MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MAY 10, 2024

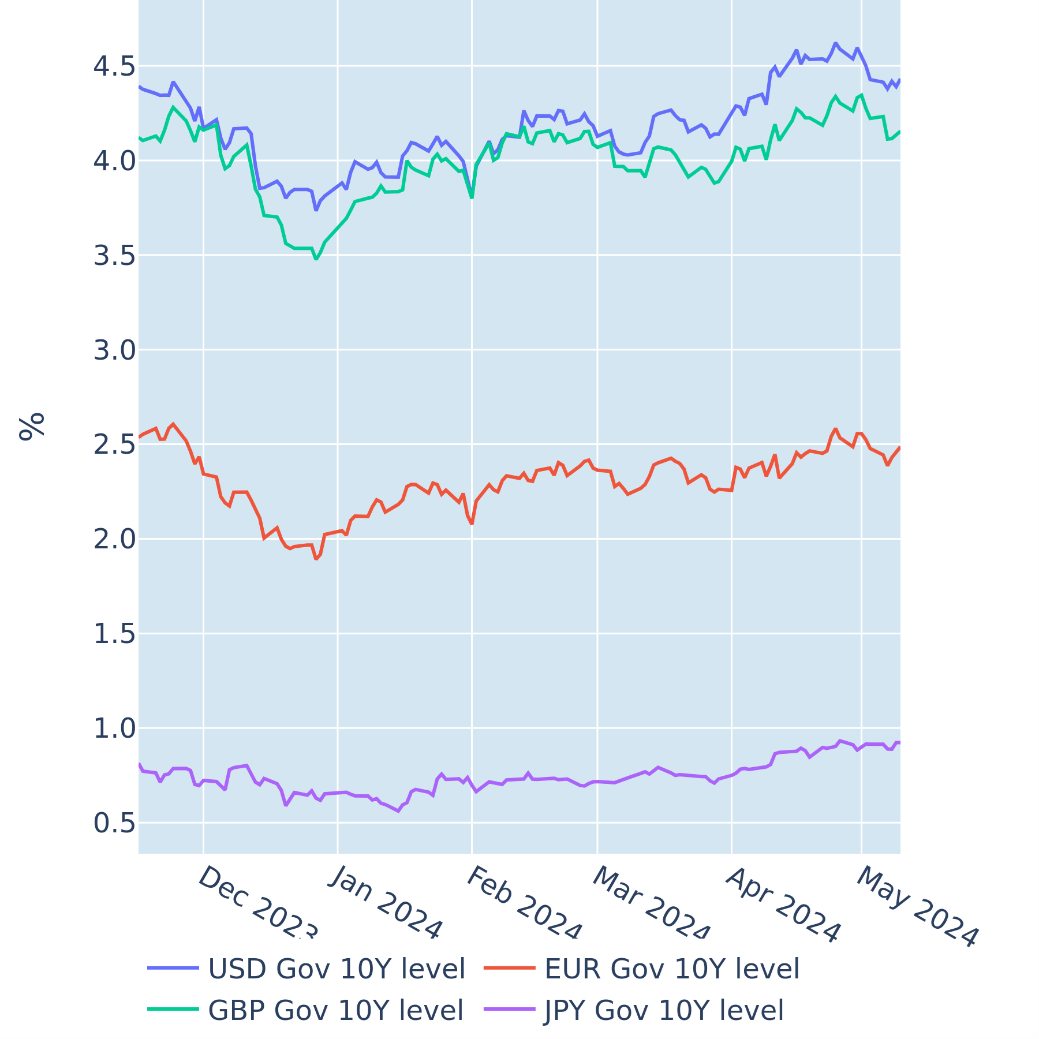

Dovish Bank of England lets Gilts shine

British government bonds outperformed their American and continental European counterparts in the week ending May 10, 2024, as the Bank of England indicated that rates could fall faster than predicted. The Monetary Policy Committee kept borrowing costs at 5.25% in line with market expectations on Thursday. But Governor Andrew Bailey noted that the Bank may have to ease monetary conditions by more than what is “currently priced into market rates” to ensure that inflation will not undershoot the 2% target by too much in the medium term. In fact, headline inflation is projected to briefly fall to 2% in the second quarter of this year, as the lower household energy price cap from April is set to take effect. But the MPC still expects core price growth to remain around 3% over the second half of 2024. With regards to potential timings of rate cuts, Bailey stressed that a move in June was neither “ruled out” nor a “fait accompli,” though markets expect that the Bank will have lowered its base rate at least once by August. Year-end projections for short-term interest rates are currently 50-60 basis points lower than current levels.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated May 10, 2024) for further details.

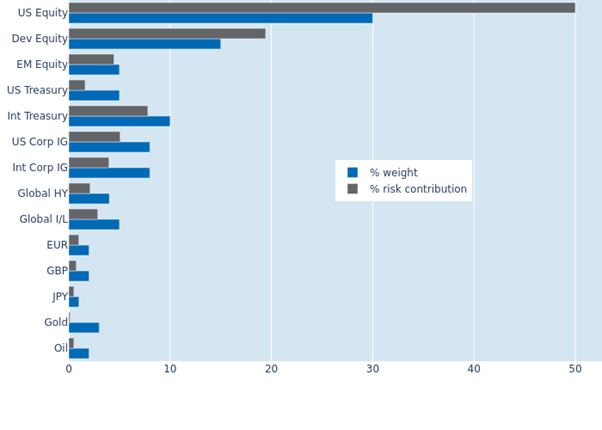

Ongoing focus on monetary policy keeps stocks and bonds in lockstep

The predicted short-term risk of the Axioma global multi-asset class model portfolio rebounded to 8.1% as of Friday, May 10, 2024, up from 7% the week before. The ongoing focus on inflation and monetary policy means that stocks and bonds continue to move together, either selling off as consumer-price growth surprises on the upside or recovering when bad economic news is good news for interest rates. The dollar often moves in the opposite direction, meaning that local gains and losses of non-USD securities get amplified when converted into the portfolio’s base currency. Taken together, this leaves little room for diversification for US-base investors. The two commodities—gold and oil—are currently the only asset classes that are largely decoupled from the rest of the portfolio and can, thus, provide some relief. But it needs to be stressed that oil is normally very positively correlated with share prices and also very volatile by itself, which means that most of the time it increases total risk. The current behavior is an exception and cannot necessarily be expected to continue for long.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 10, 2024) for further details.