MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JUNE 28, 2024

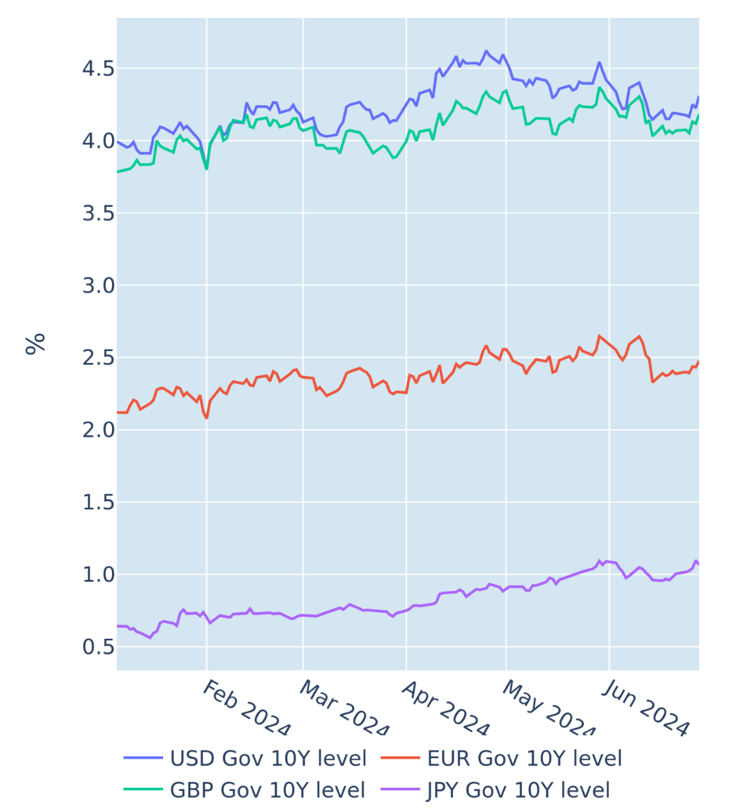

Eurozone yields rise in run-up to French election

European sovereign yields recorded their steepest weekly ascent since mid-April in the run-up to the first round of the French parliamentary election in the week ending June 28, 2024. The risk premium of 10-year French OATs over same-maturity German Bunds expanded by a further 4 basis points to 0.78%—its widest since the 2017 presidential contest between Marine Le Pen and Emmanuel Macron, of which the latter won both rounds. Following Macron’s success after round one, the OAT-Bund spread immediately tightened by almost 20 basis points, while the euro gained 1.5%. But given the strong performance of Len Pen’s National Rally party last Sunday, the French-German risk premia are likely to remain elevated and the euro range-bound.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated June 28, 2024) for further details.

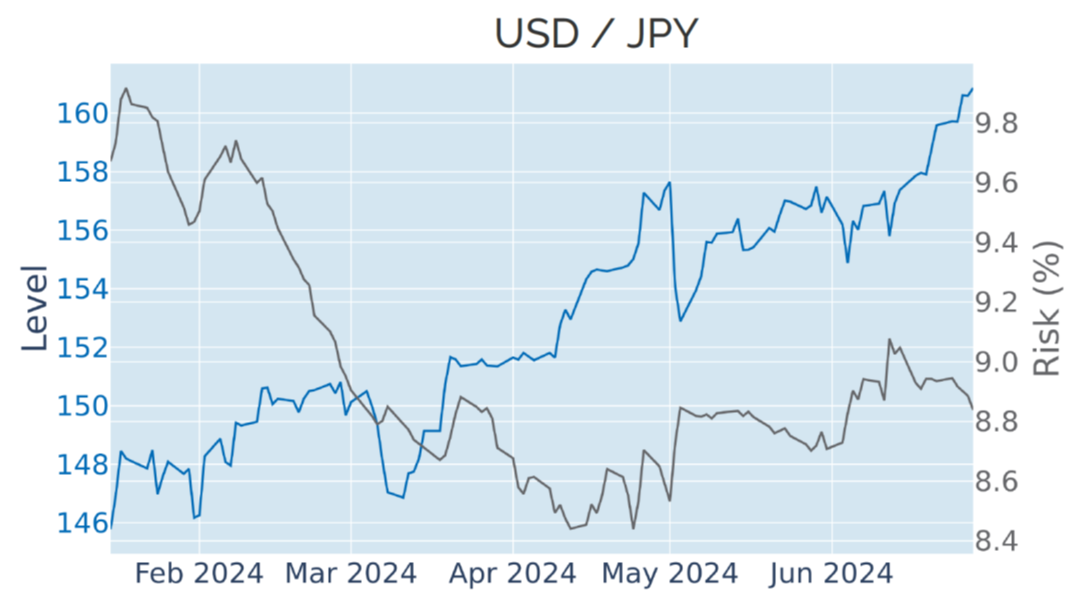

Higher US rates push yen to 38-year low

The Japanese yen dropped to its lowest level against the US dollar in 38 years in the week ending June 30, 2024, sparking fears among traders that the country’s finance ministry may be prompted to intervene to support the ailing currency. The USD/JPY exchange rate has been closely tracking Federal Reserve monetary policy expectations, with the greenback gaining 32% against its Far-Eastern rival since September 2021. On the plus side, the 12% depreciation of the yen this year—by far the biggest drawdown among all G10 currencies—has likely been a major factor behind the 18% year-to-date gain of the exporter-oriented Nikkei 225.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated June 28, 2024) for further details.

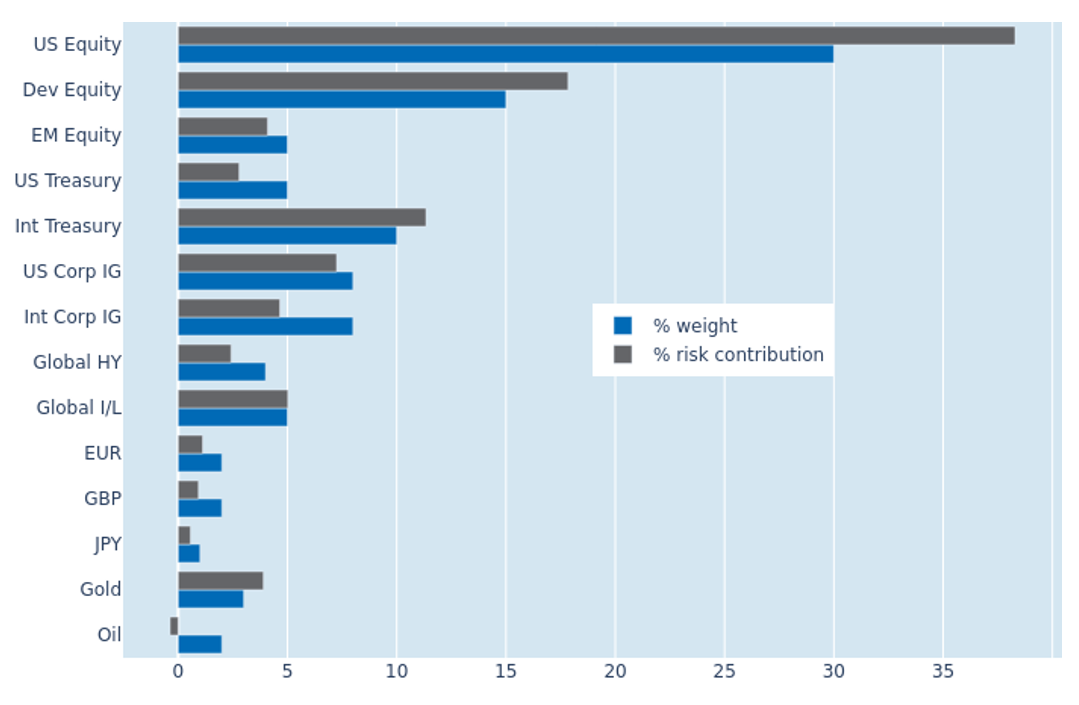

Credit spreads decouple from share prices and rates

The predicted short-term risk of the Axioma global multi-asset class model portfolio plummeted 1.4 percentage points to 5.4% as of Friday, June 28, 2024, as credit spreads decoupled from share prices and risk-free interest rates. USD-denominated investment grade corporates were the biggest beneficiaries, as their share of total portfolio volatility dropped from 11.8% to 7.3%. Their non-US and lower-rated counterparts also saw their percentage risk contributions shrink by 0.8% and 0.6%, respectively. Global sovereign bonds experienced a 1.3% drop in their contribution to overall risk as well, also due to the lower rate-spread correlation.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated June 28, 2024) for further details.