EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED SEPTEMBER 13, 2024

Axioma Risk Monitor: US large- and small-cap shares rise ahead of Fed meeting; Developed Markets risk now exceeds beginning-of-year levels; Worldwide Earnings Yield style factor plunges

US large- and small-cap shares rebound ahead of Fed meeting

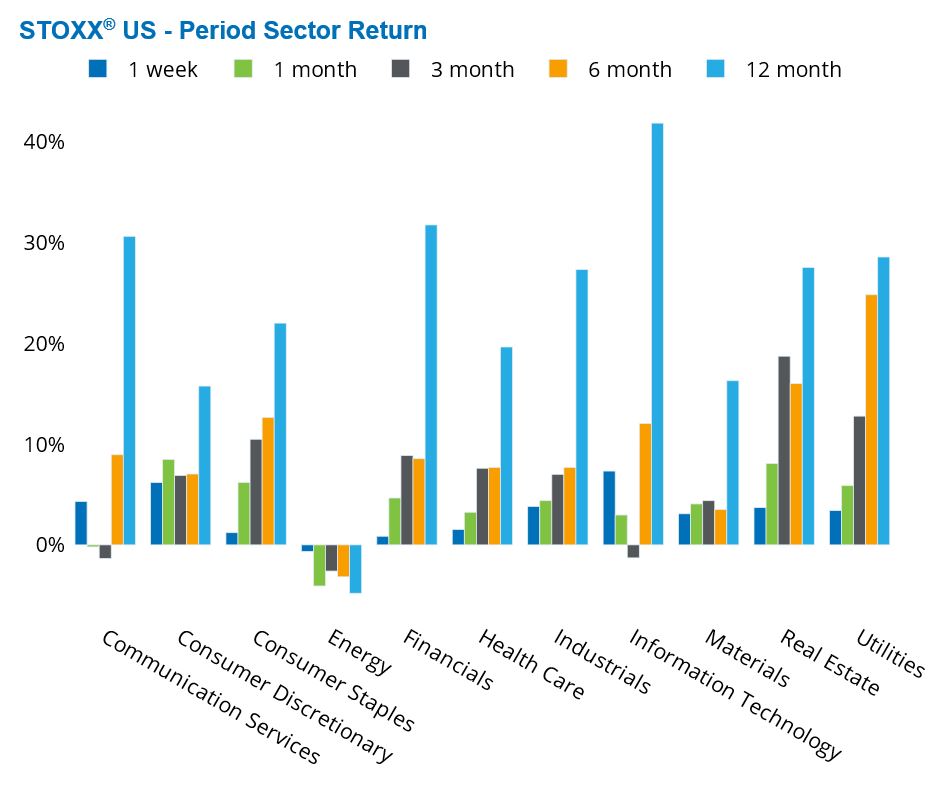

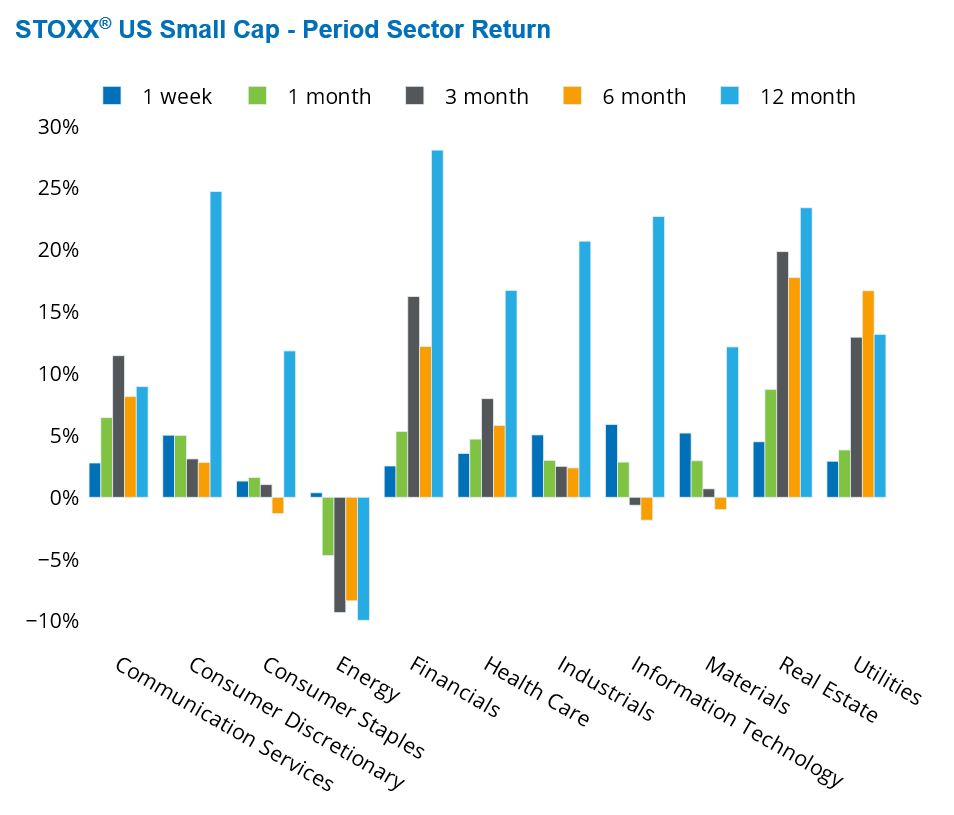

US shares rose in advance of the Fed meeting on Wednesday, as investors anticipate an interest rate cut. Both the STOXX US and STOXX US Small Cap indices rose more than 4% over the past five business days. All sectors in the small-cap benchmark were up, while the large-cap benchmark saw a single sector post a weekly loss: Energy (of 0.65%). Information Technology was the best performing sector in both small-cap and large-cap indices with 6% and 7% weekly gains, respectively.

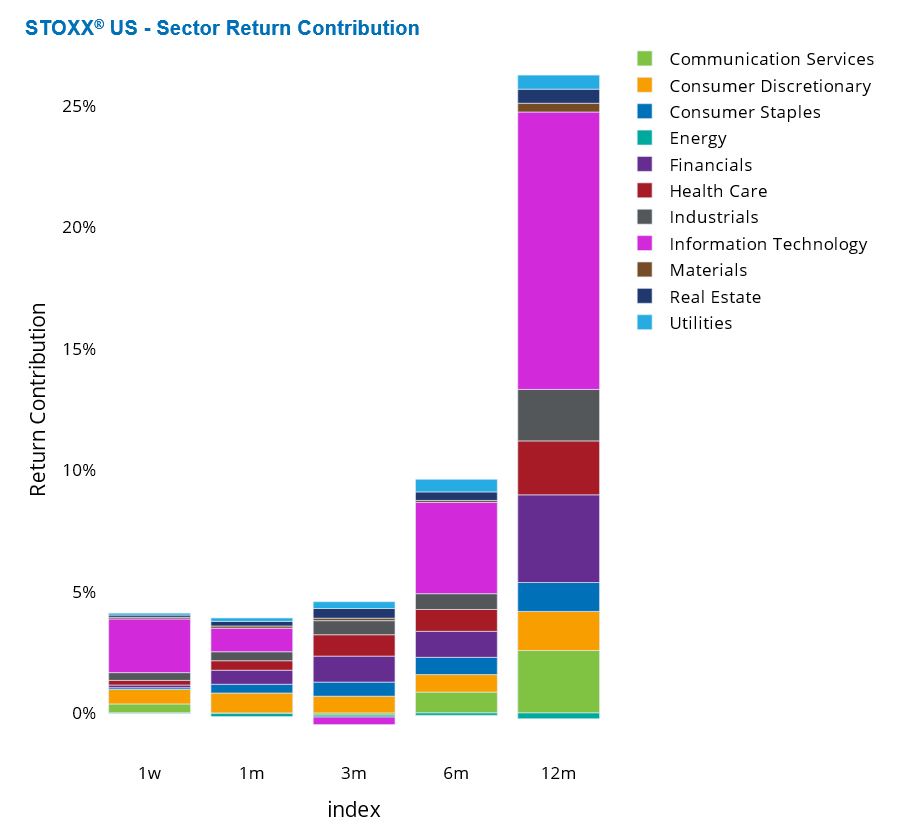

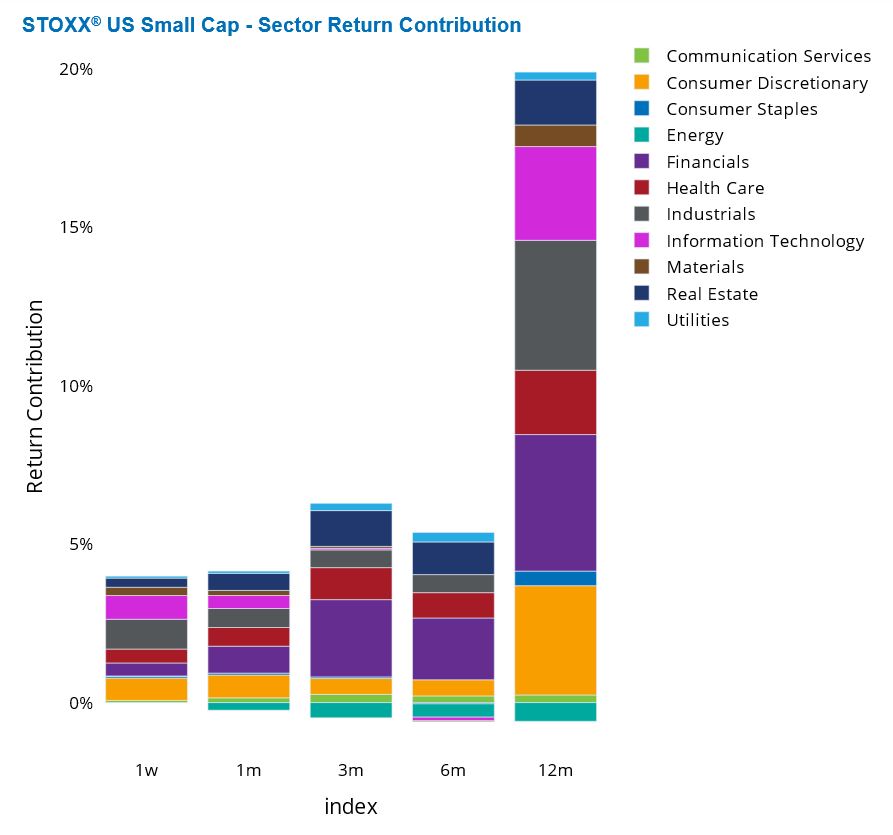

Info Tech posted the largest positive weekly contribution among the 11 sectors in STOXX US, as tech companies make up more than a third of the large-cap index. The tech sector had the second-largest positive contribution after Industrials in the STOXX US Small Cap index, where Industrials holds a larger weight than Info Tech. Sector weights and therefore return contributions are much more evenly distributed in the STOXX US Small Cap index than in its larger-cap counterpart.

See graphs from the STOXX US Equity Risk Monitor as of September 13, 2024:

See graph from the STOXX US Small Cap Equity Risk Monitor as of September 13, 2024:

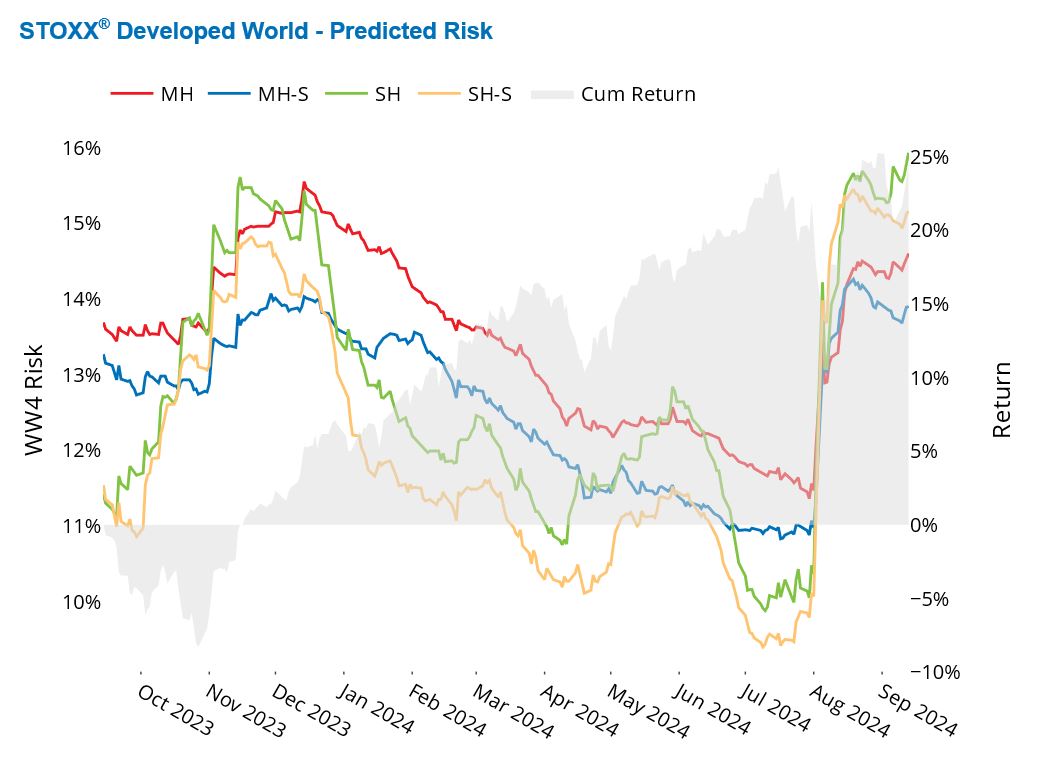

Developed Markets risk now exceeds beginning-of-year levels

Despite the rebound in global equity markets, the predicted risk for Developed Markets has continued to rise, now surpassing the levels seen at the beginning of the year. According to Axioma Worldwide fundamental short-horizon model, the 16% predicted risk for STOXX Developed World as of last Friday also surpassed the seven-year median.

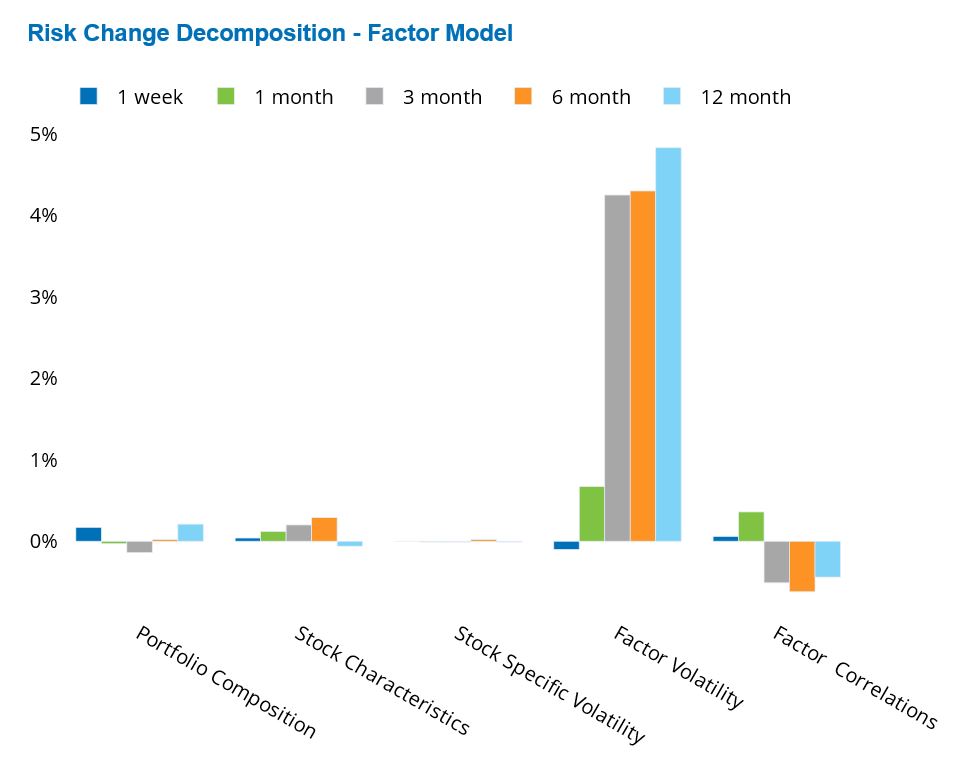

The surge in factor volatility drove the increase in risk for STOXX Developed World while factor correlations detracted from the total index risk over the past three, six and 12 months. Interestingly, the pattern has changed in the past month when the increase in factor correlations contributed along with factor volatility to the rise of total index risk.

Last week’s risk increase was attributable to small changes in index composition and factor correlations, while factor volatility declined a bit.

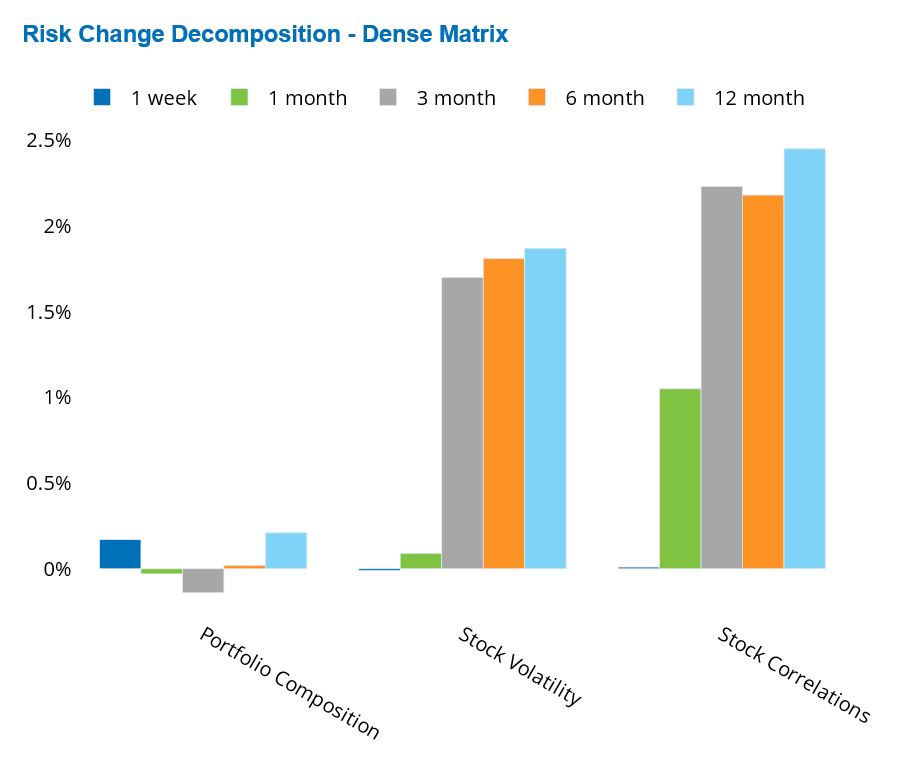

When looking at the decomposition of the change in risk from the standpoint of the dense matrix, it was the increase in stock correlations that had a larger contribution to the rise in total benchmark risk than the increase in stock volatility, and that was the case for the one-, three-, six- and twelve-month periods.

For the past five business days, the change in index composition was solely responsible for the small increase in STOXX Developed World’ risk, while stock volatility and correlations had an insignificant impact.

See graphs from the STOXX Developed World Equity Risk Monitor as of September 13, 2024:

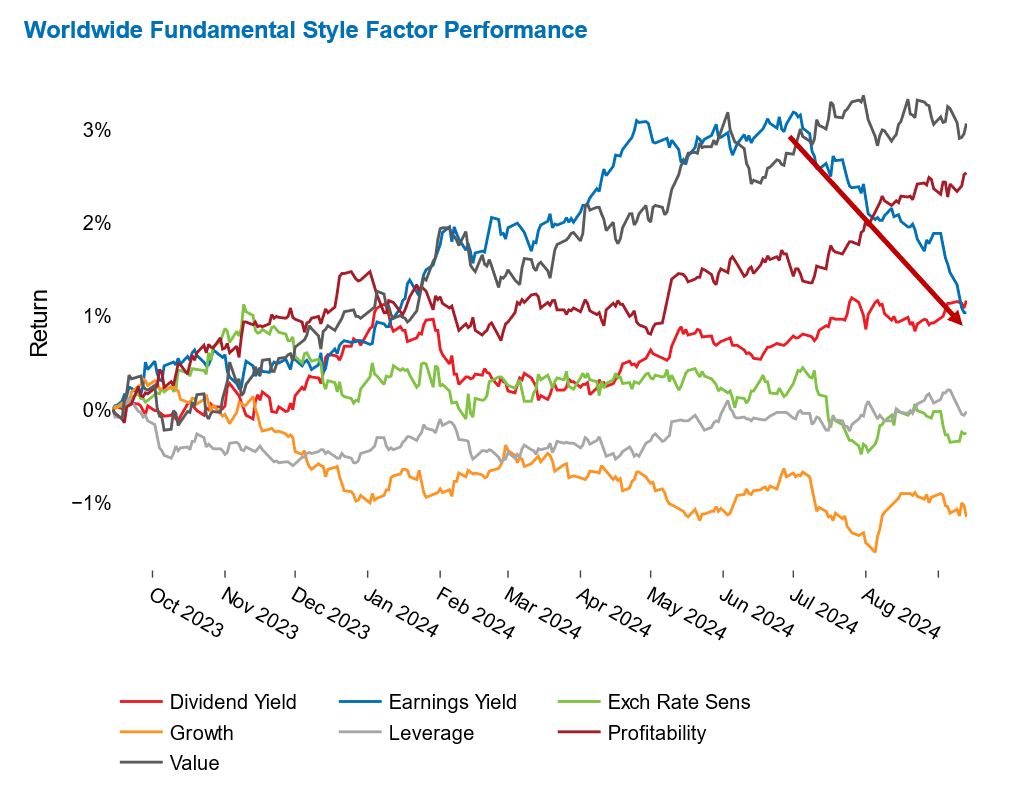

Worldwide Earnings Yield style factor plunges

The Earning Yield style factor has plunged over the past three months after being among the top performers in the first half of the year among the fundamental style factors in Axioma Worldwide medium-horizon model.

Last week’s decline (of 0.43%) was two standard deviations below the expectations at the beginning of the week, while the nearly 2% total decline over the past three months was more than three standard deviations below the expectations at the beginning of the period.

Thanks to its gains before the second-quarter earnings season, Earnings Yield’s 12-month return stayed positive, but the style factor is now underperforming Value and Profitability for the one-year period.

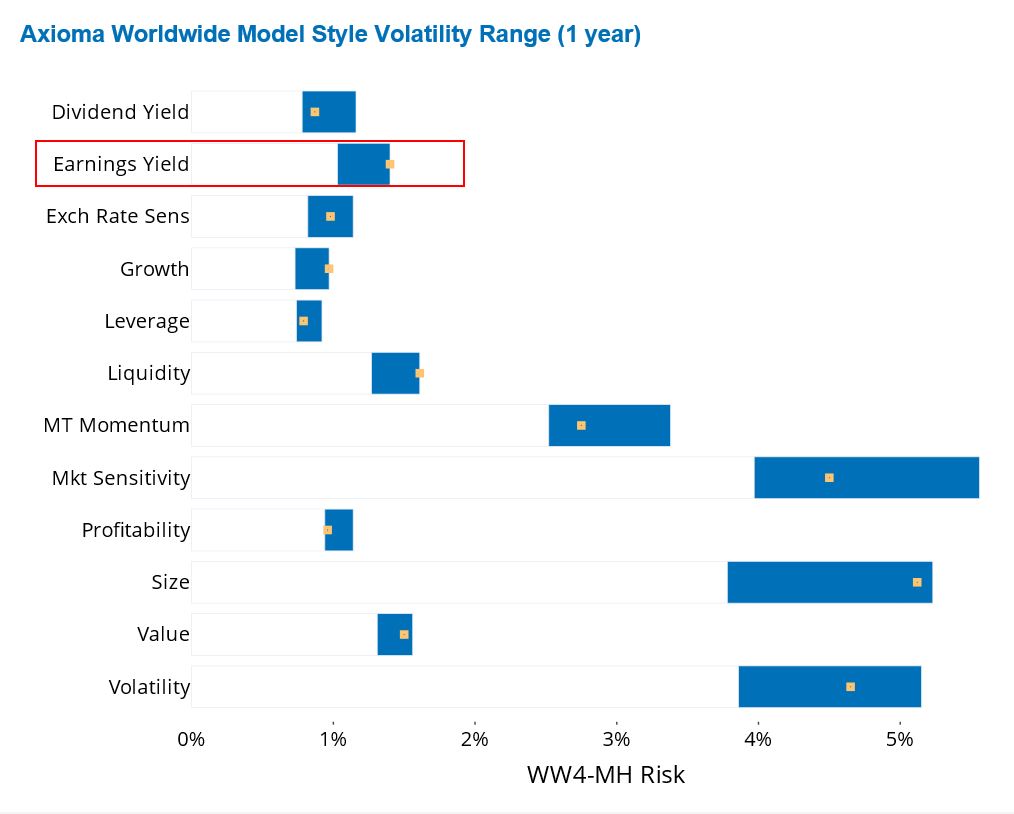

Earnings Yield is not among the most volatile style factors in the Worldwide model—Size, Volatility and Market Sensitivity holding that distinction. Yet, Earnings Yield’s current volatility has reached the high end of its one-year volatility range.

See graphs from the STOXX Developed World Equity Risk Monitor as of September 13, 2024:

You may also like