MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 15, 2024

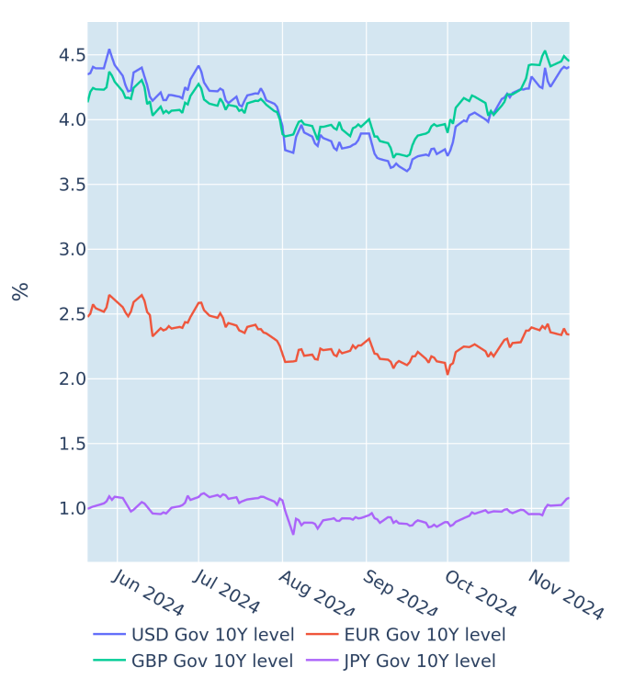

Strong US economy and inflation push Treasury yields to 4-month high

US long-term borrowing costs soared to a four-month high in the week ending November 15, 2024, as consumer price growth rebounded from recent lows, while monthly retail sales came in stronger than predicted.

The Bureau of Labor Statistics announced on Wednesday that headline prices rose 0.12% in October—compared with a 0.04 decline in the same month last year—boosting the annual inflation rate from 2.4% to 2.6% and ending a string of six consecutive monthly declines. Core CPI growth remained steady at 3.3%, as prices rose at the same monthly pace of 0.2% as a year ago. The annual growth rate is likely to remain above 3% into at least the first quarter of 2025, as prices increased by 1.8% in the first three months of this year alone. Initially, short-term interest-rate (STIR) markets appeared to be undaunted, even raising the implied probability of a Fed rate cut at the upcoming FOMC meeting on December 18 from under 60% on Tuesday to over 80% on Wednesday.

However, the move soon started to reverse after Federal Reserve Chair Jerome Powell reiterated in a speech on Thursday that the path of inflation toward the 2% target will remain “bumpy” and that the central bank was in no “hurry to lower rates.” He also noted that recent economic performance “has been remarkably good” and that “growth in consumer spending has remained strong.” This notion was further underpinned by a 0.4% growth in retail sales in September, which comfortably beat the consensus forecast of 0.3%. Following the release on Friday, only six out of ten traders still believed that the Fed would lower rates by 25-basis points next month, while the rest expected no change in policy.

It is worth noting, though, that the recent surge in long Treasury yields was not accompanied by a rise in long-term inflation expectations. In fact, the 10-year breakeven inflation rate has been hovering closely around 2.3% over the past six weeks, while the nominal yield climbed by 40 basis points, translating directly into an increase of the same size in the real rate.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated November 15, 2024) for further details.

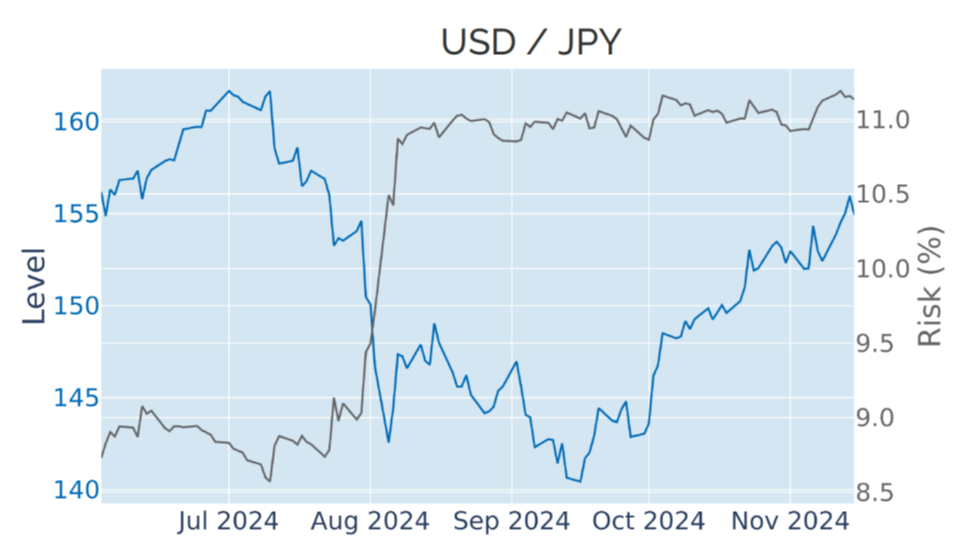

Dollar continues to strengthen over higher rates

The US dollar continued to strengthen in the week ending November 15, 2024, reaching its highest level against a basket of major trading partners in more than 12 months. The Dollar Index has been tightly correlated with monetary policy expectations over the past three years. It has risen almost 6% since mid-September as STIR derivatives markets priced out one percentage point worth of Fed rate cuts by the middle of next year. Punters now expect the easing cycle to end at a ‘terminal’ federal funds rate of just under 4% instead of around 3%.

The Japanese yen exhibited the strongest sensitivity to changes in US interest rates expectations, as the Bank of Japan (BoJ) held on to its negative rate policy until earlier this year, while most of its major counterparts tightened monetary conditions aggressively. With rate expectations in the US on the rise once more, the yen depreciated 9% against its American rival over the past nine weeks, compared to -5% for EUR/USD and -4% for GBP/USD.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated November 15, 2024) for further details.

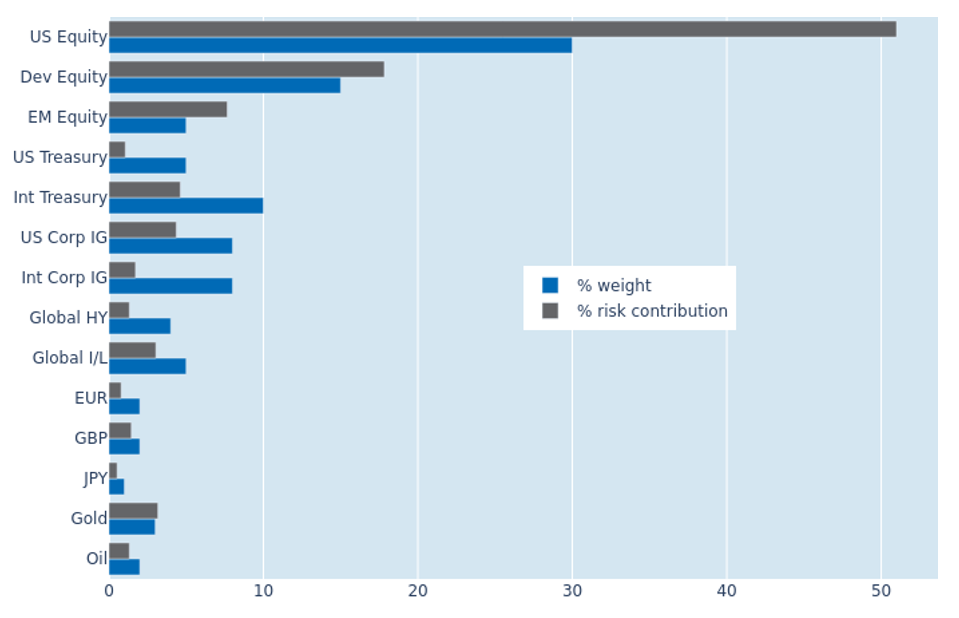

Strengthening dollar boosts portfolio risk

The latest strengthening of the US dollar boosted the predicted short-term risk of the Axioma global multi-asset class model portfolio from 7% to 7.6% as of Friday, November 15, 2024. The resulting depreciations of most other currencies amplified the concurrent losses in the respective local stock and bond markets, which led to increases of 2.4% and 2.9% in the percentage risk contributions of non-US developed and emerging-market equities, respectively. Non-USD government bonds also saw their share of overall portfolio volatility more than double from 2.1% to 4.6%. Gold and oil once more add to total risk, due to a closer co-movement with exchange rates against the dollar. US equities were the only asset class that saw its risk contribution shrink from 68.7% to 51%, as their standalone volatility decreased despite experiencing the biggest weekly selloff in more than two months.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated November 15, 2024) for further details.

You may also like