GRANOLAS entice, but Magnificent Seven deliver

A visual story

Author

Diana R. Baechle,

Ph.D., Principal,

Applied Research

GRANOLAS took the spotlight from the Magnificent Seven, but is their risk-adjusted performance brighter?

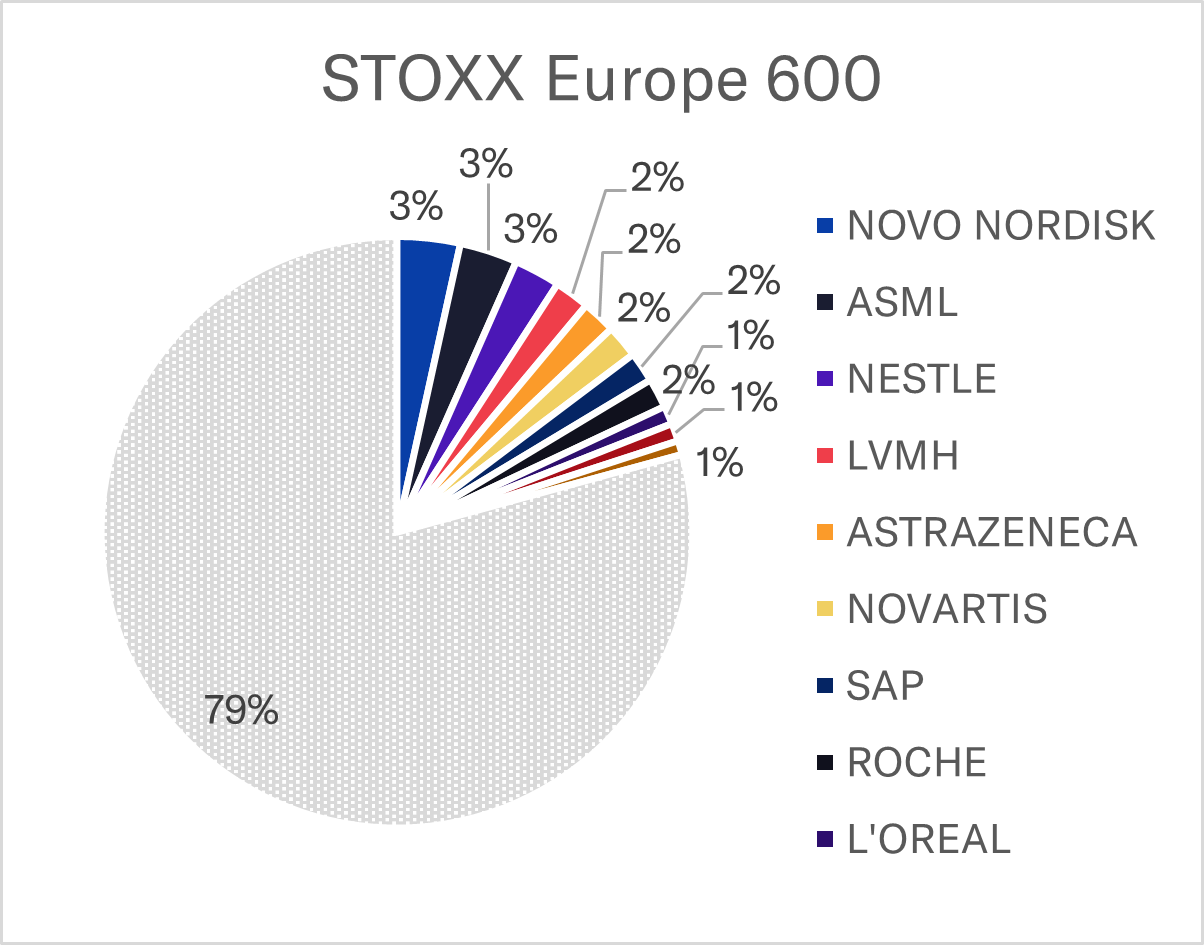

Although the GRANOLAS do not boast trillion-dollar market values individually, they collectively represent a quarter of the European market, and propelled the STOXX Europe 600 index to unprecedented heights in 2024. This shift has sparked a sense of FOMO among investors, leading them to consider diversifying beyond the tech giants and exploring varied sectors and countries.

However, for US-based investors, the Magnificent Seven remained a strong choice as they delivered superior risk-adjusted returns. This was the case over the past six years and persisted in 2024.

The term GRANOLAS was coined by Goldman Sachs in 2020 and refers to the following 11 European stocks: GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AtraZeneca, SAP, Sanofi. The Magnificent Seven is the grouping of the seven US tech stocks: Amazon, Apple, Google (Alphabet), Meta, Microsoft, Nvidia and Tesla.

To compare the performance and risk of the Magnificent Seven to the GRANOLAS, we constructed two portfolios of the Magnificent Seven and GRANOLAS stocks, with each stock having the same proportional weight as it had in the STOXX US and STOXX Europe 600 index, respectively. The analysis was performed as of May 17, 2024.

Key takeaways:

- Magnificent seven outpace GRANOLAS and broader markets in 2024

- Nvidia and Novo Nordisk shine amid mixed performance of high-flying stocks

- GRANOLAS offer diversification but face higher country and currency risks

- Magnificent Seven dominate the US and Developed Markets

- Magnificent Seven and GRANOLAS’ weights double in less than seven years

- Novo Nordisk and Nvidia emerge as powerhouses behind index performance

- Magnificent Seven outperform historically but see greater fluctuations

- Magnificent Seven drive the US market more than GRANOLAS drive the European one

- GRANOLAS’ risk aligns with that of the European market

- Magnificent Seven boast higher historical risk-adjusted returns

1) Magnificent Seven outpace GRANOLAS and broader markets in 2024

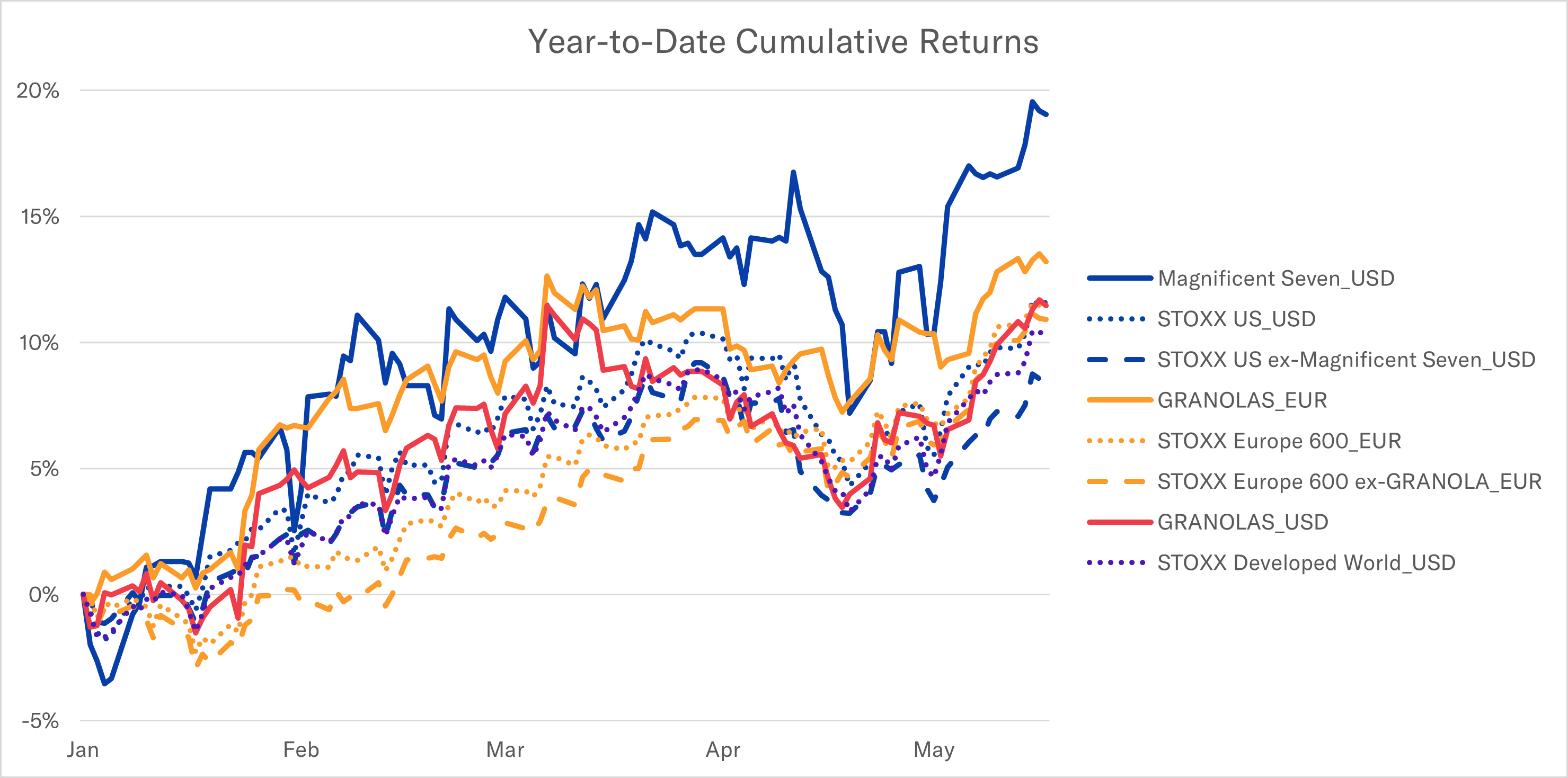

The Magnificent Seven stocks have significantly outperformed the GRANOLAS and broader US, European, and Developed Markets in 2024. In fact, without the Magnificent Seven, the US market would have lagged behind the European and Developed markets. Despite a significant drop in April, the Magnificent Seven rebounded to achieve a 19% year-to-date (YTD) return, outperforming the US market by seven percentage points. In contrast, the GRANOLAS recorded a 13% YTD return in EUR (11% in USD), surpassing the STOXX Europe 600 by a much smaller margin of two percentage points. The GRANOLAS stocks outperformed the US market when returns were calculated in local currency but not in USD, due to the weakening of the euro against the US dollar. Despite GRANOLAS constituting 20% of the index, the STOXX Europe 600 ex-GRANOLAS underperformed the benchmark only by 50 basis points.

Figure 1. Magnificent Seven and GRANOLAS YTD Performance Against Major Indices

Source: STOXX & Axioma Portfolio Analytics

Source: STOXX & Axioma Portfolio Analytics

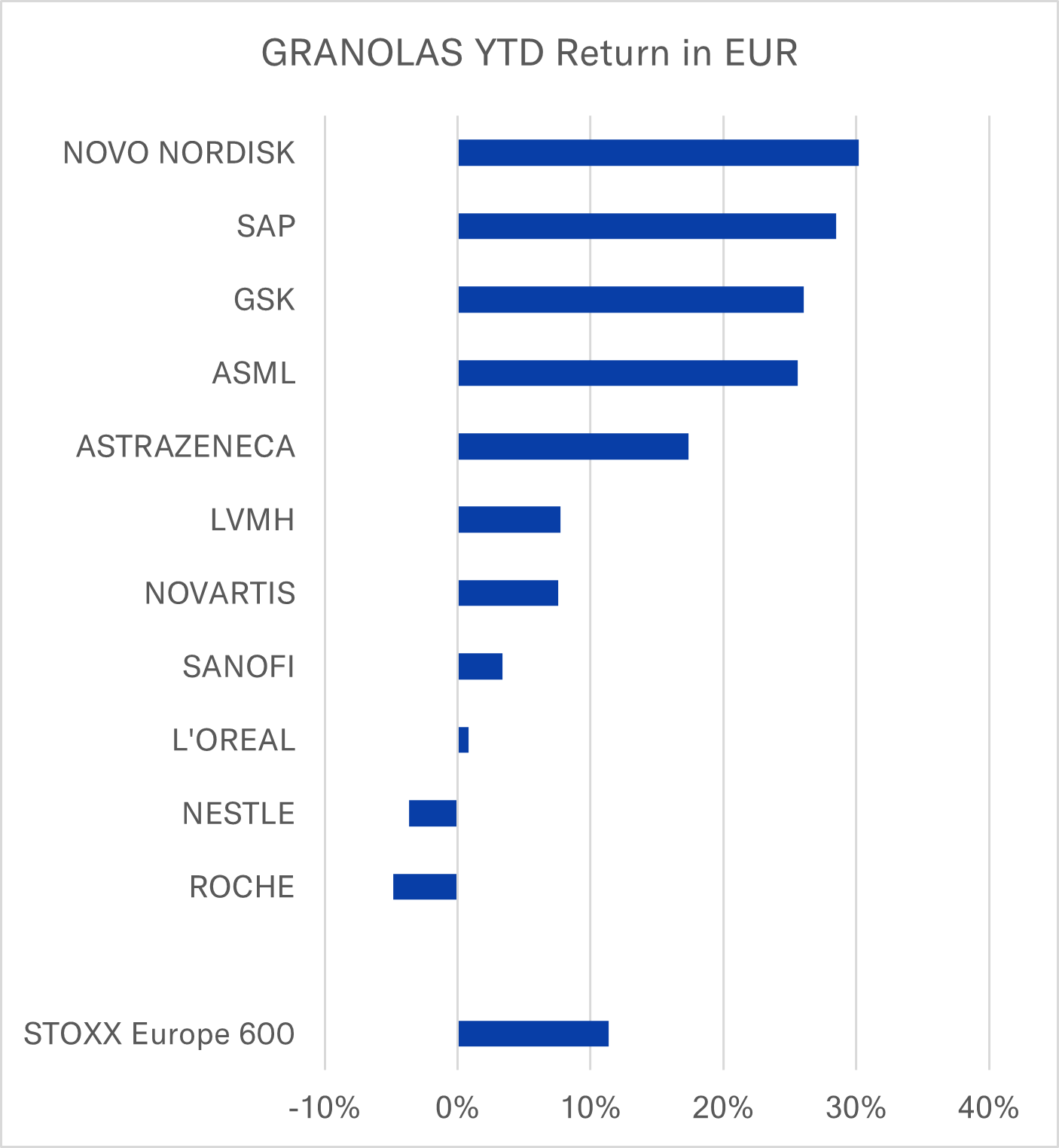

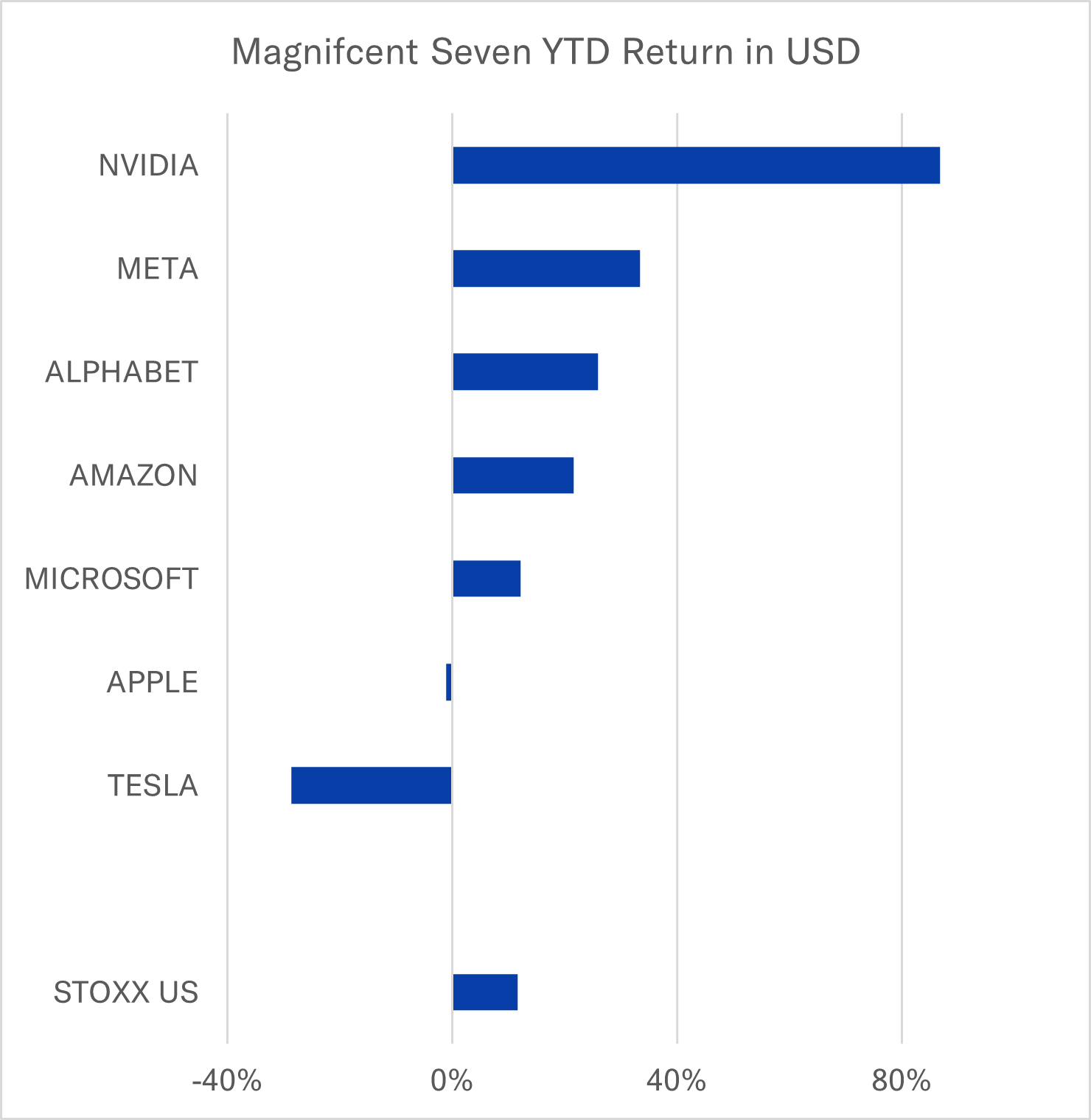

2) Nvidia and Novo Nordisk shine amid mixed performance of high-flying stocks

Nvidia has continued its remarkable performance, achieving an 87% return and becoming the third-best performer among all STOXX US constituents so far in 2024, after Vistra Corp. and Dell Technologies — two much smaller stocks, with market capitalization about 50-70 times smaller than that of Nvidia. Nvidia’s success was driven by robust demand for AI products, surpassing quarterly expectations, and a stock split. Novo Nordisk, the best-performing GRANOLA stock, rose due to strong demand for its obesity and diabetes drugs and production expansion. Novo Nordisk’s YTD return was one-third that of Nvidia. While most stocks in both categories are up this year: from the Magnificent Seven, Tesla and Apple experienced YTD losses and Roche and Nestle from the GRANOLAS.

Figure 2. Magnificent Seven and GRANOLAS Total Return Year-to-Date

Source: STOXX & Axioma Portfolio Analytics

Source: STOXX & Axioma Portfolio Analytics

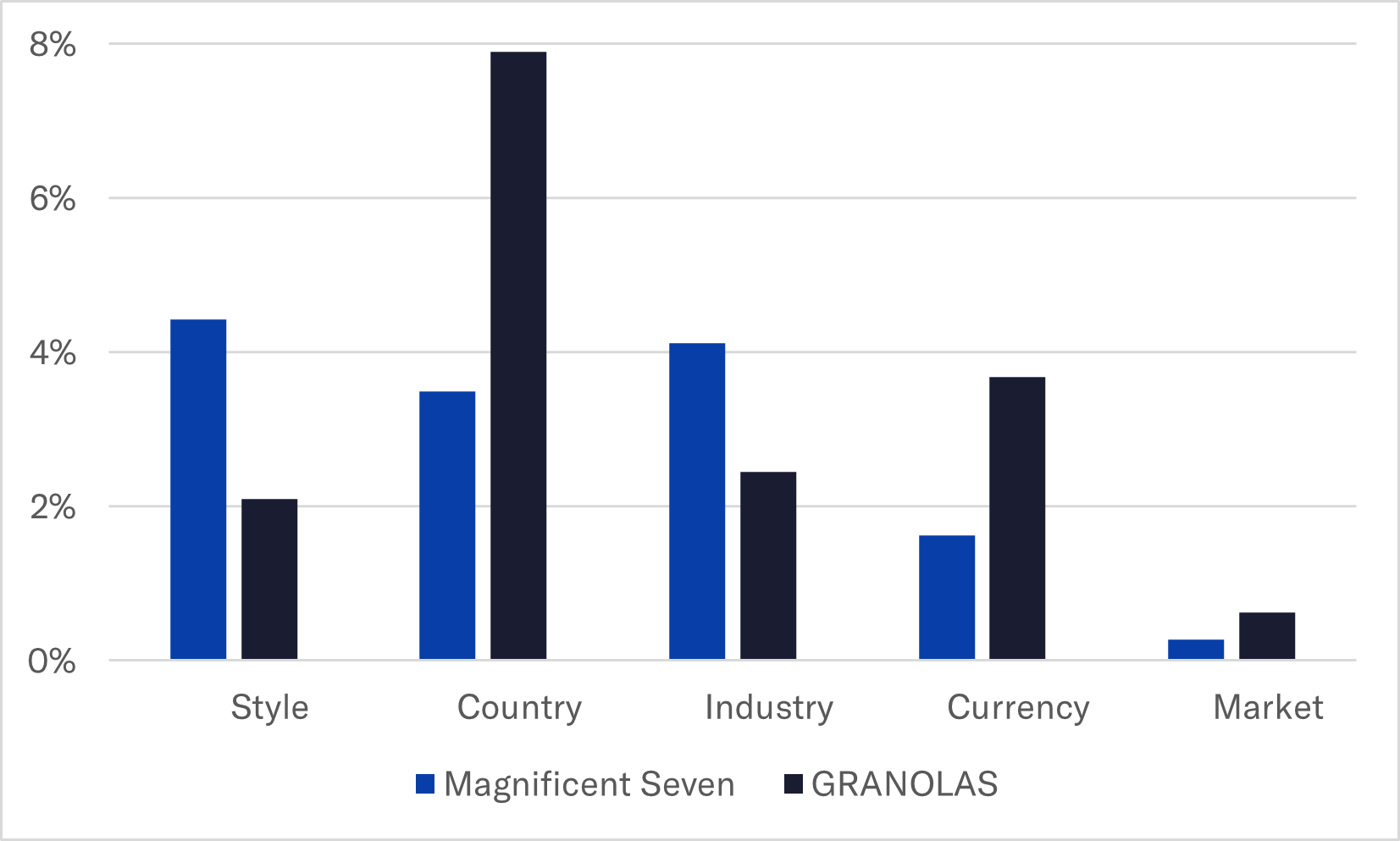

3) GRANOLAS offer diversification but face higher country and currency risks

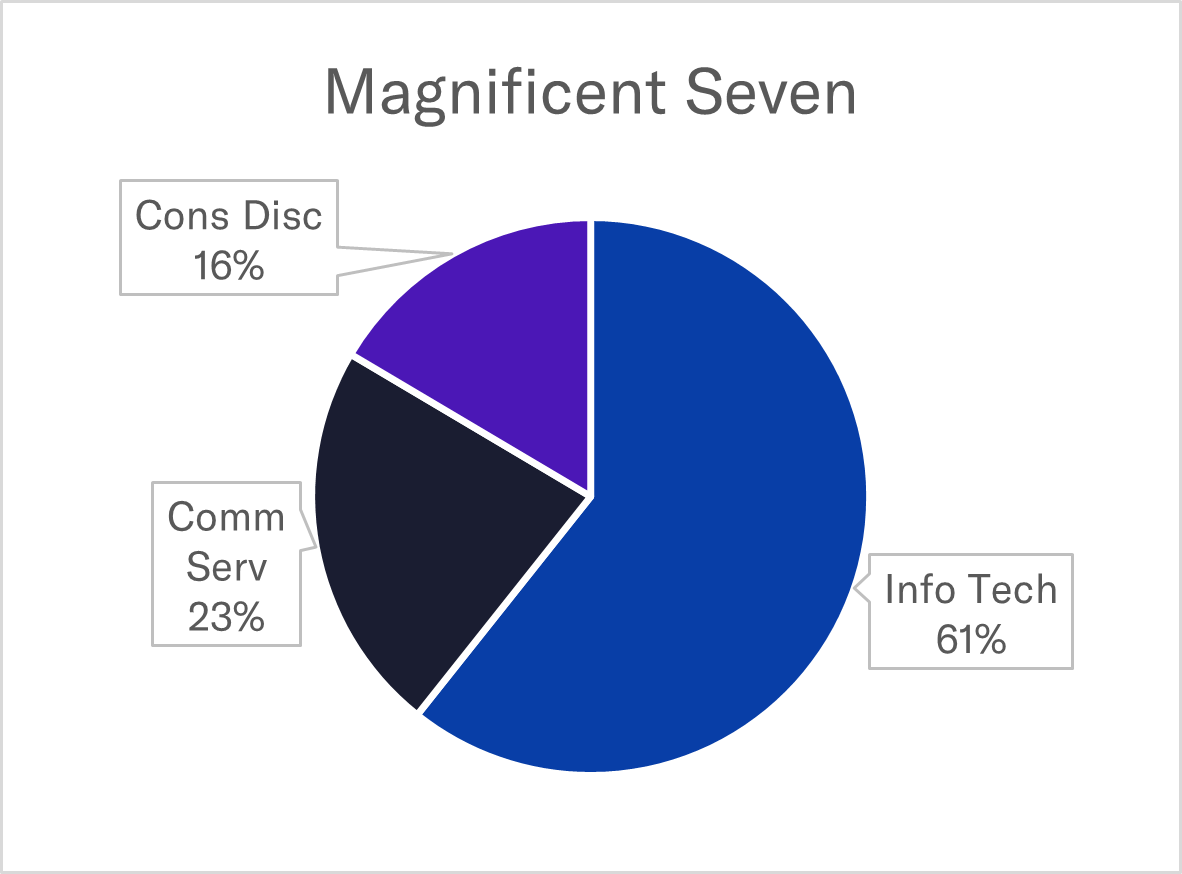

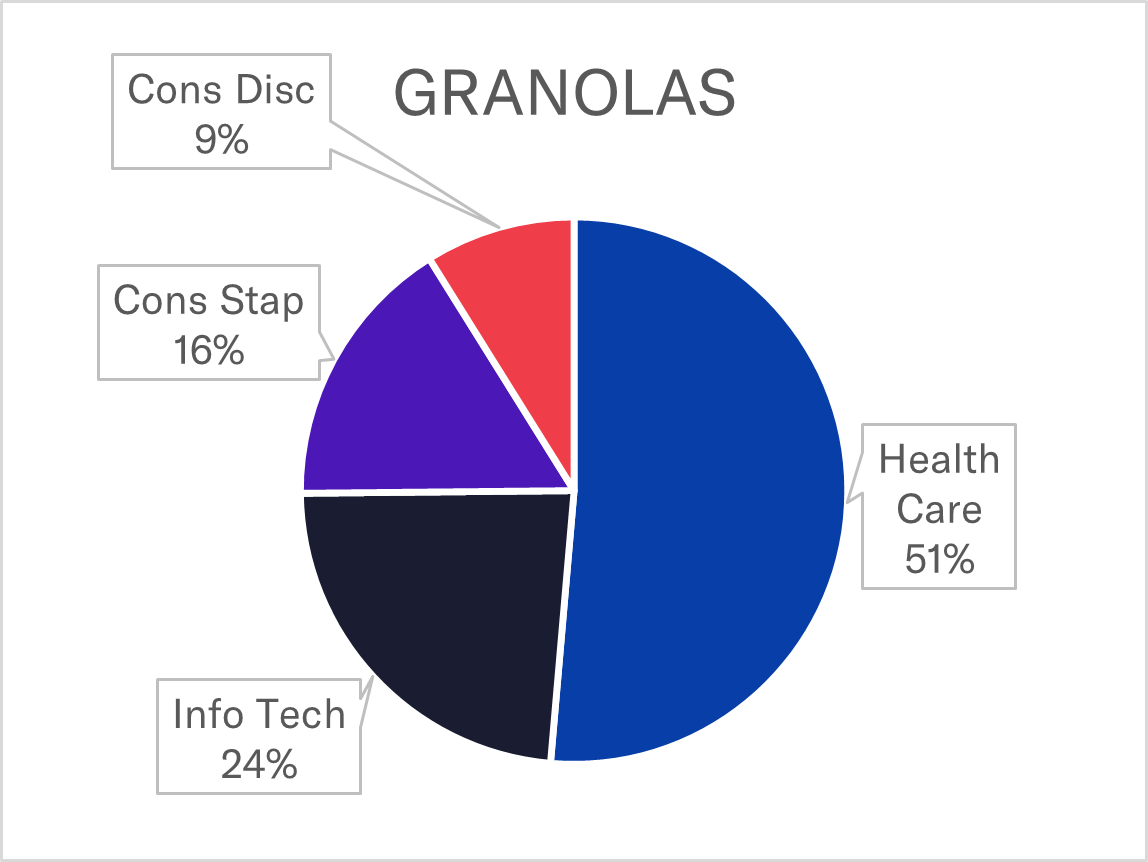

GRANOLAS are more diversified with broader country and currency exposures (since the Magnificent Seven are all in one country) but correspondingly have higher country and currency risk contributions. GRANOLAS include companies from six European countries: the Netherlands, Denmark, Switzerland, France, the United Kingdom, and Germany. Allocated across four sectors, GRANOLAS are dominated by Health Care, while the Magnificent Seven, spread among three sectors, are concentrated in Information Technology.

Both GRANOLAS and the Magnificent Seven have representation in six industries, with two industries — Semiconductors & Semiconductor Equipment and Software — shared between them. However, GRANOLAS have exhibited lower industry active risk contribution against the STOXX Developed Markets index, both year-to-date and since 2018, as measured by Axioma's Worldwide Fundamental Short-Horizon Model.

Figure 3a. Sector Classification

Source: Axioma Portfolio Analytics

Source: Axioma Portfolio Analytics

Figure 3b. Factor Contributions to Active Risk vs STOXX Developed Markets in USD

Source: Axioma Worldwide Fundamental Short-Horizon Model

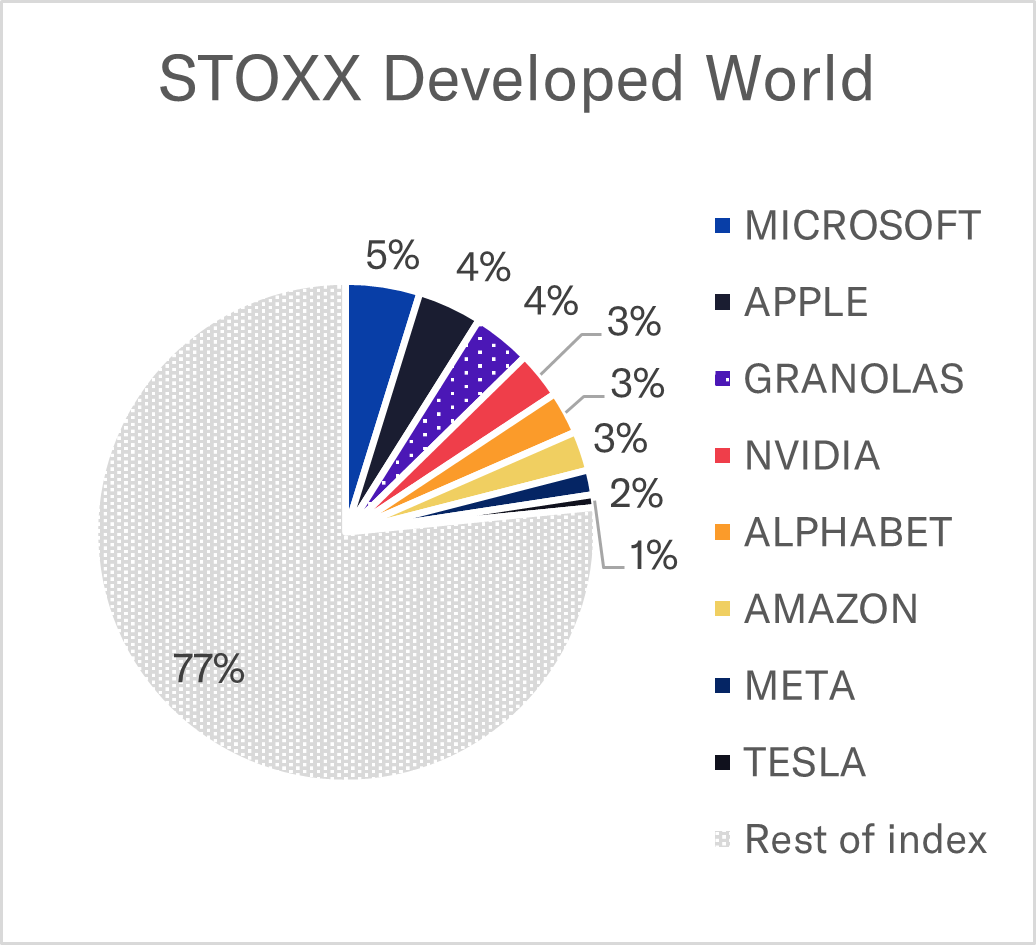

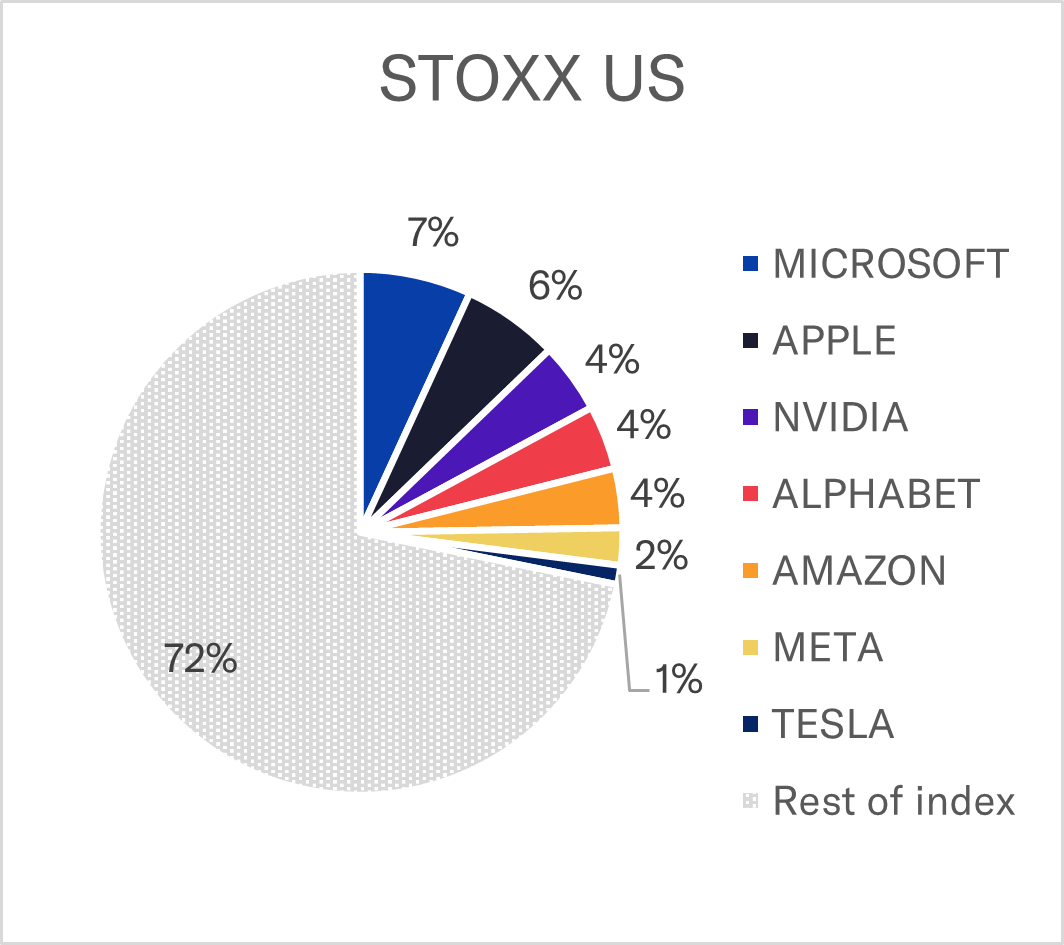

4) Magnificent Seven dominate the US and Developed Markets

The US market has a higher stock concentration than Europe’s, with the Magnificent Seven making up 29% of the STOXX US index weight, as of May 17, 2024. In the STOXX Developed Markets, the Magnificent Seven represented 20% of the index, while GRANOLAS represent only 4%, less than the individual weights of Microsoft or Apple. GRANOLAS’ weight in the European market is currently 20%.

Figure 4. GRANOLAS and Magnificent Seven Weights in Major Indices

Source: STOXX & Axioma Portfolio Analytics

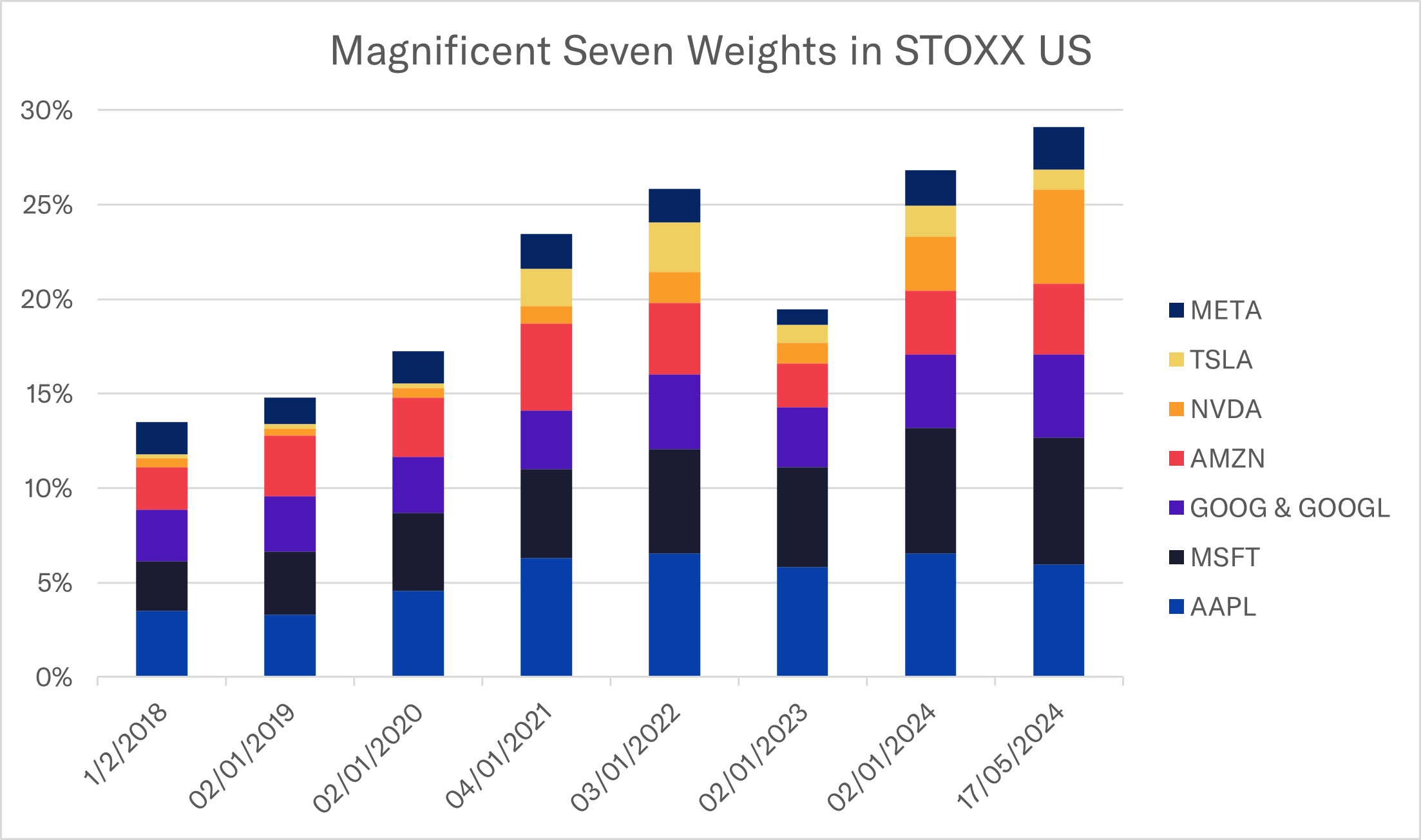

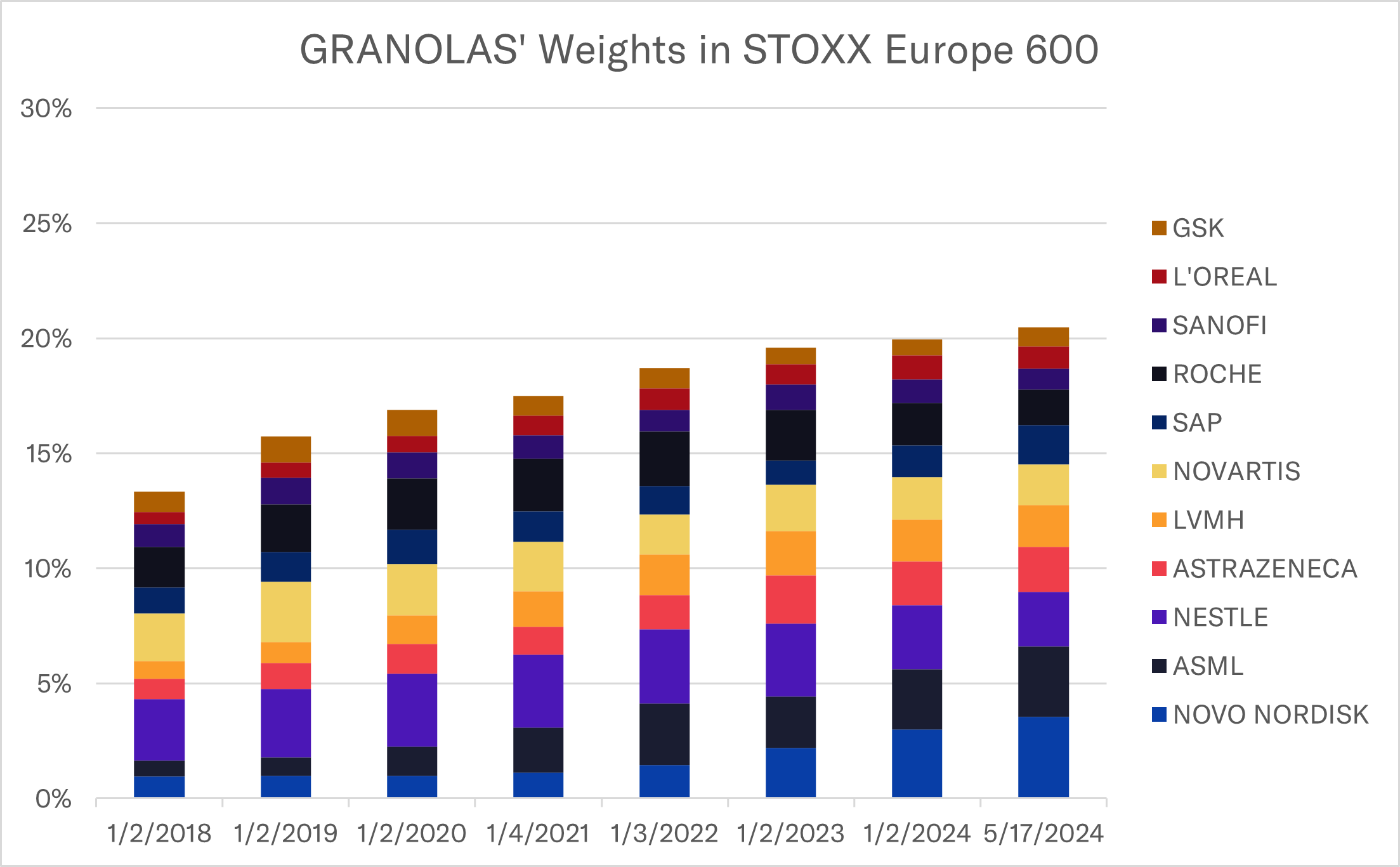

5) Magnificent Seven and GRANOLAS’ weights double in less than seven years

GRANOLAS’ aggregate weight in the STOXX Europe 600 started at 13% in 2018 and has nearly doubled by May 2024. The Magnificent Seven also started with a 13% weight but now constitute 29% of the STOXX US index. Over this period, Novo Nordisk and ASML saw the largest increases in weight within the STOXX Europe 600 index. Microsoft and Apple were and remain the largest companies in the STOXX US index, with Nvidia rapidly catching up.

Figure 5. Historical Weights in STOXX US and STOXX Europe 600 Indices

Source: STOXX & Axioma Portfolio Analytics

Source: STOXX & Axioma Portfolio Analytics

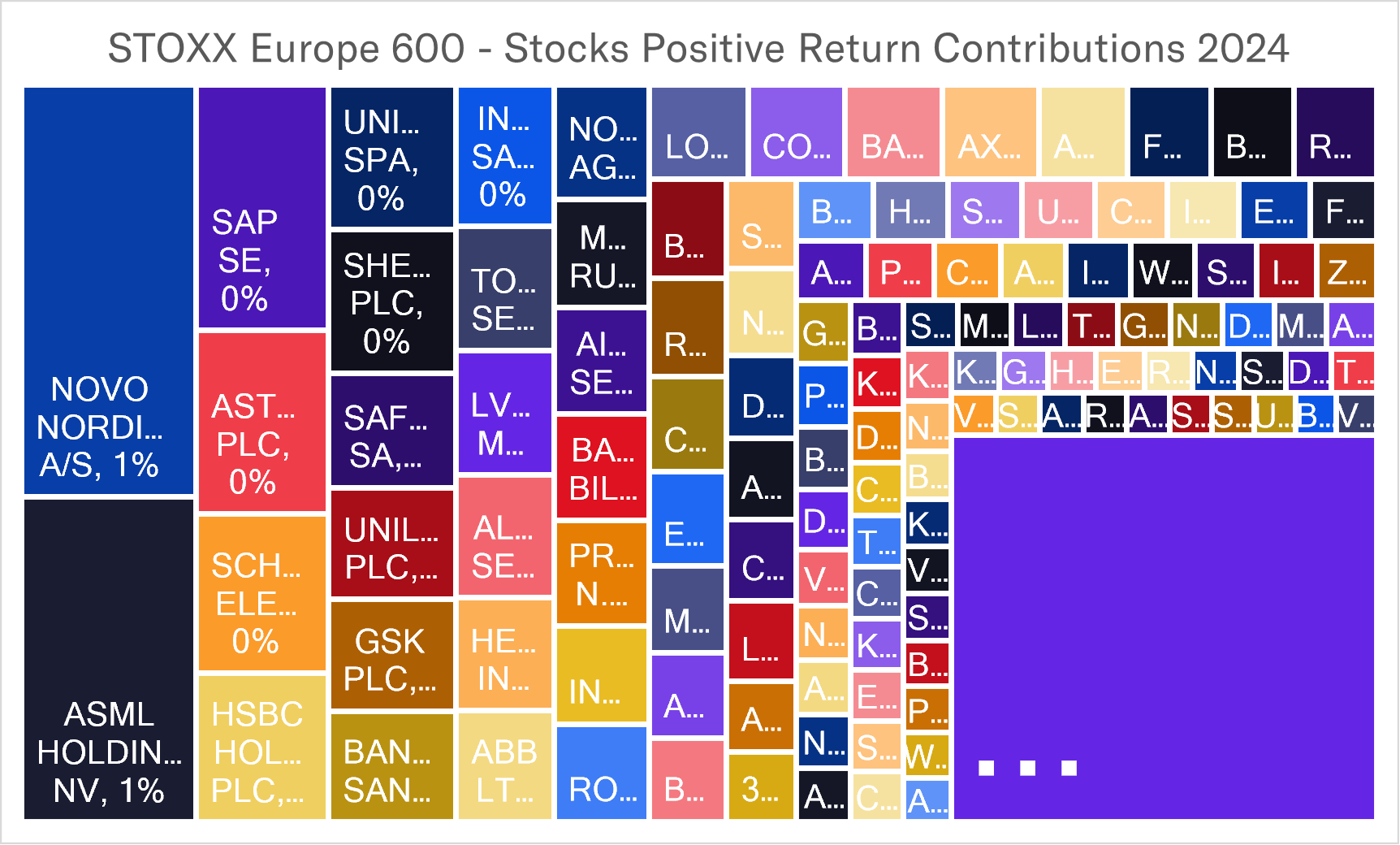

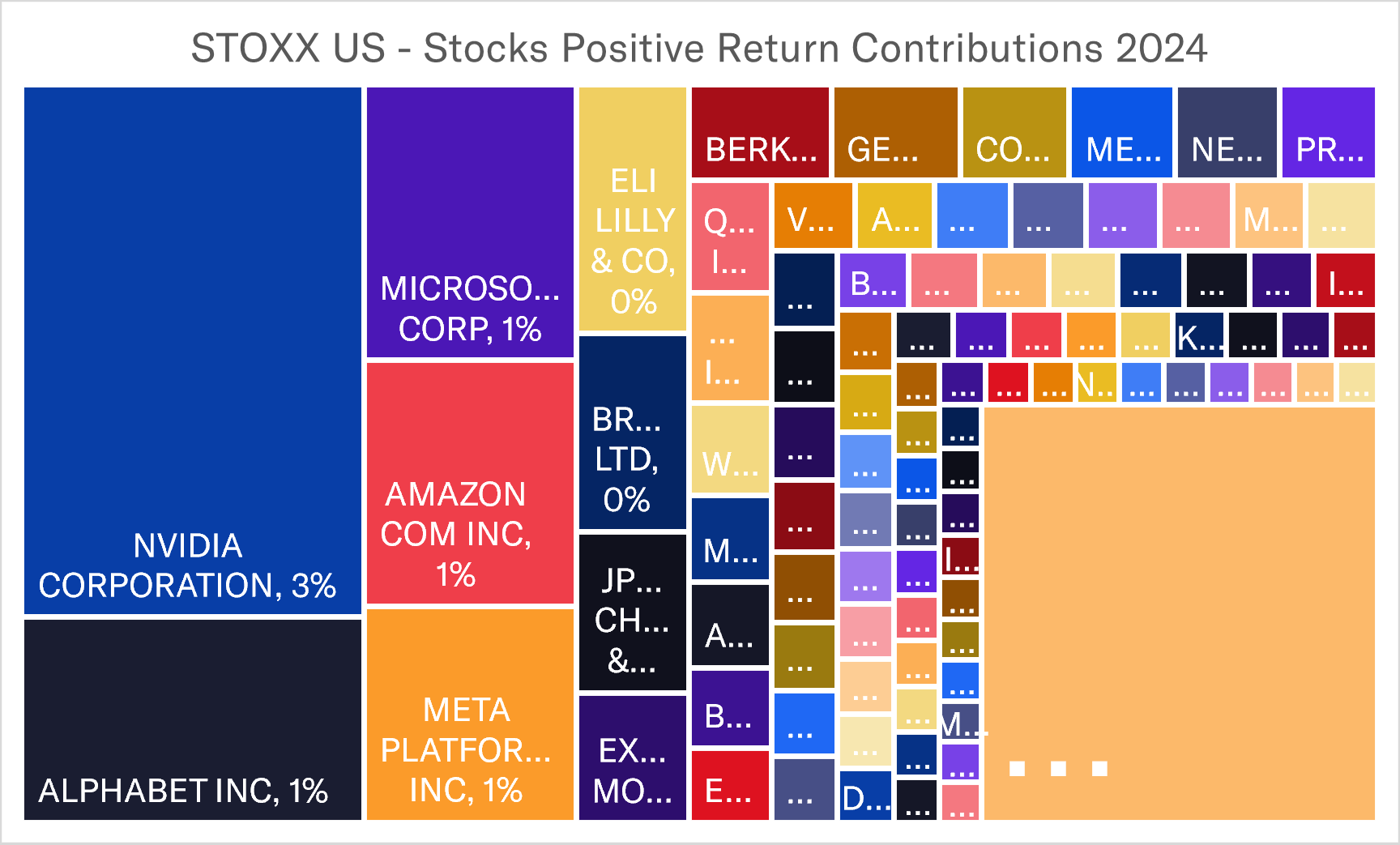

6) Novo Nordisk and Nvidia emerge as powerhouses behind index performance

Despite 55 companies in the STOXX Europe 600 recording higher returns than Novo Nordisk so far in 2024, its position as the largest-weighted name in the index placed it as the top contributor to the index YTD return. Similarly, Nvidia, ranked as the third largest stock in the STOXX US index. With the highest return among the Magnificent Seven, Nvidia made the most substantial contribution to the YTD return of the US index.

Figure 6. Constituents Positive Contributions to YTD Index Return

Source: STOXX & Axioma Portfolio Analytics

Source: STOXX & Axioma Portfolio Analytics

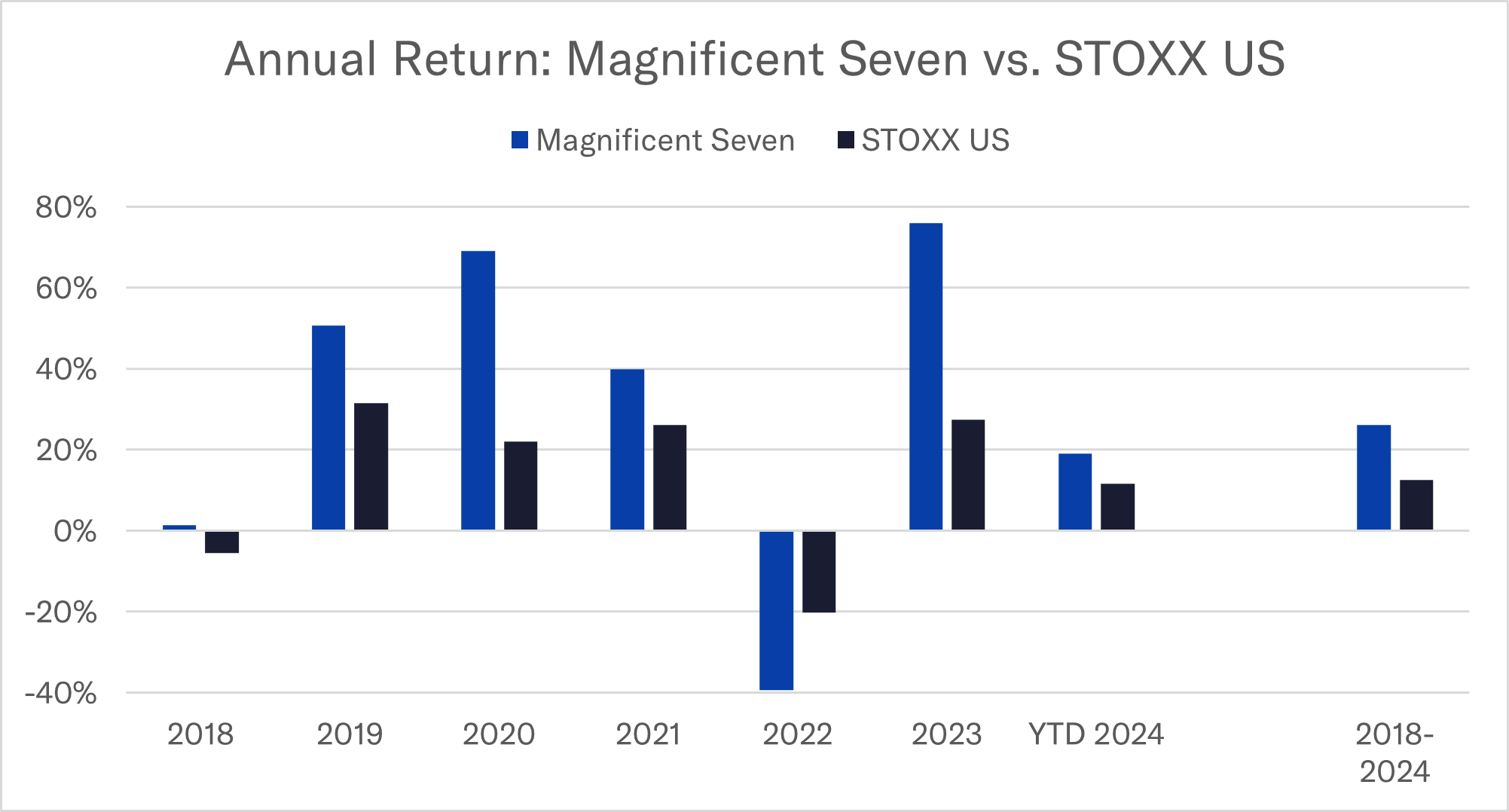

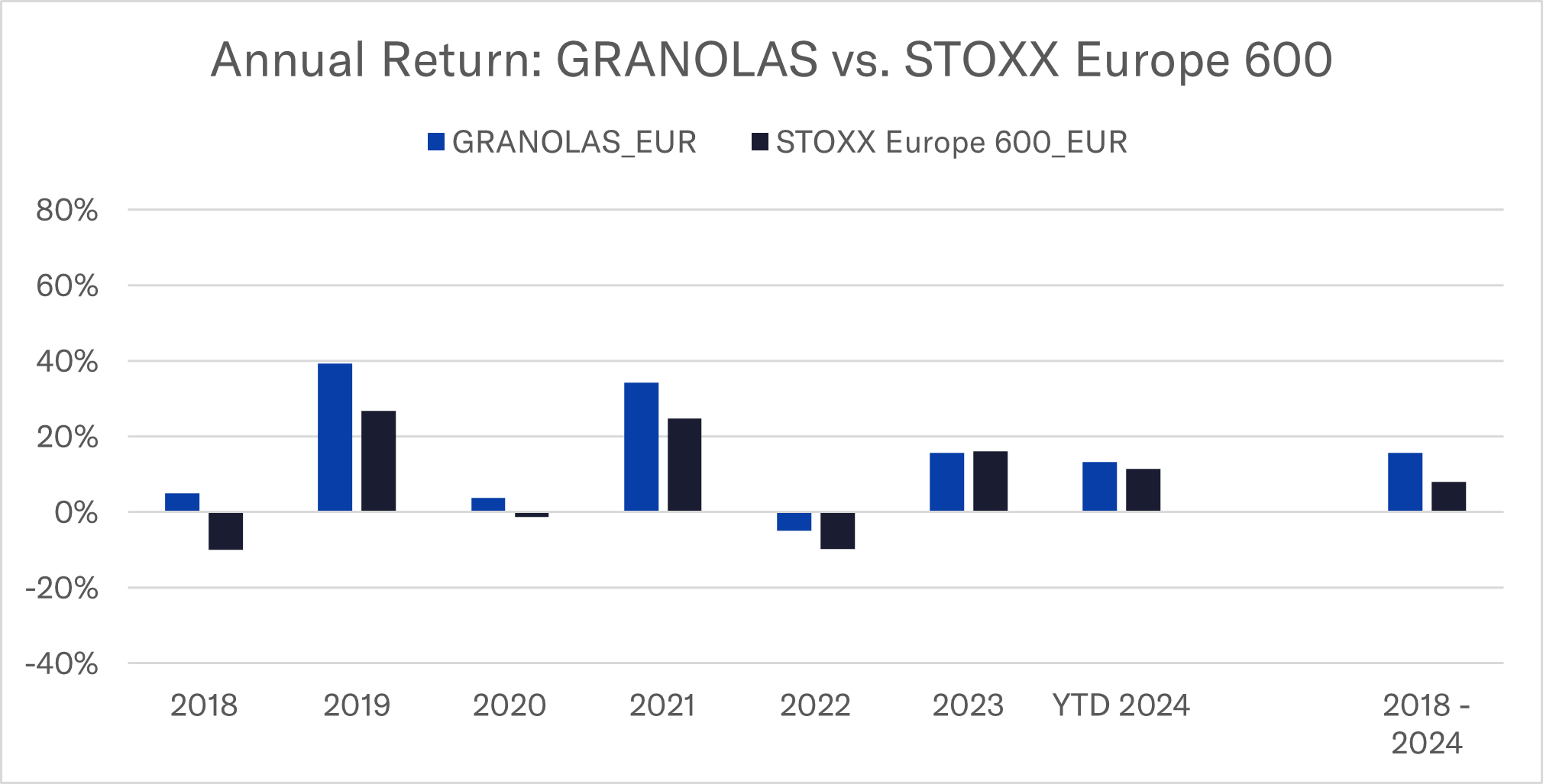

7) Magnificent Seven outperform historically but see greater fluctuations

Over the past seven years, the Magnificent Seven outperformed the GRANOLAS by ten percentage points. However, the Magnificent Seven also experienced higher fluctuations, particularly during the pandemic-year of 2020 and the start of the AI wave in 2023, while the GRANOLAS showed lower year-over-year volatility.

Compared with their local markets, the Magnificent Seven posted an annualized return of 26% from 2018 to 2024, outperforming the STOXX US index by 13 percentage points, while the GRANOLAS achieved a 16% return, eight percentage points higher than the STOXX Europe 600.

Figure 7. Annual Returns 2018 - 2024

Source: STOXX & Axioma Portfolio Analytics

Source: STOXX & Axioma Portfolio Analytics

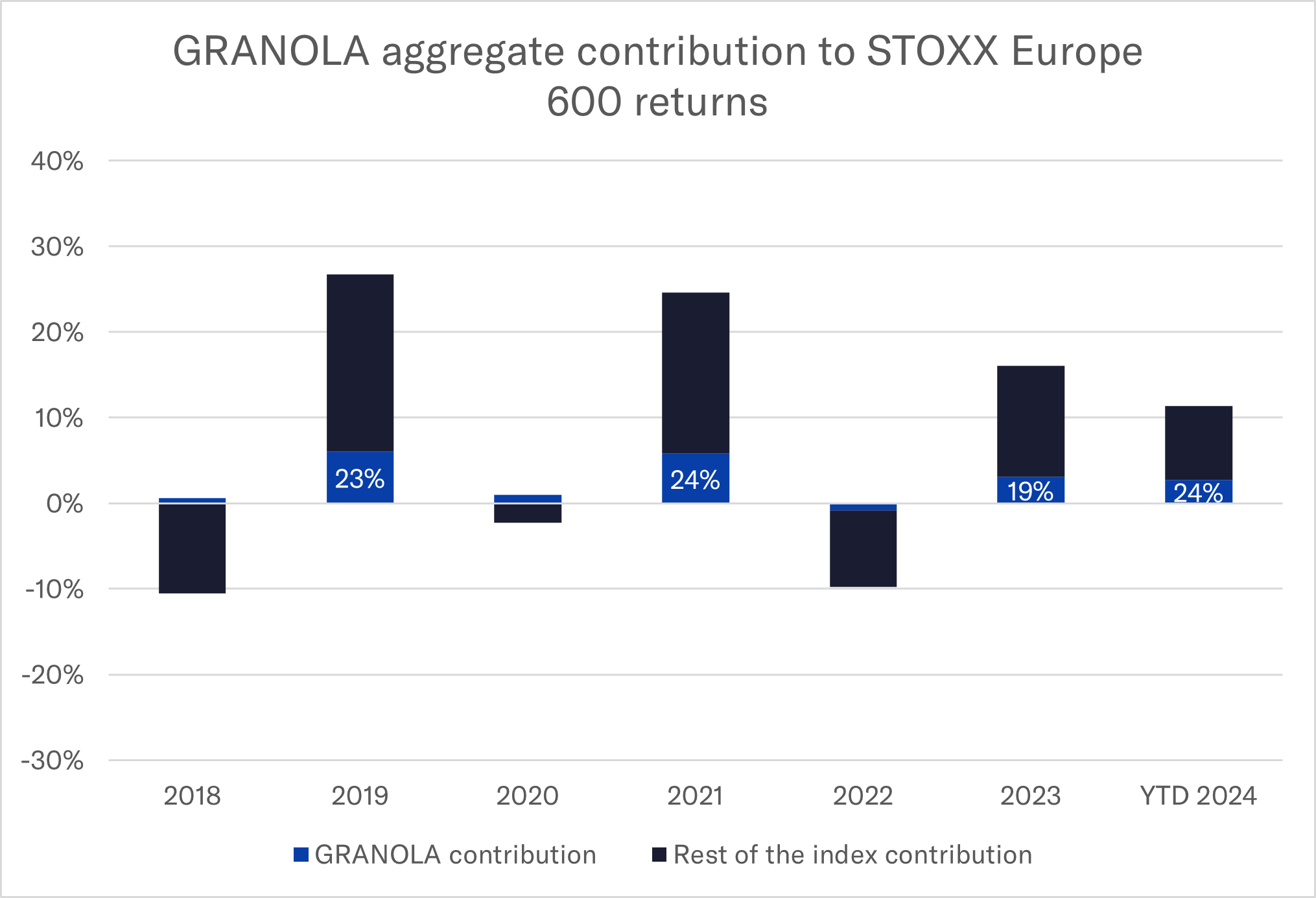

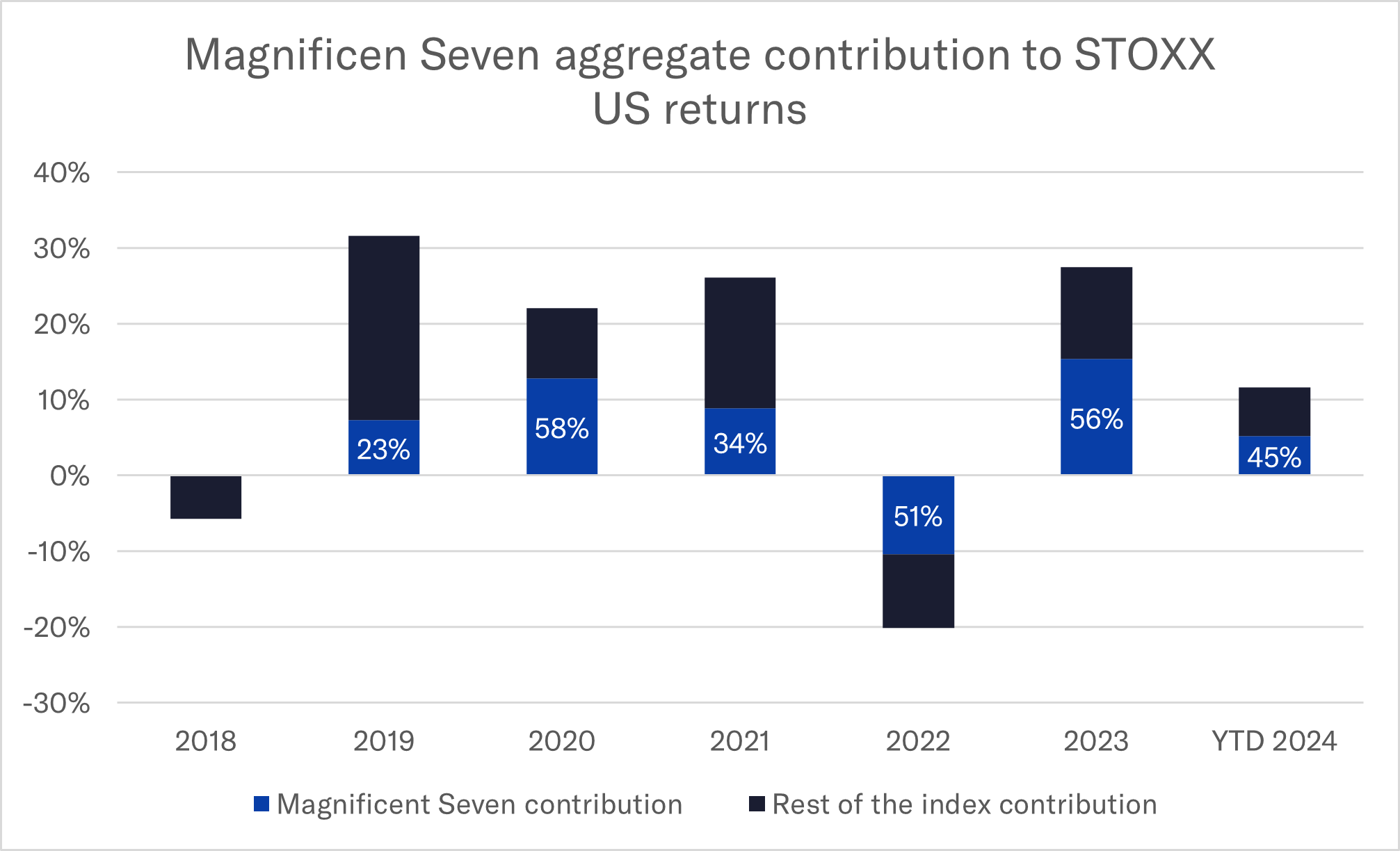

8) Magnificent Seven drive the US market more than GRANOLAS drive the European one

The Magnificent Seven exerted a significant influence on the US market return, in contrast to the GRANOLAS' impact on the European market return. This is largely the result of both the substantial combined weight of the seven US stocks in the index and their notably larger total returns. Impact differed by year, with the Magnificent Seven making the largest contribution to the index return in 2020 and 2023. GRANOLAS’ most significant proportional contribution to the European market was seen in 2021 and the current year.

Figure 8. Aggregate Contribution to Index Return

Source: STOXX & Axioma Portfolio Analytics

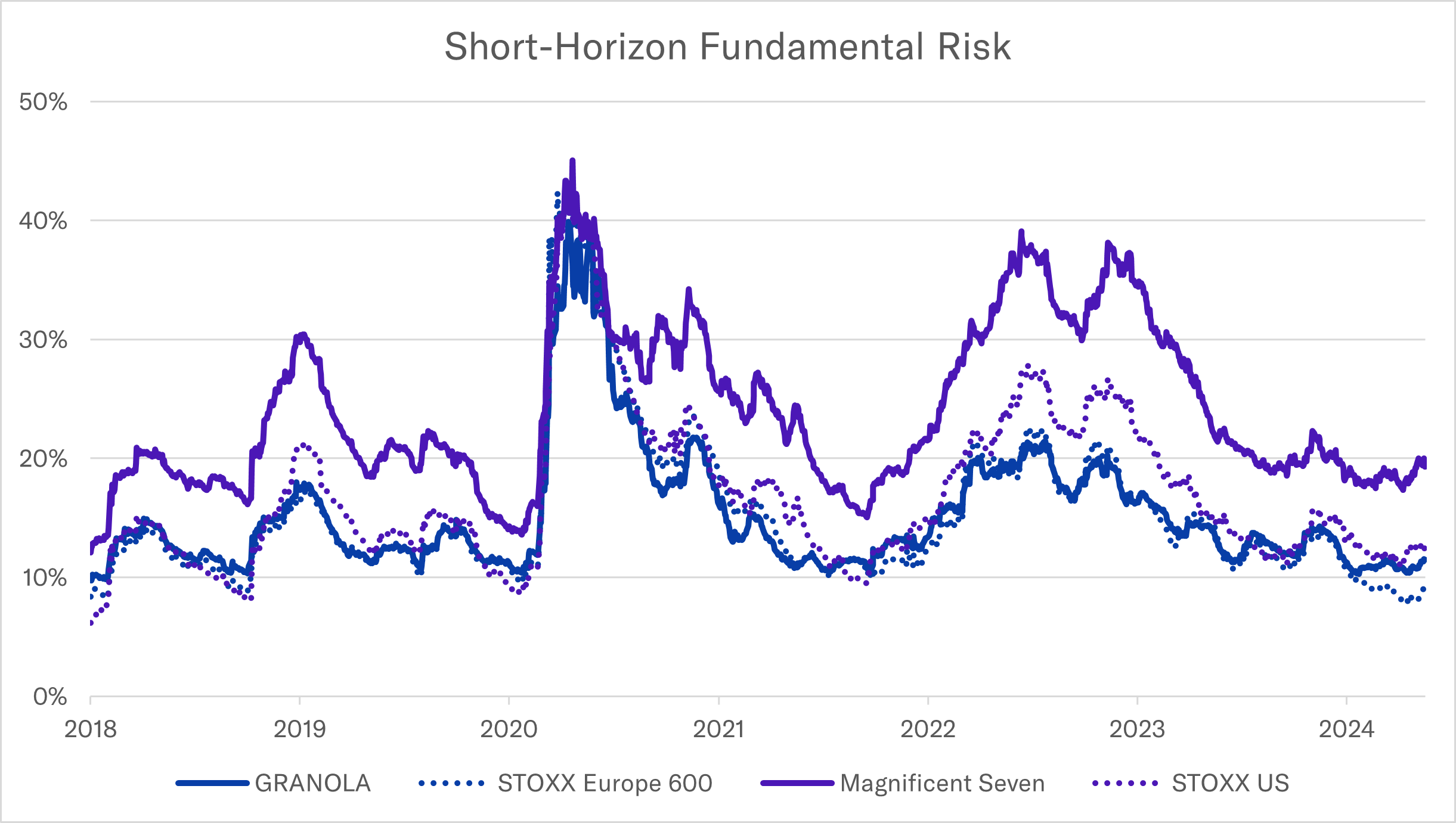

9) GRANOLAS’ risk aligns with that of the European Market

The Magnificent Seven’s risk has been mirroring that of the US market albeit at a much higher level, as measured by Axioma’s US4 Fundamental Short-Horizon Model. On average, the Magnificent Seven exhibit a risk level approximately nine percentage points higher than that of the GRANOLAS, which align closely with the risk profile of the European market, as measured by the Axioma's EU4 Fundamental Short-Horizon Model.

It is uncommon for an 11-stock portfolio of prominent stocks such as the GRANOLAS to exhibit a risk level similar to that of the STOXX Europe 600 index which benefits from the inherent diversification effect of including a large number of stocks. However, in 2024, the risk gap between GRANOLAS and the European market expanded, with GRANOLAS becoming riskier.

Figure 9. Magnificent Seven and GRANOLAS’ Risk

Source: STOXX, Axioma US4 & EU4 Fundamental Short-Horizon Models

Source: STOXX, Axioma US4 & EU4 Fundamental Short-Horizon Models

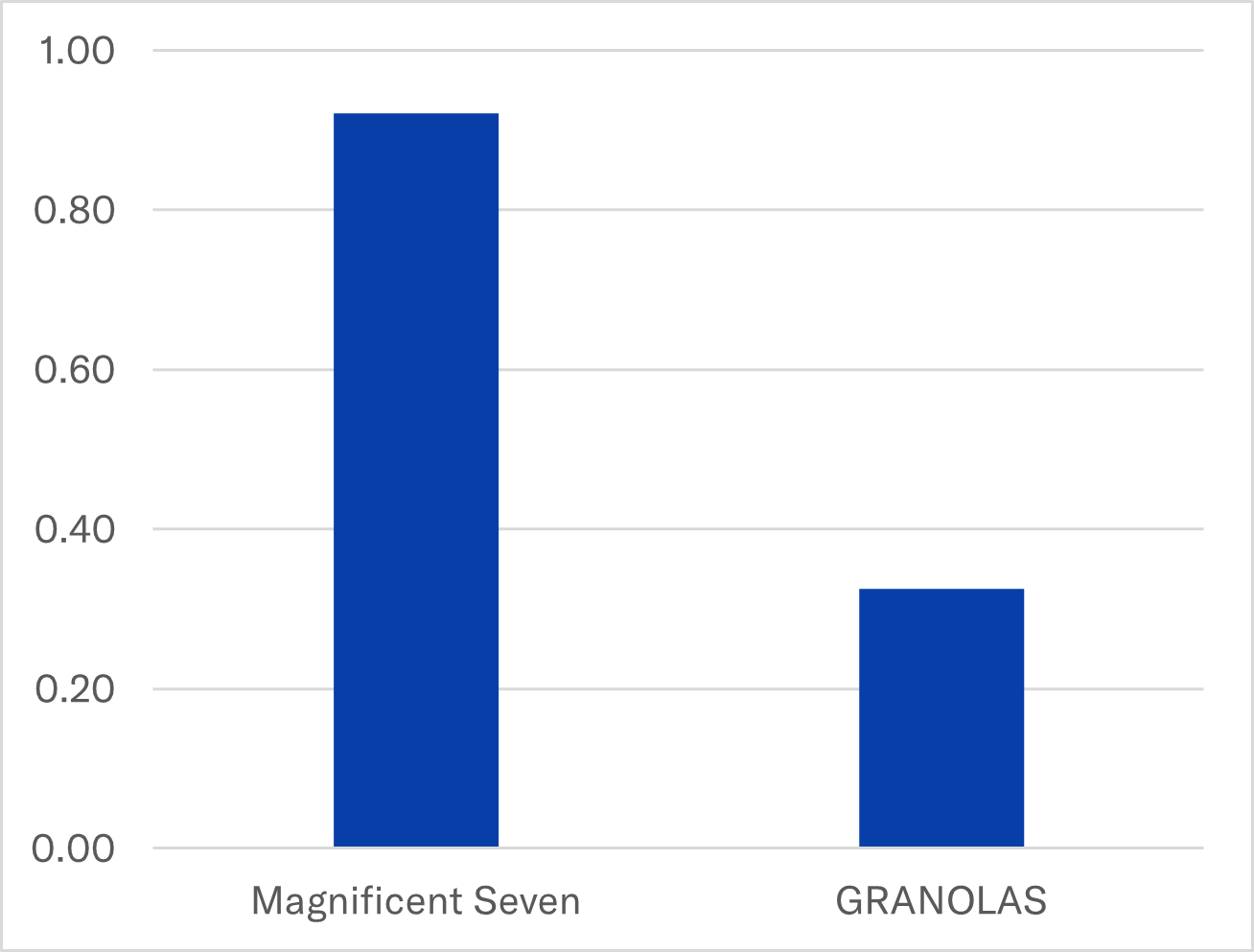

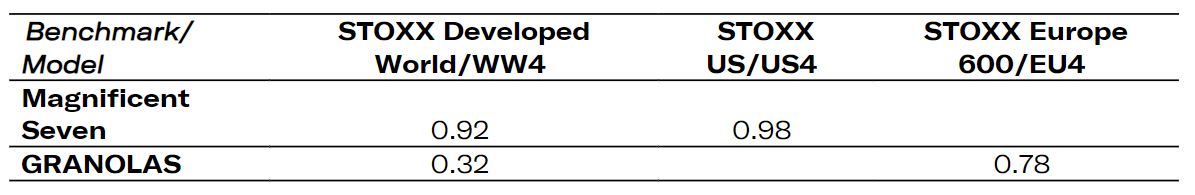

10) Magnificent Seven boast higher historical risk-adjusted returns

In 2024, the Magnificent Seven recorded an Information Ratio (IR) of 1.93, which was significantly higher than the GRANOLAS’ IR of 0.24. The IR is calculated as the ratio of active return to active risk, using STOXX Developed Markets as benchmark and the Axioma Worldwide Fundamental Short-Horizon Model as the risk model. Furthermore, during the period from 2018 to 2024, the Magnificent Seven’s IR of 0.9 was three times higher than that of the GRANOLAS.

Style factors contributed negatively to GRANOLAS’s seven-year active return versus the STOXX Developed Markets, while positively affecting the Magnificent Seven’s active return. The Magnificent Seven benefited from having higher momentum, better liquidity, and containing larger companies. The Market factor had a negative impact on the seven -year active return of both groups, while Currency effects favored the US-based stocks and disadvantaged the European ones. The Industry factor was beneficial for both, with a more pronounced positive effect on the active return of Magnificent Seven. The Country factor negatively impacted the Magnificent Seven, but positively influenced GRANOLAS’ seven-year active return.

Figure 10. Information Ratio 2018 – 2024

Conclusion

The Magnificent Seven stocks have outshined both the GRANOLAS and broader markets in 2024 and over the past six years. While GRANOLAS offer an attractive diversification option, they come with increased country and currency risks for a US investor. It is essential to account for currency fluctuations and consider hedging against this risk, as the returns of GRANOLAS were recently diluted by a weaker EUR against the USD.

Since 2018, the Magnificent Seven and GRANOLAS’ aggregate weight in their respective benchmarks has doubled. High concentration can lead to increased market volatility, and that is critical especially in case of market downturns. The US market exhibits a stronger stock concentration compared to the European market, highlighting regional differences in market structure that can influence an investor’s geographical diversification strategy.

While GRANOLAS exhibited lower year-over-year return fluctuations resulting in lower risk, the Magnificent Seven stocks boast higher risk-adjusted performance, which still maintains their “magnificent” status.

Register for more risk insights from SimCorp

You might also like...