EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 10, 2025

Axioma Risk Monitor: US Small Caps drop more than Large Caps as interest-rate cut odds diminish; China experiences one of the worst starts of the year; The US dollar strengthens further in 2025

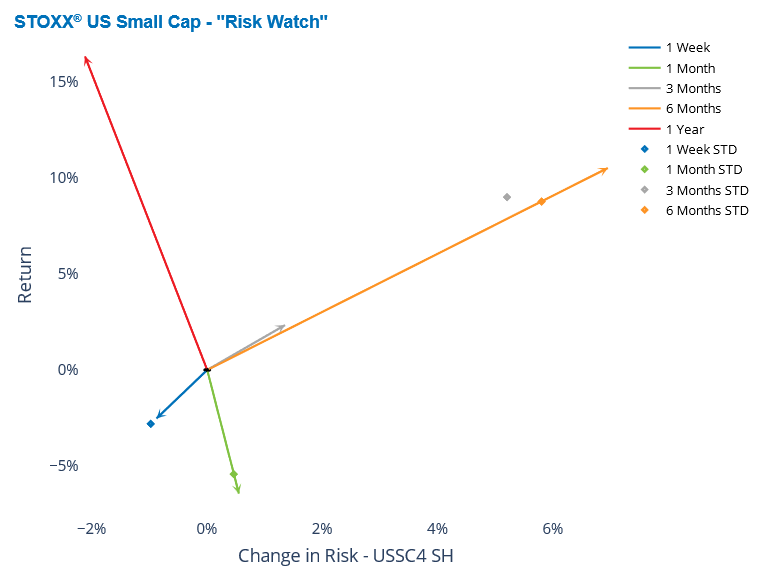

US Small Caps drop more than Large Caps as interest-rate cut odds diminish

US Small Caps retreated more than Large Caps last week on the heels of strong economic data, including a solid job report released on Friday, which dampened expectations of interest rate cuts from the Federal Reserve in 2025.

This shift heightened fears of sustained higher borrowing costs, which could slow economic growth and impact corporate profits. Moreover, US Treasury yields surged making fixed-income investments more attractive relative to equities, leading to a sell-off in the stock market as investors reassessed their portfolios.

The STOXX US index fell 2% and the STOXX US Small Cap fell 2.5% for the week ending January 10, as smaller companies tend to be more leveraged and are therefore more impacted by higher borrowing costs. Notably, US large caps (25%) have been outpacing US small caps (15%) for most of last year, finishing 2024 ten percentage points ahead of their smaller counterparts.

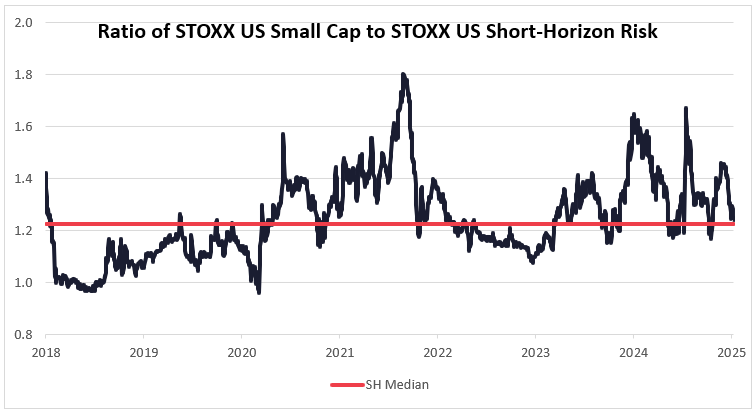

Although both small- and large-cap stocks were down last week, the risk for large caps remained flat while the risk for small caps fell slightly. At the beginning of 2024, the risk of the STOXX US Small Cap index was 60% higher than that of the STOXX US index. Since then, the relative riskiness of the Small Cap index has decreased, approaching the seven-year median of 22%. STOXX US Small Cap’s current 19% volatility is about 4 percentage points higher than that of the Large Cap Index, as measured by Axioma US Small Cap and All Cap fundamental short-horizon models, respectively.

See graph from the STOXX US Small Cap Equity Risk Monitor as of January 10, 2025:

The following chart does not appear in the Equity Risk Monitors, but is available on request:

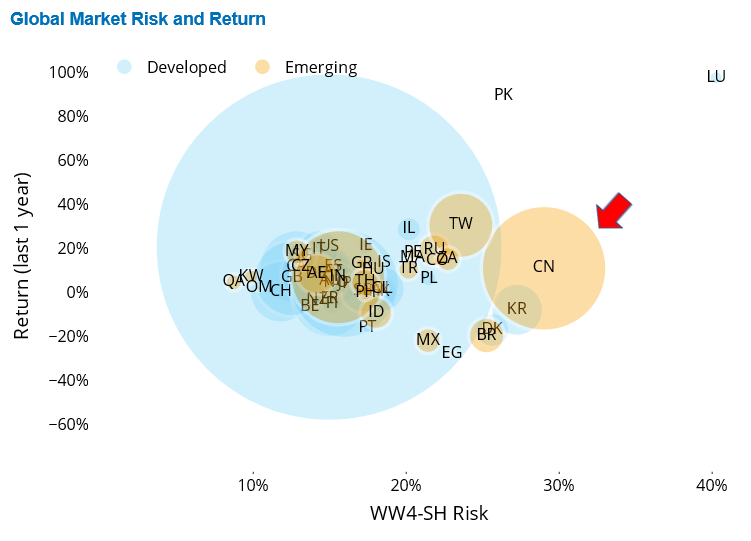

China experiences one of the worst starts of the year

China experienced one of the worst starts of the year, faced with weak economic data, potential escalating geopolitical tensions related to US - China trade relations, negative investor sentiment, and currency pressures.

Weaker-than-expected manufacturing activity in December 2024 contributed to a negative market outlook. Investors were particularly concerned about the potential steep US tariffs on Chinese imports, which could exacerbate trade tensions and impact economic growth. At the same time, the Chinese yuan faced downward pressure as investors reacted to the potential for increased tariffs and economic instability. This led to efforts by Chinese authorities in early January to stabilize both the currency and the stock market, but these measures were insufficient to prevent declines in equity prices.

The STOXX China A 900 index fell more than 5% in the first two weeks of the year, the largest decline among all regions tracked by the Equity Risk Monitors. This decline came after the Chinese index gained 11% in 2024, when the Chinese government implemented ample stimulus packages to prop up the Chinese market.

China is also one of the riskiest among major developed and emerging countries. China’s current risk of nearly 30% is double that of the US and of India, as measured by Axioma Worldwide fundamental short-horizon model.

See graph from the Equity Risk Monitors as of January 10, 2025:

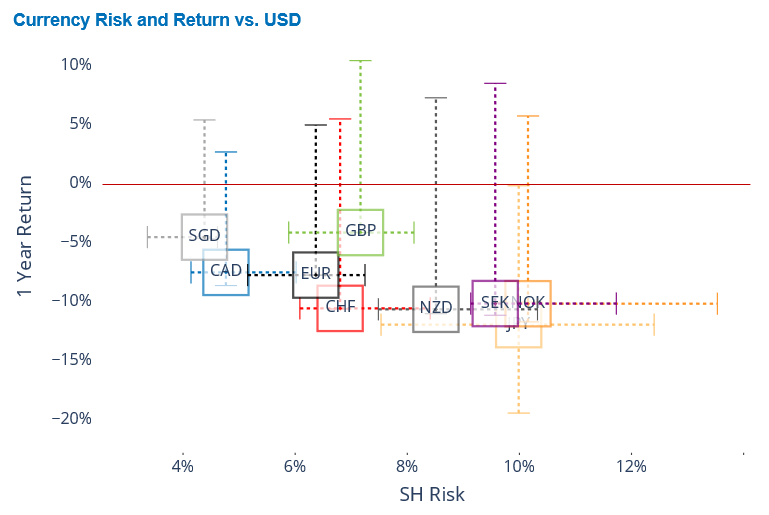

The US dollar strengthens further in 2025

The US dollar has continued to strengthen in 2025 due to several interrelated factors that have bolstered its appeal in the global market: Trump’s proposed tariff policies driving inflation expectations, the US’s strong economic performance relative to other regions, significant capital inflows into the US market, and global monetary easing in contrast to the Fed’s more conservative approach.

The anticipated implementation of significant tariffs under the incoming Trump administration is expected to create inflationary pressures, which would keep interest rates higher for longer. The US economy is projected to outperform its global peers, particularly Europe and Japan, which are facing slower growth and deeper rate cuts from their central banks. This makes US assets more attractive to international investors, driving capital inflows into the US dollar. The Fed's more measured approach to easing compared to other central banks enhances the dollar's position as a safe haven and a preferred currency for investment during times of global uncertainty.

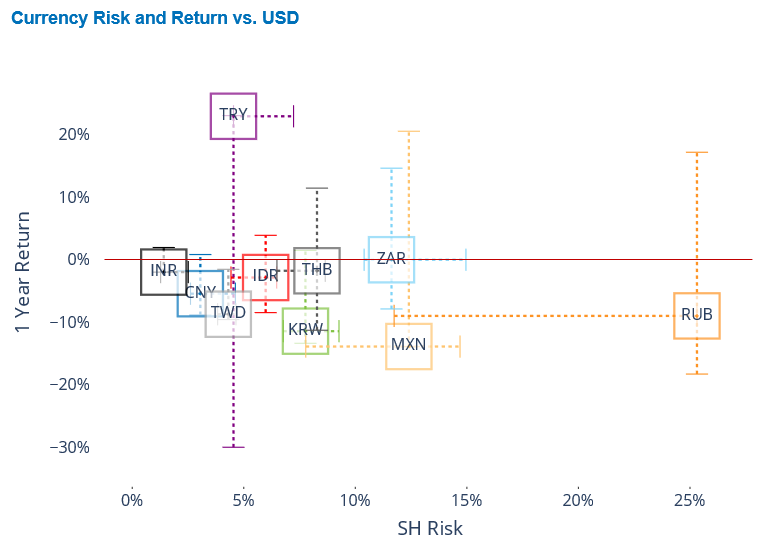

All major developed currencies’ one-year returns are now in negative territory, dipping near or to the low ends of their twelve-month return ranges against the US dollar. The Japanese yen remained the biggest loser over the 12-month period, though it is now not significantly further behind its peers.

Among emerging market currencies, only the Turkish lira was not affected by the strengthening of the greenback, while all others saw negative one-year returns. The Mexican peso recorded the largest loss (14%) and was pushed to the low end of its one-year return range.

See graph from the STOXX Developed World Equity Risk Monitor as of January 10, 2025:

See graph from the STOXX Emerging Markets Equity Risk Monitor as of January 10, 2025:

You may also like