Harnessing the power of partnerships: SimCorp’s growing ecosystem

SimCorp’s curated ecosystem of partners offers a growing choice of complementary solutions and services, in an integrated enterprise platform. This partner ecosystem brings together the most exciting solutions in the market, but without the inconvenience and cost burdens often associated with dealing with multiple vendors.

A community together with its environment, functioning as a unit.

While British botanist Arthur Tansley might not have had investment management solutions in mind when he coined the term "ecosystem" in 1935, his concept of interconnected systems thriving collectively echoes the philosophy behind SimCorp’s partner ecosystem.

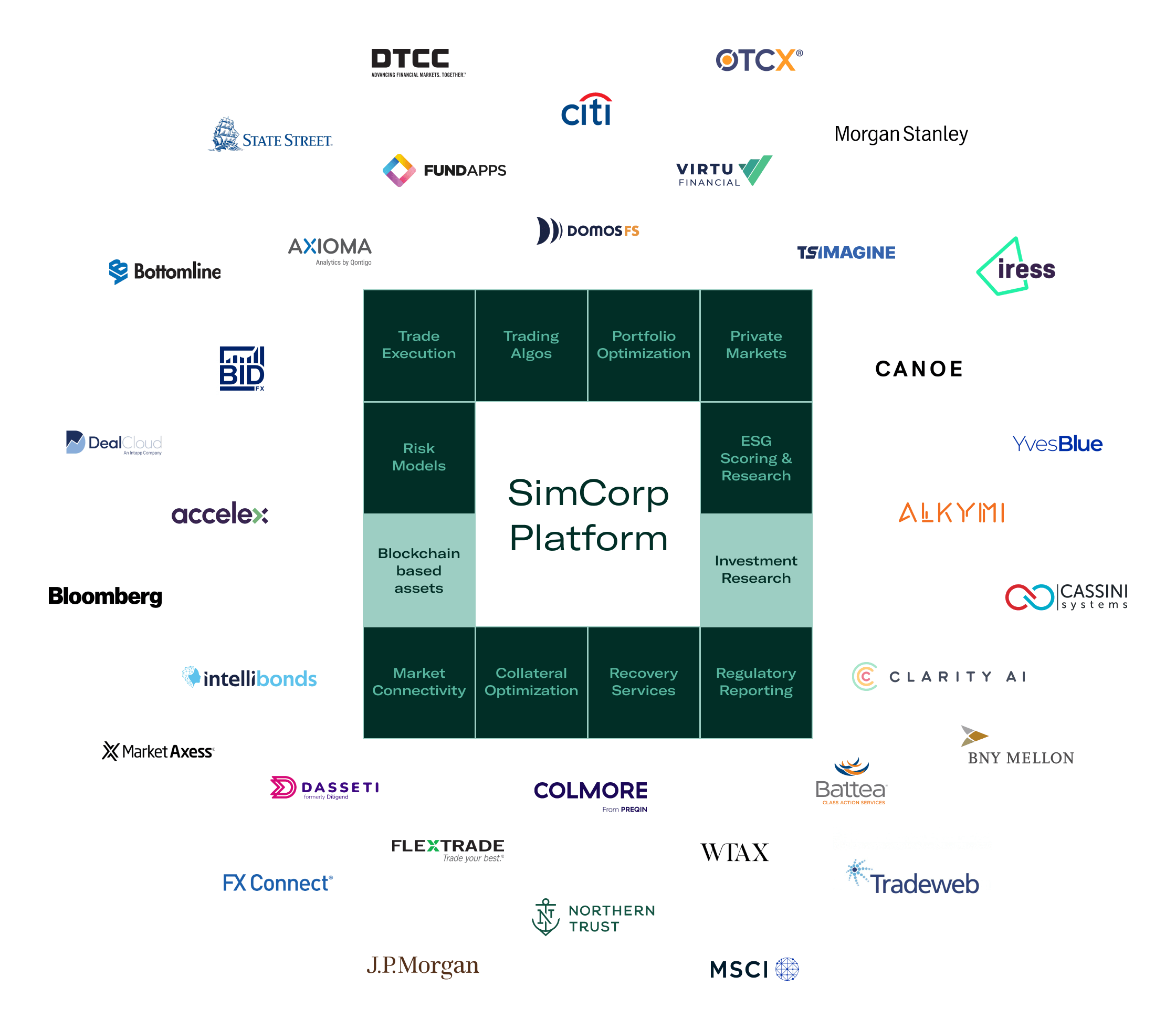

Over the last few years, SimCorp has meticulously curated a group of partners and integrated their solutions into the SimCorp platform. Out of over 250 reviewed vendors, clients can now easily access solutions from 70 – 80 partners covering the entire investment management value chain.

“SimCorp’s ecosystem comprises handpicked partners whose services and solutions integrate directly into our platform. In collaboration with our partners, we take responsibility to ensure the integration of these solutions doesn't create friction for our clients,” explains Anders Kirkeby, Head of Open Innovation at SimCorp.

SimCorp’s ecosystem comprises handpicked partners whose services and solutions integrate directly into our platform. In collaboration with our partners, we take responsibility to ensure the integration of these solutions doesn't create friction for our clients.

Anders Kirkeby, Head of Open Innovation, SimCorp

In 2023, five new solutions providers have entered the ecosystem.

“The essence of our approach to growing our ecosystem is that we set standards for things like workflows and data exchange. Standardizing integrations makes it safer and cheaper to adopt the first SimCorp partner, but it also significantly reduces the switching cost. Lower switching means reduced vendor lock-in, which in turn reduces the overall risk and cost of experimenting with additional vendors, including less proven startups,” Kirkeby says.

Since 2021, customers of SimCorp’s investment management platform have had the opportunity to leverage seamlessly integrated portfolio optimization and risk analytics from Axioma through the then SimCorp-Qontigo partnership. Recently, the two companies announced that they will join forces under their shared ownership under Deutsche Borse. The merger will allow for an even deeper integration.

Yet, SimCorp has emphasized its commitment to the open platform strategy and to offer clients the optionality, including continued access to other leading risk management providers. Similarly, Axioma’s offerings will remain accessible to other potentially competing investment management platforms.

“Our approach is to offer optionality over championing one provider in a given functional domain. This provides the flexibility clients need to maintain a competitive edge and achieve long-term, sustainable growth, with SimCorp serving as the enabling backbone,” says Anders Kirkeby.

In a multifaceted and fast-paced market with shifting strategies and priorities, leveraging specialized tools and datasets directly integrated within their main platforms can be a game changer for asset managers and asset owners. This enables a shorter turnaround time from when an idea emerges to generating value from it.

The partner ecosystem in investing and finance enhances flexibility, making it easier to adapt to changing investor preferences, regulations, and market characteristics. All this while keeping the core benefit of an end-to-end solution that encompasses every step, front-to-back, of asset managers and asset owners.

Curation

New fintech companies and solutions emerge all the time in our industry. To effectively innovate, you need to be able to identify the solutions that can add value to your operating model.

With its ecosystem, SimCorp curates the fintech market to identify the parties that best complement the SimCorp platform, at different steps in the value chain.

Anders Kirkeby emphasizes that a vibrant, relevant ecosystem goes beyond merely displaying a bunch of logos on a website.

“We look at which vendors are established and sought after by the customers, and who bring innovation to a given part of the value chain. It's not enough that a vendor was the strongest name 15 years ago and still has an established base. SimCorp is often involved in larger changes of systems and entire operating models, so we focus more on who customers would pick today.”

“We aim for a balanced mix in our ecosystem offering, consisting of vendors that are well-known as well as vendors who bring something new and innovative to the table. This could be in the use of AI, a different commercial approach, or perhaps by rethinking a common workflow,” says Anders Kirkeby.

At SimCorp, a vibrant ecosystem means that there is a wide selection of solutions on the shelves, and that they are among the best in their respective areas.

Choice

Through open innovation with fintech partners, co-creation with clients, connectivity with players in the broader capital markets ecosystem, and collaboration with the key advisors and financial industry consultants, SimCorp’s strategic focus on creating an open platform is increasingly unique in the market. Innovation sits high in the list of priorities for buy-side leaders. In the 2023 Global InvestOps Report[1], 55 percent of 200 buy-side leaders cited increasing competitiveness through technology innovation as one of their top three strategic priorities.

We look at which vendors are established and sought after by the customers, and who bring innovation to a given part of the value chain. It's not enough that a vendor was the strongest name 15 years ago and still has an established base.

Anders Kirkeby, Head of Open Innovation, SimCorp

Anders Kirkeby cites several recent partnerships that bolster the range and functionality of SimCorp’s platform. This way, the ecosystem helps to improve choice, both in functionality and the operating models supported.

“For example, we made the decision to build a great integrated order management system (OMS) but leave the trade order execution management system (EMS) area to specialist vendors who already excel in that space. To that end, we have had a successful partnership with TS Imagine for a number of years, but clients asked for more choices, so we have now added two other leading cross-asset EMS brands, FlexTrade and Virtu, as partners.”

“Preferences and strengths vary, but now clients can pick between any of these great products leveraging the same tight integration. In addition, we also have partners specializing in specific asset class, e.g. BidFX for FX order execution and hedging.”

The same holds for a recent partnership with Bottomline which provides SWIFT connectivity and certification as a service, so clients don’t have to maintain specialist skills in this area.

“Again, implementing and running solutions like SWIFT or FIX connectivity requires specialist skills but aren’t core activities for our clients. Their focus is on delivering alpha or delivering the business outcomes agreed with stakeholders; they are not here to run IT.”

“The purpose of our partner ecosystem is 100 percent aligned with that. We want to enable increased adoption of innovative solutions while helping clients focus on their core business,” says Anders Kirkeby. In that regard, SimCorp's partner ecosystem functions as a community where the whole is greater than the sum of its parts.

Ecosystem partners

lSimCorp’s partner ecosystem accelerates the adoption of innovation among SimCorp clients by offering a growing choice of complementary solutions and services.

Clarity AI

The partnership with Clarity AI, the global sustainability technology company, provides institutional investors with access to AI-powered datasets, allowing them to effectively align with the EU sustainable finance regulations and execute on impact investing strategies.

Bottomline

SimCorp clients are able to deploy Bottomline Swift gateway to securely and seamlessly integrate with the Swift network without the complexities of managing intricate IT infrastructure. The partnership also offers SimCorp clients access to Bottomline's suite of financial messaging and ISO 20022 implementation services, including message translation, validation, transformation, intelligent routing, orchestration, and integration.

Battea

With Battea Class Action Services covering the entire securities class and collective action process, from the initial news alert through the distribution of settlement funds, SimCorp clients can now rely on an industry expert to maximize their fund recovery for a wide range of security types in all jurisdictions, leveraging the data already stored in their SimCorp platform.

Virtu

SimCorp clients have been able to use ITG Net, Virtu’s broker-neutral financial communications network, in combination with SimCorp’s Order Management capabilities since 2010. Recently, the partners expanded the collaboration aimed to support SimCorp clients with enhanced trading, connectivity, and workflow solutions, which would help them efficiently manage their operations wherever they trade.

Flextrade

The partnership means that SimCorp clients can seamlessly deploy FlexTrade's multi-asset Execution Management System (EMS) solution FlexTRADER alongside the investment management platform SimCorp Dimension. The partnership addresses the increasing demand from trading teams for seamless integration and collaborative workflows between their OMS and EMS solutions.