EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 1, 2024

In the final trading week before the presidential election, the United States equity markets remain quite calm. While the Russell 1000 index was down 1.16% for the week, this was mainly due to negative reactions to the earnings announcements for many of the tech heavyweights, including Apple and Microsoft who issued lower than expected guidance, and the capex plans of nearly all the top tech companies spooked investors.

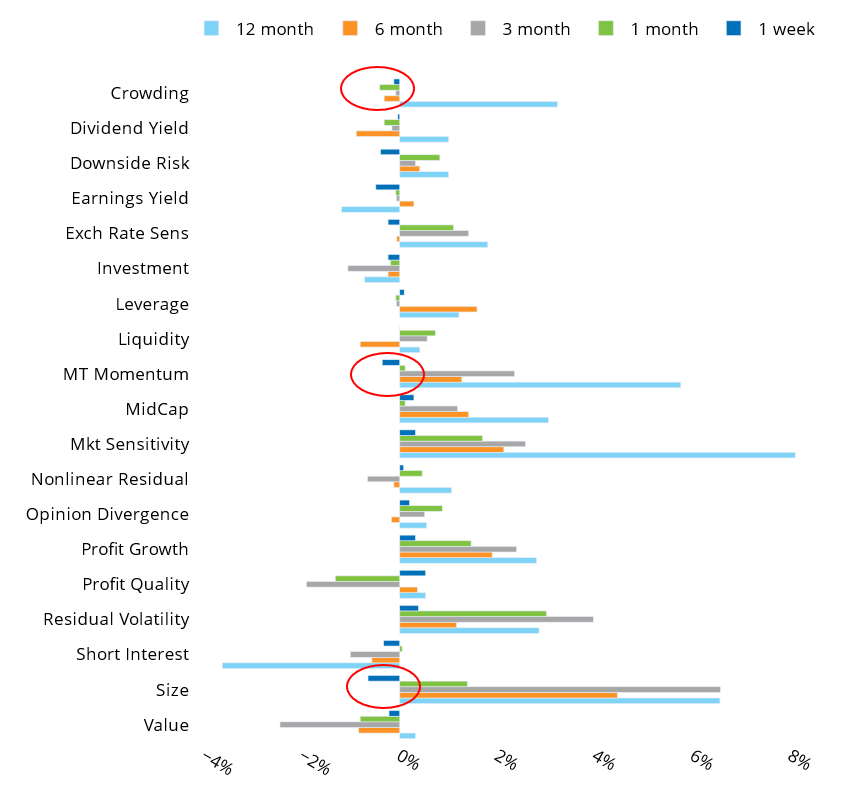

We saw this in negative factor returns to Medium-Term Momentum, Crowding as well as Size, down 36, 12, and 65 basis points respectively, over the week:

See Chart 15, US 5.1 Equity Risk Monitor, November 1, 2024:

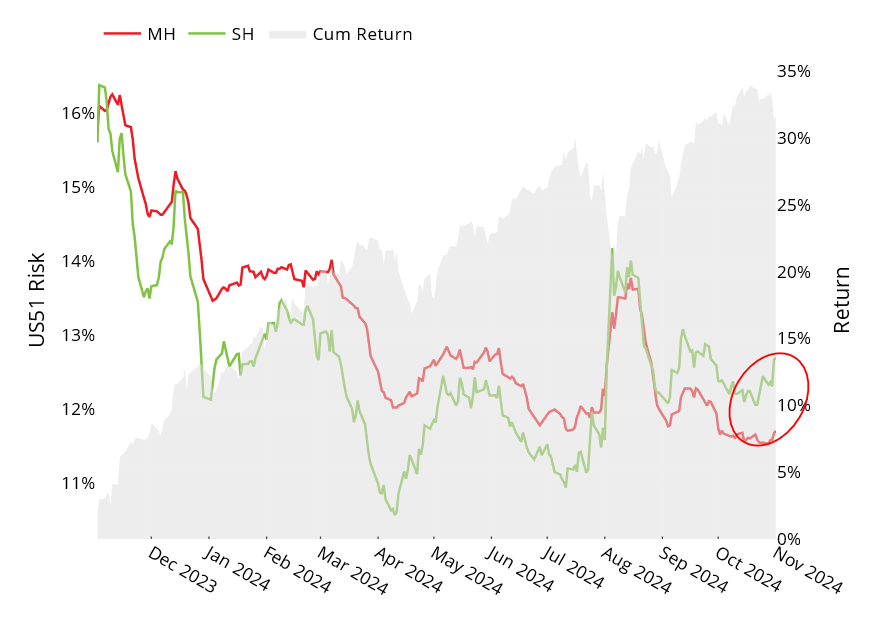

There has been a slight uptick in forecast risk from both the medium- and Short-horizon US 5.1 fundamental models, more pronounced and longer lived in the Short Horizon model, in which the market risk forecast has increased by 5% since October 21st (from 12.06% to 12.7%) while the Medium-Horizon model is just now starting to tick up, up 1.4% over the week (from 11.55% to 11.71%):

See Chart 7, US 5.1 Equity Risk Monitor, November 1, 2024:

As usual, the Short Horizon model’s greater emphasis on the most recent factor returns makes it more reactive to recent changes in the market, and we expect the medium-horizon model to lag it more generally.

This does not necessarily portend a coming shift to a higher volatility regime after the election but certainly there have been signs of greater uncertainty bubbling under what has been an unusually calm market environment given before such a momentous event.

You may also like