US ROOF Portfolio Market Sentiment Update – H1 2024

Author

Olivier d’Assier

Investment Decision Research, SimCorp

Markets rewarded risk-averse strategies

Since hitting a low in late October 2023, the STOXX USA 500 index has consistently risen, reaching 20 consecutive record highs in the first half of 2024. Market sentiment, measured by ROOF Scores, faced a brief downturn in April when initial expectations of six Federal Reserve rate cuts for 2024 were reduced to just two, following three consecutive months of high inflation reports from February to April. This adjustment was followed by two softer job reports reflecting a cooling job market. This helped initiate a recovery for both sentiment and the index in late May and June and was followed by renewed optimism that the Fed might start cutting interest rates soon, possibly beginning in the September meeting.

Markets up, but market sentiment wanes

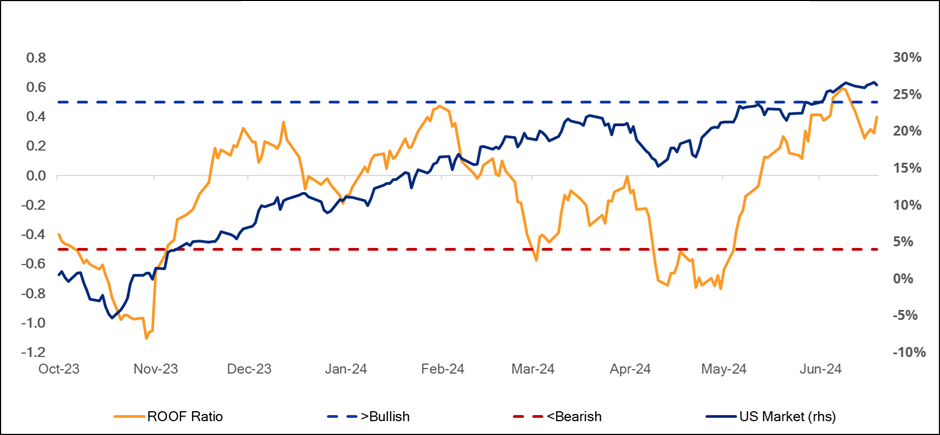

Figure 1 below illustrates the US investor sentiment over the past 180 days (from October 10, 2023, to June 28, 2024), compared with the broader US market (AXUS-LMS portfolio) 1. During this period, market sentiment varied, with bullish sentiment (ROOF ratio > +0.5) lasting only three days, positive sentiment (ROOF ratio between 0.2 and 0.5) for thirty-seven days, neutral sentiment (ROOF ratio between -0.2 and 0.2) for seventy-two days, negative sentiment (ROOF ratio between -0.5 and -0.2) for thirty days, and bearish sentiment (ROOF ratio below -0.5) for thirty-eight days.

Despite the predominantly cautious sentiment, the US market managed to climb by 26%, although it faced challenges during very negative sentiment periods in April and May (with a decline of -0.5% over these two months).

Figure 1: US Investor Sentiment Q3 2023 – Q2 2024

Source: Axioma ROOF Portfolios, STOXX USA 500

Risk-averse strategies vs risk-seeking strategies: Sector preferences using ROOF Portfolios

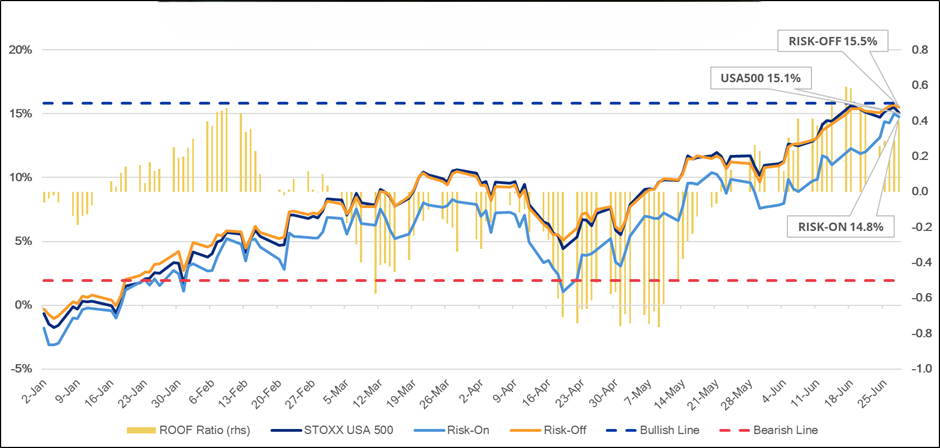

Figure 2 depicts the performance of the STOXX USA 500 index and two sentiment variants, Risk-On and Risk-Off, throughout the first half of 2024, alongside ROOF Scores. Notably, the Risk-Off variant consistently outperformed its parent index and the Risk-On counterpart, highlighting a preference for risk-averse stocks in the market. This echoes trends seen in 2021, when investors favored less risky assets due to concerns about inflation and Federal Reserve policies. This alignment with market sentiment rewarded the Risk-Off portfolio, which over weighted sectors like Consumer Staples, Financials, Health Care, Communication Services, and Utilities — sectors traditionally viewed as defensive or less volatile. In contrast, the Risk-On portfolio favored Consumer Discretionary, Information Technology, and Industrials, leaning towards small-cap, high-beta growth stocks.

Figure 2: STOXX USA 500 ROOF Portfolios – Year to Date 2024

Source: Axioma ROOF Portfolios, STOXX USA 500

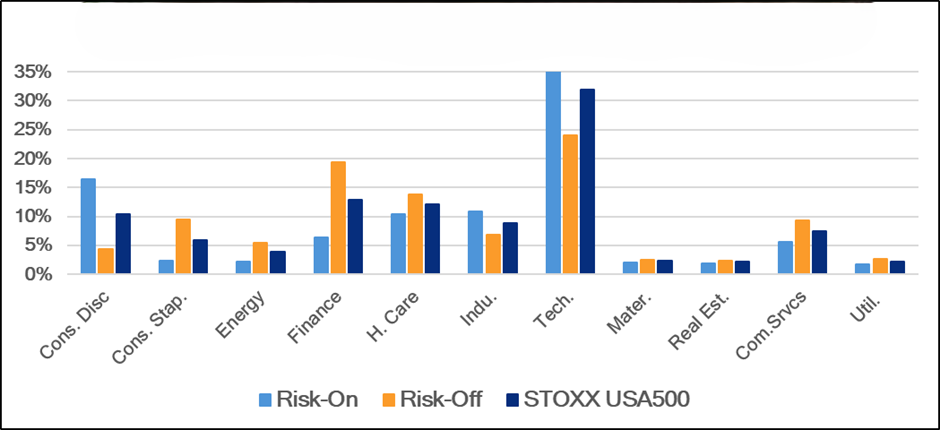

Figure 3 below shows the average sector allocation of the two ROOF portfolios during the first six months of this year. We see that the Risk-Off variant was overweight the Consumer Staples, Financials, Health Care, Communication Services, and the Utilities sectors. The Risk-On portfolio was overweight Consumer Discretionary, Information Technology, and Industrials. Additionally, while both portfolios held on average about 100 names (out of 500 in the parent index), the Active Share of the Risk-Off portfolio was almost half of the Active Share of the Risk-On portfolio at 44% versus 81%. The Risk-On portfolio also used all of its active risk budget (5% tracking error) while the Risk-Off portfolio’s active risk averaged 2.45% during the period. The Risk-On portfolio achieved this increased divergence from the parent index by loading on small-cap, high-beta growth stocks, while the Risk-Off portfolio tilted towards large-cap, low-beta, dividend-paying, value stocks 2.

Overall, the market dynamics of early 2024 underscore a strong preference for risk-averse strategies, driven by cautious investor sentiment and reinforced by sectoral preferences within the ROOF portfolios.

Figure 3: STOXX USA 500 – Sector Allocations (Average YTD 2024)

Source: Axioma ROOF Portfolios, STOXX USA 500

Impact of the Magnificent Seven on market sentiment

We also delved deeper into our portfolios to assess how the AI theme and the Magnificent Seven (Amazon, Apple, Google/Alphabet, Meta, Microsoft, Nvidia, and Tesla) influenced their performance. We have extensively covered the impact of these seven stocks on the US market and their substantial concentration, posing challenges for active managers who opt not to include them in their portfolios to surpass benchmark performance 3.

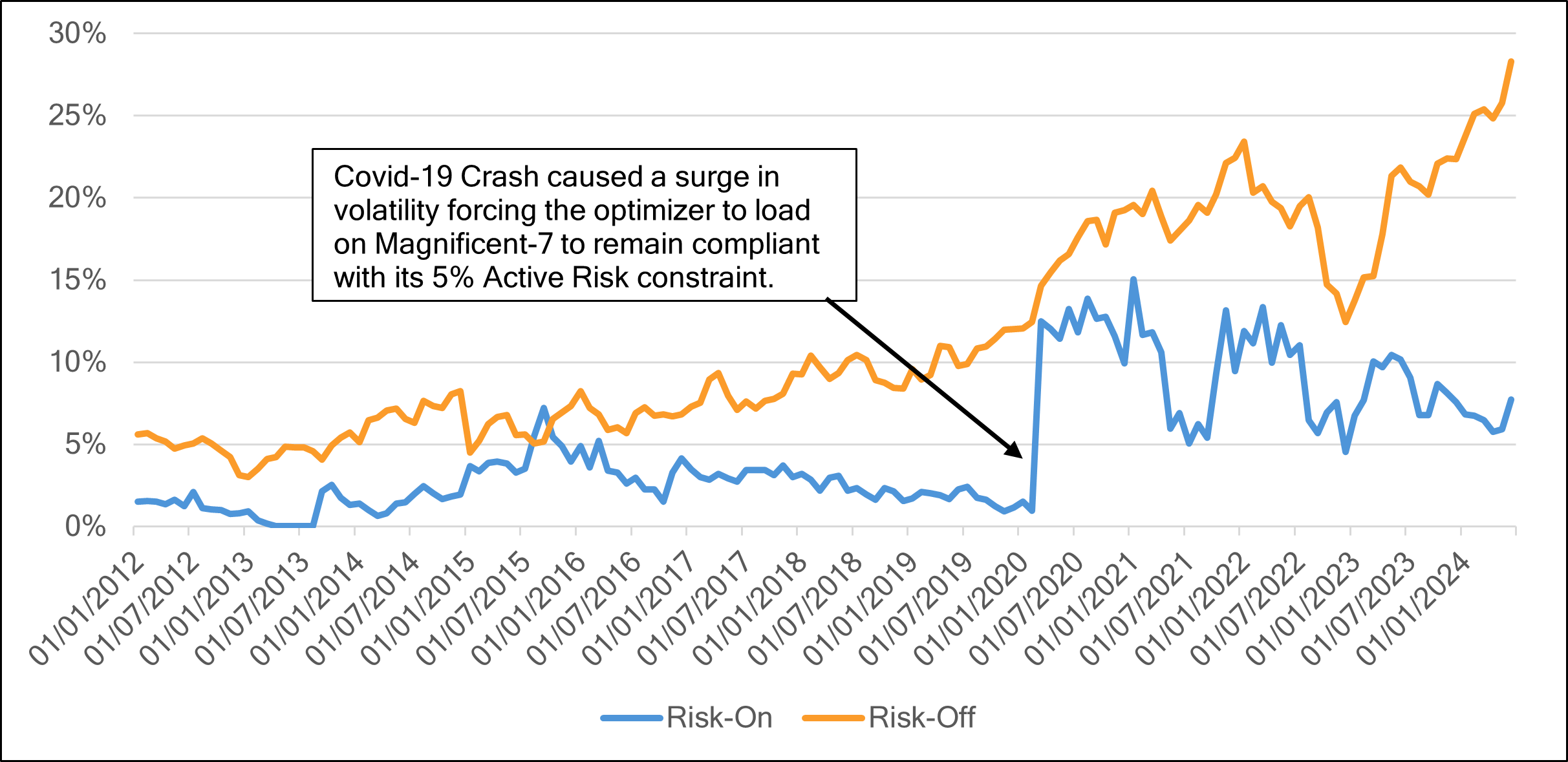

Figure 4: Weight of the Magnificent Seven in ROOF Portfolios

Source: Axioma ROOF Portfolios, STOXX USA 500

Figure 4 above illustrates the long-term weight of the Magnificent Seven in both the Risk-On and Risk-Off portfolios since January 2012. The weight of these stocks in the Risk-Off portfolio mirrors their increasing presence in the parent index. Since 2020, the Risk-Off portfolio has consistently held all seven stocks each month, except for occasional exclusions of Tesla. In contrast, the Risk-On portfolio has maintained Tesla consistently, but typically included only three or four of the Magnificent Seven at any given time, frequently omitting Alphabet and Meta. The exception was during the March-end 2020 rebalancing following heightened volatility and correlations due to the Covid-19 crash, when the Axioma Portfolio Optimizer 4 likely added Apple and Microsoft to Amazon, Nvidia, and Tesla to meet the 5% active risk constraint. As volatility subsided with substantial monetary and fiscal stimuli, Nvidia was swiftly shed, and allocations to others were reduced. From January 2023, as the AI theme gained prominence in driving market returns, the Risk-Off portfolio steadily increased its allocation to these seven stocks.

Figure 5: Long-Term Weights of the Magnificent Seven Risk-On & Risk-Off Portfolios

Source: Axioma ROOF Portfolios, STOXX USA 500

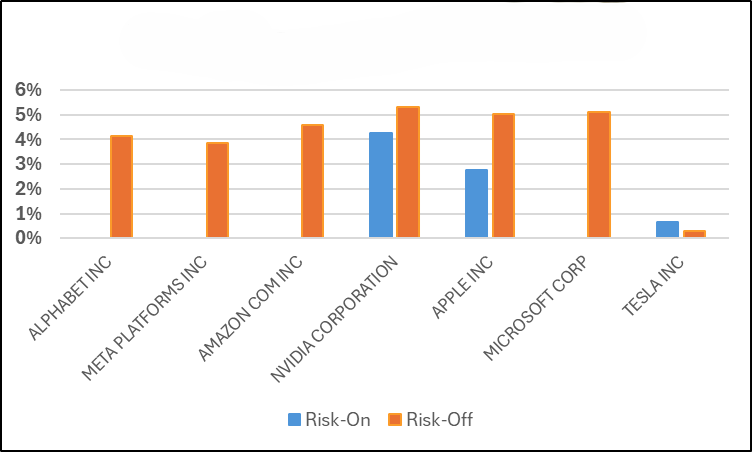

Figure 5 displays the current allocation of each Magnificent Seven stock in the two ROOF portfolios. Once again, the Risk-On portfolio adopts a more proactive approach to these index heavyweights, selectively holding only three out of the seven, primarily to adhere to active risk management protocols.

Summary and conclusions

The first half of 2024 witnessed two significant shifts in sentiment: from positive in January-February, to negative in April-May, and back to positive in June. However, amidst these fluctuations, investors also grapple with uncertainty in making return forecasts against the background of macroeconomic and geopolitical instability. This unease is evident in the predominantly negative sentiment observed year-to-date. The resulting preference for risk-averse investments over risk-tolerant ones has influenced stock performance, contributing to the outperformance of the Risk-Off portfolio relative to its Risk-On counterpart this year.

Uncertainty surrounding the upcoming Presidential election in November persists. While investors appear to have accepted the current high-interest-rate environment for the foreseeable future, the diverging economic and foreign policy stances of the candidates carry significant implications for portfolios heading into 2025 and beyond. Consequently, investors are likely to favor risk-averse strategies until uncertainties dissipate and confidence in return projections is restored. In the interim, incorporating sentiment analysis into portfolio management strategies appears prudent.

About ROOF Portfolios

The ROOF Portfolios use the sector ROOF Scores to construct sentiment-tracking portfolios designed to capture the returns from the implementation of a bullish or bearish strategy. The Risk-On and Risk-Off portfolios for the US are constructed from the holdings of the STOXX USA 500 parent index, and are rebalanced monthly (at month-end) using the then-current sector ROOF scores for each market.

"Investors are likely to favor risk-averse strategies until uncertainties dissipate and confidence in return projections is restored."

References/footnotes

- Axioma US Large, Medium, Small portfolio. Basically, a total market portfolio.

- Detailed factor-based performance attribution reports available upon request.

- Nvidia Market Impact by Leon Serfaty & Melissa R. Brown, GRANOLAS entice, but Magnificent Seven Deliver by Diana R. Baechle