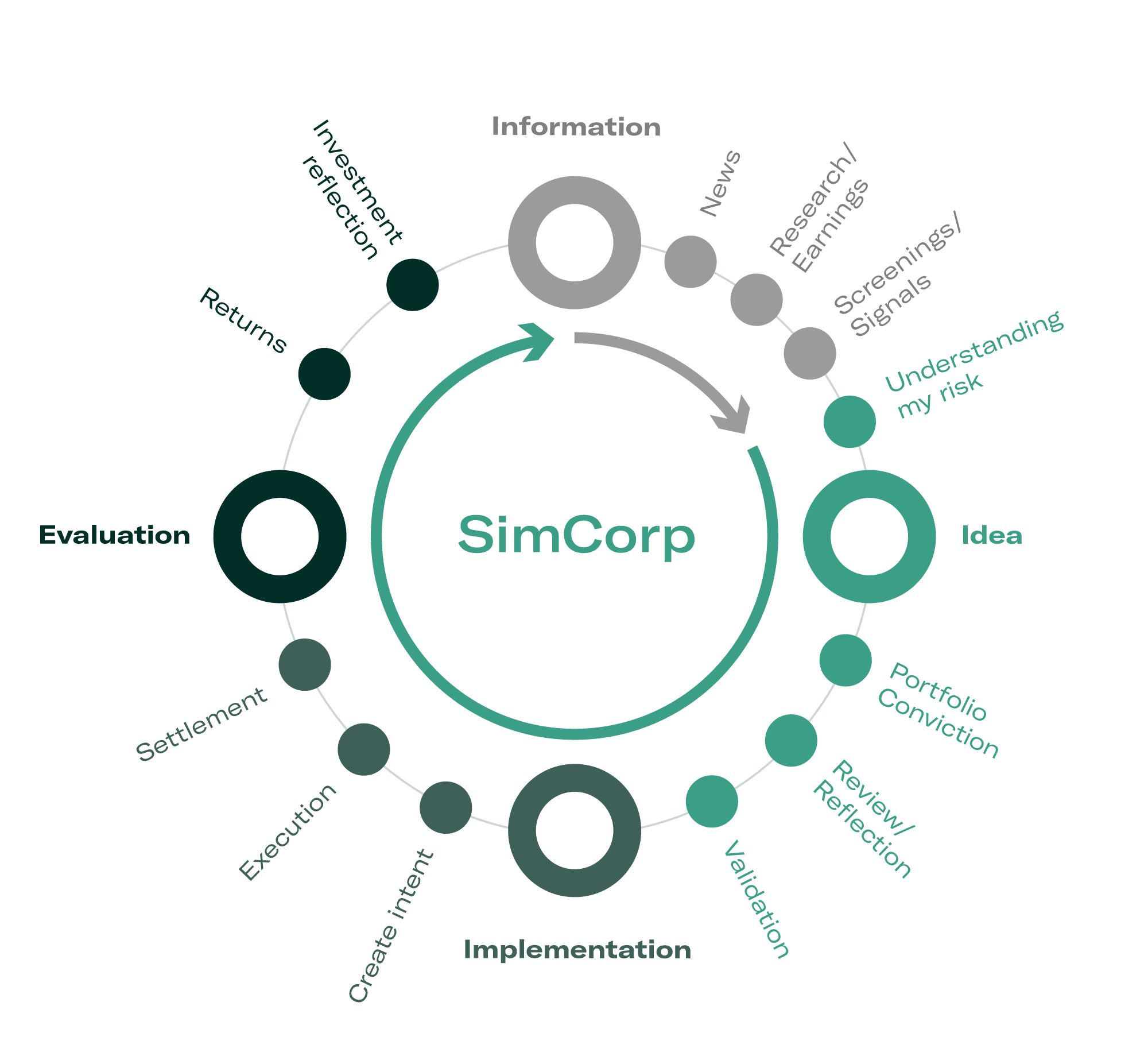

A day in the life of an Investment Manager

How SimCorp is helping investment managers in their day-to-day workflow

6:30 AM

Hi, I’m Taylor. As an investment manager my day inevitably starts early. My colleagues joke that I must sleep in the office because I’m there so early. The truth is that I like to get a head start on the markets before they open.

7 AM

Coffee in hand, my first order of business is to review the markets and overnight news flow to identify any significant events or signals that may impact today’s investment decisions.

I notice an interesting signal that could lead to massive earnings upgrades on a tech stock that I am following. Mental note, run some model simulations to solidify my idea. I open SimCorp to see how my portfolio looks. I love that it gives me a real-time view of my portfolio's performance, including performance metrics, risk exposures, liquidity and other key indicators across all asset classes. This helps me determine if I am comfortable with my risk. Having set the parameters to monitor my portfolio, I feel prepared for the day ahead.

8 AM

First cup of coffee kicks in and I run simulations on that tech stock in SimCorp. I try a few different options, pulling in different data sources and weighing them with my unique investment approach. I don’t want to brag, but around here I’m known as “The Fund Whisperer” for the way I can put together a winning portfolio. This is my investment identity – what makes me unique from the other PMs. I finish the simulation and now have a clear view of the implications of my trade and how it will impact the factor exposures across my portfolio, allowing me to execute with confidence, if I choose to.

9:30 AM

It’s go time! Markets open. Second cup of coffee in hand I act on an alert from my SimCorp system which I picked up on earlier. My regional exposure to Australia is close to my portfolio limit of 20% and the analyst rating included next to my regional exposure has changed following real-time price updates. Once I set my parameters in SimCorp, I don’t have to constantly check that I’m compliant, the system checks for me.

10:30 AM

Meeting time. I walk over to a free meeting room to dial into my investment team call. This is when we discuss current holdings and potential changes. I have a clear view of the company exposure to Apple which is reaching its limit, this prompts a discussion on how to reduce exposure as a group. Back at my desk I sell a proportion of my Apple stocks to reduce my exposure. I can instantly see the effect it has on my portfolio, the positioning updates and this frees about 4.5% cash for investments. I'm happy with this change, and best part, I don’t need to execute it on a trading screen because all my positions are already updated. I can immediately put that cash to work, doubling down on a position I initiated on yesterday.

12:30 PM

You’d be surprised how much time I spend doing research on individual securities or market sectors. Over lunch I listen to a company’s earning call and then meet with other senior leaders at our firm to discuss some of the insights from the call. We talk about broader market trends, and potential risks and opportunities that could impact the firm's overall investment strategy. During the meeting I share my SimCorp dashboard with real-time holdings with the team to give context to the discussion. It really makes such a difference to see it all altogether in one place. At my previous firm I had to contend with manual reconciliation from multiple systems which was time consuming and prone to error.

2 PM

My focus shifts back to managing my portfolio. This involves reviewing trade execution, monitoring positions, and analyzing any potential trades, monitoring risk exposure or rebalancing. I use SimCorp for all this and find it easy to backtrack my strategy to the front office trading platform as this is completely integrated.

I have some client meetings that I need to prepare for this week to discuss performance and investment strategy. SimCorp allows me to easily slice and dice the performance information per strategy and sector. I then prepare end of month reports on SimCorp. My clients really appreciate being able to download reports and interact with the data on the Digital Engagement Platform whenever it suits them.

3:45 PM

I do a final review of the local market and news flow to identify any last-minute developments that could affect the portfolio, always conscious that the other markets are open and trading. Overall, I feel confident that my compliance post/pre trade is in optimal condition. I make some final adjustments before the end of the trading day and put those through easily on SimCorp. My team and I have a quick debrief to discuss the day's activities and prepare any actions for tomorrow.

I’m psyched I can leave the office with enough time to actually hit the gym and see my family, with the knowledge that with SimCorp’s real time IBOR there is no reconciling. I have a full and clear cash ladder at any time and my compliance is monitored constantly on the entire investment book. I know some of my peers stay in late - running reconciliations, waiting for cash reports, but I can enjoy my evening and sleep well knowing I am in control.