Multi-Asset Class Monitor Highlights

WEEK ENDED APRIL 12, 2024

- Persistent US inflation kills rate cut hopes

- Higher rates propel dollar to 5-month high

- Combined stock, bond, and FX sell-off boosts portfolio risk

Persistent US inflation kills rate cut hopes

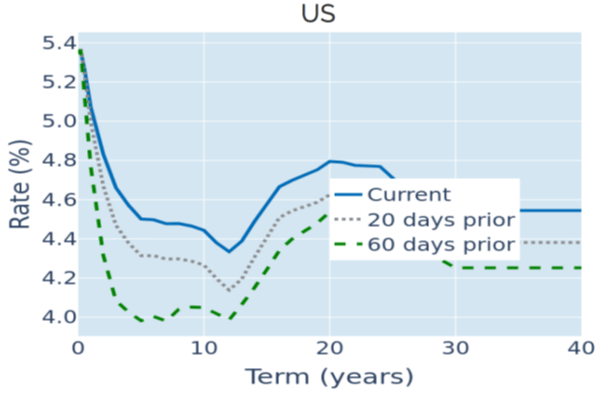

A third consecutive upward surprise in US inflation in the week ending April 12, 2024, led US interest-rates and bond traders to bury their last hopes of a June rate cut from the Federal Reserve. The Bureau of Labor Statistics reported on Wednesday that headline consumer prices grew by 3.5% in the twelve months ending in March, up from 3.4% the previous month and once more beating the consensus forecast of 3.4%. Core inflation also rose for the first time after eleven consecutive drops, as prices grew stronger this March than in the same month last year. The CME FedWatch Tool now only indicates a probability of less than 30% for a rate cut in June, down from an almost equal chance at the start of last week. The projected average fed funds rate for December also climbed from 4.76% to nearly 5% on the day the inflation numbers were released. The move was once again replicated along the entire US Treasury curve, lifting long-term yields to their highest levels since mid-November.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated April 12, 2024) for further details.

Higher rates propel dollar to 5-month high

The latest reevaluation of US monetary-policy expectations propelled the dollar to its highest level in more than five months against a basket of major trading partners in the week ending April 12, 2024. Concurrently, the Dollar Index recorded its strongest weekly gain since the Federal Reserve’s series of four ‘jumbo’ rate hikes of 75 basis points each in the summer of 2022. The move pushed the JPY/USD exchange rate to a 37-year low, sparking fears of a possible intervention by the Bank of Japan, which so far has failed to appear. But it was the euro which took the brunt of the losses, as traders stuck to their expectation that the European Central Bank will still go ahead with easing monetary conditions in June. The notion was underpinned by ECB President Christine Lagarde who told reporters in the press conference after the governing council meeting on Thursday that some of the policymakers had argued in favor of lowering rates immediately. The ECB is also still expected to ease rates by at least 75 or even 100 basis points by year-end, which would make it the most dovish of the major central banks.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor dated April 12, 2024) for further details.

Combined stock, bond, and FX sell-off boosts portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio rebounded to 5.9% as of Friday, April 12, 2024, from 5.2% the previous week, as stocks, bonds, and exchange rates against the US dollar all dropped in unison amid the significant upward revision in US interest-rate projections. Non-USD sovereign and investment grade corporate bonds experienced the biggest increases in their percentage risk contributions of 2.9% and 2%, respectively. But the adverse effect of stronger correlations was offset by lower standalone share-price volatility for non-US stocks, while American equities even saw their share of total portfolio risk shrink from 51.7% to 43.8%.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 12, 2024) for further details.