EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JUNE 28, 2024

- 1st Half 2024 Risk Changes

- Factor Performance YTD 2024

1st Half 2024 Risk Changes

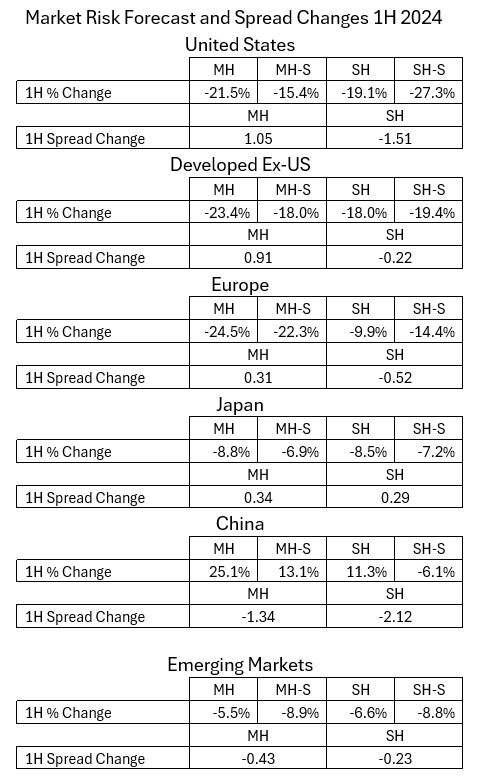

As we close out the 1st half of 2024, it is worth reviewing how risk forecasts have changed in the major markets we cover with our models. The trend was “risk down”, to be sure, but it looks quite different in different markets. The table below is not comprehensive but it is illustrative of the general worldwide trend to lower risk:

The following table and chart are not published with Equity Risk Monitors but are available upon request:

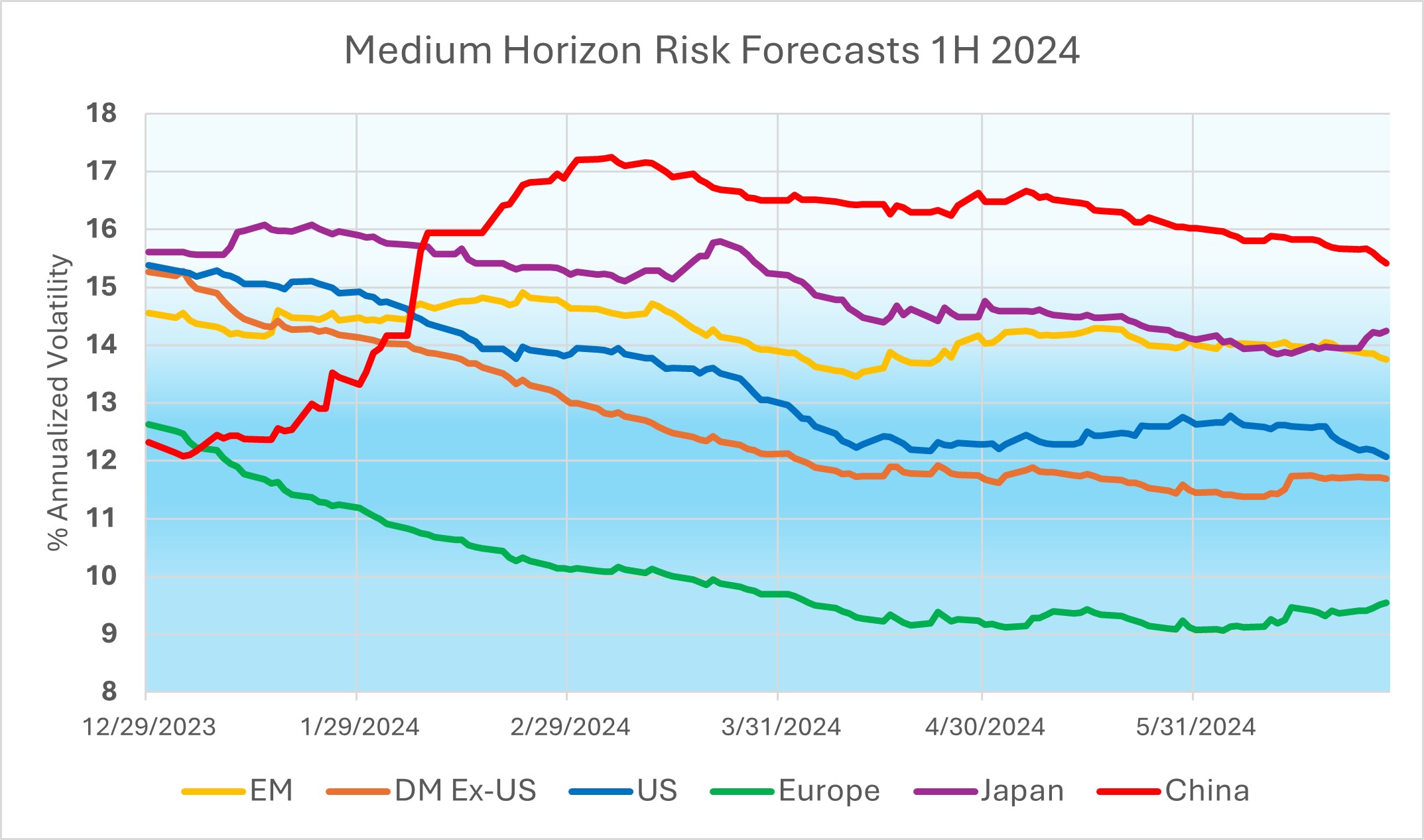

To put this in perspective, we show the Medium-horizon risk forecast levels from each of these models:

We have written about how China has bucked the worldwide “risk-down” trend, but we see that other than the alarming increase in risk in February, risk in that market has trended downwards in a similar fashion to the others.

It is noteworthy that the Statistical-Fundamental risk forecast spreads have gotten narrower in most short horizon models, and wider in most medium horizon models. At the start of the year, most medium horizon statistical models were forecasting lower risk than their fundamental counterparts, while the opposite was true at the short horizons. Now most models show statistical forecasts slightly higher than fundamental model forecasts at both horizons, but the spread is much narrower than at the beginning of the year.

Factor Performance YTD 2024

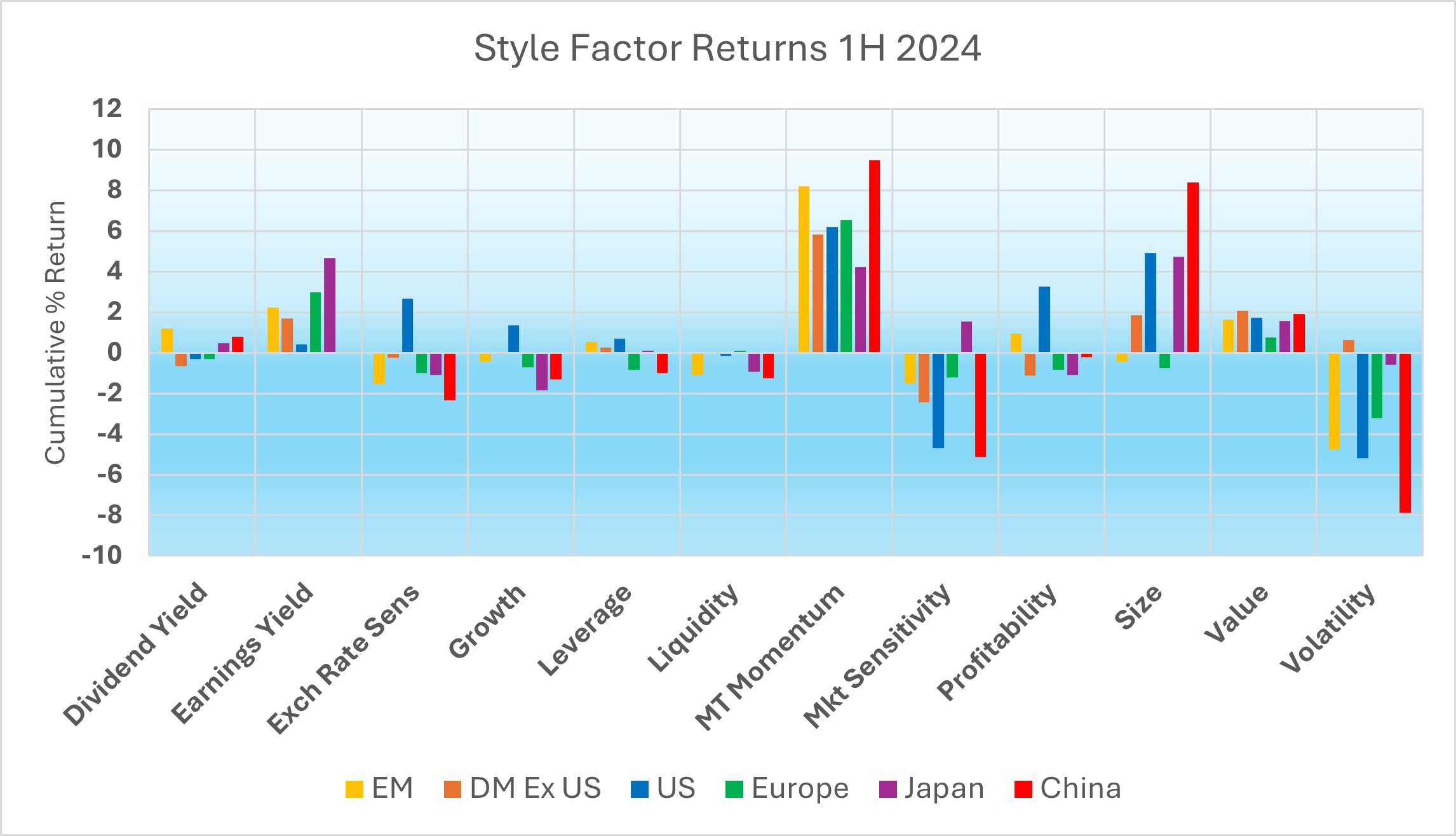

With the exception of Medium-Term Momentum, which appears to be working everywhere, there has been considerable divergence in Style factor performance year to date. Momentum and Size have gone hand-in-hand since the beginning of 2023, but in Europe this has ceased to be the case. In Emerging Markets, Size did not follow this trend last year, and Size persists in its negative risk premia. In China, the divergence between “pure risk” factors on the one hand (Mkt Sensitivity, Volatility), and compensated factors Momentum and Size on the other suggests consolidation in the largest, safest Chinese companies- a shift away from speculation in unbridled growth as the government continues to wring excesses out of the financial system.

We will cover these issues and more in the upcoming Market and Investment Risk Webinar to be held on July 9 at 10 am ET.