September is (often) the cruelest month for market returns

Author

Melissa Brown, Head of Investment Decision Research

September is (often) the cruelest month for market returns

The market nosedive on September 3 illustrated just how fraught this month can be. Historically, September has been the worst month of the year for equities, perhaps because that is when investors may determine that their rosy outlooks are not attainable, and they start to sell the most vulnerable names.

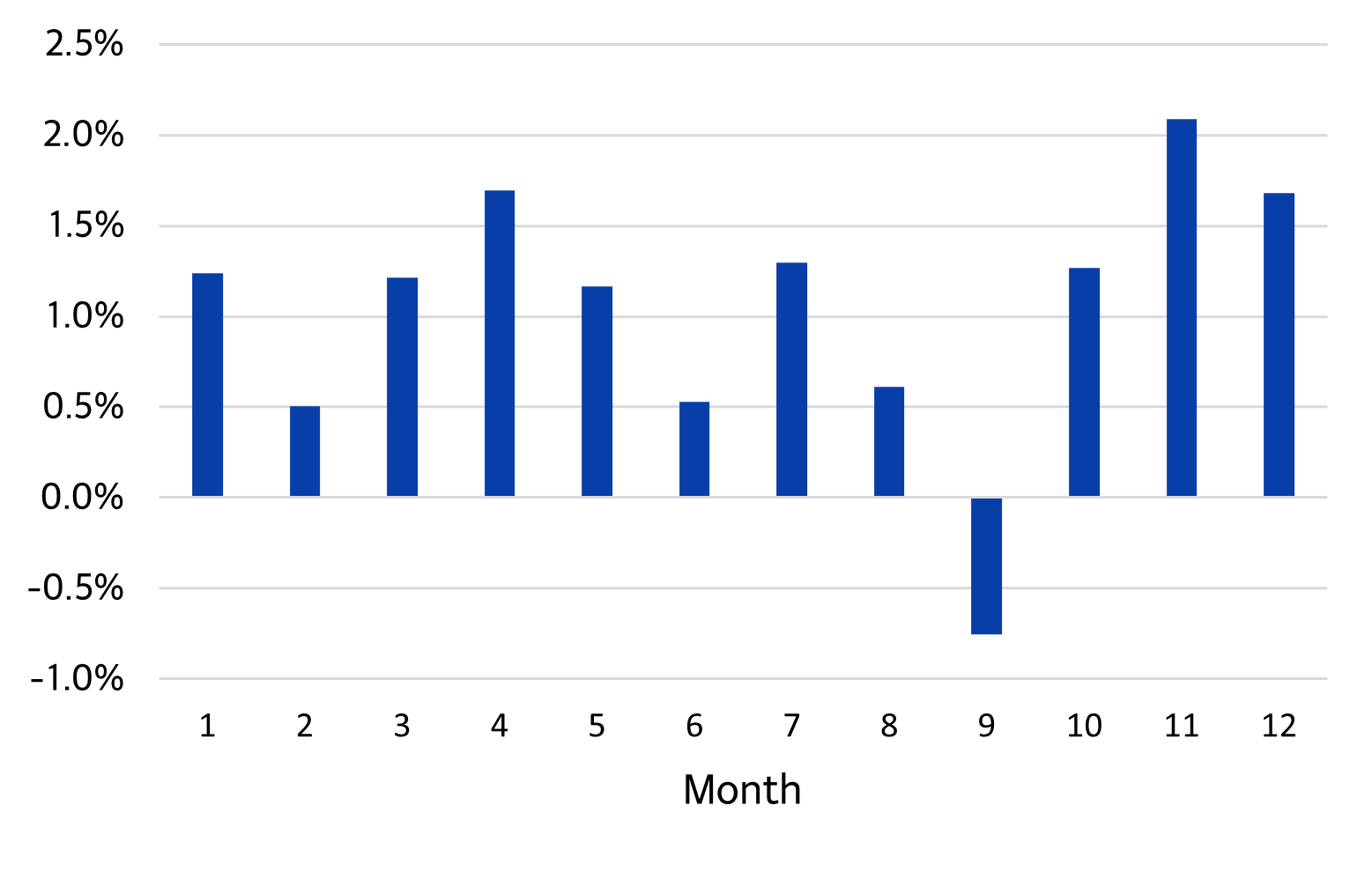

In the US, September is the only month to have seen a negative return on average for the past 41+ years, even though October seems to have the bad reputation1. Over that same time period the market was down in 175 of the 511 months, or about 34% of the time. In contrast, US stocks fell in 21 of the 42 Septembers, or 50% of the time. The best September was in 2010, when the market returned 9.1%, while the worst was in 2002, when the US market fell 10.8%. That return was the fourth-worst monthly return in the history of our US Axioma Market Portfolio, a cap-weighted index of 600 large- and mid-cap US names.

There is also a statistically significant difference in September’s returns as compared with all other months, with a p-value of 1% (in other words, there is only a 1% chance that the returns are the same in September as they are the rest of the year).

The market impact of the US election

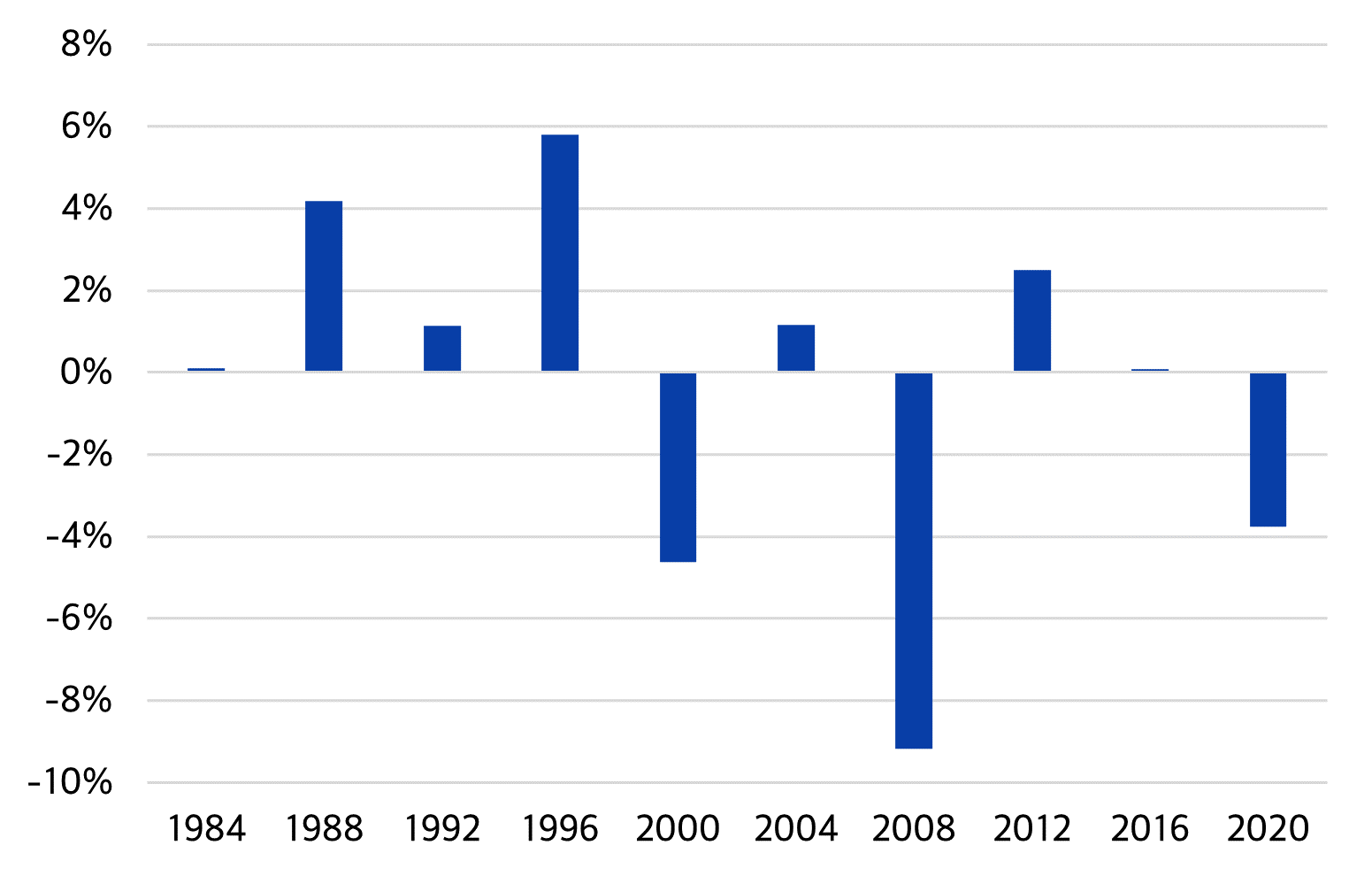

This is not just an election year phenomenon. On average, the September in the last 10 Presidential election years saw the US market fall -0.3%, but that average was dragged down by 2008, when it fell more than 9% and there were obviously other issues (such as a global financial crisis unfolding) for investors to deal with. The market was actually up more than average, declining in just three of the 10 years.

Figure 1: Average US market return by month (February 1982 – August 2024)

Source: Axioma Market Portfolios

Figure 2: September return in election years

Source: Axioma Market Portfolios

Could market returns continue to suffer?

Yes, history has shown that this decline is not necessarily one-and-done. The return on September 3 was far worse than the long-term average for the whole month, but, still, there were 16 Septembers with more negative returns in the broad market, so there is potentially more downside.

Is it all doom and gloom?

No, not at all. Note that all three months in the fourth quarter have higher-than-average returns, and the fourth quarter as a whole has been the best quarter, on average. The incidence of negative monthly returns in the fourth quarter is also about 28%, lower than average. So no need for despair!

"September has been the worst month of the year for equities, perhaps because that is when investors may determine that their rosy outlooks are not attainable, and they start to sell the most vulnerable names."

References/footnotes

1 Returns are based on the Axioma Core US Market portfolio, which is a capitalization-weighted index of large- and mid-cap companies, currently comprising just under 600 names