EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 3, 2025

Happy new year to all our readers! This week’s highlights focus on market and US factor performance in the fourth quarter. In addition, we break down the performance into pre- and post-Fed Meeting periods, when sentiment abruptly shifted.

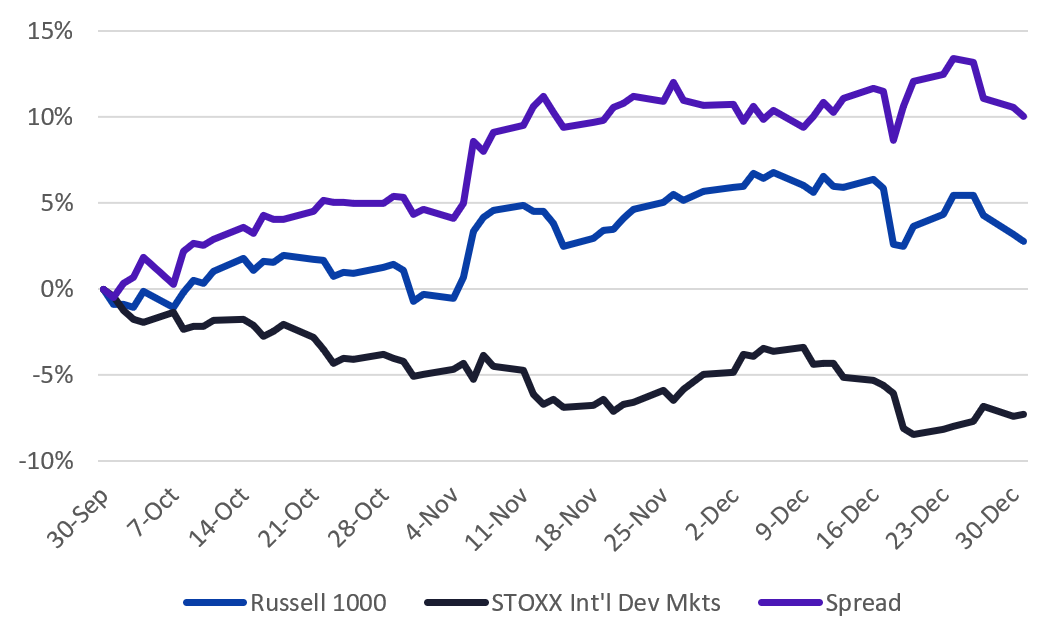

The US market dominated its developed-market counterparts in Q4

Markets diverged sharply in the fourth quarter, with the Russell 1000 gaining 2.75% while the STOXX International Developed Markets index fell 7.29% (Exhibit 1). To put this quarterly spread of more than 10% in a historical context, since 1997 the only other time it has been wider in favor of the US was the third quarter of 2008. The spread was similar in the fourth quarter of 1997 as well. For the 2008 occurrence, the spread turned the other way for three of the next four quarters (that is, non-US stocks outperformed), and a year later the relative loss for non-US stocks had been regained. In 1997 it took closer to two years to see the returns between US and nonUS converge. Although conclusions from only two observations are suspect, non-US stocks may be poised for a relative recovery.

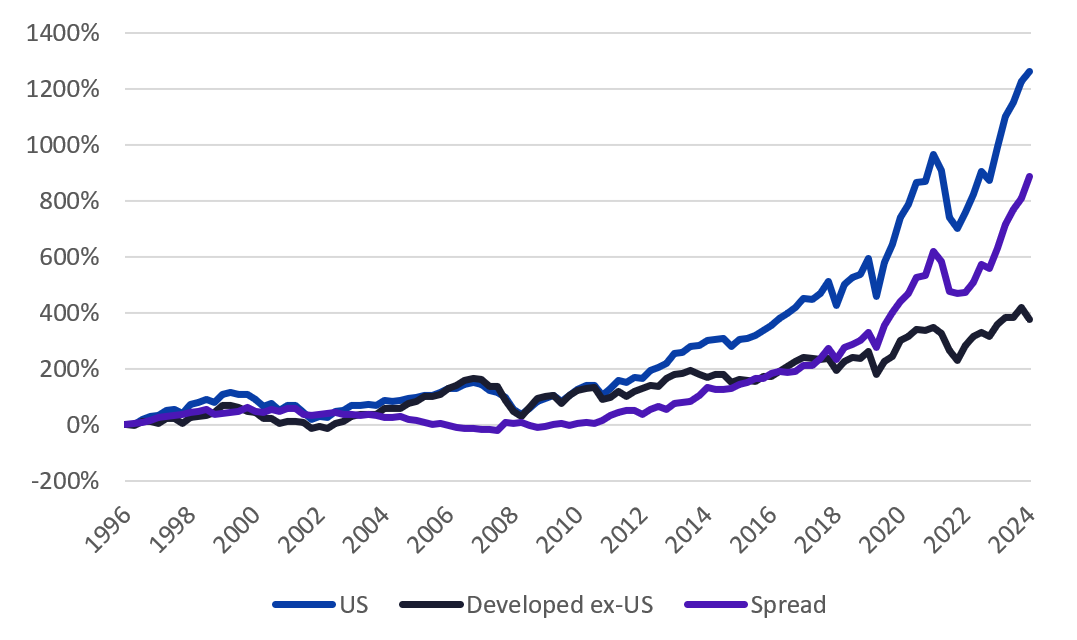

While the fourth quarter US outperformance is not unusual, the magnitude is. Over the long-term quarterly return spreads (US – non-US) were smaller than we saw in the fourth quarter, averaging less than 2%. Still, it has been tough for non-US stocks for a long time, and the US has steadily outperformed the rest of the developed world since 2010 (Exhibit 2)

Exhibit 1. 2024 returns, US vs. non-US stocks

Source: Russell Investments, STOXX, SimCorp

Exhibit 2. Long-term returns, US vs. non-US stocks, based on Axioma core market portfolios

This analysis uses the Axioma US core and Developed markets ex-US core portfolios as we have more history for those.

Source: SimCorp, Axioma Core Market Portfolios

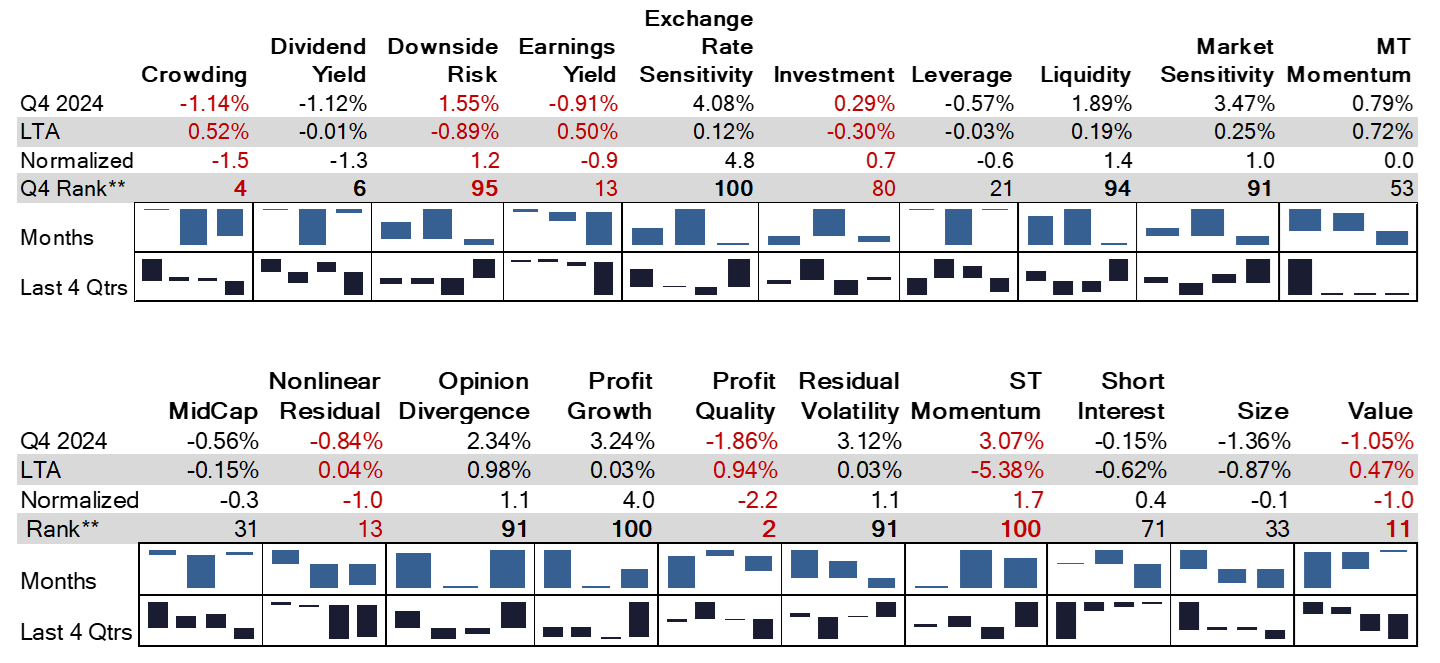

Style factor performance in Q4 surprised many

The magnitude of returns to many of the US5 style factors was high relative to history, with 11 of the 20 factors seeing returns that fell into the top or bottom decile relative to history and five others were in or close to the top or bottom quintile (Exhibit 3). Eight factors produced returns that were in the opposite direction to their long-term average; notably, returns to Crowding, Earnings Yield, Profit Quality and Value were negative, while they would be expected to be positive based on long-term results. At the same time Downside Risk, Investment and Short-Term Momentum all saw positive returns when the long-term average is negative. The combination of these unexpected returns may have meant that style-based managers had a difficult time last quarter.

Two factors not usually associated with long-term risk premia (in other words, the long-term average return is close to zero) also produced unusually high returns. Exchange Rate Sensitivity returned more than 4%, meaning that stocks with positive exposure to the US dollar surged, while those with negative exposure lagged. This return was almost five standard deviations above the long-term average quarterly result. Similarly, Profit Growth had a four-standard-deviation event with a gain of more than 3%, when on average its return is very close to zero. Again, any unintended exposures to these factors may have had a larger-than-expected impact on active portfolio returns.

Exhibit 3. Quarterly style factor returns and rankings, US5 model

Notes: LTA is the long-term average quarterly return, based on model results since inception in 1982. Normalized subtracts the long-term average from the current quarter and divides by the long-term standard deviation of quarterly returns. Rank is the percentile ranking of the current quarter relative to the 172 quarters of history. Returns are based on the Axioma medium-horizon fundamental model with the exception of Opinion Divergence and Short-Term Momentum, which are from the short-horizon variant. For more information contact your SimCorp representative.

Source: SimCorp, Axioma US5 fundamental models

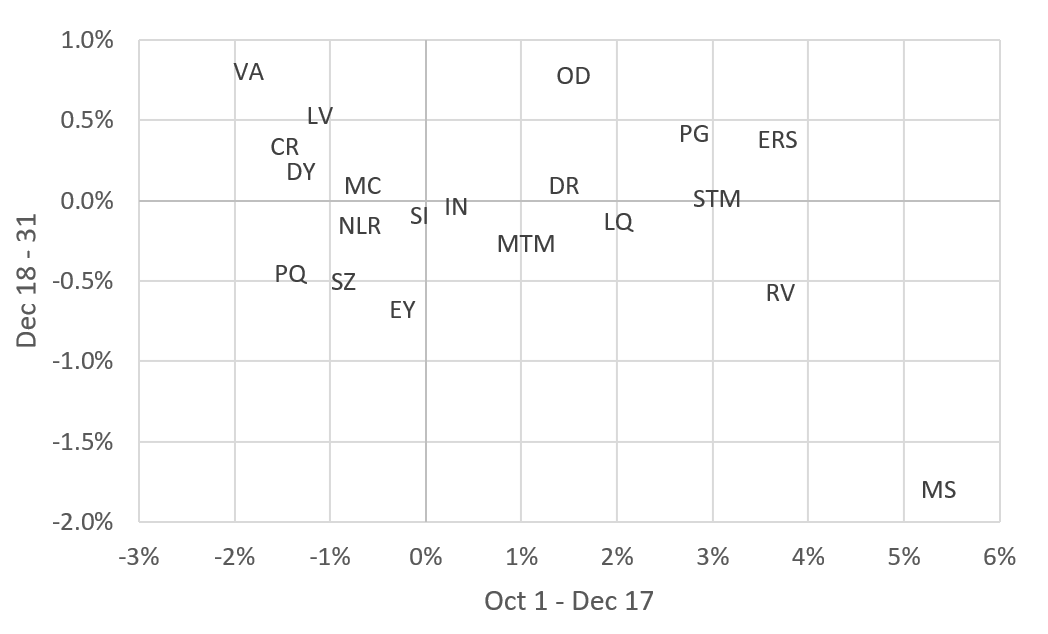

The fourth quarter was three markets in one…

Two main exogenous events drove US stocks in the quarter – the election and the Fed. We have previously written about the election’s impact on performance of the factors in our US5 model (see here). This week we will discuss the impact of the December 18 US Federal Reserve meeting, and the hint that the pace of rate reductions may be slower, on the fourth quarter’s factor returns.

From the beginning of the quarter through December 17th investors were in risk-on mode, as evidenced by high returns for Downside Risk, Market Sensitivity and Residual Volatility. Strength in the US dollar fueled high return for Exchange Rate Sensitivity (Exhibit 4). Medium-Term Momentum was strong, although there was some evidence of sentiment shifts in the negative return to Crowding and close to zero return for Short Interest. Value and Dividend Yield were seeing negative performance, as was Earnings Yield to a lesser degree.

After the Fed meeting the US market fell, and as it did so investor preferences shifted as well, to a somewhat more defensive stance. Market Sensitivity and Residual Volatility returns turned negative, although Downside Risk remained slightly positive. Value and Dividend Yield’s fortunes reversed to positive performance, although Earnings Yield’s return became more negative. Liquidity went from a highly positive performance to a slightly negative one, not surprising in a market sell-off when investors tend to sell winners. The leadership change meant a shortfall in Medium-Term Momentum’s performance, and Crowding turned positive.

Overall, more than half the model factors changed direction, with Market Sensitivity standing out the most. Active portfolio performance going into the post-Fed meeting period may have seen an abrupt change as well, making the end of the year unusually volatile, but we hope not too difficult to manage through.

Exhibit 4. US5 factor returns pre- and post-December 18 Fed meeting

Source: SimCorp, Axioma US5 fundamental models

You may also like