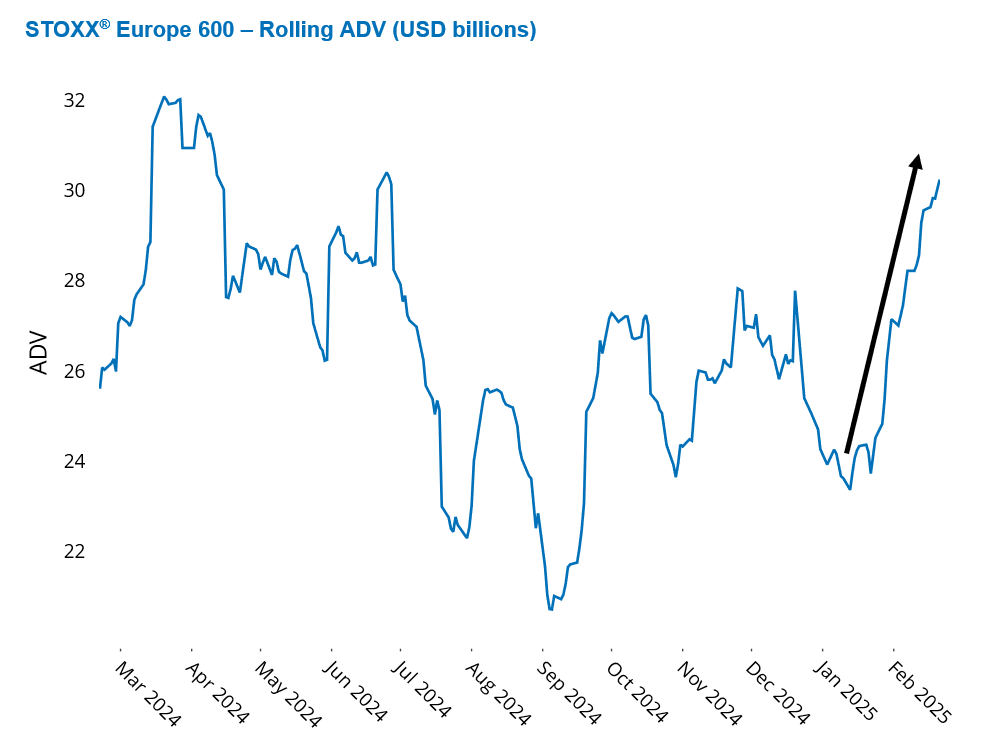

In terms of sectors, only Health Care, Financials, Consumer Staples, and Utilities were up, while Consumer Discretionary and Information Technology fell the most last week. Most European sectors also saw much higher trading volumes compared to their one-year averages, particularly Financials and Industrials (the largest European sectors). Overall, trading activity in Europe climbed to a near-term peak, reaching levels similar to those of June last year.

See graphs from the STOXX Europe 600 Equity Risk Monitor as of February 21, 2025:

Economic concerns hit US small caps harder than large caps

US small-cap stocks plunged as multiple factors combined to create a challenging market environment, leading to their underperformance compared to larger-cap stocks during a shortened week when US markets were closed on Monday for Presidents’ Day.

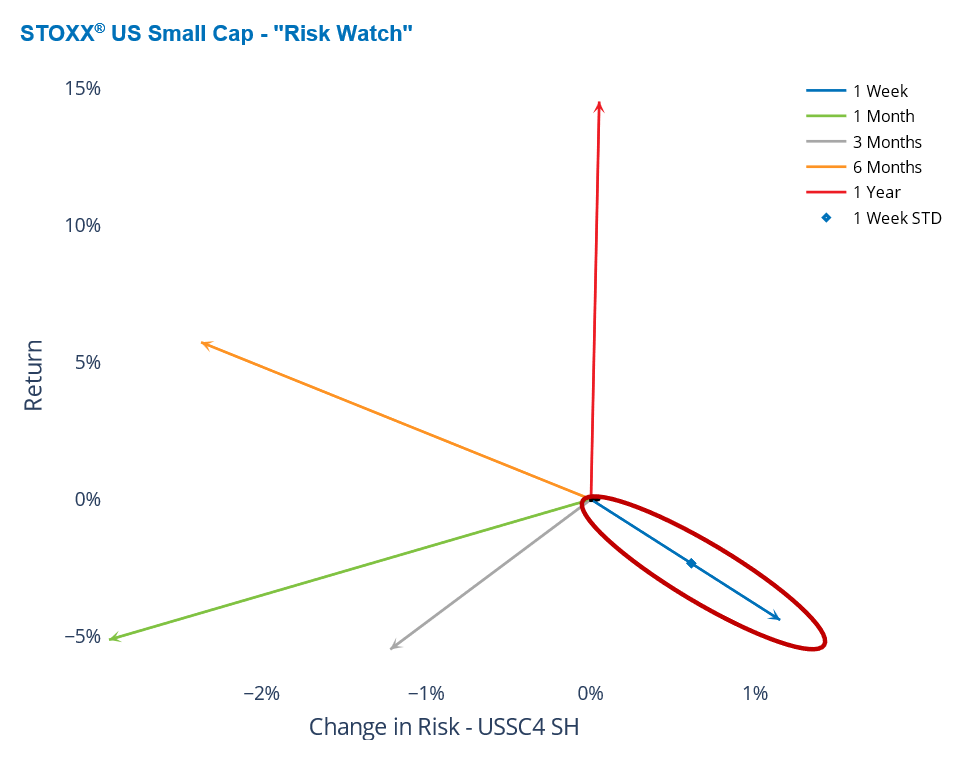

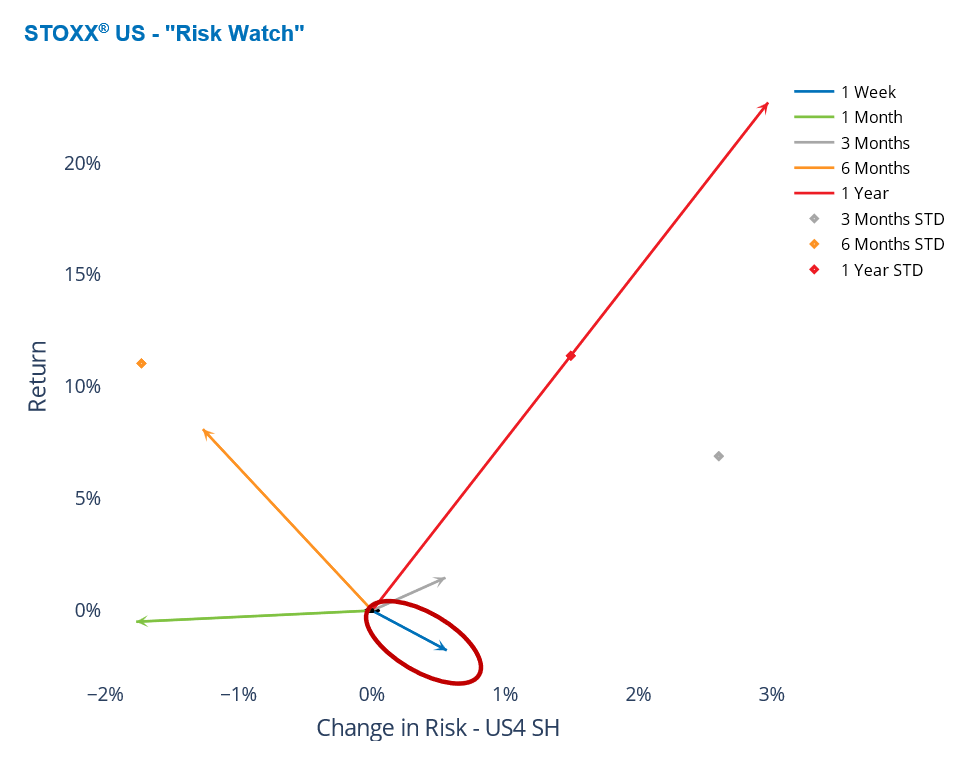

The STOXX US Small Cap index declined by 4% last week, which is two standard deviations lower than expected at the start of the week, according to Axioma US Small Cap fundamental short-horizon model. In contrast, the STOXX US index's weekly loss of 2% remained within one standard deviation of expectations, as measured by the Axioma US4 fundamental short-horizon model.

US stocks fell as investors’ expectations for interest rate cuts shifted, with a higher probability of fewer rate reductions by the Federal Reserve. This change in outlook particularly affected small-cap stocks, which are often more sensitive to interest rate fluctuations.

Lower-than-expected manufacturing growth and an unexpected contraction in the services sector raised concerns about the overall economic environment, which typically impacts smaller companies more severely. Additionally, a decline in consumer sentiment disproportionately affected small-cap companies that rely heavily on domestic consumer spending.

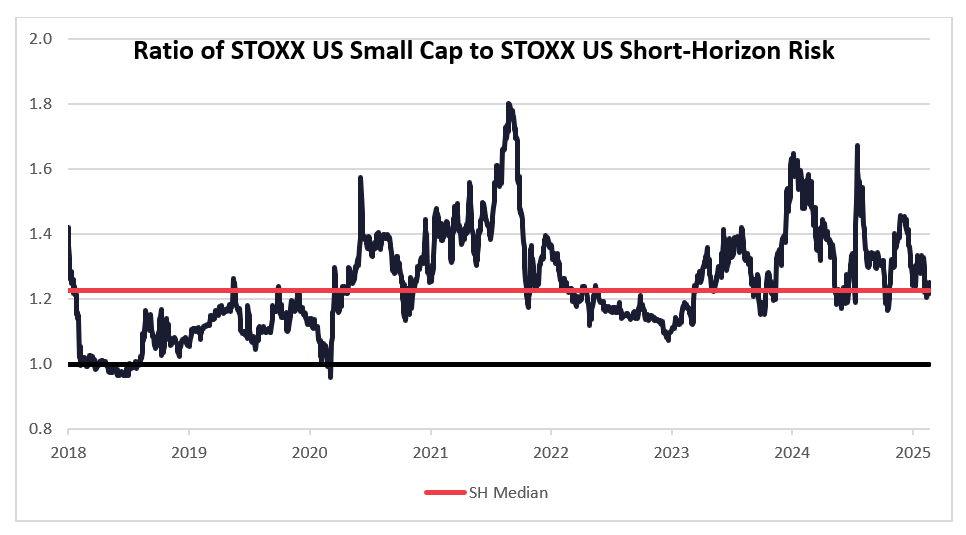

At the same time, forecasted risk increased for both small and large-cap US stocks, with a larger increase for the STOXX US Small Cap index compared to the STOXX US index. Small caps are now 25% riskier than their larger counterparts, which is around the long-term median of small vs. large-cap relative riskiness of 23%.

See graph from the STOXX US Small Cap Equity Risk Monitor as of February 21, 2025:

See graph from the STOXX US Equity Risk Monitor as of 21 February 2025:

The following chart is not in the Equity Risk Monitors but is available on request:

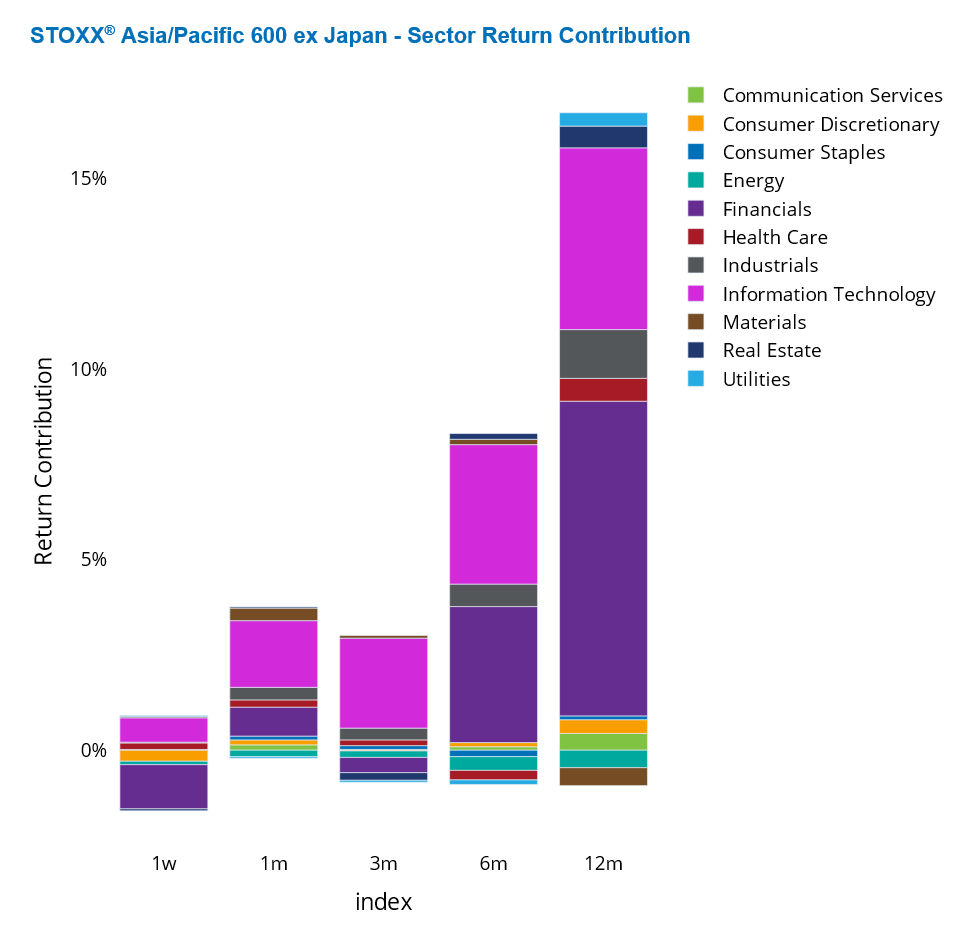

Stellar gains in Asia Pacific ex-Japan tech sector amid global tech retreat

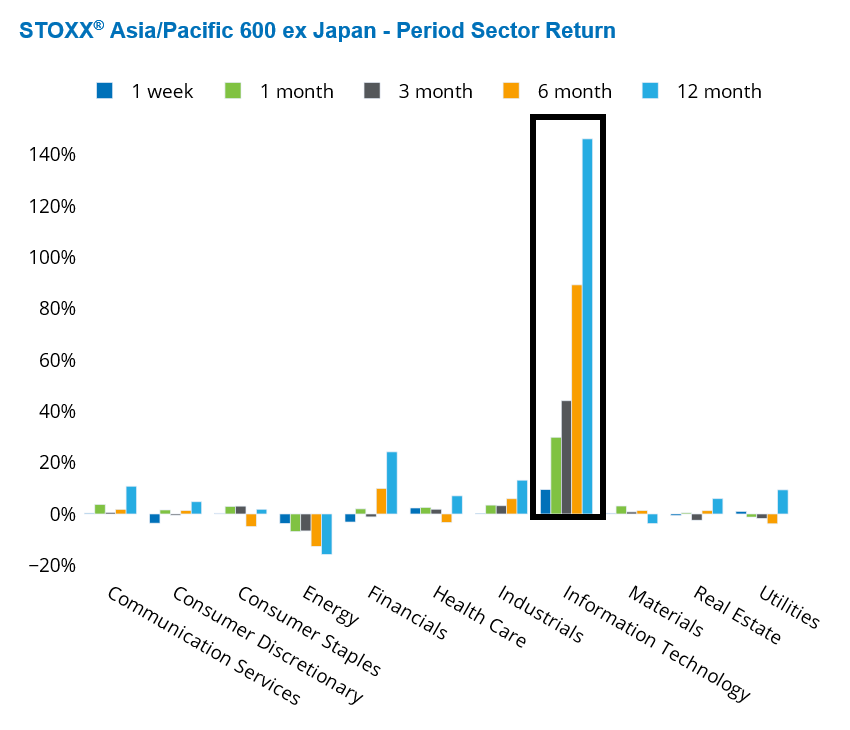

The Information Technology sector in Asia Pacific ex-Japan has seen remarkable gains over the past 12 months. Unlike in the US and Europe, where tech stocks have retreated recently, the Asia Pacific ex-Japan region has continued to experience gains in the tech sector over the past week, month, three months, and six months, culminating in an astonishing 12-month gain of 136%. For comparison, the Information Technology sector rose "only" 28% in the STOXX US and 10% in STOXX Europe 600 over the same period. The top three best-performing tech stocks in the Asian index are all located in Hong Kong and achieved one-year returns between 100% and 290%.

Despite these impressive gains, Information Technology represents less than 10% of the STOXX Asia Pacific ex-Japan, so its contribution to the benchmark’s one-year gain is less than expected. Although the Financials sector's one-year return of 25% was nearly six times lower than the Information Technology sector's return over the same period, Financials' contribution to the benchmark return was nearly twice that of the tech sector due to its massive weight. Financials dominate the STOXX Asia Pacific ex-Japan index, with a weight nearing 36%.

See graphs from the STOXX Asia Pacific 600 ex-Japan Equity Risk Monitor as of February 21, 2025:

You may also like