EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED OCTOBER 18, 2024

Axioma Risk Monitor: Volatilities and correlations loosen their grip globally; China emerges as riskiest country amid stimulus efforts; ECB rate cuts boost European market

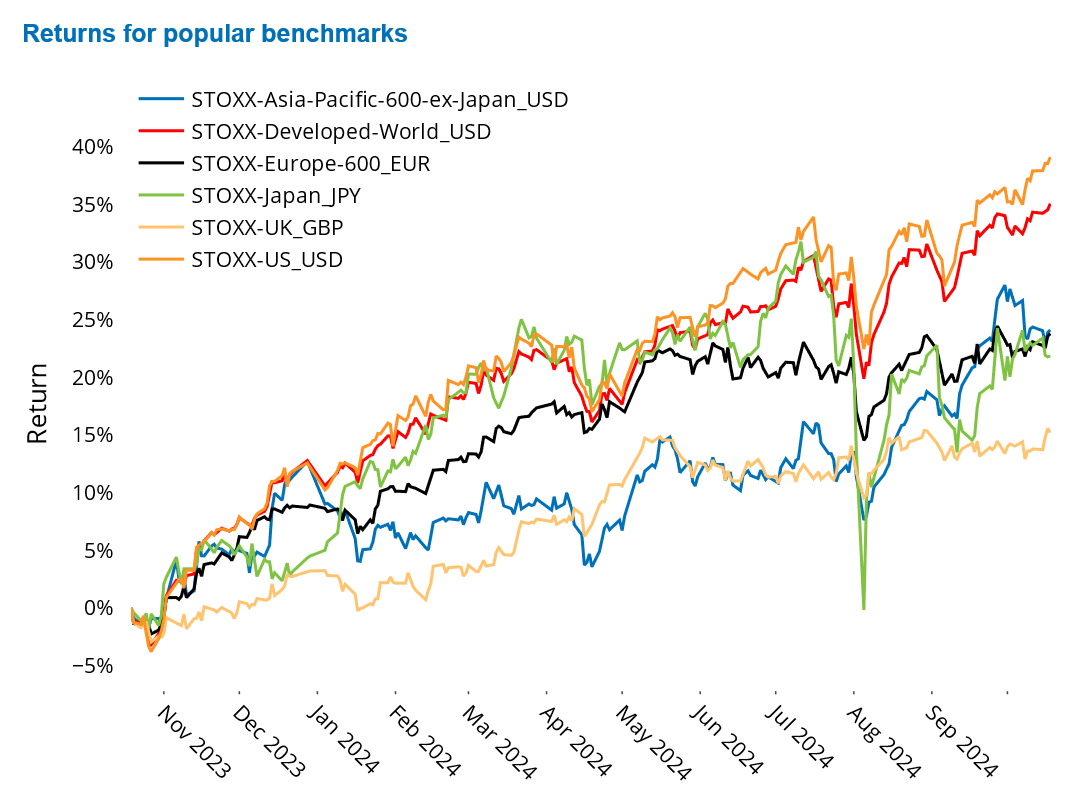

Volatilities and correlations loosen their grip globally

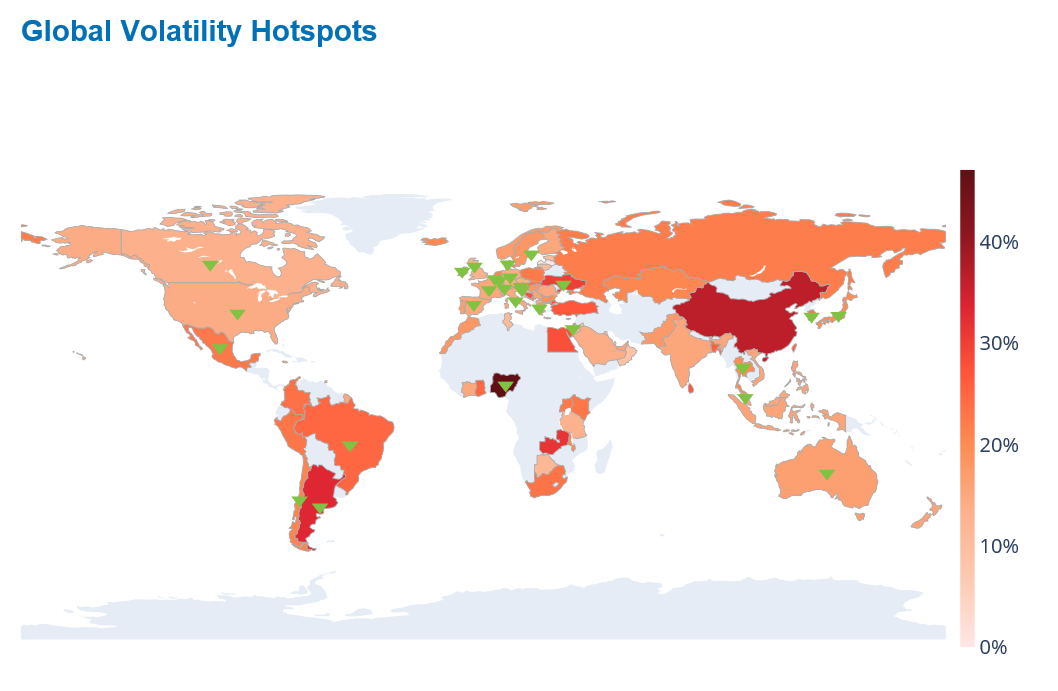

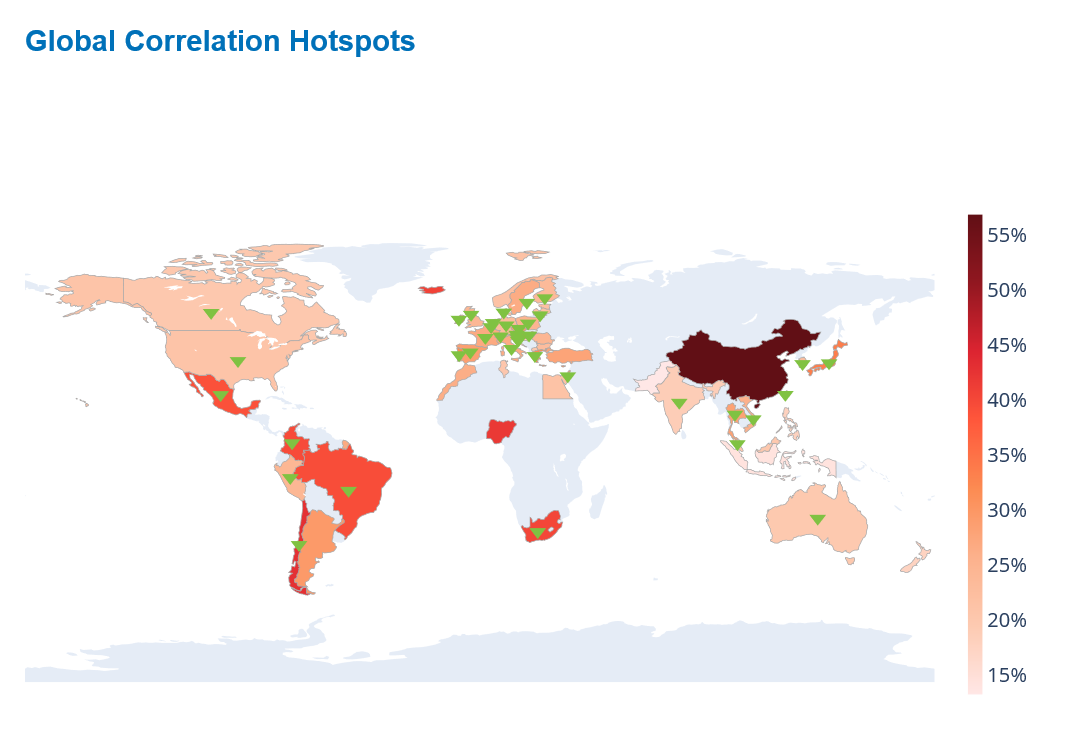

Volatility and correlations around the globe loosened their grip last week. The latest charts of global volatility and correlation hotspots were peppered with downward arrows, reflecting sharp decreases at the individual country level. Axioma’s Worldwide short-horizon fundamental model showed that volatility fell more than one percentage point, while correlations declined by more than two percentage points in most countries last week.

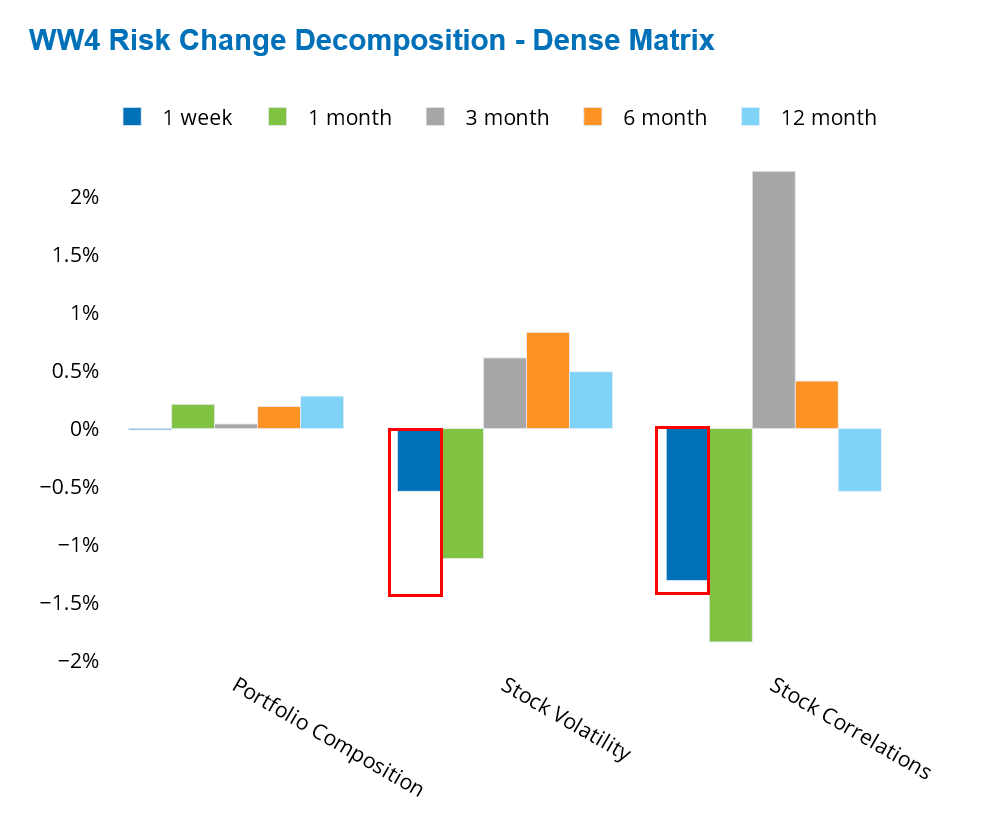

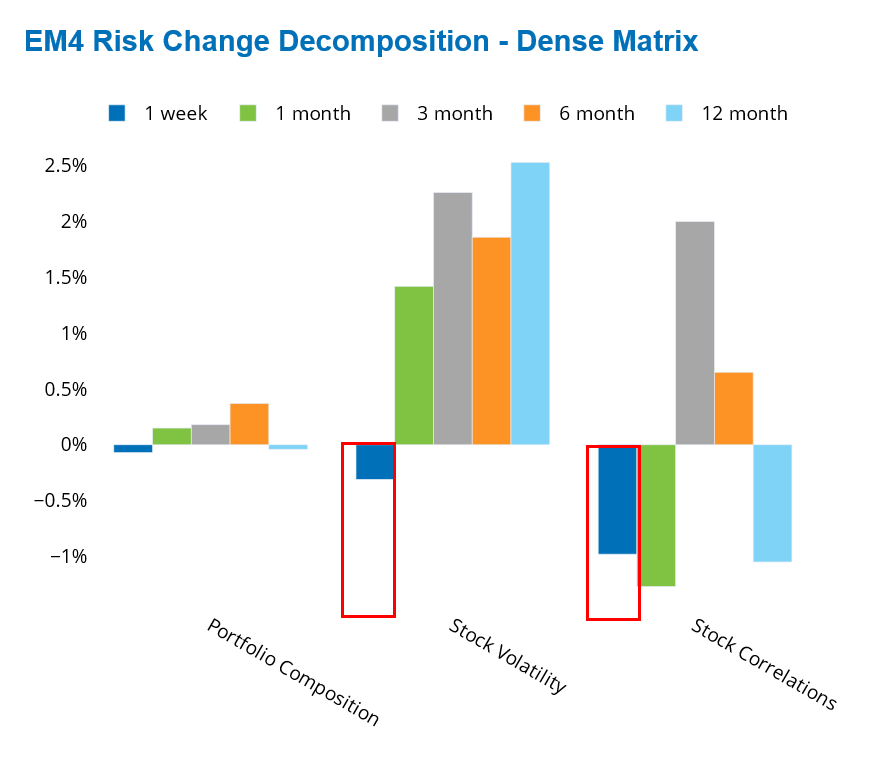

At an aggregate level, the STOXX® Developed Markets index experienced a nearly 200 basis point decline in predicted risk, and the STOXX® Emerging Market index saw a decline of almost 140 basis points over the past five business days, as measured by Axioma’s Worldwide and Emerging Markets fundamental short-horizon models, respectively.

For both indices, the reduction in stock correlations had a greater impact on the overall decrease in forecasted short-horizon risk than the decline in stock volatilities over the past week, as revealed by the decomposition of the change in risk from a dense matrix perspective. After peaking in September, the risk for both Developed and Emerging Markets has since plummeted and is now around the levels seen at the beginning of the year.

See graphs from the Equity Risk Monitors as of October 18, 2024:

See graph from the STOXX Developed World Equity Risk Monitor as of October 18, 2024:

See graph from the STOXX Emerging Markets Equity Risk Monitor as of October 18, 2024:

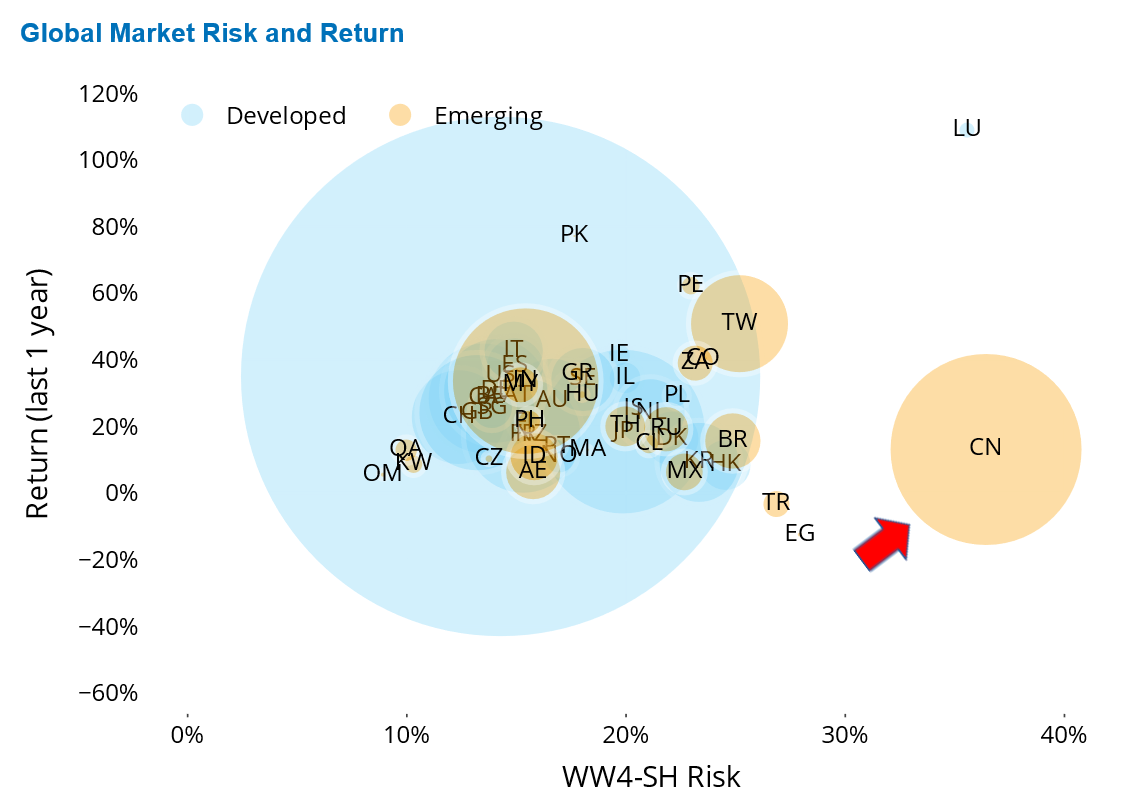

China emerges as riskiest country amid stimulus efforts

China has become the riskiest among major developed and emerging markets. Over the past month, Chinese stocks have swung widely, pushing the market’s risk near 40%, according to Axioma’s Worldwide fundamental short-horizon model. This represents a near doubling of China’s risk over the past month, making it twice as risky as India and almost three times as risky as the US.

After being one of the worst performing countries earlier in the year, Chinese stocks surged 20% in the past four weeks erasing several months of losses. The rebound was fueled by multiple stimulus measures implemented by the Chinese government to prop up its economy. Last week, Chinese stocks posted a modest gain, even though the latest stimulus efforts aimed at the real estate sector fell short of expectations and the third-quarter economic growth disappointed.

After spending most of 2024 in negative territory, China is finally showing a positive one-year return of 13%. In comparison, the US and India have 12-month returns nearing 35%.

See graph from the Equity Risk Monitors as of October 18, 2024:

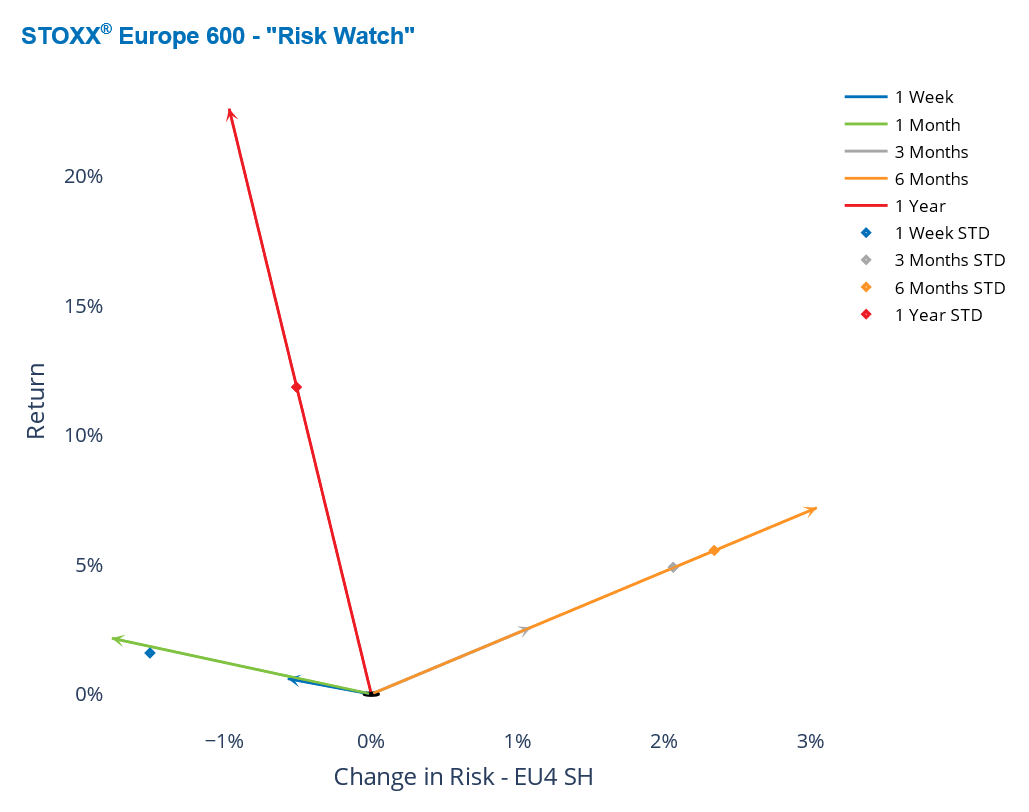

ECB rate cuts boost European market

The European equity market closed the week on a high note, driven by the European Central Bank (ECB)'s decision to cut interest rates for the second consecutive meeting and the third time this year. These rate cuts are intended to bolster economic growth within the European Union.

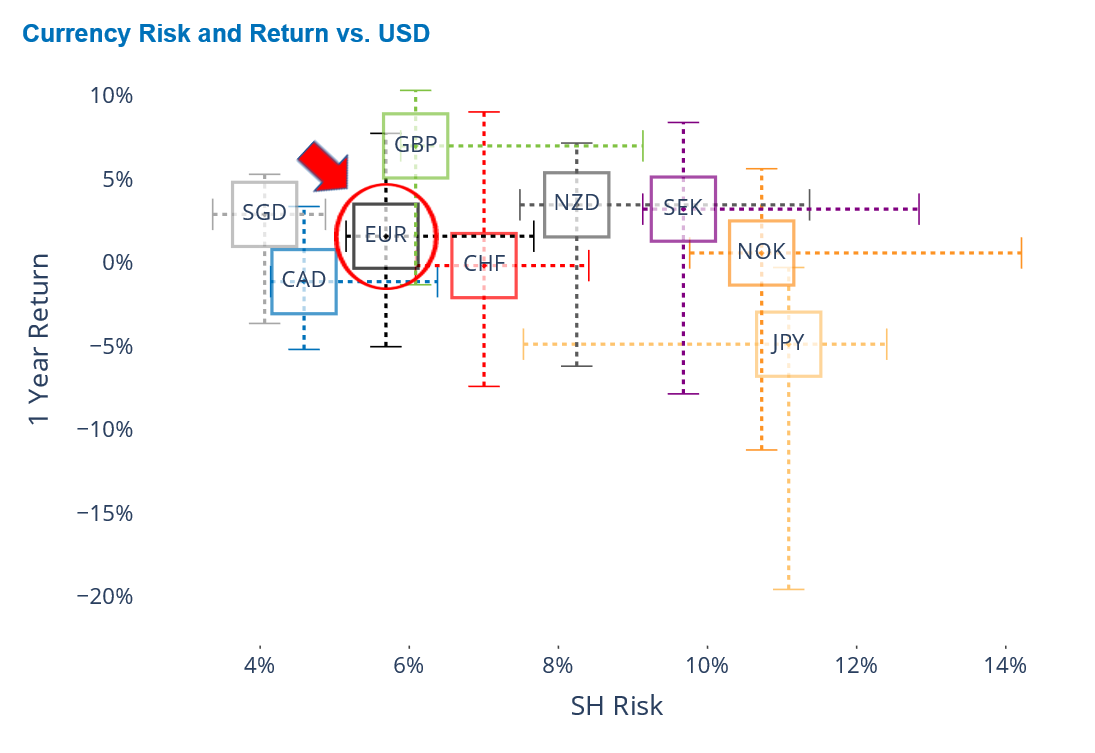

The STOXX Europe 600 index posted a 1% weekly gain, which was within one standard deviation of the expectation at the week’s start. However, its 12-month return of 23% was about two standard deviations above the expectation a year ago. Despite this strong performance, Europe’s one-year return (in local currency) ranks in the middle compared to other major regions.

The ECB’s more aggressive monetary policy, compared to that of the Federal Reserve, has led to a depreciation of the Euro against the dollar over the past month. Nevertheless, the Euro still posted a positive 12-month return against the greenback and was positioned in the middle of its one-year return range. Additionally, the Euro remains one of the least risky developed currencies, sitting near the low end of its one-year volatility range.

See graphs from the Europe Equity Risk Monitor as of October 18, 2024:

You may also like