EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JUNE 11, 2024

China Risk Drops Precipitously over Q2 2024

As the CCP’s efforts to stabilize the domestic asset markets appear to be working, the China A 900 index’s volatility levels reflect that, with a stupendous drop from just under 20% in February to just 14% now (as measured by the Fundamental and Statistical variants of the Axioma China Short-Horizon model). The Medium horizon variants are slightly higher at around 15.5% but this is structural as these models variants give greater weight to factor returns further in the past.

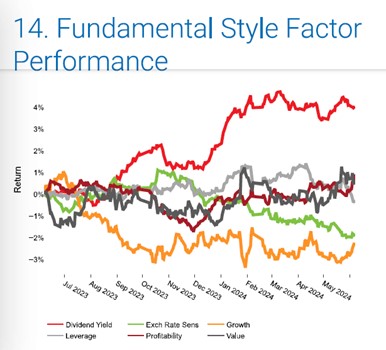

The strongest style factor return in the domestic China market over the last 12 months has been Dividend Yield. Interest rates are relatively low and the yield curve is upward sloping in China. China Dividend Yield has the strongest 12-month return over all the regional models, including Japan where it has also been strong.

By contrast, most developed markets models have shown flat or negative Dividend Yield factor returns.

Europe Risk Up over last 4 weeks

We wrote about lower risk levels in Europe over the course of 2024 YTD, but over the trailing month index risk for the STOXX Europe 600 index actually increased by nearly 100 basis points:

It is likely that this volatility increase was tied to both the pending ECB rate decision (of cutting interest rates by 25 bps) and the European Union elections that took place over the weekend. Last week, the market rallied in anticipation of the ECB decision, up by 1.4%.

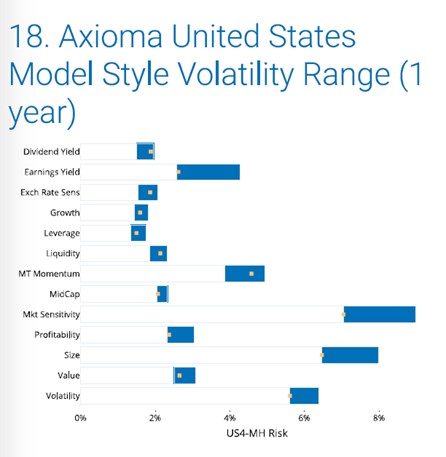

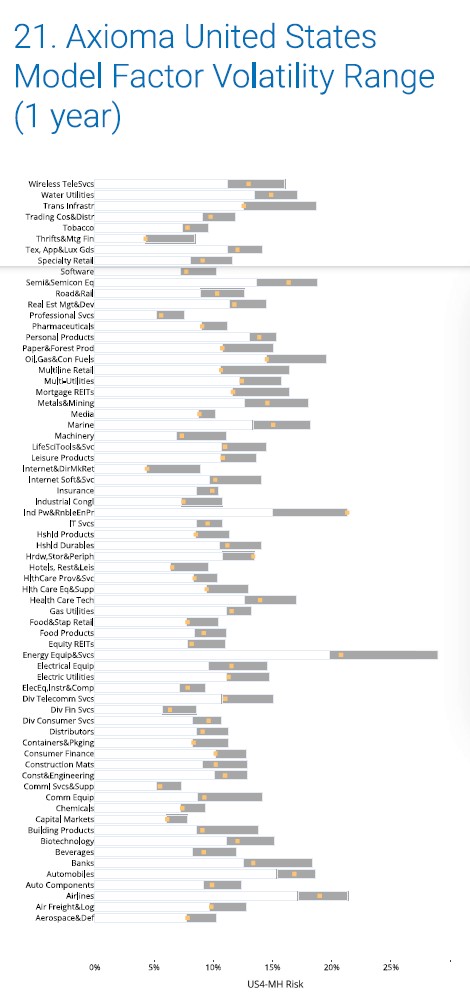

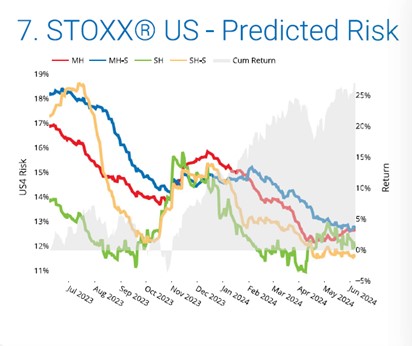

US Factor Risk Drops

All four variants of the Axioma US model are converging between 13% and 12% annualized volatility, with the medium-horizon slightly higher than the short-horizon variants, and the spreads between statistical and fundamental at both horizons very narrow.

In the first week of June, a surprising 50 basis point drop in factor risk has occurred and it indeed appears that both style and industry factors are nearly all at the bottom of their 12-month volatility ranges.