EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED OCTOBER 4, 2024

This week we are happy to announce a new Equity Risk Monitor that looks at risk from the perspective of the short- and medium-horizon variants of our US5.1 model. This monitor will cover the characteristics of the Russell 1000© Index.

The US5.1 models differ from their predecessor US4 in a number of ways. The US 5.1 model includes several new style factors, including Crowding, Downside Risk (and its remainder, Residual Volatility), Investment, Opinion Divergence (only in the short-horizon model), and a Non-Linear Residual. At the same time some of the existing factor definitions have been revamped. There have been changes to how we define the estimation universe, and we have modified our methodology for conditioning the covariance matrix and specific risk forecasts, using an instantaneous measure of forecast bias to scale forecasts up or down. For more information on this or any of the other Axioma risk models, please contact your SimCorp representative.

This issue of the Equity Risk Monitor Highlights is dedicated to the results we observe from this new monitor.

- US Risk has fallen from a year ago…

- …driven down by lower factor and individual stock volatility

- Size, Medium-Term Momentum, Short Interest and Residual Volatility performance has been notable

- Style factor volatilities remain low

US Risk has fallen from a year ago…

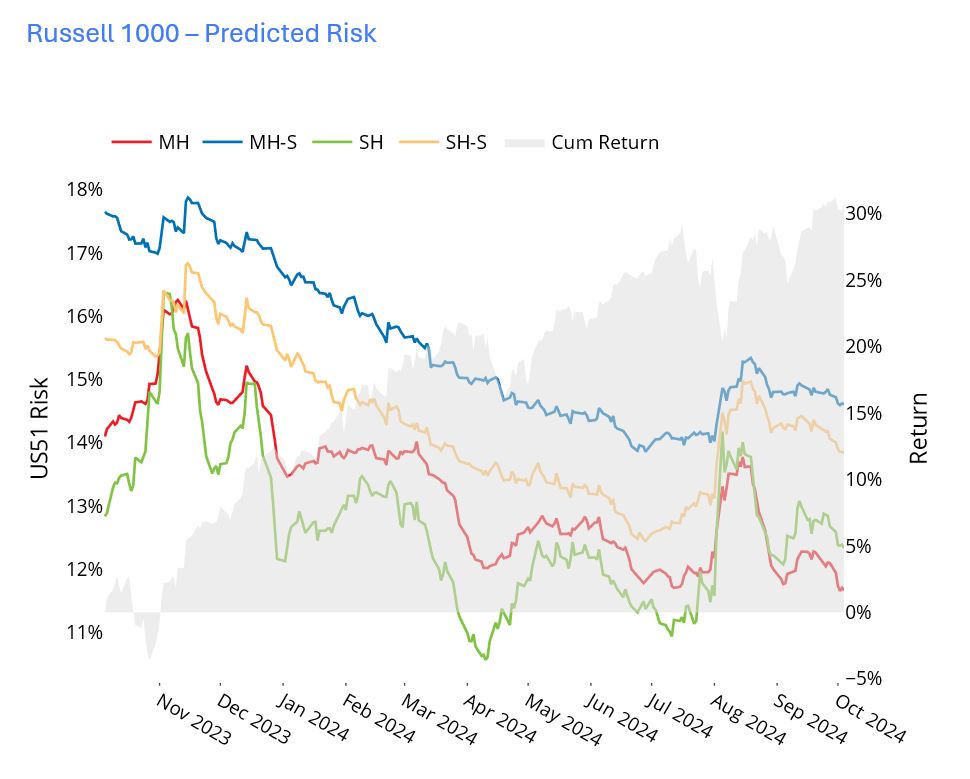

Russell 1000 risk has generally declined this year. We saw a jump up during the August “mini-crash”, but even then risk remained below its level at the start of the year. Short-horizon fundamental predicted volatility bottomed out in April whereas its medium-horizon counterpart saw its 12-month low in August. And medium-horizon risk saw a much bigger and steadier decline than short-horizon.

See graph from the Russell 1000 Risk Monitor dated October 4, 2024:

…driven down by lower factor and individual stock volatility

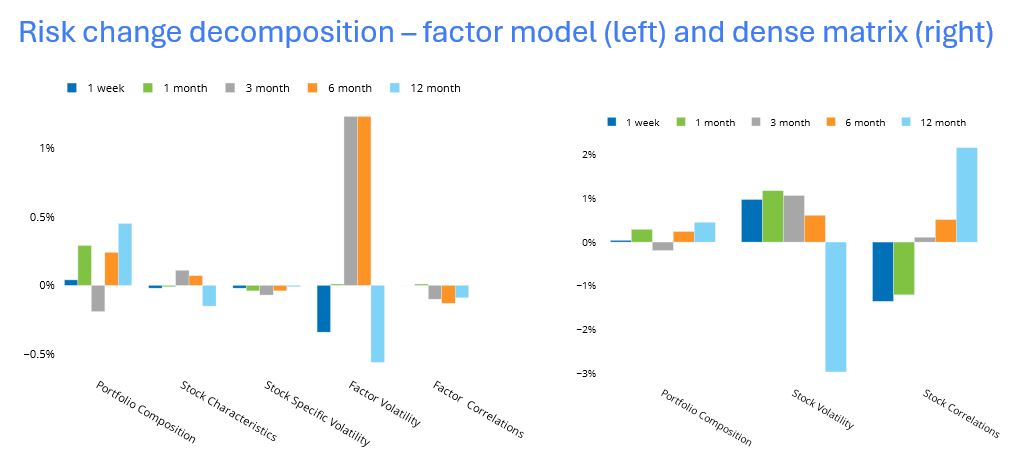

The decomposition of the decline in short-horizon risk from the point of view of the factor model for the 12-month period shows that it was driven mainly by lower factor volatility, offset by an increase in risk from the composition of the portfolio, as measured by the Axioma US5.1 short-horizon fundamental model. As we have written about in the past, the increasing prevalence of risky technology names has changed the nature of the index. Higher factor volatility pushed three- and six-month risk increases, this time adding to the volatility driven by the market concentration in riskier names.

When we decompose risk from the point of view of a dense, asset-asset matrix, we see that the 12-month decline resulted from lower stock volatility, while higher asset-asset correlations kept risk from dropping more. This has reversed more recently, with stock volatility increasing for the last week, month, three months and six months, but correlations falling in the first two.

See graphs from the Russell 1000 Risk Monitor dated October 4, 2024:

Size, Medium-Term Momentum, Short Interest and Residual Volatility performance has been notable

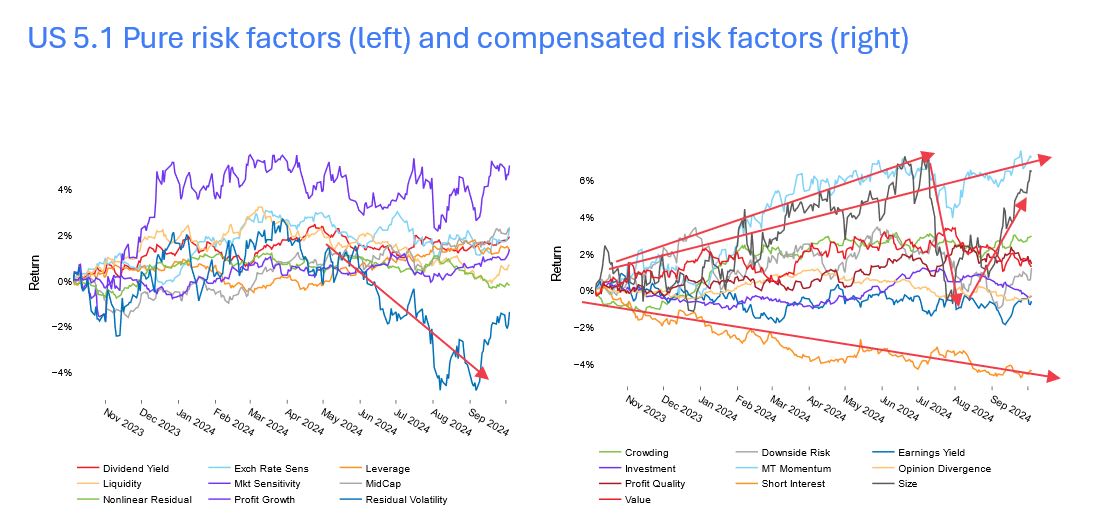

As noted, the number of factors included in the model has increased. We have changed the charts in the Risk Monitor to reflect those that are considered purely risk factors (in other words, there is no long-term risk premium associated with the factor, although of course since it is considered a risk factor there may be substantial short-term performance), and those that on average have significantly positive or negative returns (i.e., compensated factors).

We can see from the chart that most of the pure risk factors have in fact been uncompensated this year, with returns close to zero. One standout, however, is Residual Volatility (which is the volatility after taking into account downside risk). While over the long term this factor’s return is close to zero, from June to August the return was around -5%, which could have had an unexpectedly large impact on a portfolio that did not control for this factor. The Downside Risk + Residual Volatility factors together closely track the Volatility factor from US4. Research has shown that most of the negative return we observed in US4 Volatility comes from those names with the biggest downside risk. The negative return to Residual Volatility in this period suggests higher volatility, even after accounting for high Downside Risk, fared worse than lower volatility.

For the factors we would expect to see positive or negative returns, Medium-Term Momentum has fared quite well, with a higher-magnitude 12-month return than any of the other factors, and one that has been fairly steady throughout the year. Point-to-point, Size has seen almost the same return, as the mega-cap “Magnificent Seven” or its subsets have dominated the market, but Size had a short period of sharp retreat in August, falling almost 7% before resuming its upward path (i.e., stocks of larger companies outperforming those of smaller ones). Finally, Short Interest, with a long-term average annual return of lower than -2%, has far surpassed that level, as investors’ short positions have paid off.

See graphs from the Russell 1000 Risk Monitor dated October 4, 2024:

Style factor volatilities remain low

The lower level of risk in the market as compared with a year ago is also reflected in the predicted volatility of many of the style factors in the Axioma US5.1 medium-horizon model. Most of the style factors have current levels of volatility below the median for the years, and half are within 10% of their 12-month lows. Size stands out not only as the highest volatility – by far – of all the style factors, but also one that is far closer to its yearly high than to the low. This is to be expected, given the up-down-up pattern we outlined earlier. And Exchange Rate Sensitivity is at its highest level of predicted risk for the year, also not surprising given the sharp moves of the US dollar this year, especially since the Fed lowered rates last month.

See graphs from the Russell 1000 Risk Monitor dated October 4, 2024:

Of course, there are many more aspects of US market risk we can see in this new Risk Monitor, and we will certainly be covering them over months and years ahead. Until then, we hope this short discussion highlights Axioma’s newest capabilities and our commitment to research and model improvement.

You may also like