EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED MAY 3, 2024

- Predicted volatility remains low across markets despite recent upticks

- Utilities exhibit unexpected return strength

- Trading volume has fallen, but remains highest in Technology

Predicted volatility remains low across markets despite recent upticks

Recent economic data have hinted that the economy may not be quite as robust as we have been seeing recently, with the dreaded word “stagflation” being revived after many years of dormancy. Reports that inflation may be ticking back up put a pin in the hopes that the Fed will cut rates this year, while first-quarter GDP and jobs growth fell short of expectations. Earnings for the first quarter were reasonably strong however, so the news for equity investors has been decidedly mixed.

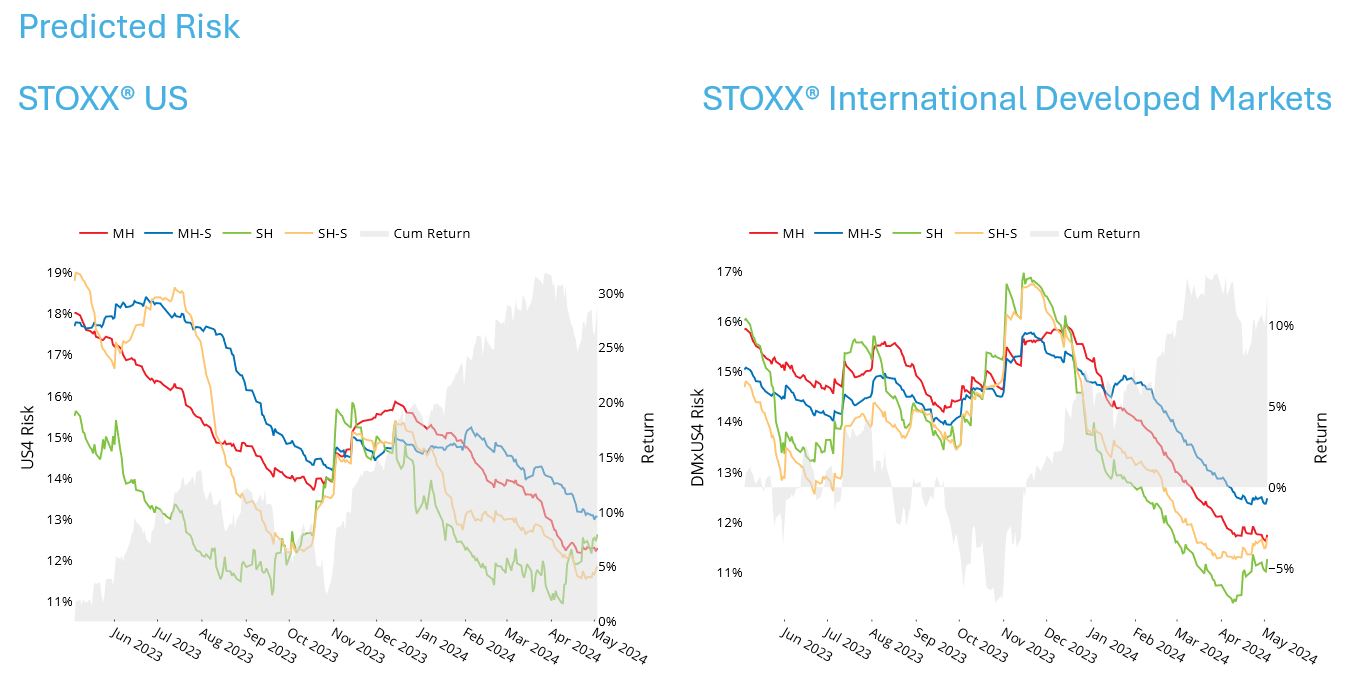

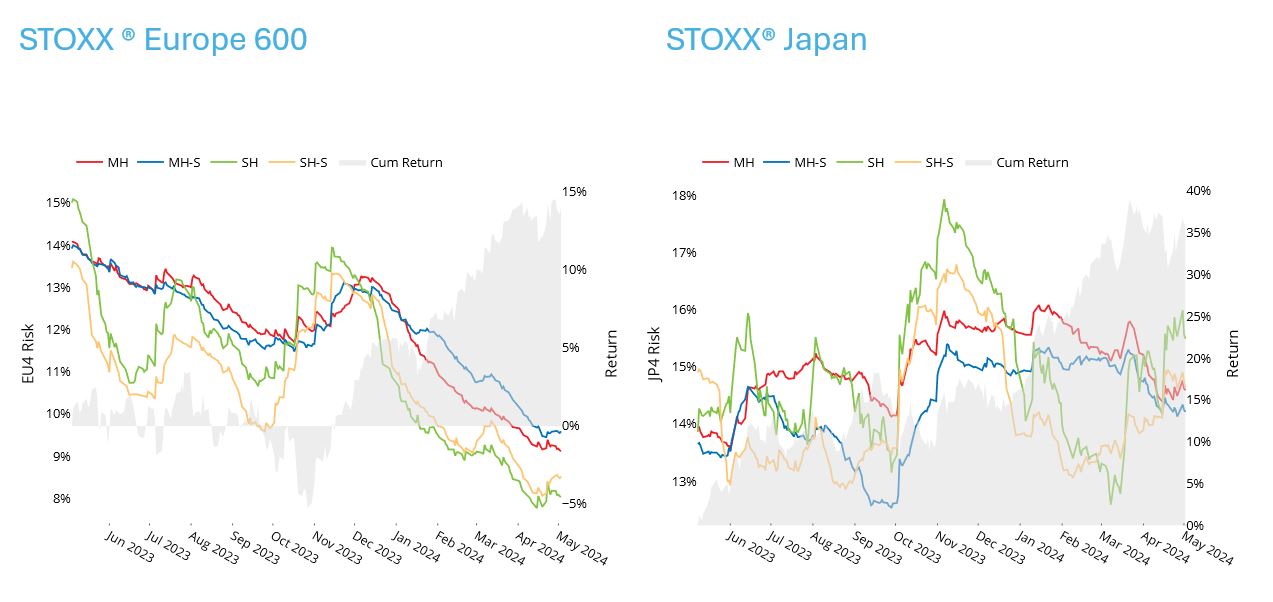

The uncertainty about the path of the economy and Fed actions has not translated into substantially higher equity market volatility, although short-horizon forecasts have ticked up a little in some regions. In the STOXX® US, the short-horizon fundamental model variant of the Axioma US4 risk model rose more than 15% from the recent reached in early April, with a sharp increase in aggregate factor volatility driving risk higher. The short-horizon statistical variant of the same model was down slightly over the same period. Both the statistical and fundamental variants of the Japan version 4 model for the STOXX® Japan index rose about 3%, and in the STOXX® International Developed Markets Index (World ex-US), fundamental risk according to the Developed Markets ex-US model rose about 8% while statistical risk was up almost 4%. In contrast, Europe (as measured by the STOXX® Europe 600) saw fundamental risk remain flat.

Volatility is low versus historical observations in these large markets. It is at roughly the 32nd percentile (where the first percentile would be lowest risk) in the US compared with observations since 1997, and in the 27th percentile in Japan. The historical comparison is even lower in some markets: in the 7th percentile for World ex-US and 6th percentile in Europe. (These rankings are all based on the relevant Axioma short-horizon regional fundamental models.)

Our major fear, one stated numerous times in these comments, is that low volatility may drive overly risky behavior on the part of investors, as they expect that consequences will not be too big. They have been right so far, but we remain concerned.

See graphs from the STOXX US, STOXX International Developed Markets, STOXX Europe 600 and STOXX Japan Equity Risk Monitors as of May 3, 2024:

Utilities exhibit unexpected return strength

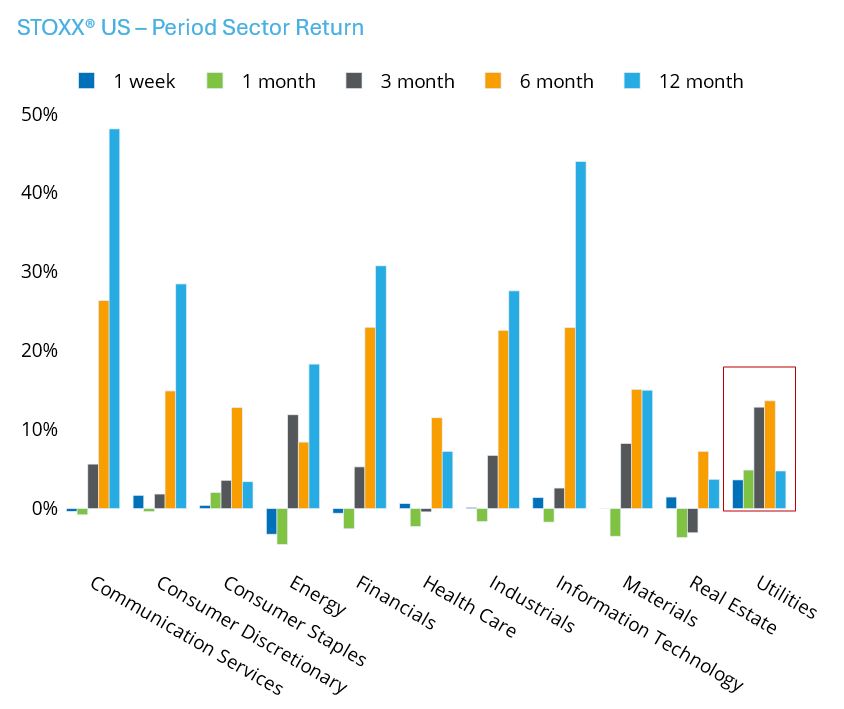

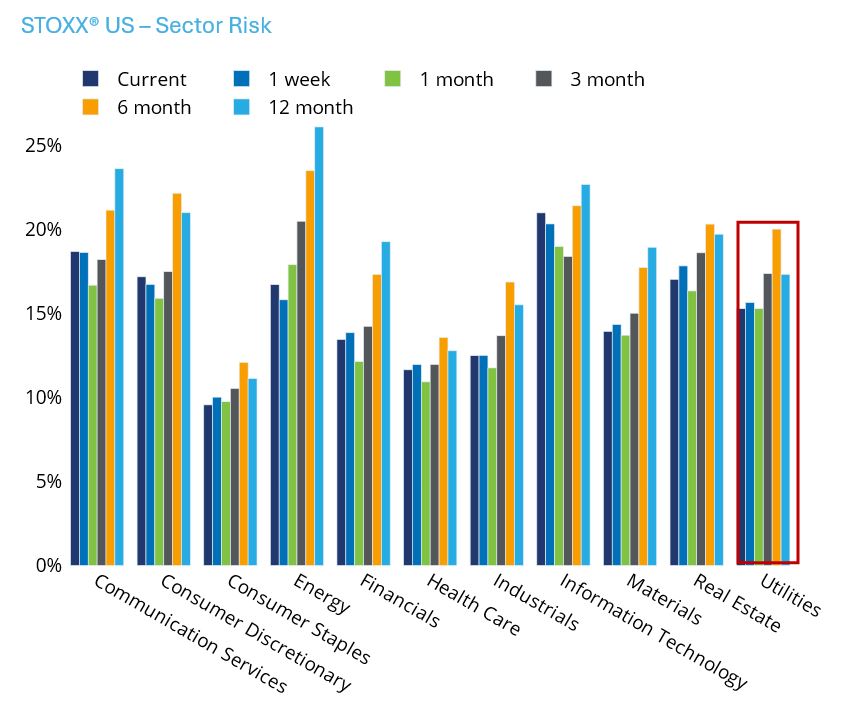

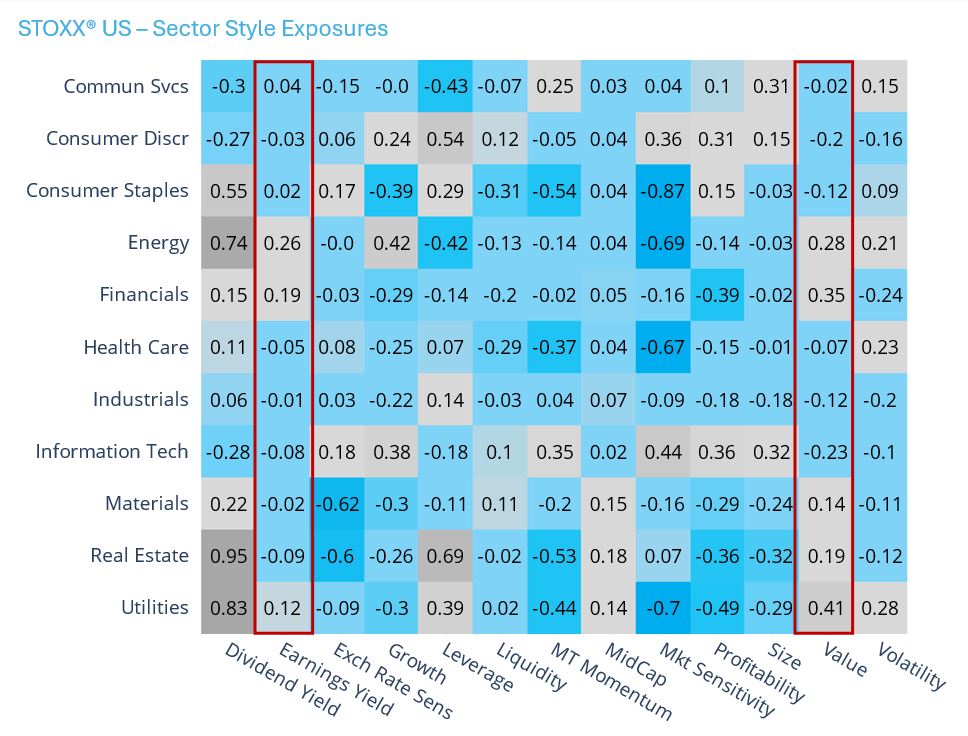

Interestingly, Utilities have been the best performing sector in the US for the last week, month and three months. Non-US utilities have outpaced their sector peers over the past month as well. In an environment of higher interest rates this seems a bit anomalous, as Utilities tend to be very rate sensitive both because of their usual high debt levels and their high dividend yields, which can be used as a source of income in lower interest rate environments.

The sector falls in the middle of the 11 GICS sectors in the STOXX US index in terms of risk currently, whereas a year ago it was closer to being one of the lowest risk sectors. Over the past six months it has seen a bigger decline in predicted volatility than any other sector, and in the past month, when most sectors saw their risk rise, Utilities’ volatility remained flat.

We believe the sector’s outperformance could be the result of mean reversion, as investors have punished the stocks severely when rates started to rise. The sector’s exposure to Value is higher than that of any other sector in the US, and its Earnings Yield is relatively high as well. The recent weaker-than-expected jobs report has boosted (albeit slightly) expectations about rate cuts later this year that may also help the sector. Finally, it seems that AI is reaching into Utilities as well, and may help both operational capabilities and profit margins in the sector.

See graphs from the STOXX US Equity Risk Monitor as of May 3, 2024:

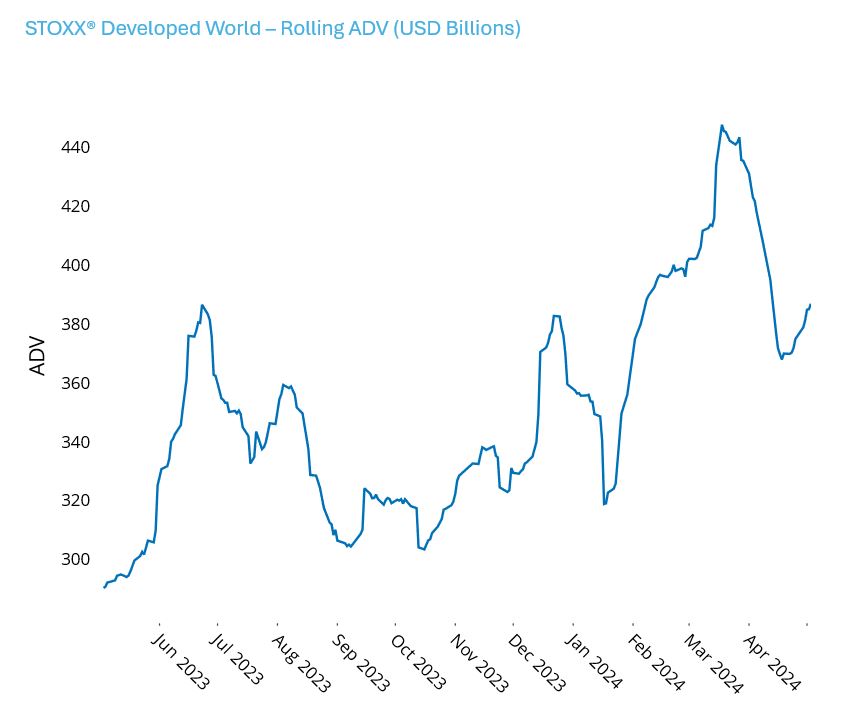

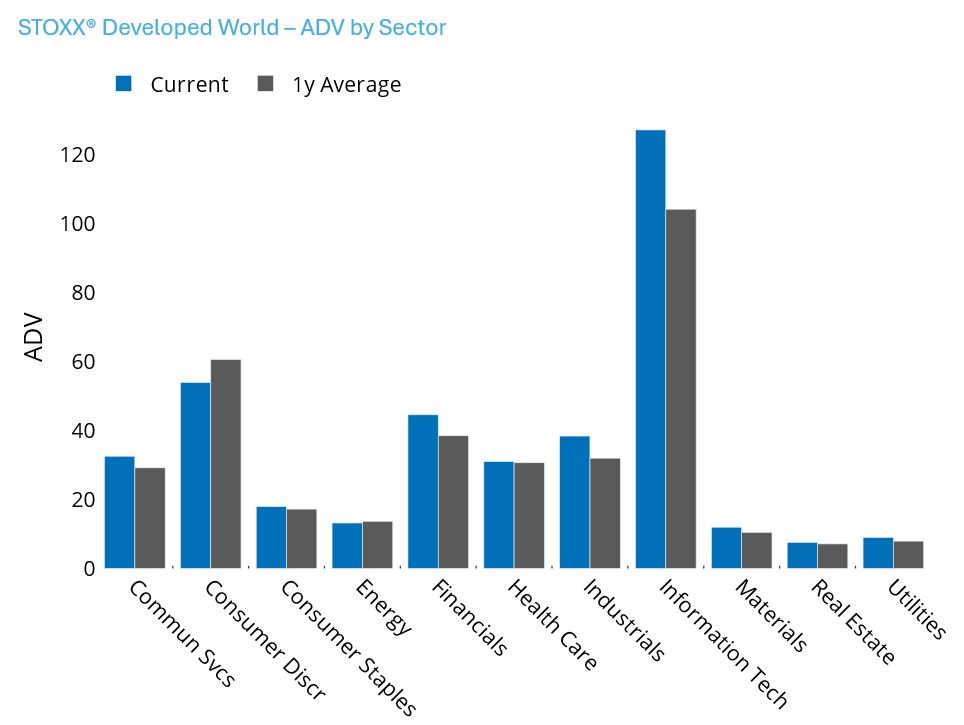

Trading volume has fallen, but remains highest in Technology

Average daily trading volume hit a recent peak in late March, retreated sharply as some of the economic news described above was reported, and then picked up slightly last week. It remains well above its level of a year ago. As we have noted in past commentary, much of the increase in volume has been concentrated in the Information Technology sector, where total volume is also almost twice as high as in the next-highest sector, Consumer Discretionary. As noted, Utilities have fared well over the past six months, but returns were not accompanied by a substantial increase in the relatively low trading volume.

See graphs from the STOXX Developed World Equity Risk Monitor as of May 3, 2024: