MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 1, 2024

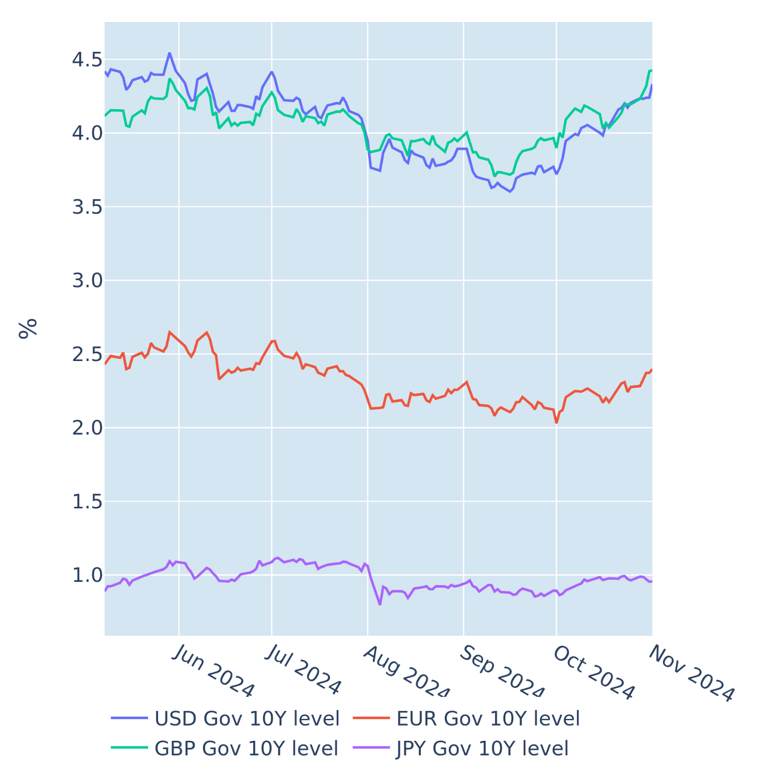

UK budget announcement sends Gilt yields to 12-month high

British long-term sovereign yields soared by 23 basis points to their highest levels in 12 months in the week ending November 1, 2024, following the unveiling of the Labour government’s highly anticipated first budget. Chancellor Rachel Reeves raised taxes by £40bn to (partly) fund extra annual spending of £70bn anticipated over the next five years. At the same time, the additional tax revenues are expected to decline to £34bn in the 2026-27 financial year, leaving the remainder of the expenditure to be funded through further borrowing.

Rates increased even more at the monetary policy-sensitive 2-year point of the Gilt curve (+0.36%), as traders revised their monetary policy expectations upward. Short-term interest-rate derivatives now imply just one percentage point of additional easing, compared with 125 basis points before the budget was announced. But the Bank of England is still expected to lower its base rate by 0.25% at its upcoming meeting this Thursday.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated November 1, 2024) for further details.

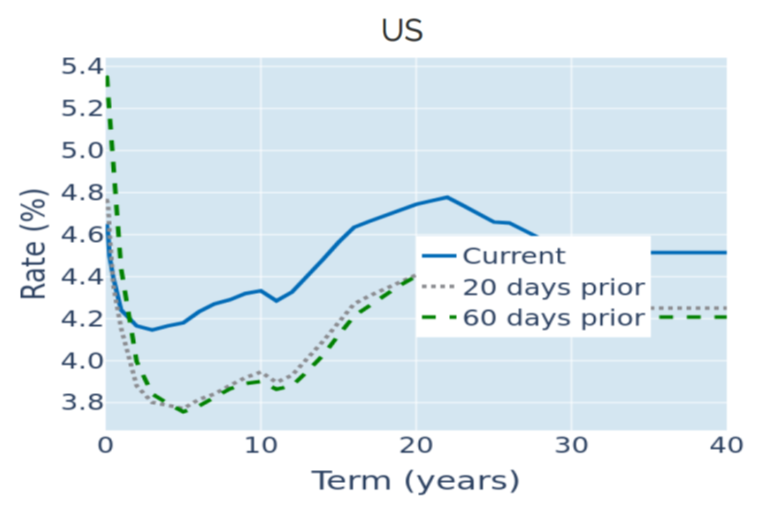

US Treasury rates soar ahead of presidential election

Treasury yields soared across all maturities greater than two years in anticipation of higher fiscal spending and net borrowing from both contenders in the US presidential election this week. Since the Federal Reserve cut its policy rate by half a percentage point in mid-September, the 10-year Treasury yield has risen by 0.73%, around one third of which can be attributed to higher long-term inflation expectations. Coupled with stronger-than-expected labor-market reports, this led short-term interest-rate futures markets to price out more than 85 basis points worth of monetary easing by the middle of next year. The 2-year borrowing rate rose 0.64% in turn.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated November 1, 2024) for further details.

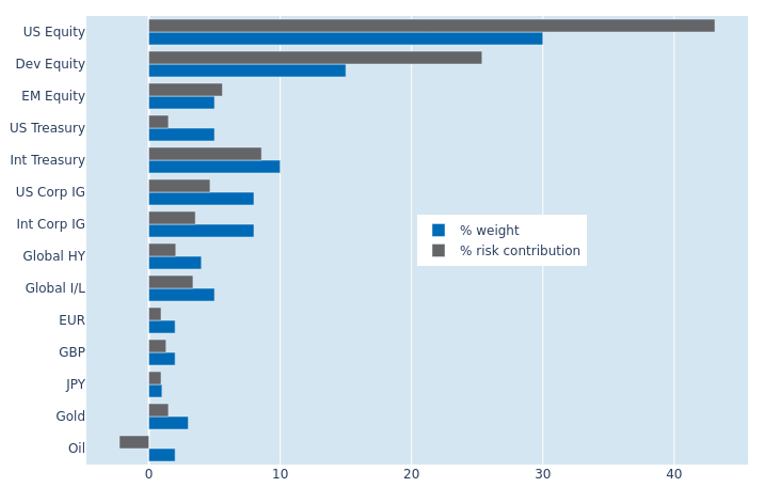

Ongoing cross-asset sell-off raises portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio rebounded to 6.2% as of Friday, November 1, 2024, from its most recent low of 5.1% at the end of the previous week. The rise was caused by a second consecutive week of combined losses in the equity, fixed income, and FX markets. Accordingly, non-US sovereign bonds and developed stocks recorded the biggest expansions in their percentage risk contributions of 4.2% and 2.6%, respectively. International investment grade corporates also experienced a more than fourfold increase in their share of overall portfolio volatility from 0.7% to 2.9%, while high yield securities and inflation linkers saw theirs double. Holding oil futures, on the other hand, lowered total risk, due to their strong negative correlation with most debt instruments.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated November 1, 2024) for further details.

You may also like