European ROOF Portfolio Market Sentiment Update – H1 2024

Author

Olivier d’Assier

Investment Decision Research, SimCorp

Risk-averse strategies preferred but will the trend continue?

Since hitting a low in late October 2023, the STOXX Europe 600 index has risen consistently, reaching consecutive record highs in the first half of 2024. Yet, during the first half of this year, market sentiment, measured by ROOF Scores, which started the year on a bullish note, hoping for at least three interest rate cuts by the ECB in 2024, turned bearish twice: First for a week in late March on the back of stronger than expected inflation numbers which delayed any ECB rate cuts, then again for thirty consecutive days from May 5 to June 6, as the ECB announced it was likely to cut rates only once in 2024. Despite this disappointment, the STOXX Europe 600 continued to climb but peaked in early June (June 6).

Market climbs despite predominant risk-averse investor sentiment

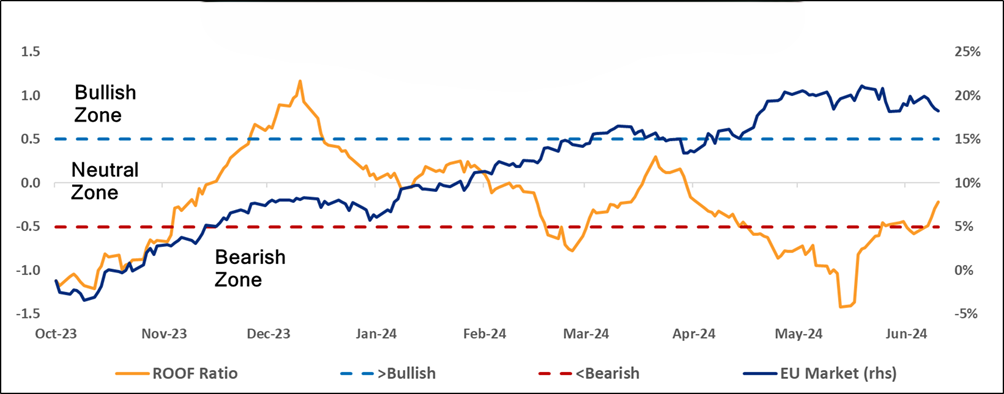

Figure 1 below illustrates the European investor sentiment over the past 180 days (from October 20, 2023, to June 28, 2024), compared with the broader European Developed market (AXEUDM-LMS portfolio1). During this period, investor sentiment varied, with bullish sentiment (ROOF ratio > +0.5) lasting only 14 days in the second half of December 2023, positive sentiment (ROOF ratio between 0.2 and 0.5) followed for another 18 days in January and February, neutral sentiment (ROOF ratio between -0.2 and 0.2) followed for 51 days, before turning negative (ROOF ratio between -0.5 and -0.2) for 35 days, and bearish (ROOF ratio below -0.5) for another 62 days.

Despite the predominantly risk-averse sentiment, the broad European market managed to climb by 20%, pausing only for a short period in early April (with a decline of -2.6% over these two weeks).

Figure 1: European Investor Sentiment Q4 2023 – Q2 2024

Source: Axioma ROOF Portfolios, STOXX Europe 600

Sector and Style factor tilts in bullish vs bearish strategies

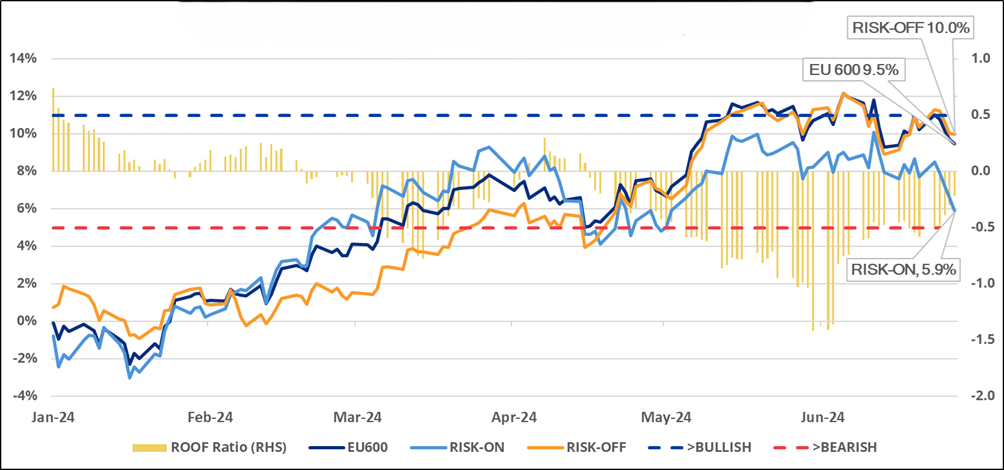

Figure 2 depicts the performance of the STOXX Europe 600 index and two sentiment variants, Risk-On and Risk-Off, throughout the first half of 2024, alongside the ROOF Scores for that period. We note that during this six month period, sentiment went from bullish at the start to bearish and negative in the end. This change in the direction of sentiment means that no one variant (Risk-On or Risk-Off) should be expected to outperform for the whole period. Instead, we see that the Risk-Off variant underperformed in the first half of the period but recovered during the second half when sentiment soured and investors sold risk-tolerant assets for the safety of risk-averse ones, driving the Risk-Off variant up, to end the first half above both its parent benchmark and its Risk-On counterpart. This gradual change in sentiment rewarded the Risk-Off portfolio, which overweighed sectors like Consumer Staples, Energy, Financials, Health Care, Materials, and Communication Services – sectors traditionally viewed as defensive or less volatile. In contrast, the Risk-On portfolio favored Consumer Discretionary, Industrials, and Information Technology, traditionally seen as more volatile in this market.

Figure 2: STOXX Europe 600 ROOF Portfolios – Year to Date 2024

Source: Axioma ROOF Portfolios, STOXX Europe 600

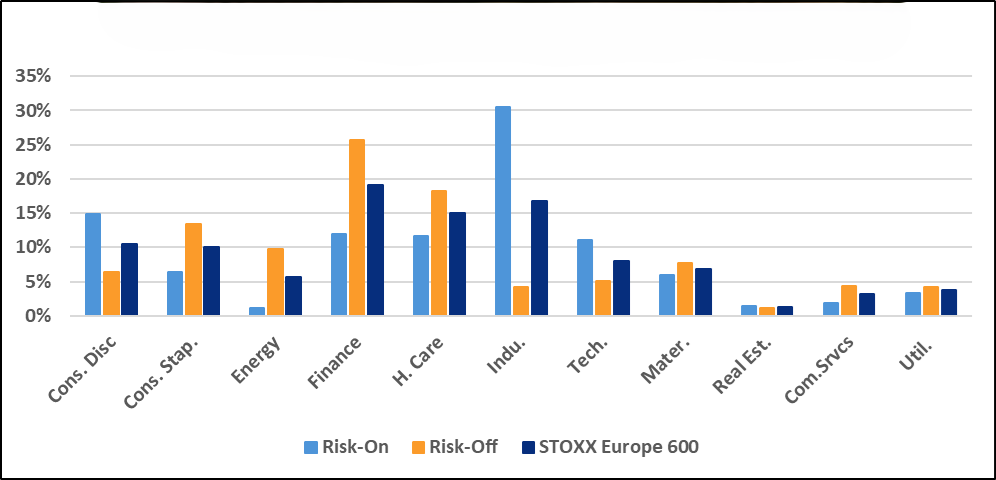

Figure 3 below shows the average sector allocation of the two ROOF portfolios during the first six months of this year. We see that the Risk-Off variant outweighed the Consumer Staples, Energy, Financials, Health Care, Materials, Communication Services, and the Utilities sectors. The Risk-On portfolio was overweight Consumer Discretionary, Industrials, Information Technology, and Real Estate sectors. Additionally, while the Risk-Off portfolio held on average only about 82 names (out of 600 in the parent index) and the Risk-On portfolio held 105, the Active Share of the Risk-Off portfolio was almost half of the Active Share of the Risk-On portfolio at 55% versus 90%. The Risk-On portfolio also used all of its active risk budget (5% tracking error) while the Risk-Off portfolio’s active risk averaged 3.4% during the period. The Risk-On portfolio achieved this increased divergence from the parent index by loading on small-cap, high-beta growth stocks, while the Risk-Off portfolio tilted towards large-cap, low-beta, profitable, dividend-paying, value stocks2.

Overall, the market dynamics of early 2024 underscore a strong preference for risk-averse strategies, driven by cautious investor sentiment and reinforced by sectoral preferences within the ROOF portfolios.

Figure 3: STOXX Europe 600 – Sector Allocations (Average YTD 2024)

Source: Axioma ROOF Portfolios, STOXX USA 500

What was the impact of the European GRANOLAS on ROOF Portfolios?

We also delved deeper into our portfolios to assess how the 11 dominant European stocks, termed the GRANOLAS – GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AtraZeneca, SAP, Sanofi – influenced overall performance. We have extensively covered the impact of these eleven stocks on the European market and their substantial concentration, posing challenges for active managers who opt not to include them in their portfolios to surpass benchmark performance 3.

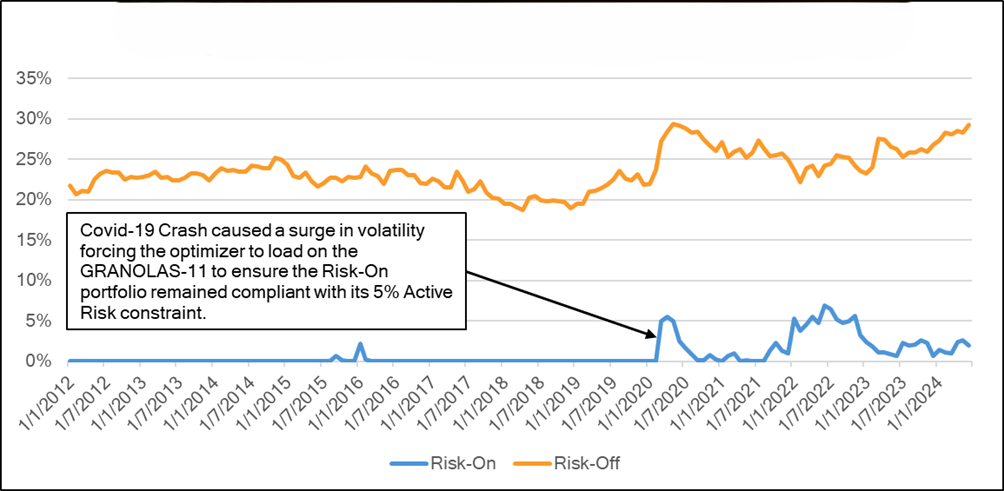

Figure 4: Long-Term Weight of the GRANOLAS in ROOF Portfolios

Source: Axioma ROOF Portfolios, STOXX Europe 600

Figure 4 above illustrates the long-term weight of the GRANOLAS in both the Risk-On and Risk-Off portfolios since January 2012. The weight of these stocks in the Risk-Off portfolio mirrors their increasing presence in the parent index over that period. Since 2012, the Risk-Off portfolio has consistently held all eleven stocks each month, except for occasional exclusions of ASML Holdings and/or LVMH in some months. In contrast, the Risk-On portfolio has very rarely held more than three of the eleven stocks under the GRANOLAS label at any one time. The exception was during the March-May 2020 rebalancings, following heightened volatility and correlations due to the Covid-19 crash, when the Axioma Portfolio Optimizer 4 likely added ASML, AstraZeneca, LVMH, and Nestle to meet the 5% active risk constraint. As volatility subsided post Covid-19 crash, with substantial monetary and fiscal stimuli, the Risk-On portfolio quickly shed those keeping only LVMH from the group. We also note that at no time in our history did the Risk-On portfolio choose to hold L’Oreal, Novartis, or Sanofi. All three are excluded from the portfolio’s holdings history.

Since January 2022, as worries about the ECB’s hawkish monetary policy and fear of recessions forced investors into the safety of so called ‘recession-proof' stocks (i.e., consumer staples, and luxury goods), the Risk-Off portfolio steadily increased its allocation to these eleven stocks choosing them as the best way to limit active drawdowns against the parent index which itself was seeing these eleven stocks increase in weight.

Figure 5: Current Weights of the GRANOLAS in Risk-On & Risk-Off Portfolios

Source: Axioma ROOF Portfolios, STOXX USA 500

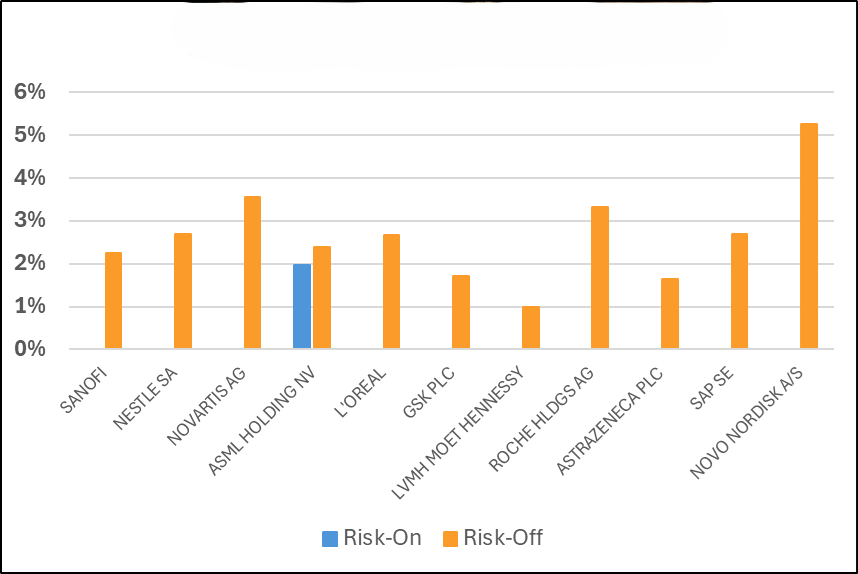

Figure 5 displays the current allocation of each of the eleven GRANOLAS stock in the two ROOF portfolios. Once again, the Risk-On portfolio adopts a more speculative approach to these index heavyweights, selectively holding only one (ASML) out of the eleven. As we are in a period of low market risk, we can assume that the optimizer was able to meet the active risk constraints with just a single name in this group, electing to spend most of its active risk budget elsewhere.

More bearish investor sentiment to come or will the bulls emerge?

The first half of 2024 witnessed four significant shifts in investor sentiment: from bullish in January, to bearish in March, back to neutral in April, and down to bearish again in May and June. However, amidst these fluctuations, investors also grapple with uncertainty in making return forecasts against the background of macroeconomic and geopolitical instability. This unease is evident in the predominantly negative sentiment observed year-to-date among European investors. The resulting preference for risk-averse investments over risk-tolerant ones has influenced stock performance, contributing to the outperformance of the Risk-Off portfolio relative to its Risk-On counterpart this year.

Uncertainty surrounding the upcoming US Presidential election in November persists as well as the fallout from the recent elections in Europe (European parliament, France, and the UK). While investors appear to have accepted the current high-interest-rate environment for the foreseeable future, the weakening of European governments’ response to any geopolitical shocks, as well as the yet unknown results of the US Presidential election in November, will keep investors on edge heading into 2025 and beyond. Consequently, they are likely to favor risk-averse strategies until uncertainties dissipate and confidence in return projections is restored. In the interim, incorporating sentiment analysis into portfolio management strategies appears prudent.

About ROOF Portfolios

The ROOF Portfolios use the sector ROOF Scores to construct sentiment-tracking portfolios designed to capture the returns from the implementation of a bullish or bearish strategy. The Risk-On and Risk-Off portfolios for the US are constructed from the holdings of the STOXX Europe 600 parent index, and are rebalanced monthly (at month-end) using the then-current sector ROOF scores for the European market.

"…the weakening of European governments’ ability to mount an effective response to any geopolitical shocks, as well as the yet unknown results of the US Presidential election in November, will keep investors on edge heading into 2025 and beyond."

References/footnotes

- Axioma US Large, Medium, Small portfolio. Basically, a total market portfolio.

- Detailed factor-based performance attribution reports available upon request.

- Nvidia Market Impact by Leon Serfaty & Melissa R. Brown, GRANOLAS entice, but Magnificent Seven Deliver by Diana R. Baechle