EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED SEPTEMBER 6, 2024

Axioma Risk Monitor: Drop in US shares reinforces historical pattern; Asset dispersion widens as US market plummets; India emerges as one of the top performers

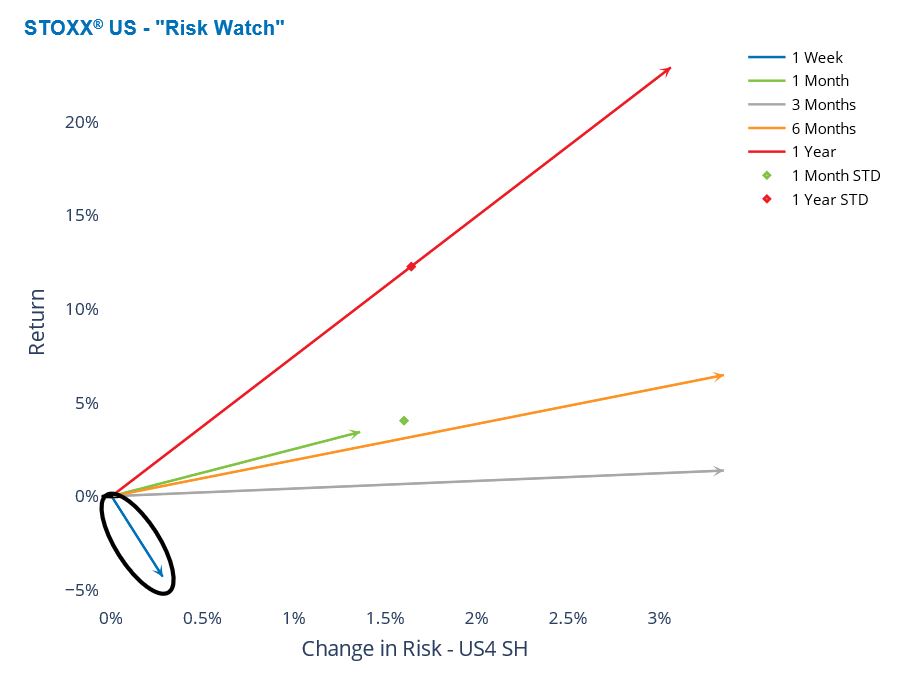

Drop in US shares reinforces historical pattern

The first week of September started with a steep nosedive in US shares, reinforcing the historical pattern of this month, which has been the cruelest for monthly returns for at least 41 years. Even though it was a short week—due to the US Labor Day holiday—the STOXX US index fell 4% in four business days. The US stock selloff was triggered by several disappointing news stories that raised concerns about the health of the US economy. As predicted volatility levels have skyrocketed recently, the US weekly loss still remained within the one standard deviation of the expectations at the beginning of the week, as measured by Axioma US4 fundamental short-horizon model.

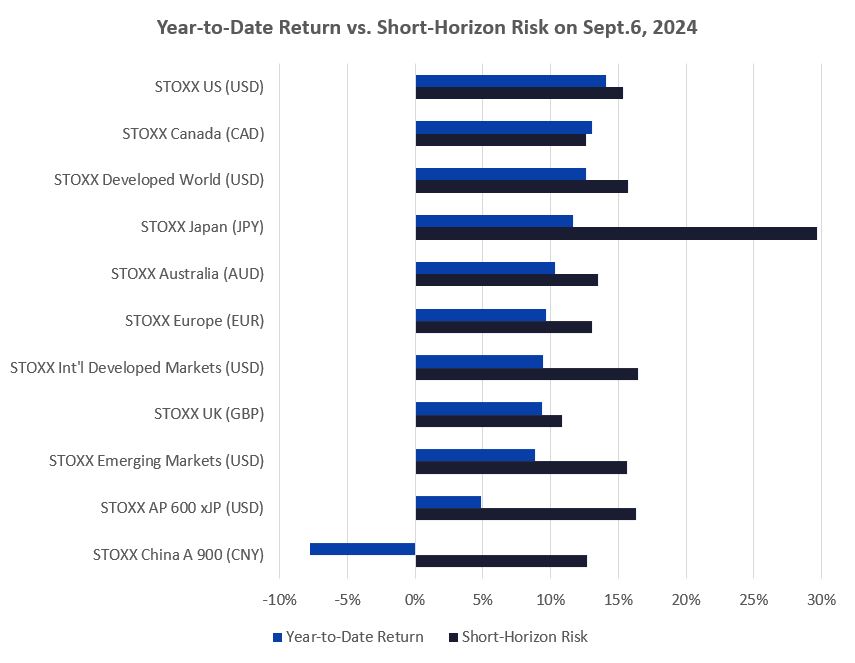

Amid global turmoil in stock markets, the US is now the best performer (with a 14% year-to-date gain) among major regions tracked by the Equity Risk Monitors. Japan had been outpacing all markets by far until the end of July when the Bank of Japan’s announcement of an interest-rate increase tanked the Japanese market, and since then the US took its place. In terms of risk, the US is now positioned somewhere in the middle of its peers, while Japan became the riskiest regions and twice as risky as the US, as measured by Axioma fundamental short-horizon regional models.

See graph from the STOXX US Equity Risk Monitor as of September 6, 2024:

The following chart is not published in the Equity Risk Monitors but is available upon request:

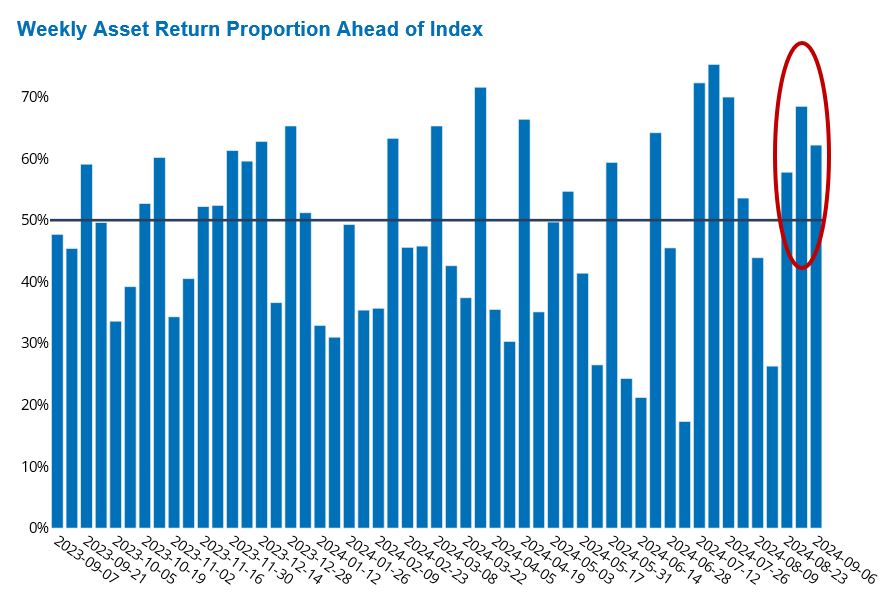

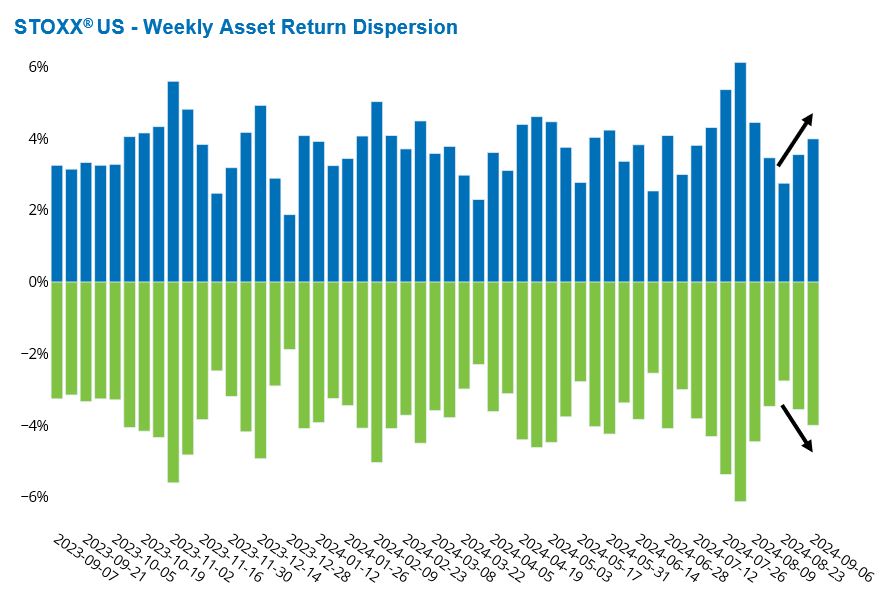

Asset dispersion widens as US market plummets

Despite the sharp decline in the US market, outperformers outnumbered underperformers in the STOXX US index last week. This means that it was mostly the largest stocks that dragged down the US market. At the same time, asset return dispersion—the cross-sectional standard deviation of five-day returns—has risen over the past three weeks, indicating that the spread between the winners and losers has widened. These two statistics reflect the divergence in returns across US stocks and suggest—as many active managers hope—that it was possible to outperform the declining market.

See graphs from the STOXX US Equity Risk Monitor as of September 6, 2024:

India emerges as one of the top performers

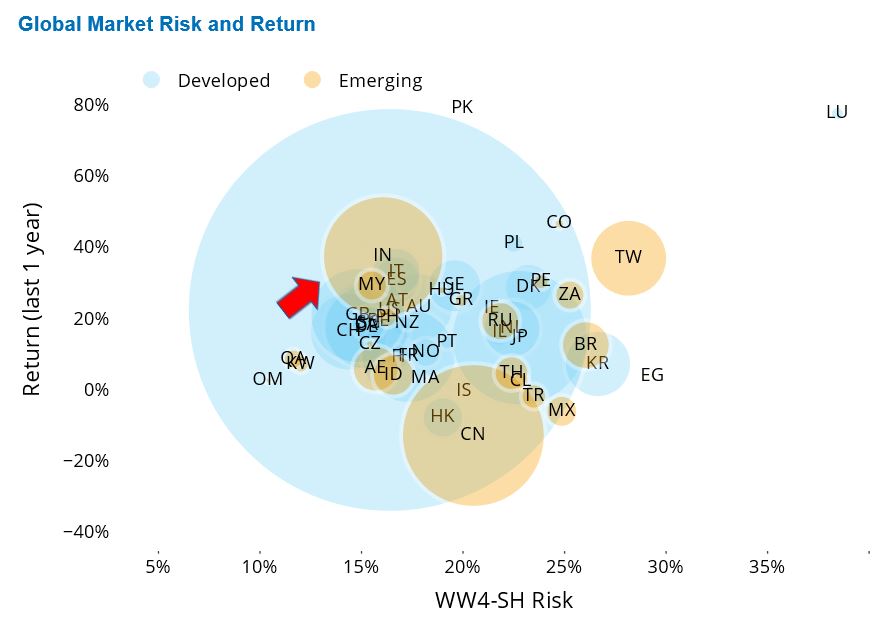

India emerged as one of the top performers among major developed and emerging countries, when looking at country returns denominated in US dollars. As one of the fastest-growing economies, India has recorded a 12-month return of nearly 40%. In contrast, China is experiencing a 13% loss over the same period becoming the largest underperformer.

India’s risk rose almost 50% in 12 months, and yet the country’s current level of risk (of 16%) places it among the least risky countries, as measured by Axioma Worldwide fundamental short-horizon model.

India’s risk is now 4 percentage points lower than that of China and 12 percentage points lower than that of Taiwan—the riskiest emerging market.

See graph from the Equity Risk Monitors as of September 6, 2024: