MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 10, 2025

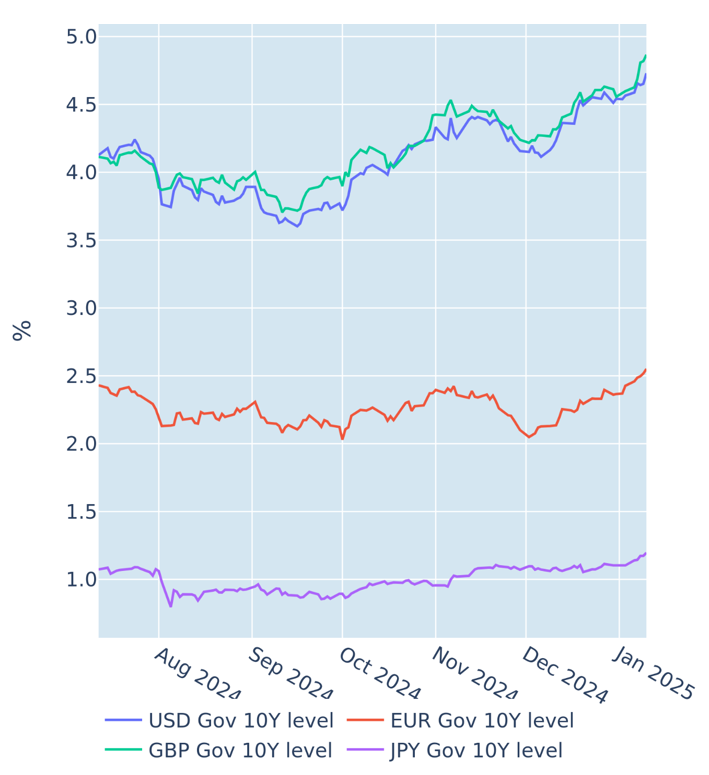

Global inflation concerns lift Gilt yields to 16-year highs

Long-term British Gilt yields soared to their highest levels in at least 16 years in the week ending January 10, 2025, jeopardizing the UK government’s spending and budget plans. The 10-year benchmark climbed to levels not seen since August 2008, while a 30-year rate above 5.4% was last recorded in 1998. This means that the United Kingdom now faces the highest borrowing costs among all G7 nations. Much of the recent increase was blamed on concerns about possible stagflation, which could force the government to borrow more to meet its ambitious spending and investment plans without raising taxes further. But the chart below shows that the rise of more than 100 basis points in the 10-year Gilt rate since the most recent lows in September mostly tracked a similar increase in the same-maturity US Treasury yield. This seems to indicate that the move was predominantly driven by the general reacceleration of global consumer price growth and the expected impact of measures introduced by the incoming Trump administration on long-term inflation expectations, rather than concerns about the UK’s economic and fiscal outlook.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated January 10, 2025) for further details.

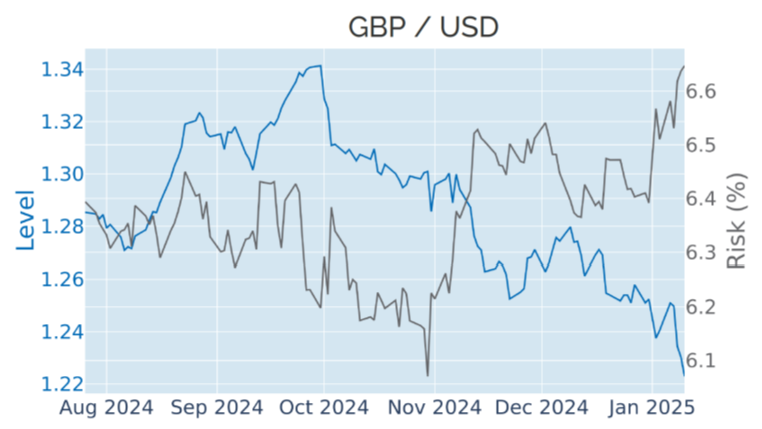

Traders push out next Fed rate cut, boosting the dollar

The US dollar hit a two-year high against a basket of major trading partners in the week ending January 10, 2025, as a stronger-than-expected labor market report prompted investors to slash their Fed rate cut projections. The Bureau of Labor Statistics announced on Friday that the American economy added 256,000 jobs in December, crushing the consensus forecast of 160,000. Futures markets initially assigned a roughly even chance to the next rate move happening in March, but traders raised the implied probability of no change to 75% after the data was released. No further easing of monetary conditions is now expected until at least the fourth FOMC meeting of the year in June.

Much has recently been made of the fact that the GBP/USD exchange rate plummeted to a 14-month low, but this can once again be explained by the overall dollar strength rather than anything UK-specific factors. In fact, the pound’s 8% depreciation since its most recent high at the end of September was almost exactly matched by the euro, the Swiss franc, and the Japanese yen, as this period coincided with an upward revision in the projected ‘terminal’ federal funds rate from 3.17% to 4.07%. The euro is now closest to trading at parity with the greenback since November 2022.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated January 10, 2025) for further details.

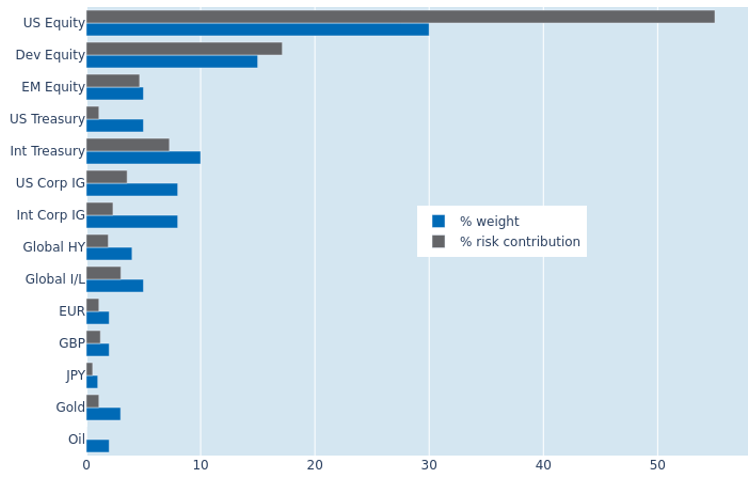

Lower US equity volatility reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio declined by 0.9% to 7.3% as of Friday, January 10, 2025. Most of the change was recorded in the US equity bucket, which saw its share of overall risk shrink by one percentage point to 55%, due to a fall in its standalone volatility from 17.4% to 15.4%. USD investment grade corporate bonds experienced a similar reduction in their percentage risk contribution from 4.5% to 3.6%, as credit spreads remained stable despite last week’s 2% selloff in the American stock market. Oil no longer actively reduced total portfolio volatility, but continued to offer the best diversification benefits relative to its monetary weight due to its near-zero correlation with share prices.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated January 10, 2025) for further details.

You may also like