T+1 is drawing ever closer. Ready to settle in half the time?

If you cannot support T+1 by May 2024, your ability to trade in North America ends

“The last days of May are among the longest of the year.” – Alice Munro

For investment managers that have not yet started preparing for the May 2024 North American T+1 deadline or are unlikely to meet the deadline with their current infrastructure/operating model, the above quote rings true. And the days in June will seem even longer when they discover that their ability to trade in the US and Canada is severely compromised, if not impossible.

Much has been written about T+1 (SEC announces T+1 settlement for May 2024), but one key factor hasn’t changed. Unlike previous regulations of this type, the SEC is unlikely to change the May 2024 deadline. This is evidenced by the fact that Canada’s regulatory agency recently moved its T+1 deadline from September 2024 to May 2024 to harmonize with the US SEC deadline.

Where exactly are the break points with T+1 versus T+2?

In our discussions with clients, prospects, and industry consultants/advisors, a clear pattern emerges between those who are ready/will be ready for T+1 and those who will struggle to meet the deadline. At present, the trade workflow and timelines look like this:

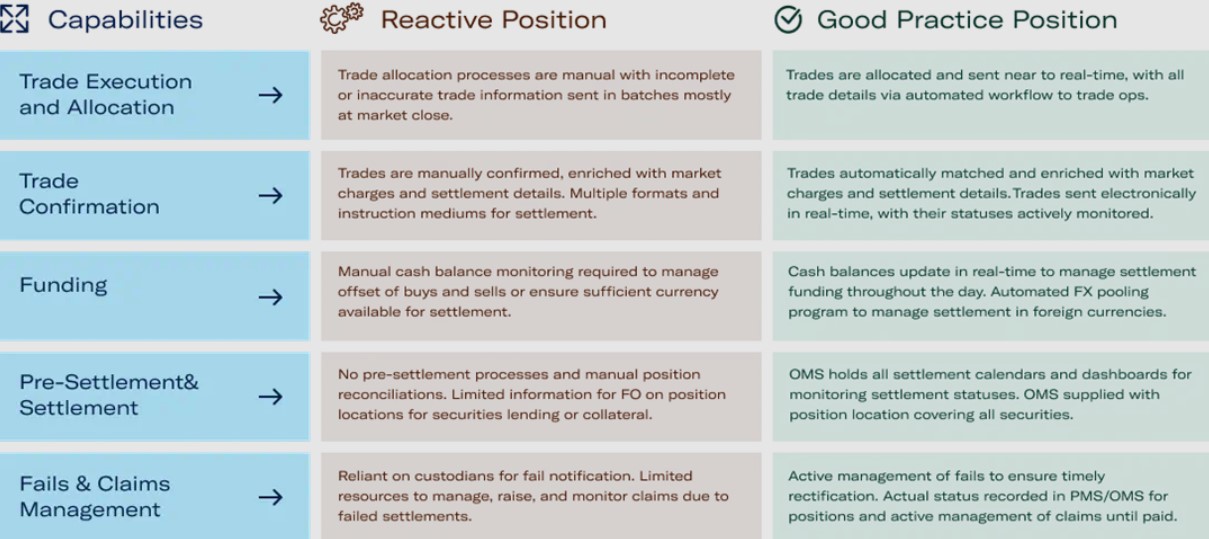

With T+1, the confirmation, settlement and reconciliation steps have to happen almost twice as fast as they do today- with the same degree of accuracy. All of the pre-settlement and settlement activities have to take place within a day of the trade instead of the two days allowed today. The specific activities that need to be accelerated, and the difference between inadequate versus modern infrastructure in supporting this are effectively summarized by Cutter Associates below:

Source: Cutter Associates

Looking at the reactive positions, the word “manual” is quite prominent. The only time manual beats automatic is when one drives a high-performance car, not when you are trying to complete your investment processing within a tight time frame. With automated processes leveraging a single data source, benefitting from near real time metrics and a fully integrated investment management system (whether insourced, outsourced or a hybrid combination), you are in a prime position to support T+1 and remain compliant.

From reactive to active - how SimCorp can have you ready for T+1

All solution vendors will state that they can fully support T+1 and have you ready when the May 2024 deadline comes around. As you know, this is much easier said than done. Without delving into too much detail, here is how SimCorp can have you ready for T+1:

- Market connectivity. For T+1 and investment processing in general, SimCorp’s connectivity to a vast array of venues, custodians and counterparties gives you better data, higher straight-through-processing (STP) rates and enhanced exception handling. T+1 compliance is assured.

- Follow the sun support. Our service operation team is built to ensure that T+1 obligations are met. Should exceptions arise, our “follow the sun” 24/6 operations team are there to deal with them. In particular, our North American operations team specialize in the local market and have strong relationships with custodians, counterparties and the DTCC. If you are located in Europe or Asia, you can rest easy knowing that your T+1 needs are catered to no matter what time it is.

- Open ecosystem. We realize that we cannot cover all possible needs you may have. This is why we have over 100 partnerships with everything from leading providers of specialized functionality, infrastructure, consulting, custodian services and more. The solution partners all have robust, tested API’s to the SimCorp solution and you can select the partners that best fit with your investment workflows and T+1 compliance. Find all of our partners here.

- The only true front-to-back investment management system on the market. Others can and do make this claim, but cobbling together disparate systems via middleware and/or having a behind- the-scenes army of spreadsheet workers does not a true front-to-back system make. SimCorp Dimension is natively built across the front, middle and back offices, which for T+1 purposes means that changes to settlement times can be handled quickly, efficiently and automatically. Have control of your data with uniform view throughout the system, displayed in near real-time, that is accurate and trustworthy.

- Fully SaaS enabled. SimCorp provides SaaS-based solutions. In fact, over the past six years, SimCorp has invested over USD 500 million in research and development into our solutions and continues to do so. The SaaS enabled model gives you the optionality and scale to future proof your operating model and ensure that you are always T+1 compliant.

Related content