Expanding business while reducing cost-to-income ratios

Client story

In a relentless drive to expand the business, Australian-based Challenger Limited (Challenger) has gone from strength to strength. This article presents how an ambitious business growth strategy empowered by a single integrated investment management solution was successfully realized by Challenger.

When Challenger set out to implement an ambitious growth strategy, we knew that a fully aligned operational IT solution would play a key role in driving this expansion and fulfil its goals. What was envisaged was a solution that not only would meet existing business requirements but also support future growth opportunities.

For Challenger, the adoption of one core integrated investment management solution that provides essential efficiencies and control has empowered the company to achieve outstanding growth rates. We are able to administer the company’s entire range of assets through a single IT solution that creates the optimal operational environment for successful and sustainable growth.

Learn why Challenger wanted an end-to-end solution in order to house front, middle, and back office all in one system as well as cater to a broad range of securities.

Video interview with David Mackaway, General Manager at Challenger

Targeting business growth of 20% p.a. or more

In 2004, we chose to proceed with a growth strategy that was based on expanding both the company’s annuity business and fund management business. This strategy was to be achieved organically (i.e. profiting from the growth of the superannuation/pension system in Australia) and with the help of strategic acquisitions. Targeted was a business growth rate of 20% per annum or more over a period of five to eight years.

Distinct strategies were chosen for each of the two main business areas. For each business, growth areas were identified in terms of retaining and growing business with existing clients, attracting new clients and/or entering new markets.

Within the life business, where Challenger is the largest provider of annuity income streams to retirees in Australia, the growth strategy was to:

- grow the business through acquisition with a number of smaller annuity providers likely to be subscale and hence open to acquisition

- continue to expand the diverse range of investments;

- maintain momentum in organic sales growth through increased distribution team size and more sophisticated and targeted sales and marketing.

Within the fund management business, on the other hand, Challenger’s strategy was to re-engineer the business in its entirety. Moving away from a model where investment professionals were direct employees, we adopted a model whereby investment teams were established as independent ‘boutique’ investment houses. Key investment professionals would become owners of the business in partnership with Challenger via its wealth management business Fidante Partners and Challenger would provide administrative and distribution support to the businesses.

IT solution supports growth strategy

Challenger’s strategic growth objectives entailed a number of operational requirements that highlighted the importance of ensuring sufficient and fully aligned IT operations support. To precisely outline the target operation model (TOM), we performed a detailed mapping of key operational needs against system capabilities. This process served as a cornerstone in developing the fully aligned IT platform strategy that would be supporting Challenger’s business growth strategy.

In terms of system capabilities, Challenger mapped out the following TOM requirements:

- Ability to service a complex business model investing in a diverse range of securities across markets/jurisdictions and then structure these into varying product types

- Rapid adaptability to change

- Scalability to cope with an aggressive and non-linear growth (due to acquisitions)

- Scalability to remain cost-efficient despite growth

- Well-controlled and effectively monitored and measured processing

- Ability to handle complex regulatory requirements and client demands related to a diverse product set

One solution spurs competitive advantages

Determined to meet ambitious growth targets, and with the necessary technology and operational requirements mapped out, the IT strategy was in place to go out and find the supporting platform solution that would be fundamental to our success. With the growth we were undertaking in the organization and our move into servicing the boutique environment, we were finding that the range of securities and services that were being asked of us from an operations perspective was broadening, and our current legacy systems were struggling to meet those needs.

To provide optimal operational support, we were looking for a fully integrated end-to-end investment management solution with a proven ability to be highly flexible in accounting for and administering assets for different businesses. Having one core asset management system would provide multiple efficiencies and control to a company like Challenger with a highly diverse range of asset classes and client needs. With this in mind, we chose in 2004 to effectively transition the operation of the entire business and all its assets to a single in-house investment management system in the form of SimCorp Dimension.

"To provide optimal operational support, we were looking for a fully integrated end-to-end investment management solution with a proven ability to be highly flexible in accounting for and administering assets for different businesses."

In the intervening period, we have achieved a holistic administration process for our institutional grade investment process: trade entry, portfolio valuation and unit pricing, performance and attribution and compliance. With all these functions carried out within the one system, measurable operational efficiencies and strong risk and management control are achieved over the entire book of assets. Operating in a highly complex regulatory and tax environment, the move to an integrated investment management solution with a single book of records means that Challenger does not need to worry about having multiple and often overlapping sources of truth.

Flexibility key in administration of assets

A fundamental benefit achieved by Challenger’s choice of a fully flexible and integrated IT solution based on state-of-the-art technology is also the ability to customize securities accurately by defining them as a set of cash flows rather than trying to force-fit securities into a pre-defined model. Securities in the system are literally made up of a bundle of cash flows, and once all these cash flows are gathered and assembled, each and every one can then be valued at varying rates. This is a real strategic difference and advantage compared with other systems that are available in Australia.

The ability to slice and dice a security and break our valuation down into cash flow components clears the way to proceed along many different paths. This has allowed significant amounts of flexibility in the business, not only to deal with legislative changes but also to effectively handle the complexities of some of the instruments Challenger trades in.

Avoiding work and data duplication

Another important feature of using a fully integrated software solution is that Challenger does not run into the problem of having to duplicate either work or data processes. For example, if the underlying value given to a security has to be changed in one system and then different changes have to be made within the compliance system, this requires duplicate effort and workload, as well as the risk of multiple data sets.

For Challenger, having all data in one centralized system allows us to process all tasks in a streamlined, efficient and holistic way. The software solution inherent in a centralized source of truth is therefore critical to both this control and speed to market. It increases Challenger’s ability to support all these needs and is a key reason why the investment administration function is retained in-house. This ensures Challenger both cost effectiveness and flexibility.

Tangible results

For Challenger, the achievements accomplished after adopting an ambitious business growth strategy have been significant. These achievements were supported by moving all our operations and assets to a fully integrated in-house investment management solution.

In a period of five to eight years, strong growth in our client base has been accomplished, with Challenger growing the annuity business via acquisition as follows:

- 2008 – AUD 1.8 billion acquisition of Met Life Annuity Book

- 2009 – AUD 1.3 billion acquisition of AXA Annuity Book

- 2011 – AUD 0.4 billion acquisition of High Yield Annuity Book

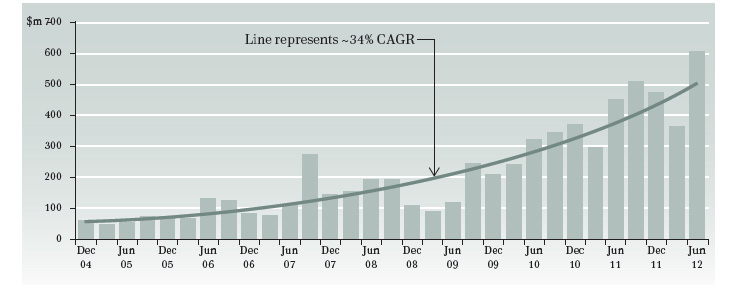

In addition, annuity sales have grown organically by 34% p.a. for the last eight years as shown in Figure 1.

"Not only has the system helped to power exceptional growth rates, it is also a key factor in an institutional grade investment administration environment that is scalable, flexible and efficient enough to maximize immediate output and ensure Challenger is best positioned for future growth as well."

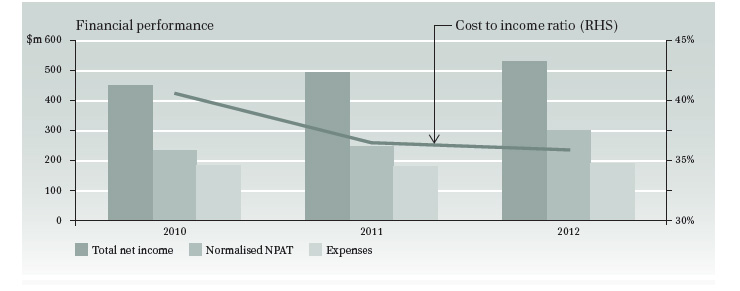

In relation to Challenger’s fund management boutique business, this has grown from less than AUD 1 billion in 2007 to current levels in excess of AUD 19 billion. A corresponding growth in revenue has also been accomplished. Revenue has steadily accreted since 2007 by approximately 35%, while the cost-to-income ratio has been reduced from 49% to 36% over five years (Figure 2).

Figure 2. Revenue has steadily grown by around 35%, while the cost-to-income ratio has been reduced to 36% over five years. Source: Challenger Limited, August 2012.

Ambitious growth targets accomplished

Incrementing a fully integrated centralized asset management system to suit expanding business needs, Challenger executed on the company’s broader business plan with the full support of a fully aligned operational and IT strategic plan. The growth ambitions of predominantly driving revenue up front have been realized, with the operational and IT strategy also able to successfully support the revenue growth strategy by keeping costs relatively flat, hence delivering a steadily improving cost-to-income ratio.

Generating cost efficiencies was only part of Challenger’s success, however. Also contributing to the company’s achievements was our new asset management system’s ability to service a wide and diverse range of assets and clients, whether existing or potential. Not only has the system helped to power exceptional growth rates, it is also a key factor in an institutional grade investment administration environment that is scalable, flexible and efficient enough to maximize immediate output and ensure Challenger is best positioned for future growth as well.

Quick facts

Name: Challenger Limited

Headquarters: Sydney, Australia

Industry: Asset Management

AUM: AUD 56.1 billion (as at September 2015)

Established: 1985

Website: www.challenger.com.au

About Challenger Limited

Established in 1985 and listed on the Australian Securities Exchange (ASX:CGF) in 1987, Challenger Limited (Challenger) is an investment management firm managing more than AUD 56.1 billion in assets.

Challenger is focused on providing Australians with financial security in retirement. We do this by investing to create wealth in the accumulation phase of superannuation, and by converting accumulated wealth into safe and reliable income streams for retirees.