MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MAY 17, 2024

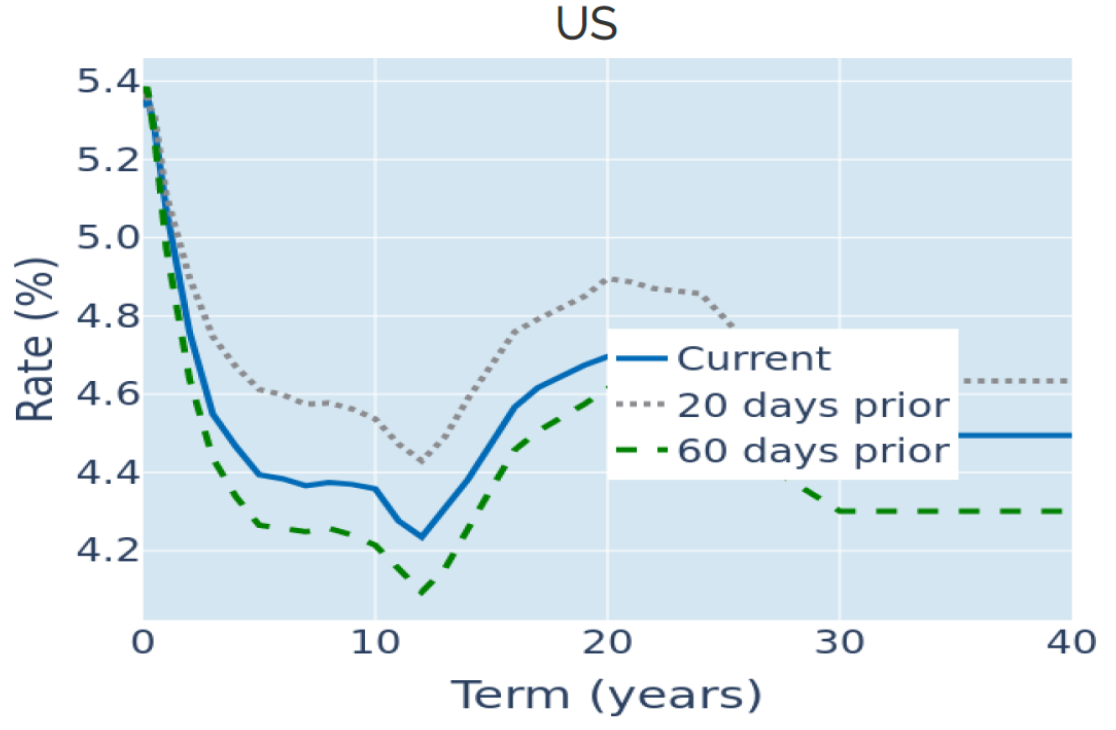

US Treasury yields fall to six-week lows as inflation eases

US Treasury yields fell to their lowest levels in almost six weeks in the week ending May 17, 2024, as consumer-price growth for April eased in line with market expectations. Both the annual headline inflation rate of 3.4% and the core component of 3.6% met economists’ predictions and were lower than the previous month’s readings. But although core prices rose at a slower pace this April (+0.28%) than in the same period last year (+0.47%), it is much faster than the average monthly growth of 0.17% that would be consistent with an annual inflation of 2%. And even if month-over-month rates were to revert to 0.17% for the remainder of year, the average price level would still be more than 3% higher than at the end of 2023. This leaves very little room for any further upside inflation surprises and may make it hard for the Federal Reserve to justify easing monetary conditions anytime soon.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated May 17, 2024) for further details.

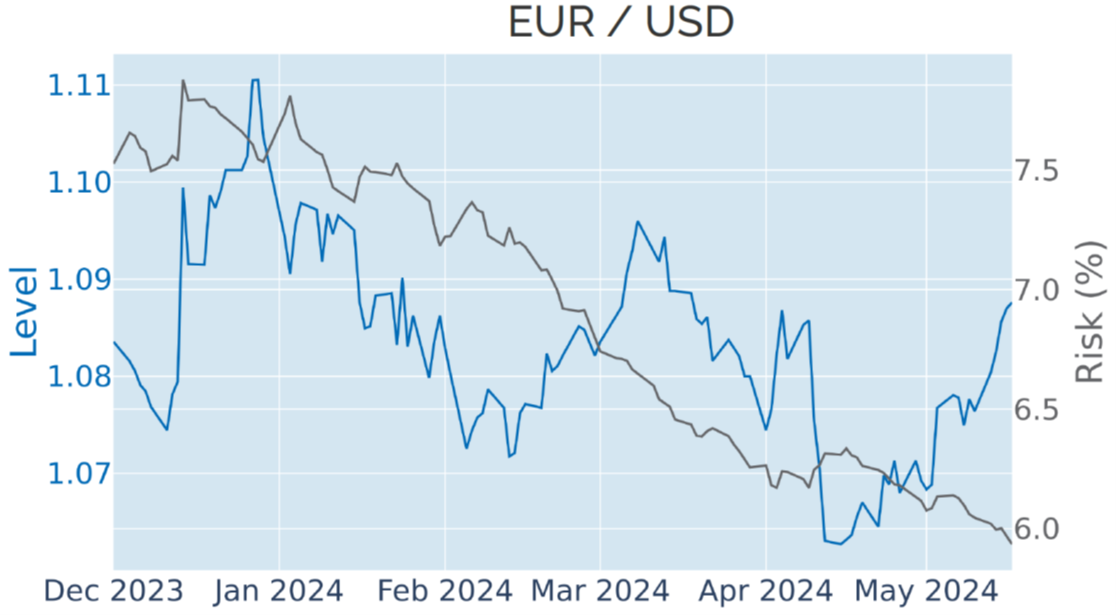

Lower interest rates and yields weigh on the US dollar

Last week’s decline in bond yields pushed the US dollar to a nine-week low against the euro and the pound. Since monetary-policy expectations started rising in September 2021, the greenback has been closely tracking the level of interest rates and bond yields in the United States. In the first four months of this year, the Dollar Index—a measure of the USD’s value against a basket of major trading partners—appreciated more than 5%, as traders priced out a 125 basis points worth of rate cuts by year end on the back of three upward inflation surprises. But it has given back around one third of the gains (-1.7%) since the beginning of May, as a cooling labor market and easing inflationary pressures raised hopes of some monetary easing before the year is out.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated May 17, 2024) for further details.

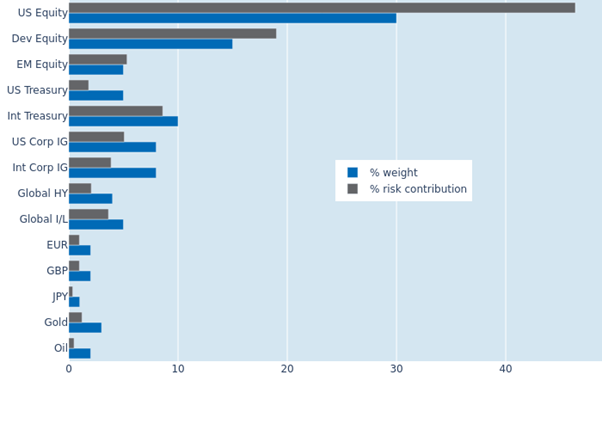

Cross-asset rally raises portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio rose from 8.1% to 8.3% as of Friday, May 17, 2024, as stocks, bonds, and foreign currencies against the USD all rallied together amid easing inflationary pressures. Standalone equity volatility actually decreased by one percentage point, but the stronger interaction with interest-rate and FX returns resulted in higher total portfolio risk. Non-US sovereign bonds (nominal and index-linked) once again took the brunt of the overall increase, alongside emerging market shares, while US equities were the only asset class in the portfolio that saw its percentage risk contribution decrease from 50% to 46.4%.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 17, 2024) for further details.