EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 15, 2024

Axioma Risk Monitor: US election rally fizzles as rate cut prospects decline; Developed Markets ex-US not excited about the Trump win; Emerging and Developed Market currencies weaken against the US dollar

US election rally fizzles as rate cut prospects decline

The post-election rally lost momentum last week as the likelihood of an imminent interest rate cut by the Fed diminished. Additionally, sectors that could be adversely affected by US policy changes further weighed down the US market. The STOXX US index dropped 2% over the past five business days—a sharp reversal from the strong performance of US stocks earlier in November.

Strong economic data and the Fed’s comments last week raised doubts about whether the Fed would continue to cut rates in the near future. Solid retail sales data on Friday reinforced the case for a strong US economy, suggesting that it may not need support in the form of a rate cut. Additionally, the latest inflation reports were slightly higher than officially expected.

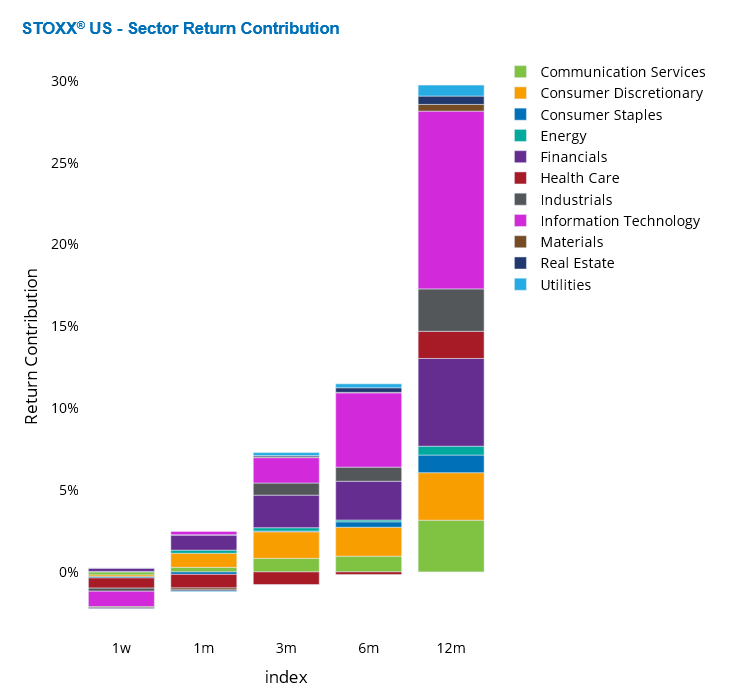

The STOXX US index rose 5% during the first full week of November when the Fed cut interest rates on the heels of the US elections, and investors were optimistic about the prospects of favorable economic policies.

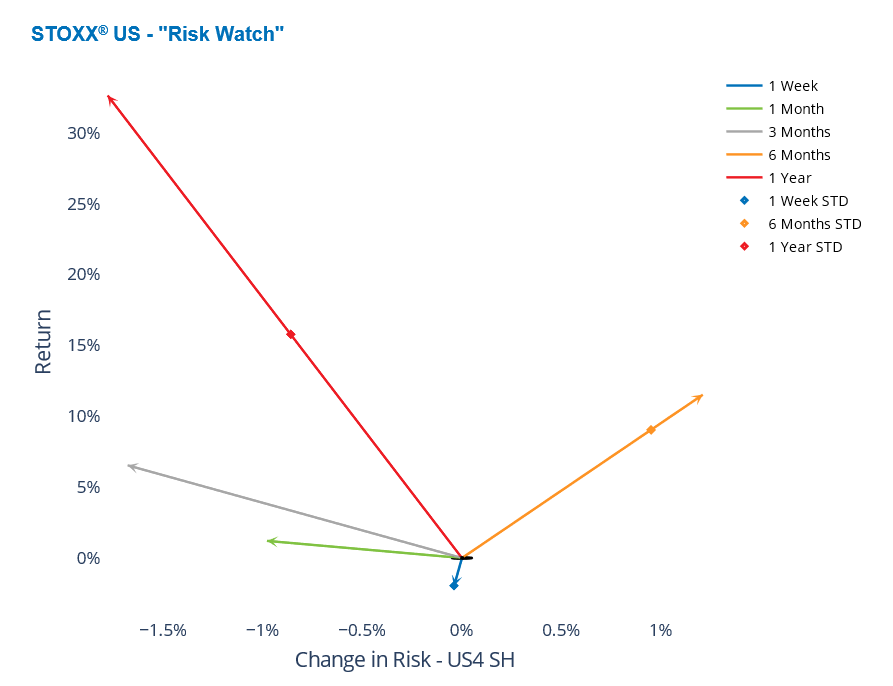

However, even the gains in US stocks on Monday, when US indices reached new highs, were not enough to offset the losses that occurred later last week. Yet, last week’s decline was within one standard deviation of the expectations at the start of the week, according to the Axioma US4 fundamental short-horizon model. At the same time, after the surge immediately following November 5, the forecasted risk for the STOXX US index fell last week, as measured by Axioma US4 fundamental short-horizon model.

All US sectors were down over the past five business days, except for Energy and Financials. Information Technology, Health Care, and Communication Services were the main contributors to the weekly decline of the US market.

Health Care experienced the largest decline (nearly 6%), following the appointment of RFK Jr. as the head of HHS. Although Health Care's weight (10%) is only a third of Information Technology's, it had a comparable impact on the US market decline as the tech sector—the largest US sector—due to its substantial weekly loss.

See graphs from the STOXX US Equity Risk Monitor as of November 15, 2024:

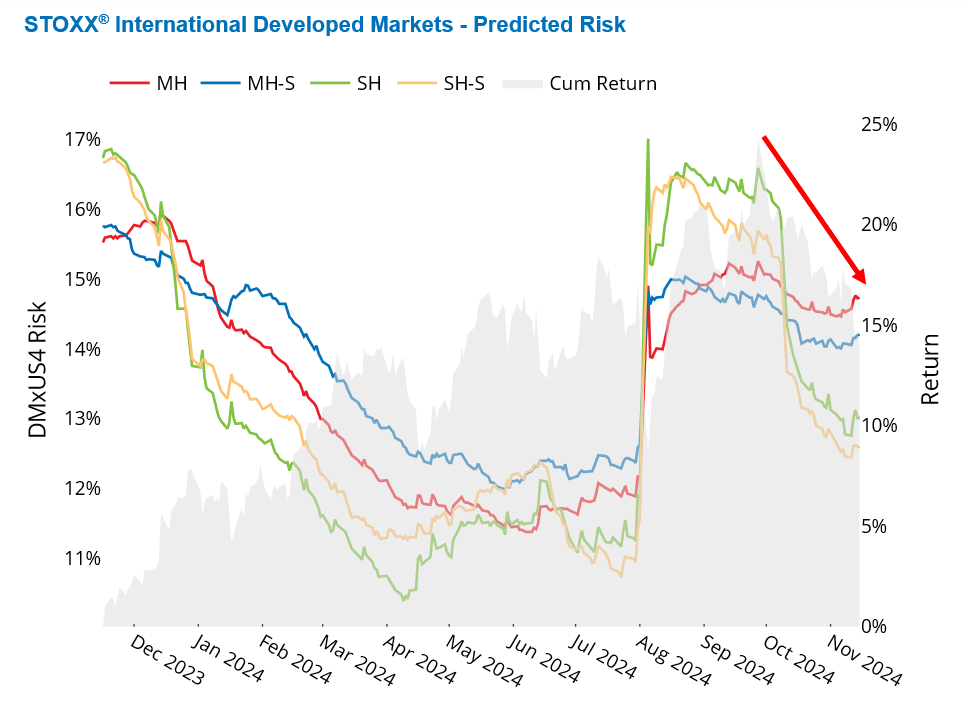

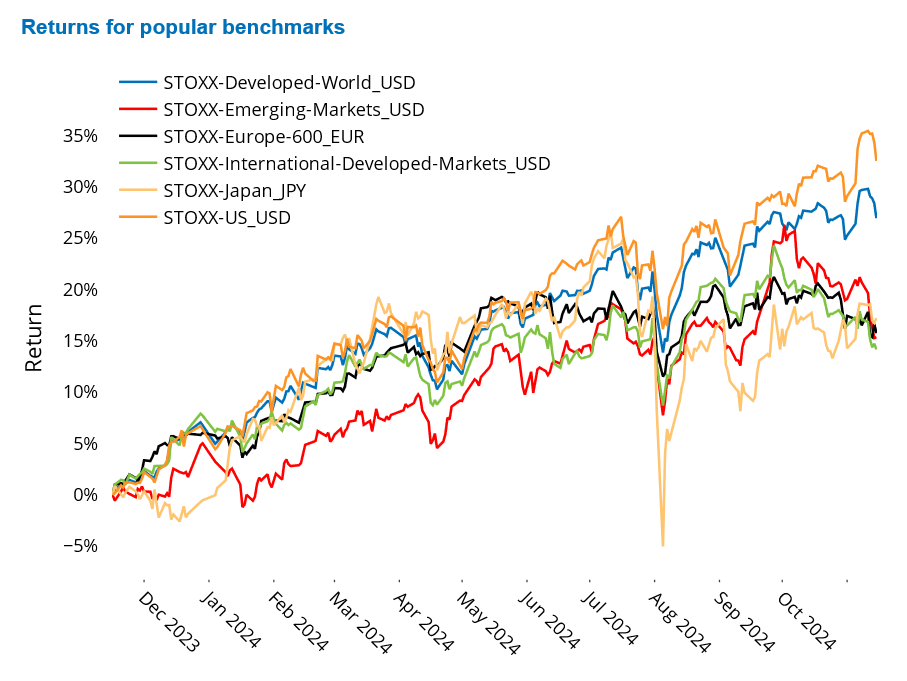

Developed Markets ex-US not excited about the Trump win

Developed Markets ex-US have experienced a significant decline this quarter, initially due to the prospect of a Trump victory, later exacerbated by the US election results. The STOXX International Developed Markets index has fallen 3% since November 5, resulting in a total loss of 7% quarter-to-date. In contrast, the STOXX US index has risen by approximately 1% since Election Day and has gained more than 2% so far in Q4, despite last week’s significant loss.

Over the longer 12-month period, Developed Markets ex-US have not only underperformed the US but also Developed Markets (which are dominated by the US), Emerging Markets, Europe, and Japan. The decline in stock markets outside the US can be attributed to concerns about Trump's protectionist trade policies, a strengthening dollar, increased competitiveness of US companies, and an overall shift in investor sentiment favoring US assets.

The Trump administration is expected to implement significant tariffs on US imports, raising fears of a trade war that could disrupt global supply chains and negatively affect countries reliant on exports or international trade. Additionally, the strengthening of the US dollar signals potential inflationary pressures, which may lead investors to prefer US assets over international equities.

Trump's proposed economic policies, which include tax cuts and deregulation for US corporations, are anticipated to make American companies more attractive compared to their international counterparts. There have been significant outflows from international markets towards the US, which is now perceived as safer amidst rising geopolitical risks.

At the start of the quarter, Developed Markets ex-US were riskier than the US market, as reflected by the Axioma Developed Markets ex-US and US4 fundamental and short-horizon models, respectively. Since November 5, however, US risk has increased by 10%, while the risk for Developed Markets ex-US has remained relatively flat, with the risk of the US market outpacing that of Developed Markets ex-US by 100 basis points as of last Friday. In fact, Developed Markets ex-US is now the least risky among all regions tracked by the Equity Risk Monitors.

See graphs from the STOXX International Developed Markets Equity Risk Monitor as of November 15, 2024:

Developed and emerging currencies weaken against the US dollar

Following Trump's victory, the US dollar surged to its highest level in two years. This appreciation was fueled by expectations of the new administration's economic policies, which are seen as pro-business and likely to stimulate domestic growth. As mentioned earlier, the anticipation of increased tariffs has led investors to perceive the US as a safer investment destination, thereby boosting demand for the dollar. These factors collectively reinforce the dollar's status as a strong reserve currency in global markets. Furthermore, the US dollar strengthened as the likelihood of an interest rate cut by the Fed later this year diminished.

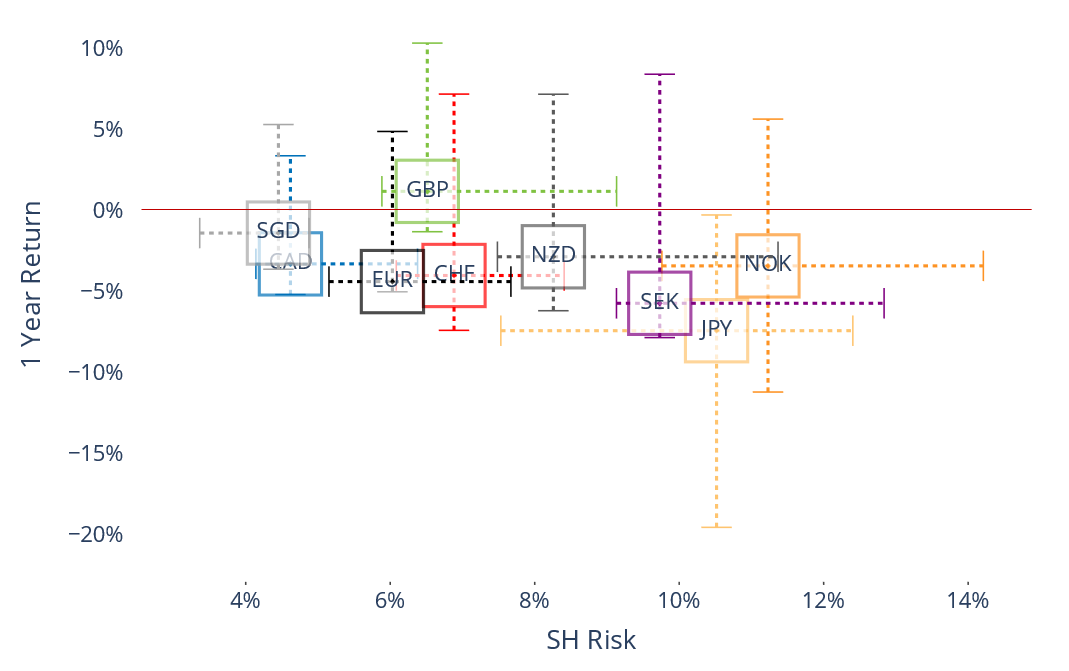

Most major developed currencies saw their one-year returns dip into negative territory last week, and they are now at or near the low ends of their twelve-month return ranges against the US dollar. The British pound is still showing a small positive one-year return, while the Japanese yen remained the biggest loser over the 12-month period.

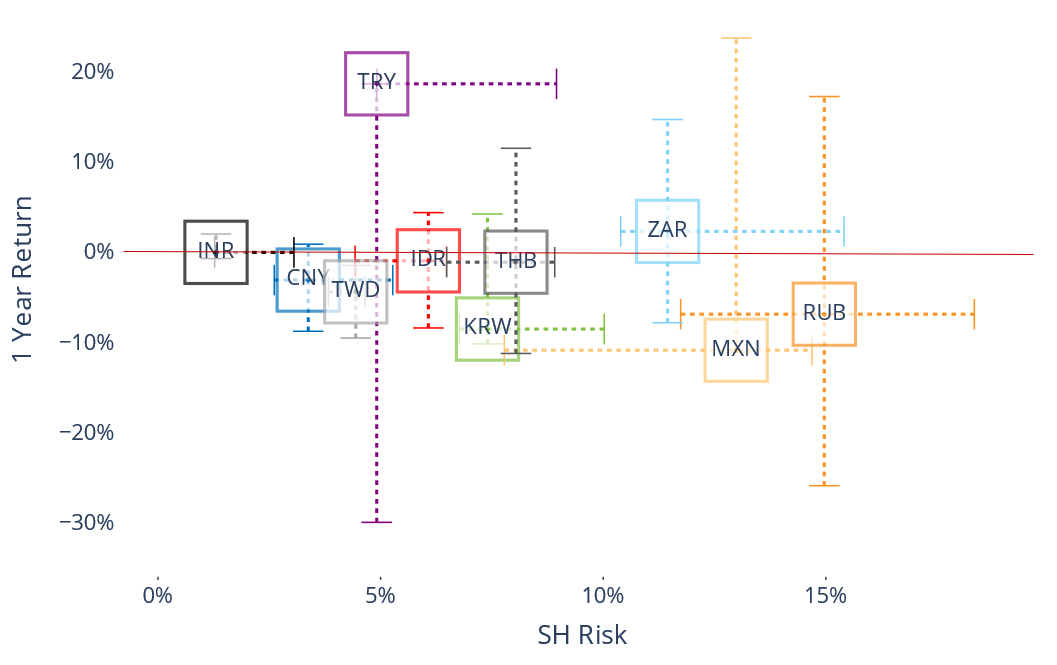

Among emerging market currencies, the Turkish lira was not affected by the strengthening of the dollar. In fact, its 20% twelve-month return positioned the lira at the high end of its one-year return range. However, most other emerging market currencies are experiencing one-year losses. The Mexican peso recorded the largest loss (of 10%) and was pushed to the low end of its one-year return range.

While most developed currencies exhibited low volatility, emerging market currencies’ risk rose pushing them near the high ends of their one-year volatility ranges.

See graph from the STOXX Developed World Equity Risk Monitor as of November 15, 2024:

See graph from the STOXX Emerging Markets Equity Risk Monitor as of November 15, 2024:

You may also like