MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JUNE 11, 2024

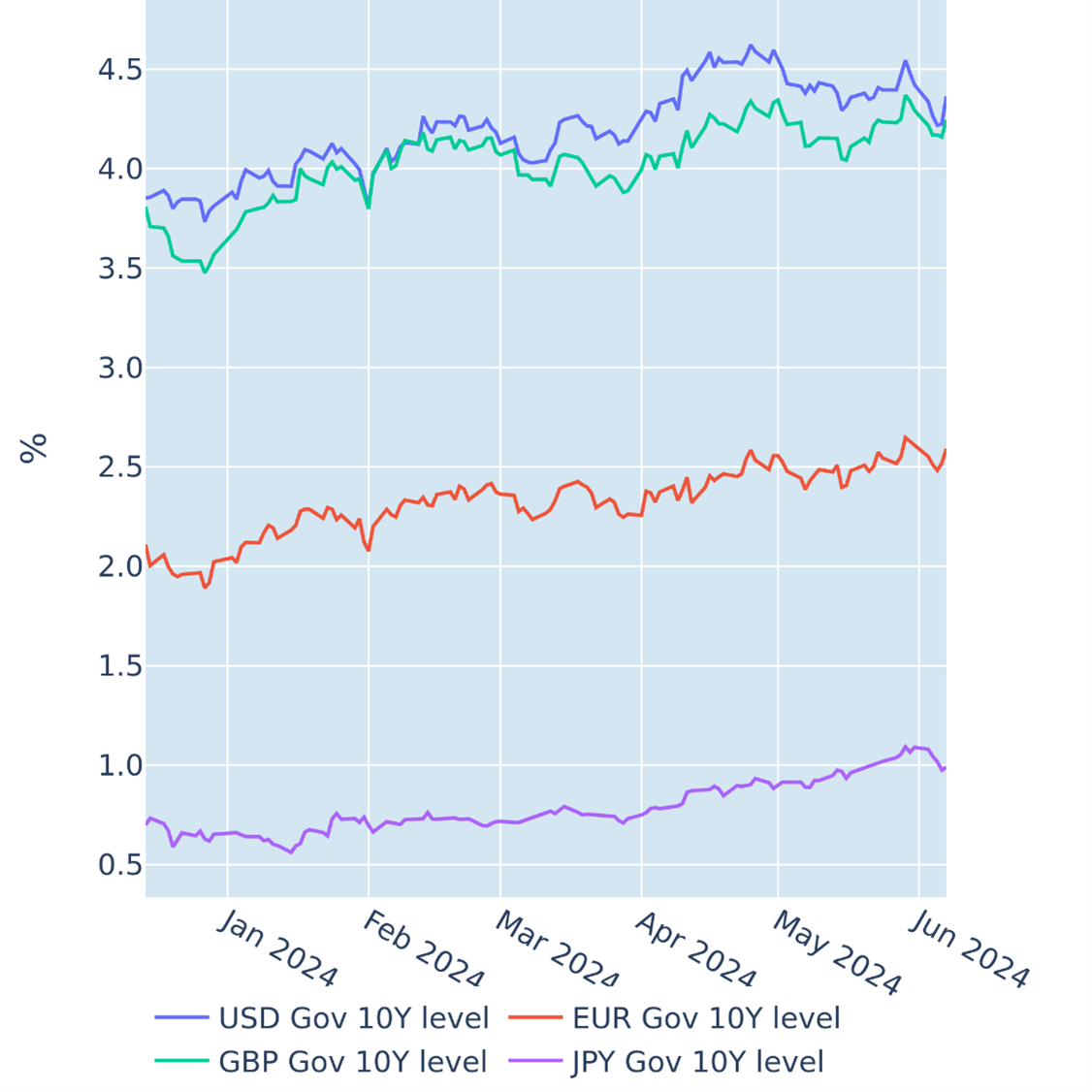

Mixed economic data rock US Treasury yields

A flurry of seemingly contradictory economic data sent US Treasury yields on a rollercoaster ride in the week ending June 7, 2024. First up was the Institute of Supply Management on Monday, whose purchasing managers index for the manufacturing sector fell unexpectedly, mostly driven by a decline of new orders. The ADP employment change report on Wednesday also missed analyst projections, showing that private businesses in the US added 152,000 workers to their payrolls in May, compared to a consensus forecast of 175,000. The previous month’s number was also revised downward from 192,000 to 188,000. The combined impact was a 20-basis point decline in long-term borrowing rates, which was then partly reversed by a 14-basis point surge on Friday, when the non-farm payroll release showed a gain of 272,000 jobs for May, which comfortably beat the 185,000 predicted by economists. Short-term interest-rate futures markets mimicked the moves in longer yields, temporarily raising the implied probability for two Fed rate cuts by year end to 68% on Thursday, but ended the week at a less than equal chance (46%).

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated June 7, 2024) for further details.

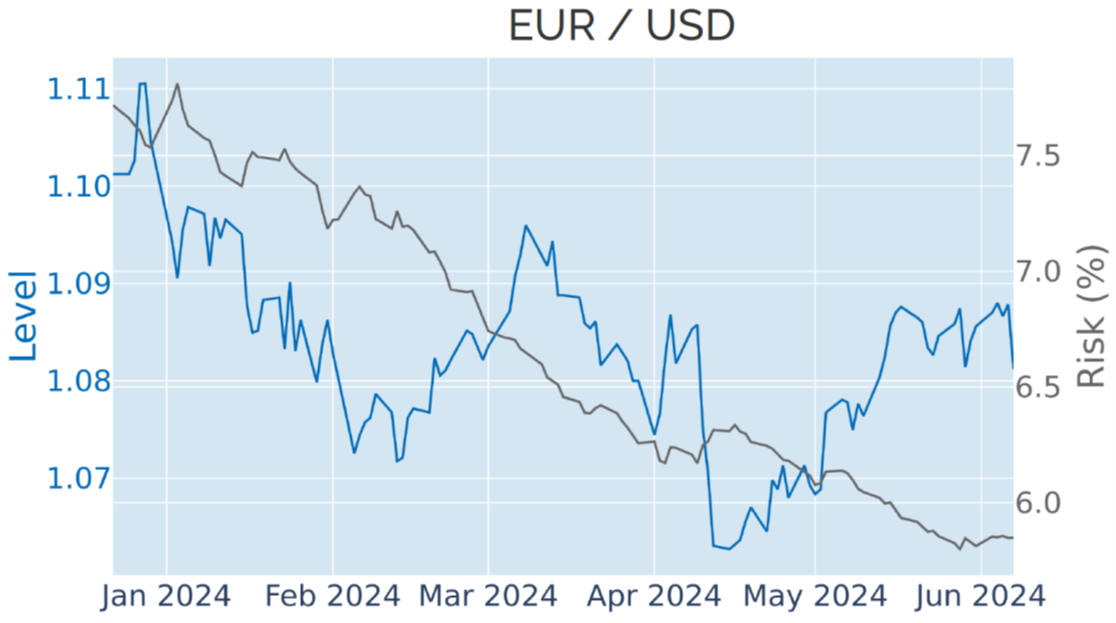

ECB rate cut leaves markets unimpressed

The European Central Bank cut interest rates for the first time in almost five years on Thursday, June 6, 2024, but markets showed little reaction, as the move had been widely anticipated. The EURO STOXX 50 index rose 0.7%, but sovereign bonds ended the day in the red, as Bund yields climbed between 2 and 4 basis points across all maturities. The euro also strengthened slightly—against the conventional wisdom that lower rates make a currency less attractive to foreign investors—appreciating 0.1% against the US dollar. But the latter more than recouped its losses on Friday, gaining 0.6% on its European rival on the back of tighter monetary policy expectations.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated June 7, 2024) for further details.

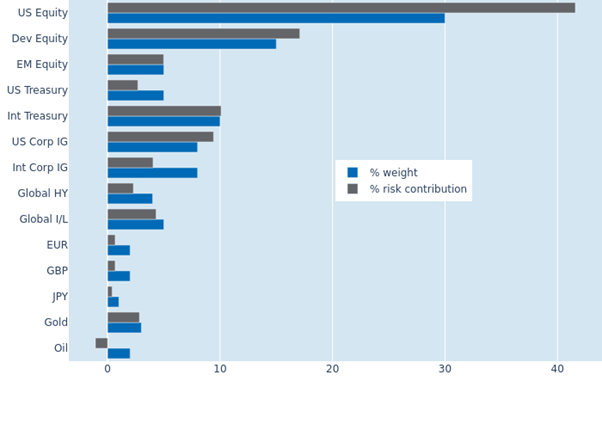

Portfolio risk continues to ease despite stronger rate volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased by another 0.2% to 7.4% as of June 7, 2024. mostly due to lower stock-market volatility. This meant that the combined percentage risk contribution of the three equity buckets shrank by 7.5% to 63.7%. However, those benefits were partly offset by bigger fluctuations in interest rates, which also exhibited a stronger co-movement with credit spreads. The combined effect of this was most notable for USD-denominated investment grade corporates, which saw their share of total portfolio volatility soar from 3.7% to 9.4%. Holding oil, on the other hand, now actively reduces overall risk, as crude prices have been negatively correlated with most other asset classes in the portfolio.

Please refer to Figure 7 of the current Multi-Asset Class Risk Monitor (dated June 7, 2024) for further details.